please answer c & d as well.

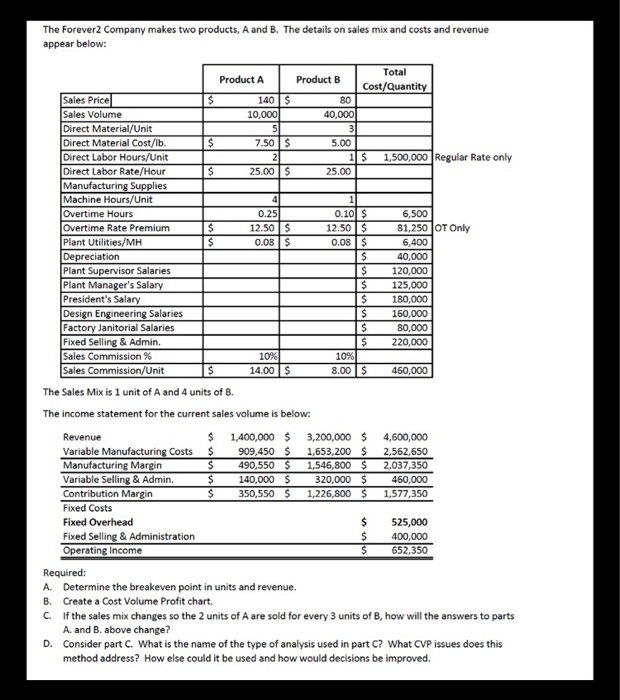

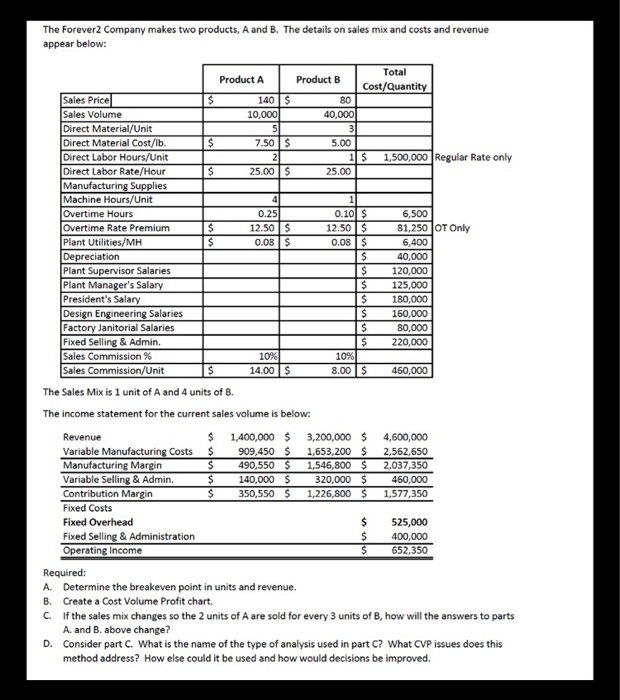

The Forever 2 Company makes two products, A and B. The details on sales mix and costs and revenue appear below: $ Product 140$ 10,000 5 7 .50 $ 2 25.00 $ Total Product B Cost/Quantity 80 40,000 31 5.00 1 $ 1,500,000 Regular Rate only 25.00 S $ Sales Price Sales Volume Direct Material/Unit Direct Material Cost/lb. Direct Labor Hours/Unit Direct Labor Rate/Hour Manufacturing Supplies Machine Hours/Unit Overtime Hours Overtime Rate Premium Plant Utilities/MH Depreciation Plant Supervisor Salaries Plant Manager's Salary President's Salary Design Engineering Salaries Factory Janitorial Salaries Fixed Selling & Admin. Sales Commission % Sales Commission/Unit $ $ 0.25 12.50 0.00 $ $ 0.10 $ 12.50 $ 0.08 $ $ $ $ $ $ I$ $ 6,500 81,250 OT Only 6,400 40,000 120,000 125,000 180,000 160,000 80,000 220,000 $ 14.00 $ 8.00 $ 460,000 The Sales Mix is 1 unit of A and 4 units of B. The income statement for the current sales volume is below: Revenue Variable Manufacturing Costs Manufacturing Margin Variable Selling & Admin. Contribution Margin Fixed Costs Fixed Overhead Fixed Selling & Administration Operating Income $ $ $ $ $ 1,400,000 $ 909,450 $ 490,550 $ 140,000 $ 350,550 $ 3,200,000 $ 1,653,200 $ 1,546,800 $ 320,000 $ 1,226,800 $ 4,600,000 2,562,650 2,037,350 460,000 1,577,350 $ $ $ 525,000 400,000 652,350 Required: A. Determine the breakeven point in units and revenue. B. Create a Cost Volume Profit chart. C. If the sales mix changes so the 2 units of A are sold for every 3 units of B, how will the answers to parts A. and B. above change? D. Consider part C. What is the name of the type of analysis used in part C? What CVP issues does this method address? How else could it be used and how would decisions be improved. The Forever 2 Company makes two products, A and B. The details on sales mix and costs and revenue appear below: $ Product 140$ 10,000 5 7 .50 $ 2 25.00 $ Total Product B Cost/Quantity 80 40,000 31 5.00 1 $ 1,500,000 Regular Rate only 25.00 S $ Sales Price Sales Volume Direct Material/Unit Direct Material Cost/lb. Direct Labor Hours/Unit Direct Labor Rate/Hour Manufacturing Supplies Machine Hours/Unit Overtime Hours Overtime Rate Premium Plant Utilities/MH Depreciation Plant Supervisor Salaries Plant Manager's Salary President's Salary Design Engineering Salaries Factory Janitorial Salaries Fixed Selling & Admin. Sales Commission % Sales Commission/Unit $ $ 0.25 12.50 0.00 $ $ 0.10 $ 12.50 $ 0.08 $ $ $ $ $ $ I$ $ 6,500 81,250 OT Only 6,400 40,000 120,000 125,000 180,000 160,000 80,000 220,000 $ 14.00 $ 8.00 $ 460,000 The Sales Mix is 1 unit of A and 4 units of B. The income statement for the current sales volume is below: Revenue Variable Manufacturing Costs Manufacturing Margin Variable Selling & Admin. Contribution Margin Fixed Costs Fixed Overhead Fixed Selling & Administration Operating Income $ $ $ $ $ 1,400,000 $ 909,450 $ 490,550 $ 140,000 $ 350,550 $ 3,200,000 $ 1,653,200 $ 1,546,800 $ 320,000 $ 1,226,800 $ 4,600,000 2,562,650 2,037,350 460,000 1,577,350 $ $ $ 525,000 400,000 652,350 Required: A. Determine the breakeven point in units and revenue. B. Create a Cost Volume Profit chart. C. If the sales mix changes so the 2 units of A are sold for every 3 units of B, how will the answers to parts A. and B. above change? D. Consider part C. What is the name of the type of analysis used in part C? What CVP issues does this method address? How else could it be used and how would decisions be improved

please answer c & d as well.

please answer c & d as well.