Answered step by step

Verified Expert Solution

Question

1 Approved Answer

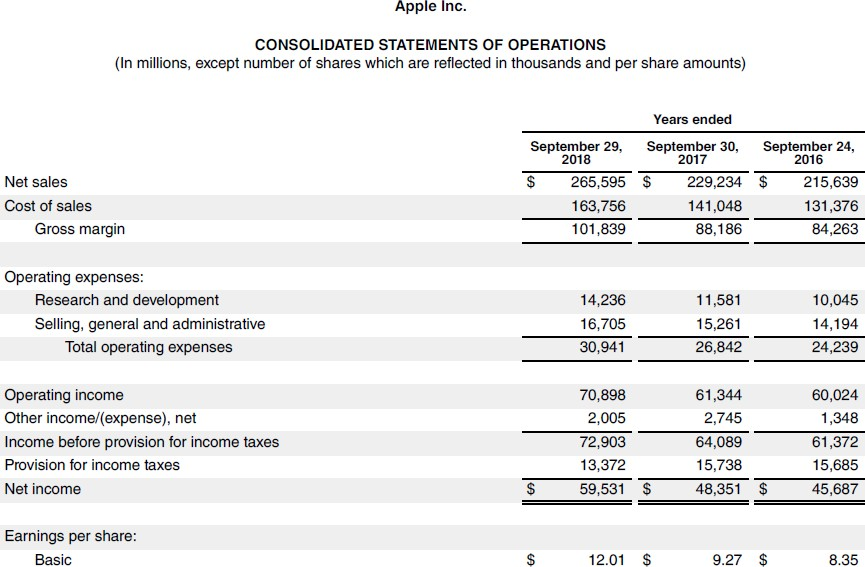

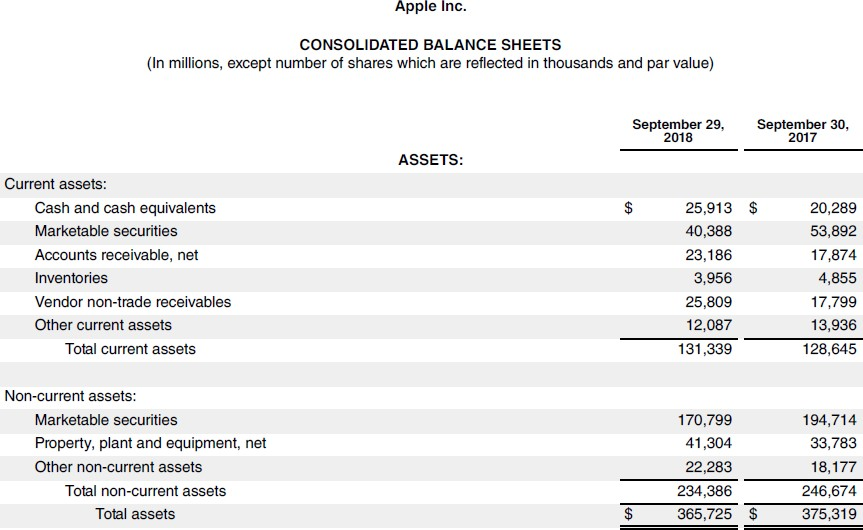

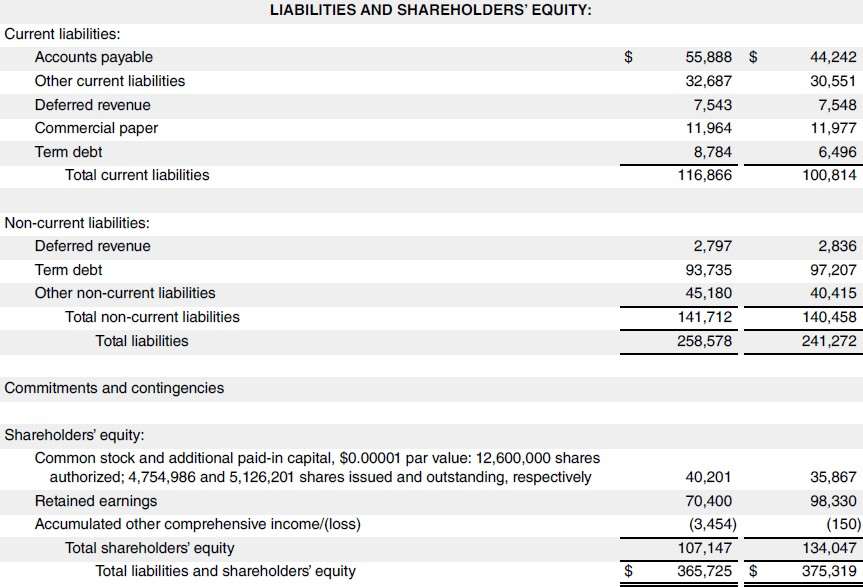

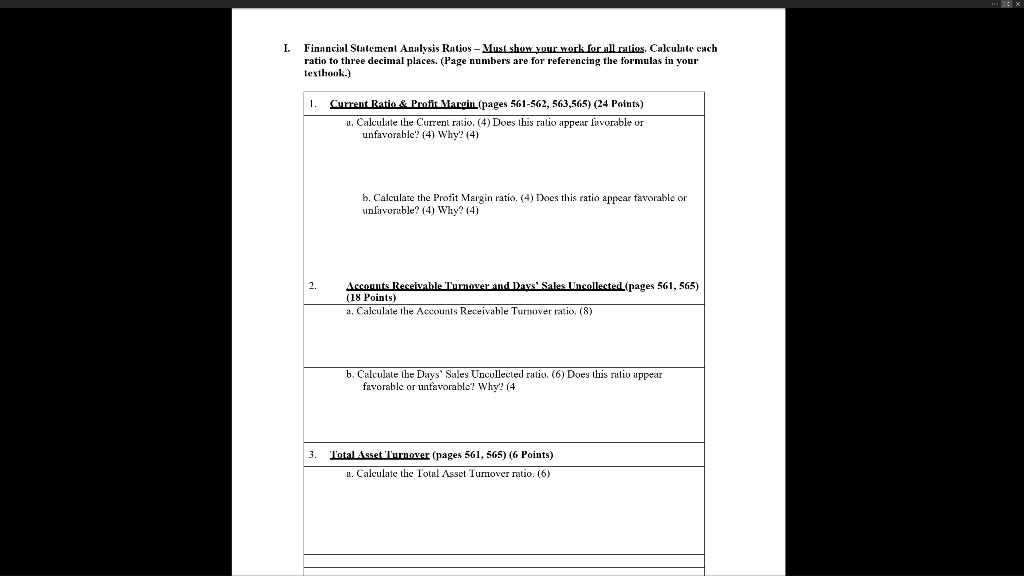

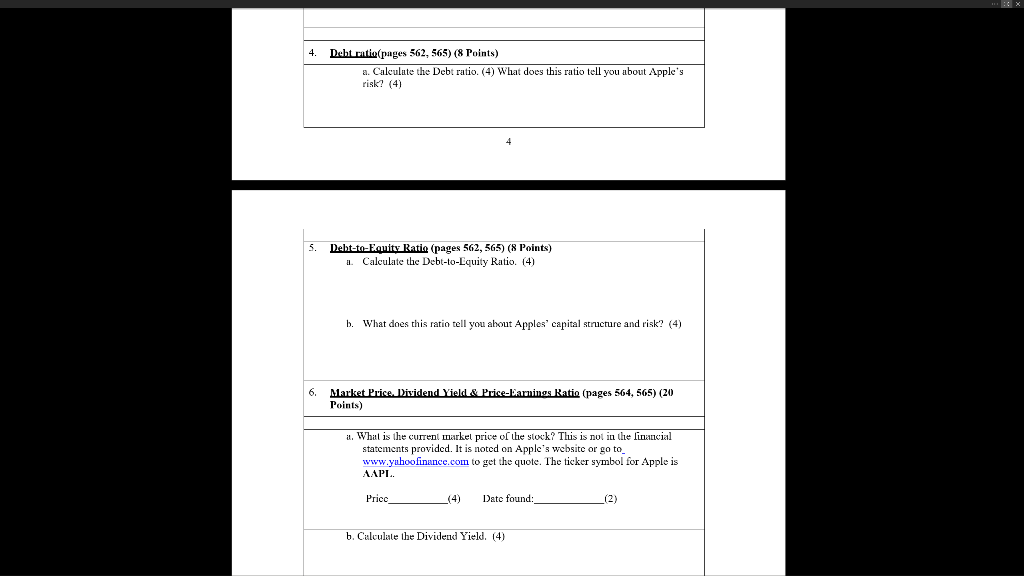

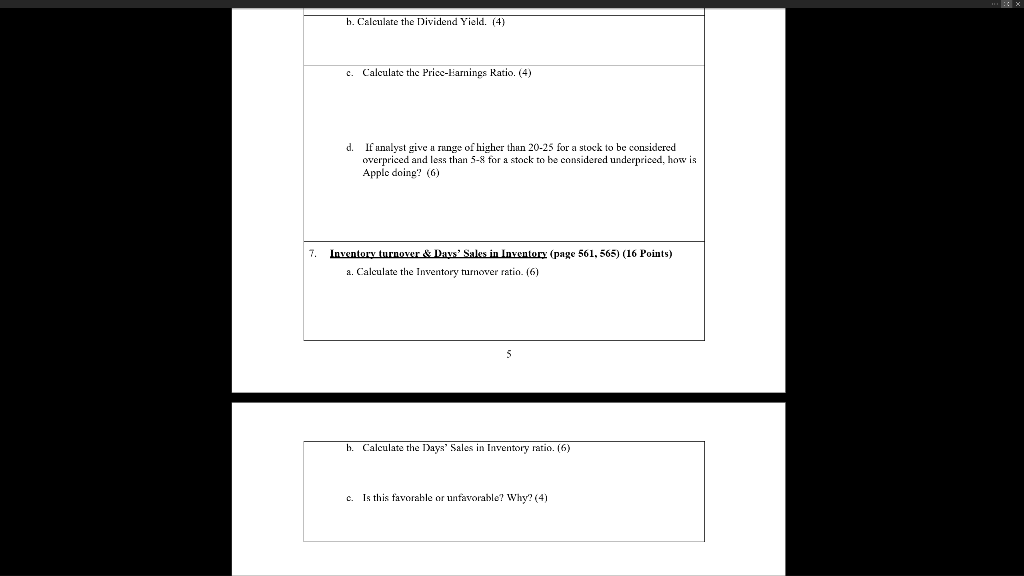

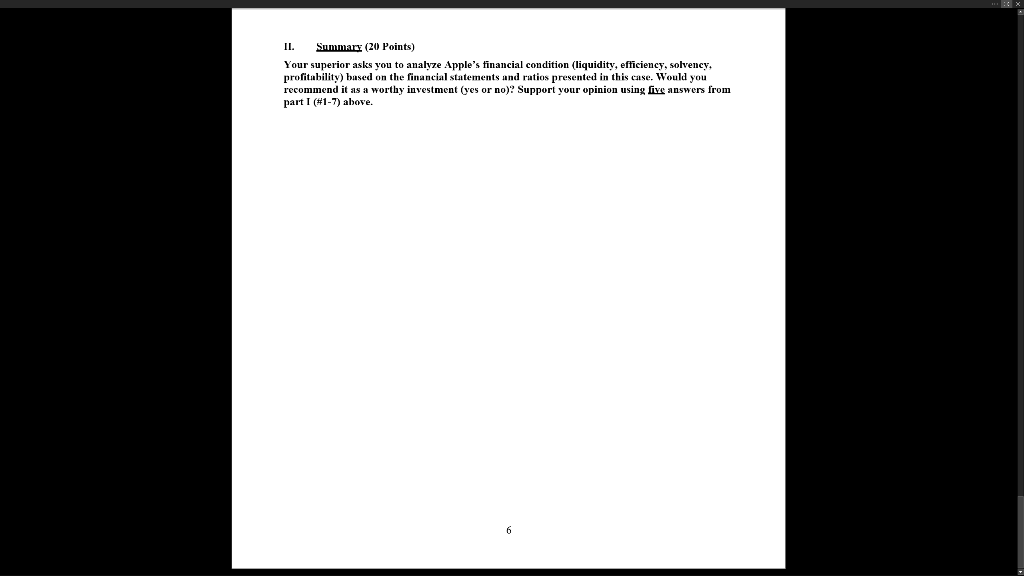

*Please answer completely and will thumbs up. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and

*Please answer completely and will thumbs up.

Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 30, 2017 $ 229,234 141,048 88,186 September 29, 2018 $ 265,595 163,756 101,839 Net sales Cost of sales Gross margin September 24, 2016 $ 215,639 131,376 84,263 Operating expenses: Research and development Selling, general and administrative Total operating expenses 14,236 16,705 30.941 11,581 15,261 26,842 10,045 14,194 24,239 Operating income Other income/expense), net Income before provision for income taxes Provision for income taxes Net income 70,898 2,005 72,903 13,372 59,531 $ 61,344 2,745 64,089 15,738 48,351 $ 60,024 1,348 61,372 15,685 45,687 $ Earnings per share: Basic 12.01 $ 9.27 $ 8.35 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 29, 2018 September 30, 2017 ASSETS: $ Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 25,913 40,388 23,186 3,956 25,809 12.087 131,339 20,289 53,892 17,874 4,855 17,799 13,936 128,645 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 170,799 41,304 22,283 234,386 365,725 194,714 33,783 18,177 246,674 375,319 $ $ LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 55,888 32,687 7,543 11,964 8,784 116,866 44,242 30,551 7,548 11,977 6,496 100,814 Non-current liabilities: Deferred revenue Term debt Other non-current liabilities Total non-current liabilities Total liabilities 2,797 93,735 45,180 2,836 97,207 40,415 140,458 241,272 141,712 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,754,986 and 5,126,201 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 40,201 70,400 (3,454) 107,147 365,725 35,867 98,330 (150) 134,047 375,319 $ Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands and per share amounts) Additional Paid-in Capital Share Amount Retained Earnings Accumulated Comprehensive Income Los) Shareholders' 3,126,201 36,367 98.330 (150) 134,047 278 (278) 59.531 59,581 (3,026) 13.026) Balances as of September 30, 2017 Cumulative effect of change in accounting principle Net Income Other comprehensive income foss) Dividends and dividend equivalents declared at $2.72 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Balances as of September 29, 2018 (405,549) (18.735) (73,066) (18,785) (73,066) 5,443 5.443 34.334 4,754,900 (1.1091 40,201 3 S 1 9480 70.400 $ 12,0671 107.147 (3,454) $ I. Financial Statement Analysis Raitios-Must show your work for all ralios, Calculate cach ratio to three decimal places. (Page numbers are for referencing the formulas in your textbook.) 1. Current Ratio & Profit Margin.(pages 561-562, 563,565) (24 Points) a. Calculate the Current ratio. (4) Does this ratio appear Lavorable or unfavorable? (4) Why? (4) b. Calculate the Profit Margin ratio. (4) Does this ratio appear favorable or unlavoruble? (4) Why? (4) Accounts Receivable Turnover and Days' Sales Uncollected (pages 561, 565) (18 Points) a. Calculate the Accounts Receivable Turnover ratio. (8) b. Calculate the Days' Sales Uncollected ratio. (6) Does this ratio appear favorable or unfavorable? Why? (4 3. Total Asset Turnover (pages 561, 565) (6 Points) u. Calculate the Total Asset Turnover ratio. (6) 4. Deht ratio (pages 562, 565) (8 Points) a. Calculute the Debt ratio. (4) What does this ratio tell you about Apple's risk? (4) 5. Debt-to-Favity Ratio (pages 562, 565) (8 Points) 1. Calculate the Debt-to-Equity Ratio. (4) b. What does this ratio tell you about Apples' capital structure and risk? (4) 6. Market Prise Dividend Yield & Price-Earnings Ratio (pages 564, 565) (20 Points) i. What is the current market price of the stock? This is not in the financial statements provided. It is noted on Apple's website or go to www.yuhoofinance.com to get the quote. The ticker symbol for Apple is AAPL. Price (4) Date found: b. Calculate the Dividend Yield. (4) b. Calculate the Dividend Yield. (4) c. Calculate the Price-Earnings Ratio. (4) d. If analyst give a range of higher than 20-25 for a stock to be considered overpriced and less than 5-8 for a stock to be considered underpriced, how is Apple doing? (6) 7. Inventory turnover & Days' Sales in Inventory (page 561, 565) (16 Points) a. Calculate the Inventory turnover ratio. (6) h. Calculate the Days' Sales in Inventory ratio. (6) c. Is this favorable or unfavorable? Why?(4) II. Summary (20 Points) Your superior asks you to analyze Apple's financial condition (liquidity, efficiency, solvency, profitability) based on the financial statements and ratios presented in this case. Would you recommend it as a worthy investment (yes or no)? Support your opinion using five answers from part I (#1-7) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started