Please answer by filling in the blue highlighted areas (4l, 4m, 4n, and 4o) with the correct answer. I will greatly appreciate it. Let me know if more information is needed.

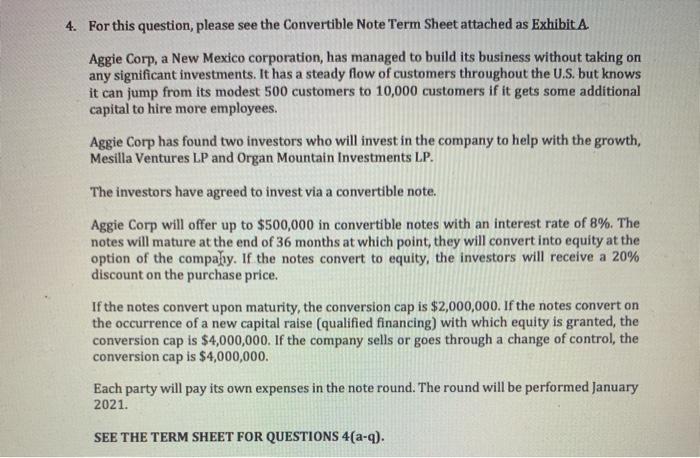

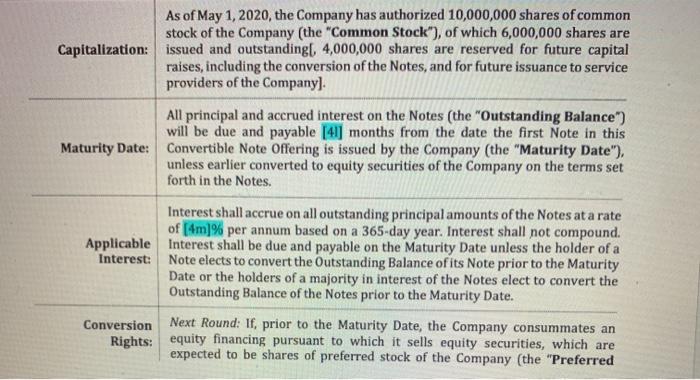

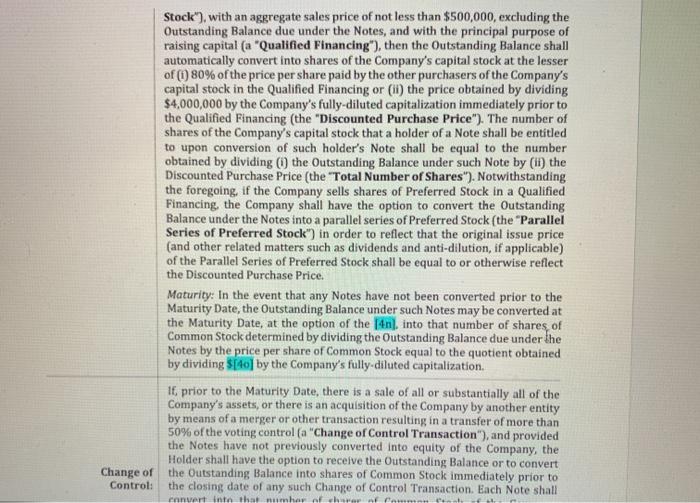

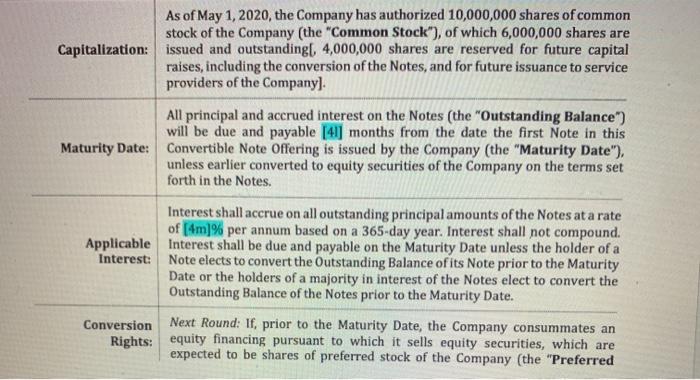

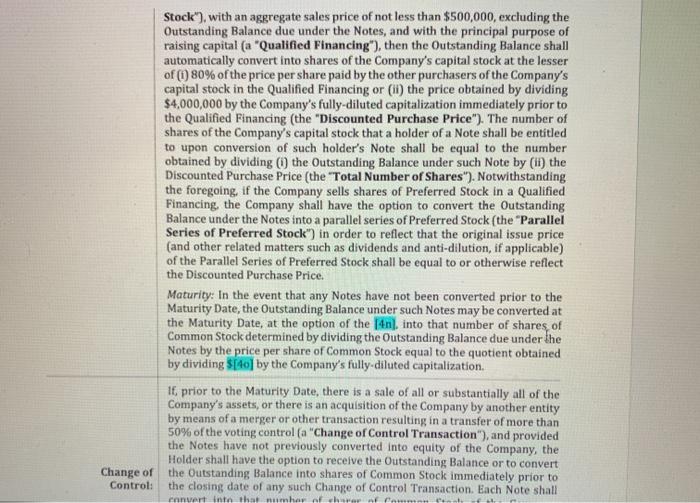

4. For this question, please see the Convertible Note Term Sheet attached as Exhibit A. Aggie Corp, a New Mexico corporation, has managed to build its business without taking on any significant investments. It has a steady flow of customers throughout the U.S. but knows it can jump from its modest 500 customers to 10,000 customers if it gets some additional capital to hire more employees. Aggie Corp has found two investors who will invest in the company to help with the growth, Mesilla Ventures LP and Organ Mountain Investments LP. The investors have agreed to invest via a convertible note. Aggie Corp will offer up to $500,000 in convertible notes with an interest rate of 8%. The notes will mature at the end of 36 months at which point, they will convert into equity at the option of the compally. If the notes convert to equity, the investors will receive a 20% discount on the purchase price. If the notes convert upon maturity, the conversion cap is $2,000,000. If the notes convert on the occurrence of a new capital raise (qualified financing) with which equity is granted, the conversion cap is $4,000,000. If the company sells or goes through a change of control, the conversion cap is $4,000,000. Each party will pay its own expenses in the note round. The round will be performed January 2021. SEE THE TERM SHEET FOR QUESTIONS 4(a-q). As of May 1, 2020, the Company has authorized 10,000,000 shares of common stock of the Company (the "Common Stock"), of which 6,000,000 shares are Capitalization: issued and outstanding 4,000,000 shares are reserved for future capital raises, including the conversion of the Notes, and for future issuance to service providers of the Company] All principal and accrued interest on the Notes (the "Outstanding Balance") will be due and payable [41] months from the date the first Note in this Maturity Date: Convertible Note Offering is issued by the Company (the "Maturity Date"), unless earlier converted to equity securities of the Company on the terms set forth in the Notes. Interest shall accrue on all outstanding principal amounts of the Notes at a rate of [Am]% per annum based on a 365-day year. Interest shall not compound. Applicable Interest shall be due and payable on the Maturity Date unless the holder of a Interest: Note elects to convert the Outstanding Balance of its Note prior to the Maturity Date or the holders of a majority in interest of the Notes elect to convert the Outstanding Balance of the Notes prior to the Maturity Date. Conversion Next Round: If, prior to the Maturity Date, the Company consummates an Rights: equity financing pursuant to which it sells equity securities, which are expected to be shares of preferred stock of the Company (the "Preferred Stock"), with an aggregate sales price of not less than $500,000, excluding the Outstanding Balance due under the Notes, and with the principal purpose of raising capital (a "Qualified Financing"), then the Outstanding Balance shall automatically convert into shares of the Company's capital stock at the lesser of (1) 80% of the price per share paid by the other purchasers of the Company's capital stock in the Qualified Financing or (ii) the price obtained by dividing $4,000,000 by the Company's fully-diluted capitalization immediately prior to the Qualified Financing (the "Discounted Purchase Price"). The number of shares of the Company's capital stock that a holder of a Note shall be entitled to upon conversion of such holder's Note shall be equal to the number obtained by dividing the Outstanding Balance under such Note by (11) the Discounted Purchase Price (the "Total Number of Shares"). Notwithstanding the foregoing, if the Company sells shares of Preferred Stock in a Qualified Financing, the Company shall have the option to convert the Outstanding Balance under the Notes into a parallel series of Preferred Stock (the "Parallel Series of Preferred Stock") in order to reflect that the original issue price (and other related matters such as dividends and anti-dilution, if applicable) of the Parallel Series of Preferred Stock shall be equal to or otherwise reflect the Discounted Purchase Price. Maturity: In the event that any Notes have not been converted prior to the Maturity Date, the Outstanding Balance under such Notes may be converted at the Maturity Date, at the option of the [4n). into that number of shares of Common Stock determined by dividing the Outstanding Balance due under the Notes by the price per share of Common Stock equal to the quotient obtained by dividing $[40] by the Company's fully diluted capitalization If prior to the Maturity Date, there is a sale of all or substantially all of the Company's assets, or there is an acquisition of the Company by another entity by means of a merger or other transaction resulting in a transfer of more than 50% of the voting control (a "Change of Control Transaction"), and provided the Notes have not previously converted into equity of the Company, the Holder shall have the option to receive the Outstanding Balance or to convert the Outstanding Balance into shares of Common Stock immediately prior to the closing date of any such Change of Control Transaction. Each Note shall Change of Control: convert into the number och 4. For this question, please see the Convertible Note Term Sheet attached as Exhibit A. Aggie Corp, a New Mexico corporation, has managed to build its business without taking on any significant investments. It has a steady flow of customers throughout the U.S. but knows it can jump from its modest 500 customers to 10,000 customers if it gets some additional capital to hire more employees. Aggie Corp has found two investors who will invest in the company to help with the growth, Mesilla Ventures LP and Organ Mountain Investments LP. The investors have agreed to invest via a convertible note. Aggie Corp will offer up to $500,000 in convertible notes with an interest rate of 8%. The notes will mature at the end of 36 months at which point, they will convert into equity at the option of the compally. If the notes convert to equity, the investors will receive a 20% discount on the purchase price. If the notes convert upon maturity, the conversion cap is $2,000,000. If the notes convert on the occurrence of a new capital raise (qualified financing) with which equity is granted, the conversion cap is $4,000,000. If the company sells or goes through a change of control, the conversion cap is $4,000,000. Each party will pay its own expenses in the note round. The round will be performed January 2021. SEE THE TERM SHEET FOR QUESTIONS 4(a-q). As of May 1, 2020, the Company has authorized 10,000,000 shares of common stock of the Company (the "Common Stock"), of which 6,000,000 shares are Capitalization: issued and outstanding 4,000,000 shares are reserved for future capital raises, including the conversion of the Notes, and for future issuance to service providers of the Company] All principal and accrued interest on the Notes (the "Outstanding Balance") will be due and payable [41] months from the date the first Note in this Maturity Date: Convertible Note Offering is issued by the Company (the "Maturity Date"), unless earlier converted to equity securities of the Company on the terms set forth in the Notes. Interest shall accrue on all outstanding principal amounts of the Notes at a rate of [Am]% per annum based on a 365-day year. Interest shall not compound. Applicable Interest shall be due and payable on the Maturity Date unless the holder of a Interest: Note elects to convert the Outstanding Balance of its Note prior to the Maturity Date or the holders of a majority in interest of the Notes elect to convert the Outstanding Balance of the Notes prior to the Maturity Date. Conversion Next Round: If, prior to the Maturity Date, the Company consummates an Rights: equity financing pursuant to which it sells equity securities, which are expected to be shares of preferred stock of the Company (the "Preferred Stock"), with an aggregate sales price of not less than $500,000, excluding the Outstanding Balance due under the Notes, and with the principal purpose of raising capital (a "Qualified Financing"), then the Outstanding Balance shall automatically convert into shares of the Company's capital stock at the lesser of (1) 80% of the price per share paid by the other purchasers of the Company's capital stock in the Qualified Financing or (ii) the price obtained by dividing $4,000,000 by the Company's fully-diluted capitalization immediately prior to the Qualified Financing (the "Discounted Purchase Price"). The number of shares of the Company's capital stock that a holder of a Note shall be entitled to upon conversion of such holder's Note shall be equal to the number obtained by dividing the Outstanding Balance under such Note by (11) the Discounted Purchase Price (the "Total Number of Shares"). Notwithstanding the foregoing, if the Company sells shares of Preferred Stock in a Qualified Financing, the Company shall have the option to convert the Outstanding Balance under the Notes into a parallel series of Preferred Stock (the "Parallel Series of Preferred Stock") in order to reflect that the original issue price (and other related matters such as dividends and anti-dilution, if applicable) of the Parallel Series of Preferred Stock shall be equal to or otherwise reflect the Discounted Purchase Price. Maturity: In the event that any Notes have not been converted prior to the Maturity Date, the Outstanding Balance under such Notes may be converted at the Maturity Date, at the option of the [4n). into that number of shares of Common Stock determined by dividing the Outstanding Balance due under the Notes by the price per share of Common Stock equal to the quotient obtained by dividing $[40] by the Company's fully diluted capitalization If prior to the Maturity Date, there is a sale of all or substantially all of the Company's assets, or there is an acquisition of the Company by another entity by means of a merger or other transaction resulting in a transfer of more than 50% of the voting control (a "Change of Control Transaction"), and provided the Notes have not previously converted into equity of the Company, the Holder shall have the option to receive the Outstanding Balance or to convert the Outstanding Balance into shares of Common Stock immediately prior to the closing date of any such Change of Control Transaction. Each Note shall Change of Control: convert into the number och