Answered step by step

Verified Expert Solution

Question

1 Approved Answer

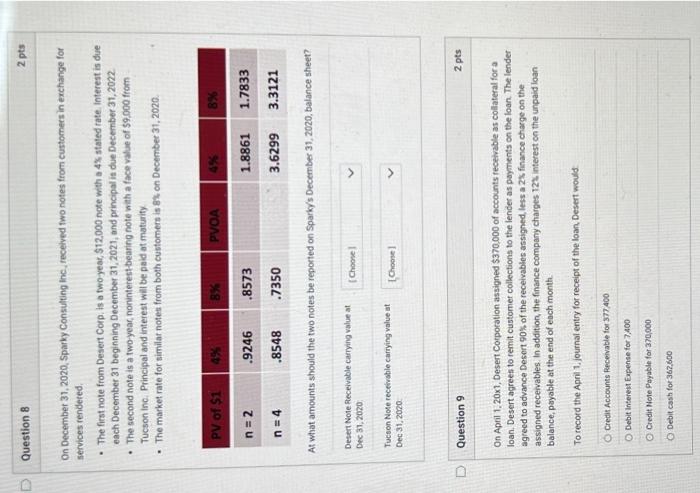

please answer both will upvote On December 31, 2020, Sparky Consulting inc, recelved fwo notes from customers in exchange for services rendered. - The first

please answer both will upvote

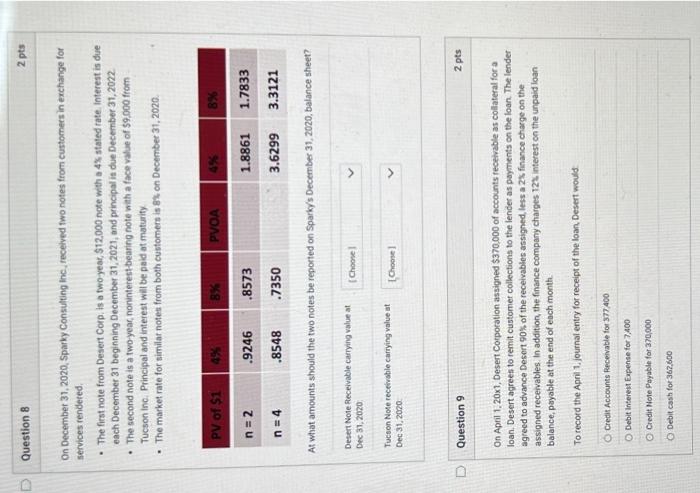

On December 31, 2020, Sparky Consulting inc, recelved fwo notes from customers in exchange for services rendered. - The first note from Desert Corp. Is a fwo-yeat, $12,000 note with a 4% stated rate. interest is due each December 31 beginning December 31, 2021, and principal is due December 31, 2022 - The second note is a two-year, noninterestbearing note wath a face value of $9,000 from Tucson inc. Principal and interest wal be paid at maturity - The market rate for similar notes from both customers is 84 on December 31, 2020. At what amounts should the two notes be reported on Sparky's December 31,2020 , balance sheet? Desert Nore fleceivable carrying value at Dec 31, 2020. Tucson Note receivible carrying value at Dec 31,2020 Question 9 2 pts On April 1,20x1, Desert Corporation assigned $370,000 of accounts recetvable as collateral for a loan. Desert agrees to remit customer collections to the lender as payments on the loan. The lender agreed to advance Desert 90% of the receivables assigned, less a 25 finance charge on the assigned receivables. In addition, the finance company charges 125 interest on the unpaid loan balance, payable at the end of each month. To record the April 1. journal entry for receipt of the loan. Desert would Credit Accounts Recenable for 377,400 Debit interent Expense for 7,400 Credit Note Payable far 370,000 Debit cash for 362,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started