Question

PLEASE ANSWER BY 10/21 9PM CASH FLOW We are only doing the indirect method Start by entering net income and dividends. Dividends were declared but

PLEASE ANSWER BY 10/21 9PM CASH FLOW

We are only doing the indirect method

Start by entering net income and dividends. Dividends were declared but not paid.

Then run the facts and the income statement for information. Here are some aids:

o Bad debt expenses and Lower of cost or market adjustments are straight noncash items that need to be added back to net income.

o Always explain allowance for bad debts before you try to explain change in accounts receivable. You need to know the write-offs before you can determine increase or decrease in accounts receivable.

o The gain on equipment makes me look for cost and accumulated depreciation on the asset the notes tell you that. You want to get the gain out of operations and show the cash received under investing.

o The investments are trading investments. The proceeds of the sale go in cash investing. Take the gain out of cash operations and join it with cost to show the total cash received which is included in investing section of cash flow. Bottom line, you remove the gain and insert the cash received. .

o Just show cash received from stock issue as a single amount (par and paid-in excess are one amount).

o The factoring of the accounts receivable was without recourse. They knew they would sell the accounts and never established an allowance for them. They still have other accounts receivable and the allowance for bad debts applies to those accounts. You will be taking the loss out of cash from operations and you will insert the net cash received in operating cash.

o Land cost $25,000, but partial cash payment was only $7,000, The $7,000 goes under cash investing. The $18,000 portion is shown in the schedule of non-cash transactions.

o Stock worth $40,000 was issued as payment for land. That appears in your statement of non-cash transactions.

o Your call on automating the worksheet. You can pre-enter the formula for the balance column. It is handy but might spoil you for exam. The formula is: debit balance debit explanation credit balance + credit change. You have explained the change when this amount is 0 I loaded the formula for accounts receivable and for the allowance for bad debts. You can decide if you want to use it.

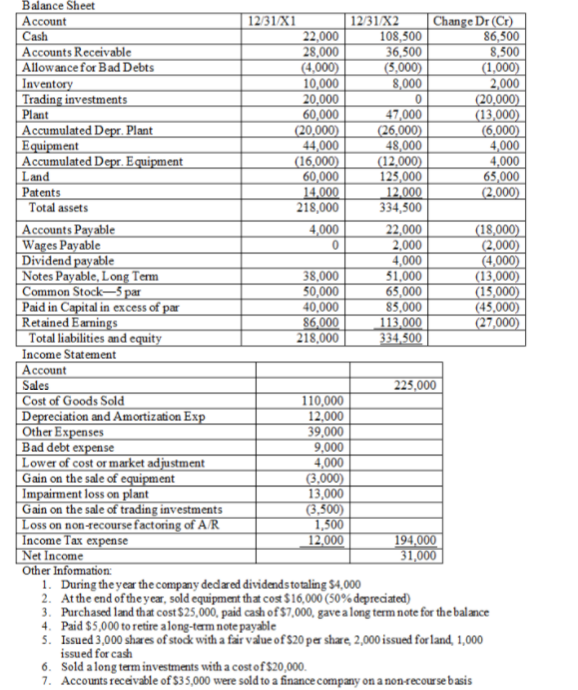

0 Balance Sheet Account 12/31X1 1231X2 Change Dr (Cr) Cash 22,000 108,500 86,500 Accounts Receivable 28,000 36,500 8,500 Allowance for Bad Debts (4,000) (5,000) (1,000) Inventory 10,000 8,000 2,000 Trading investments 20,000 0 (20.000) Plant 60,000 47.000 (13,000) Accumulated Depr. Plant (20,000) (26,000) (6.000) Equipment 44,000 48.000 4,000 Accumulated Depr. Equipment (16,000) (12.000) 4.000 Land 60,000 125,000 65,000 Patents 14.000 12.000 (2.000) Total assets 218,000 334,500 Accounts Payable 4,000 22,000 (18,000) Wages Payable 2.000 (2.000) Dividend payable 4,000 (4,000) Notes Payable, Long Term 38,000 51.000 (13,000) Common Stock-5 par 50,000 65,000 (15,000) Paid in Capital in excess of par 40,000 85,000 (45,000) Retained Earnings 86,000 113,000 (27,000) Total liabilities and equity 218,000 334.500 Income Statement Account Sales 225.000 Cost of Goods Sold 110,000 Depreciation and Amortization Exp 12.000 Other Expenses 39,000 Bad debt expense 9,000 Lower of cost or market adjustment 4,000 Gain on the sale of equipment (3.000) Impairment loss on plant 13,000 Gain on the sale of trading investments (3,500) Loss on non-recourse factoring of AR 1,500 Income Tax expense 12,000 194,000 Net Income 31,000 Other Information: 1. During the year the company dedared dividends totaling $4,000 2. At the end of the year, sold equipment that cost $16,000 (50% depreciated) 3. Purchased land that cost $25,000, paid cash of $7,000, gave a long term note for the balance 4. Paid $5,000 to retire along-term note payable 5. Issued 3,000 shares of stock with a fair value of $20 per share, 2,000 issued for land, 1,000 issued for cash 6. Sold a long term investments with a cost of $20,000 7. Accounts receivable of $35,000 were sold to a finance company on a non-recourse basisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started