Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer clearly thanks Q1) An investor named Jack decided to invest in a zero coupon bond on October 1, 2015. Jack paid $7,800 for

please answer clearly thanks

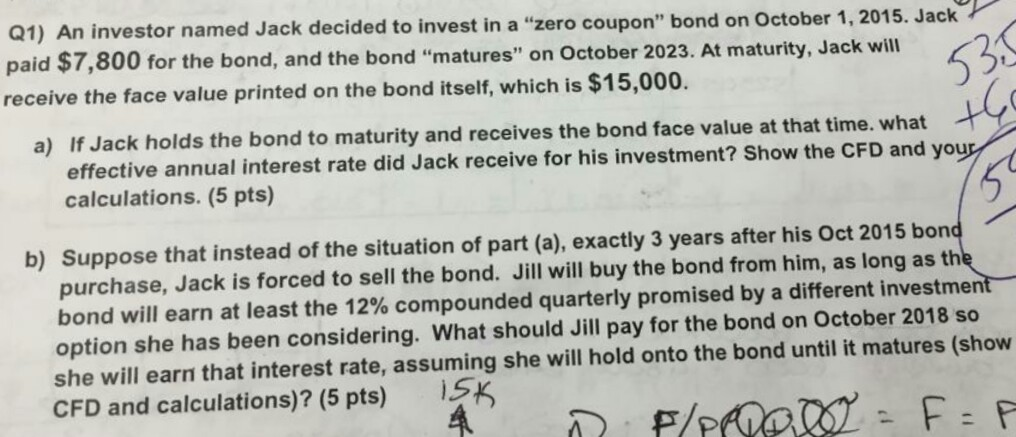

Q1) An investor named Jack decided to invest in a "zero coupon" bond on October 1, 2015. Jack paid $7,800 for the bond, and the bond "matures" on October 2023. At maturity, Jack will receive the face value printed on the bond itself, which is $15,000 530 a) If Jack holds the bond to maturity and receives the bond face value at that time. what effective annual interest rate did Jack receive for his investment? Show the CFD and your calculations. (5 pts) b) Suppose that instead of the situation of part (a), exactly 3 years after his Oct 2015 bond purchase, Jack is forced to sell the bond. Jill will buy the bond from him, as long as the bond will earn at least the 12% compounded quarterly promised by a different investment option she has been considering. What should Jill pay for the bond on October 2018 so she will earn that interest rate, assuming she will hold onto the bond until it matures (show CFD and calculations)? (5 pts) F/P F FStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started