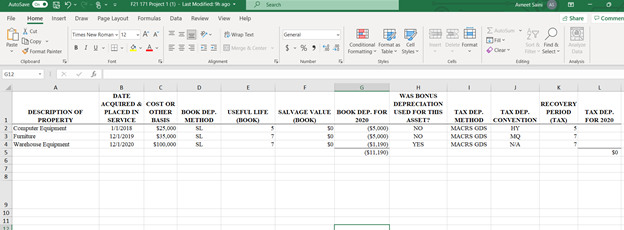

please answer column C , D , and E .also answer colomn L in the last picture for depriciation .

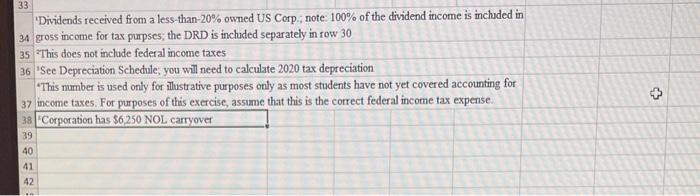

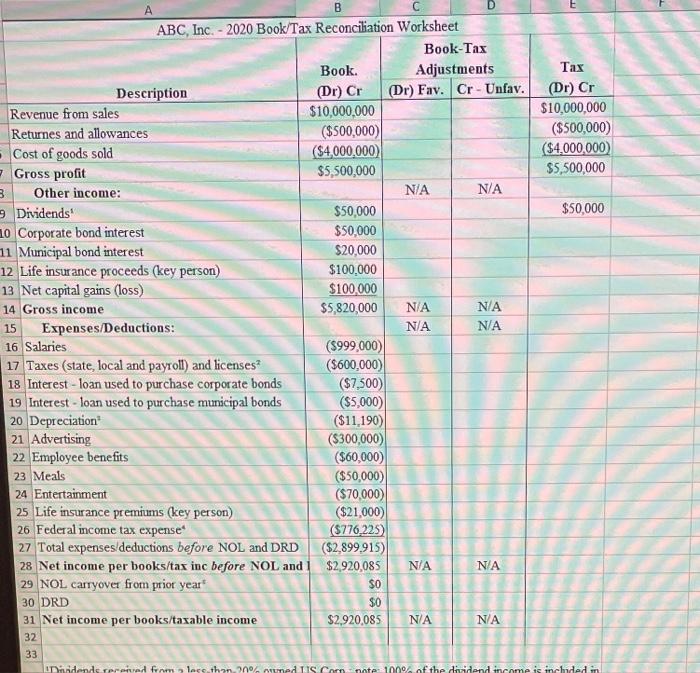

| DESCRIPTION OF PROPERTY | DATE ACQUIRED & PLACED IN SERVICE | COST OR OTHER BASIS | BOOK DEP. METHOD | USEFUL LIFE (BOOK) | SALVAGE VALUE (BOOK) | BOOK DEP. FOR 2020 | WAS BONUS DEPRECIATION USED FOR THIS ASSET? | TAX DEP. METHOD | TAX DEP. CONVENTION | RECOVERY PERIOD (TAX) | TAX DEP. FOR 2020 |

| Computer Equipment | 1/1/18 | $25,000 | SL | 5 | $0 | ($5,000) | NO | MACRS GDS | HY | 5 | |

| Furniture | 12/1/19 | $35,000 | SL | 7 | $0 | ($5,000) | NO | MACRS GDS | MQ | 7 | |

| Warehouse Equipment | 12/1/20 | $100,000 | SL | 7 | $0 | ($1,190) | YES | MACRS GDS | N/A | 7 | |

| | | | | | | ($11,190) | | | | | $0 |

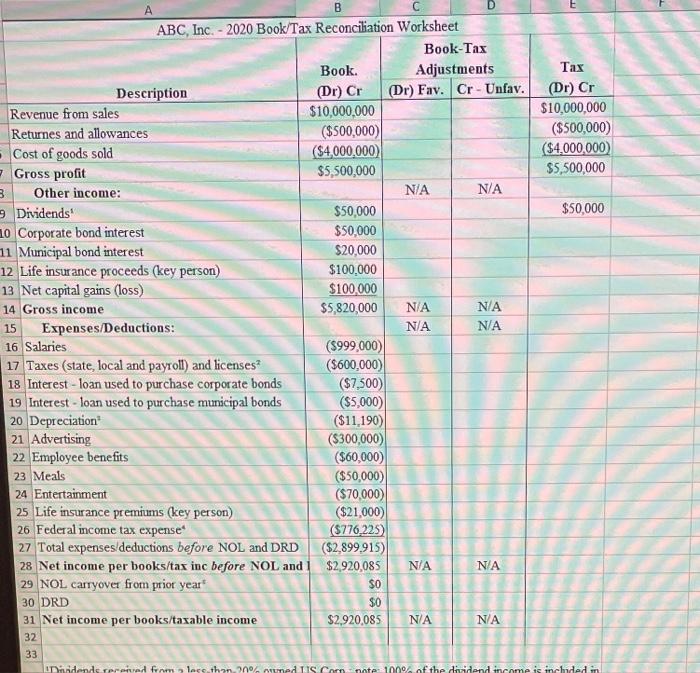

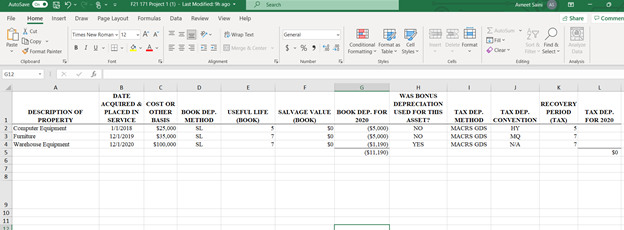

A B ABC, Inc. - 2020 Book/Tax Reconciliation Worksheet Book-Tax Book. Adjustments Tax Description (Dr) Cr (Dr) Fav. Cr-Unfav. (Dr) Cr Revenue from sales $10,000,000 $10,000,000 Returnes and allowances ($500,000) ($500,000) - Cost of goods sold ($4,000,000) ($4,000,000) - Gross profit $5,500,000 $5,500,000 3 Other income: N/A N/A 9 Dividends' $50,000 $50,000 10 Corporate bond interest $50,000 11 Municipal bond interest $20,000 12 Life insurance proceeds (key person) $100,000 13 Net capital gains (loss) $100.000 14 Gross income $5,820,000 NA N/A 15 Expenses/Deductions: N/A N/A 16 Salaries ($999,000) 17 Taxes (state, local and payroll) and licenses (5600,000) 18 Interest - loan used to purchase corporate bonds ($7,500) 19 Interest - Ioan used to purchase municipal bonds ($5,000) 20 Depreciation ($11.190) 21 Advertising ($300,000) 22 Employee benefits ($60,000) 23 Meals ($50,000) 24 Entertainment ($70,000) 25 Life insurance premiums (key person) ($21,000) 26 Federal income tax expense (5776,225) 27 Total expenses deductions before NOL and DRD ($2,899,915) 28 Net income per books/tax inc before NOL and $2,920,085 NA NA 29 NOL carryover from prior year $0 30 DRD $0 31 Net income per books/taxable income $2,920,085 NA NA 32 33 Didende serred from less than 2007 wedsCompate 1000 of the dividend income is inchided in 33 "Dividends received from a less-than-20% owned US Corp. note: 100% of the dividend income is included in 34 gross income for tax purpses; the DRD is included separately in row 30 35 "This does not include federal income taxes 36 Sec Depreciation Schedule, you will need to calculate 2020 tax depreciation *This mumber is used only for illustrative purposes only as most students have not yet covered accounting for 37 income taxes. For purposes of this exercise, assume that this is the correct federal income tax expense. 38 Corporation has 56 250 NOL carryover > 39 40 41 42 Area AS e Share Com Atelie 121171 Project 1) - Last Modifiedh ago File Home Insert Dr Page Layout Formules Data View Help XCH Times New Roma 12 -AA I 15 weet Copy formatie Face Gere 5. % Conditional Format Forning table Styles 0 DATE ACQUIRED & COSTOR PLACED IN OTHER HOOK DEP. SERVICE METHOD 111.2015 525.000 SI 12/1/2019 535.000 SL 1211/2000 USEFUL LINE (IOM) RECOVERY PERIOD TAX TAX DEP. FOR 2020 DESCRIPTION OF 1 PROPERTY 2 Computer 3 Pune 4 Warehouse WAS BONUS DEPRECIATION SALVAGE VALLE OOK DER FOR USED FOR THIS (HOOK) 20 ASSET: 50 (55.000) NO 0 (59.000 51.190) YES (511.190) TAX DET. TAX DEP. METHOD CONVENTION MACRS GDS HY MACRS GDS MO MACRS GDS NA wo 10 11