Answered step by step

Verified Expert Solution

Question

1 Approved Answer

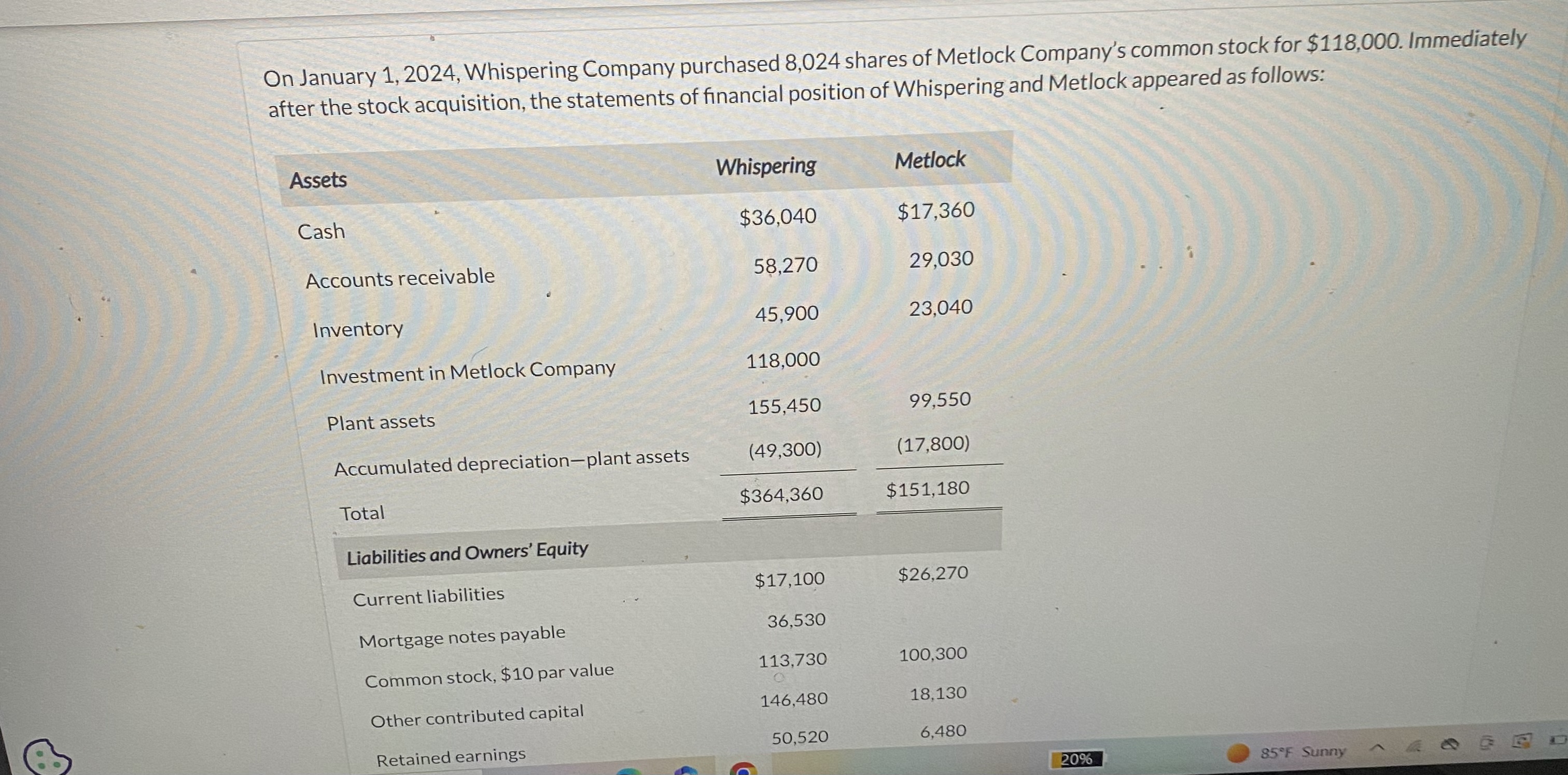

Please answer completely On January 1, 2024, Whispering Company purchased 8,024 shares of Metlock Company's common stock for $118,000. Immediately after the stock acquisition, the

Please answer completely

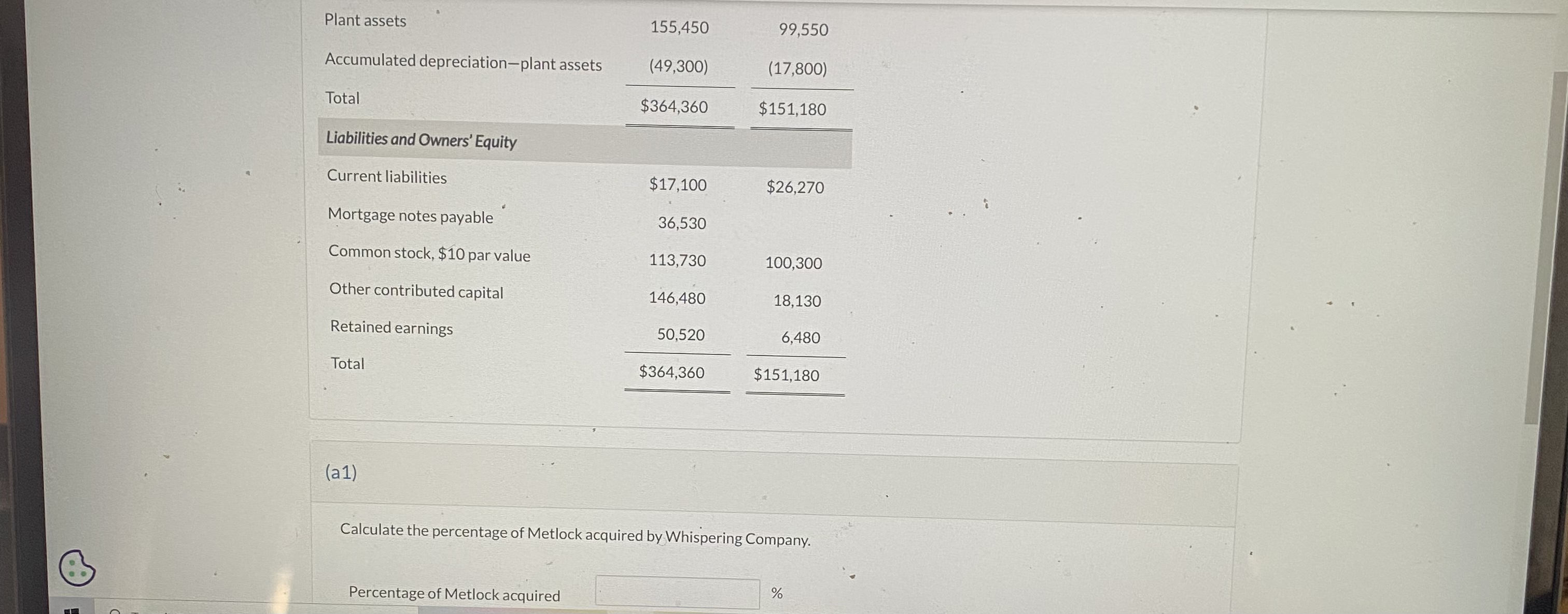

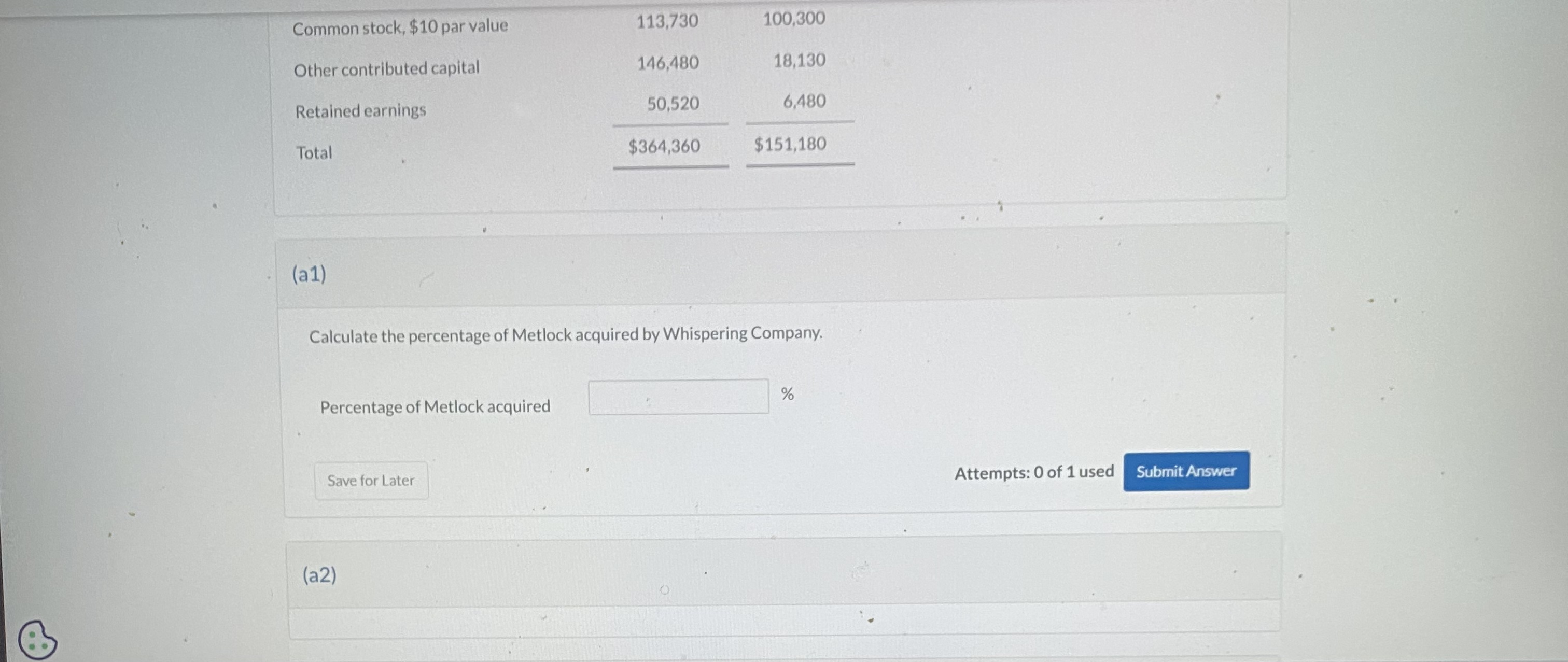

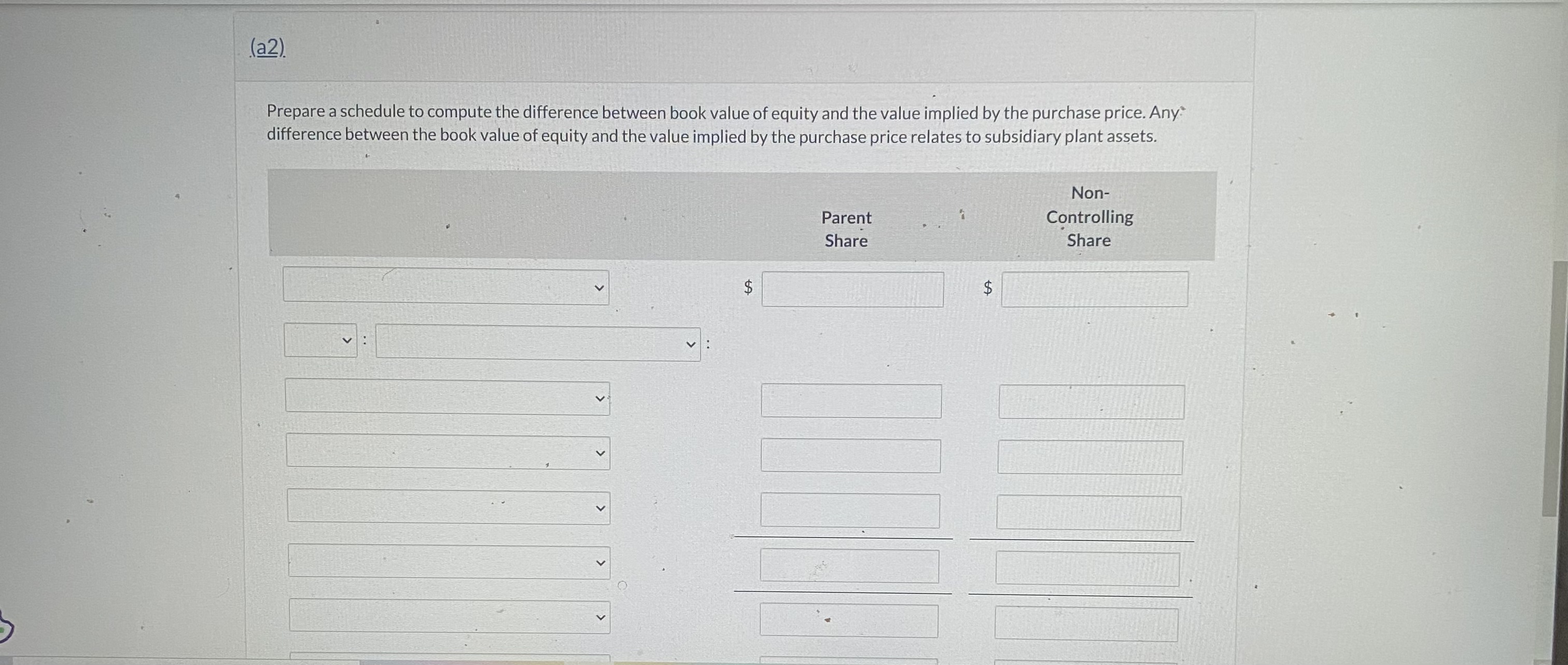

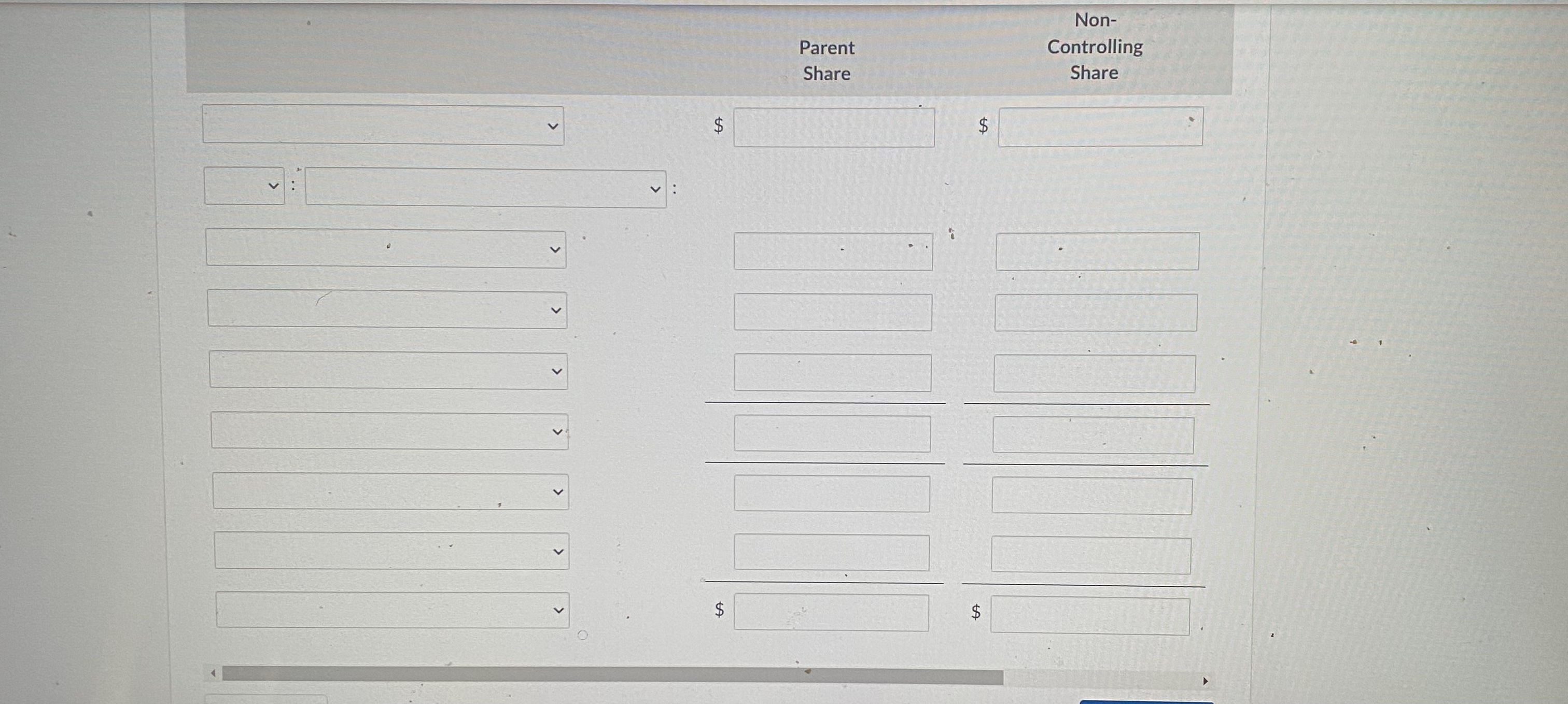

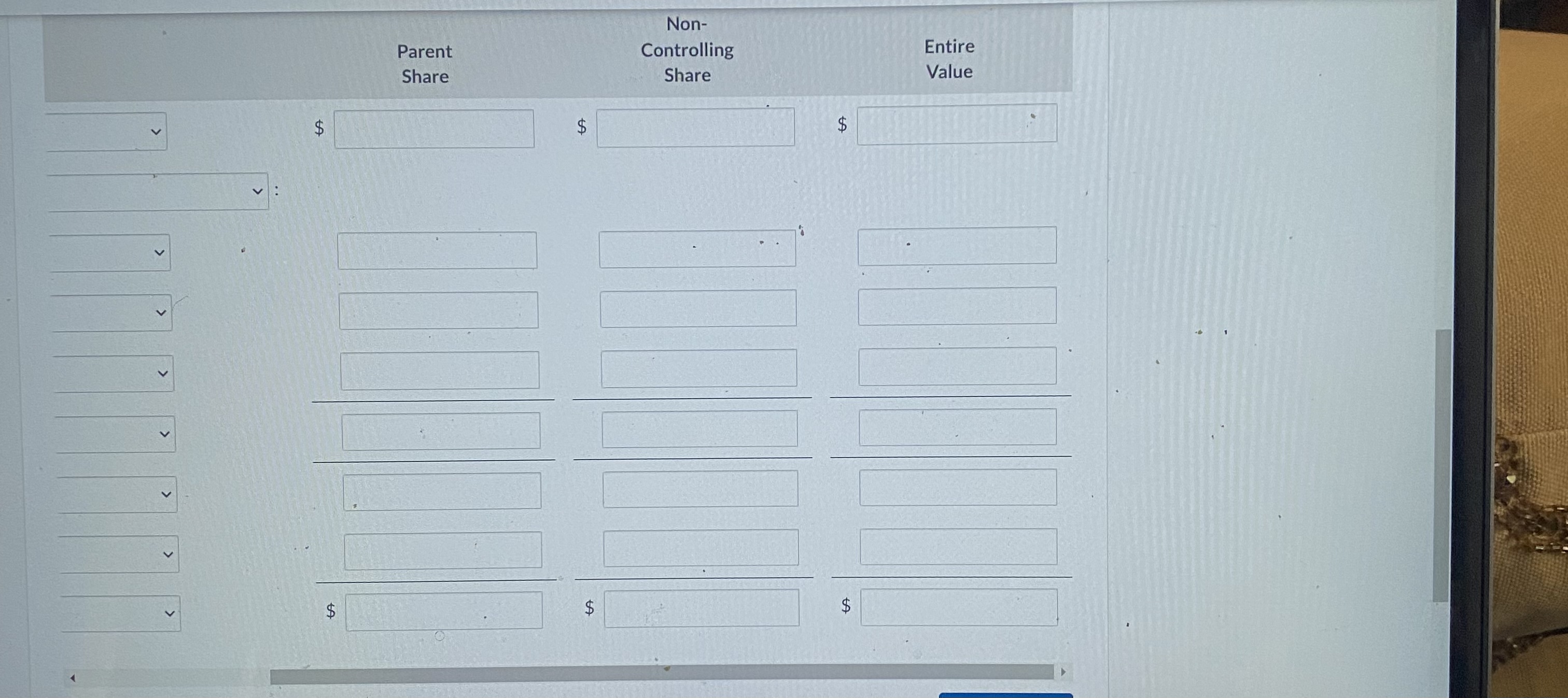

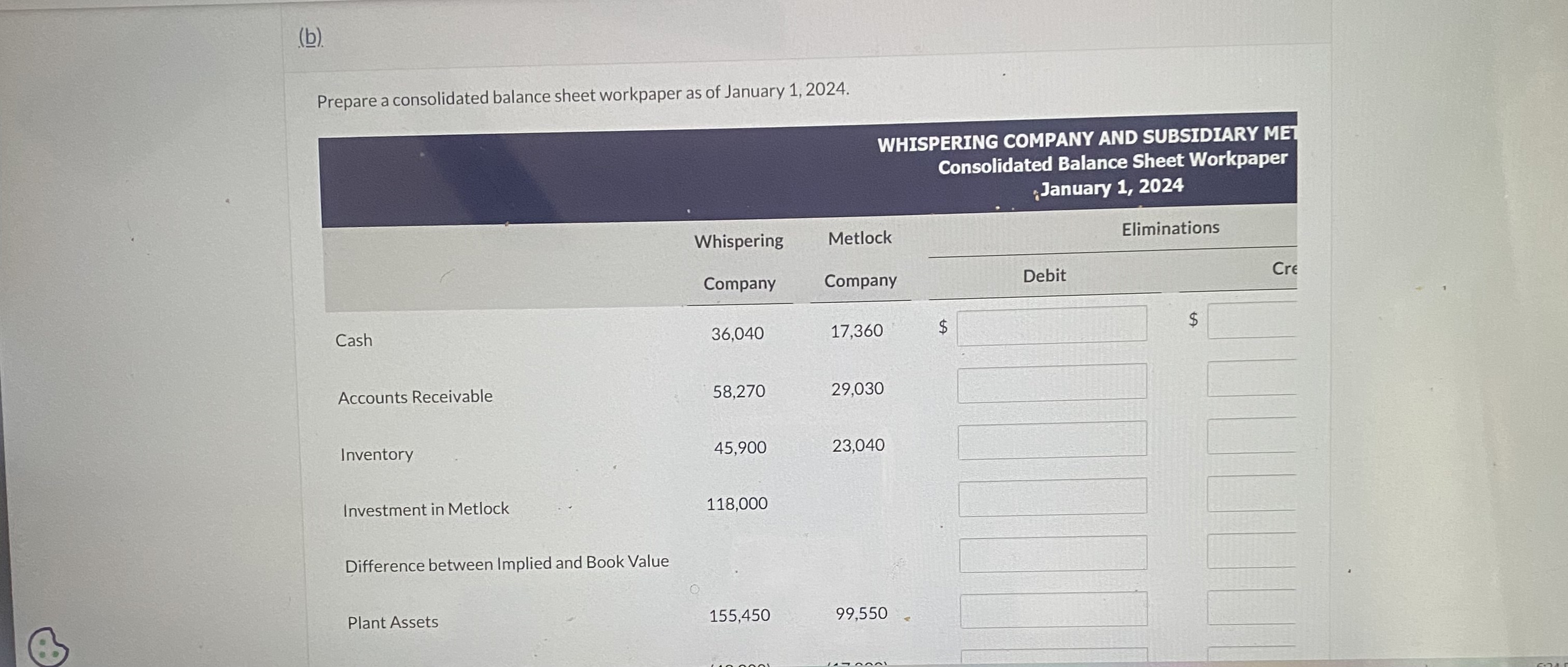

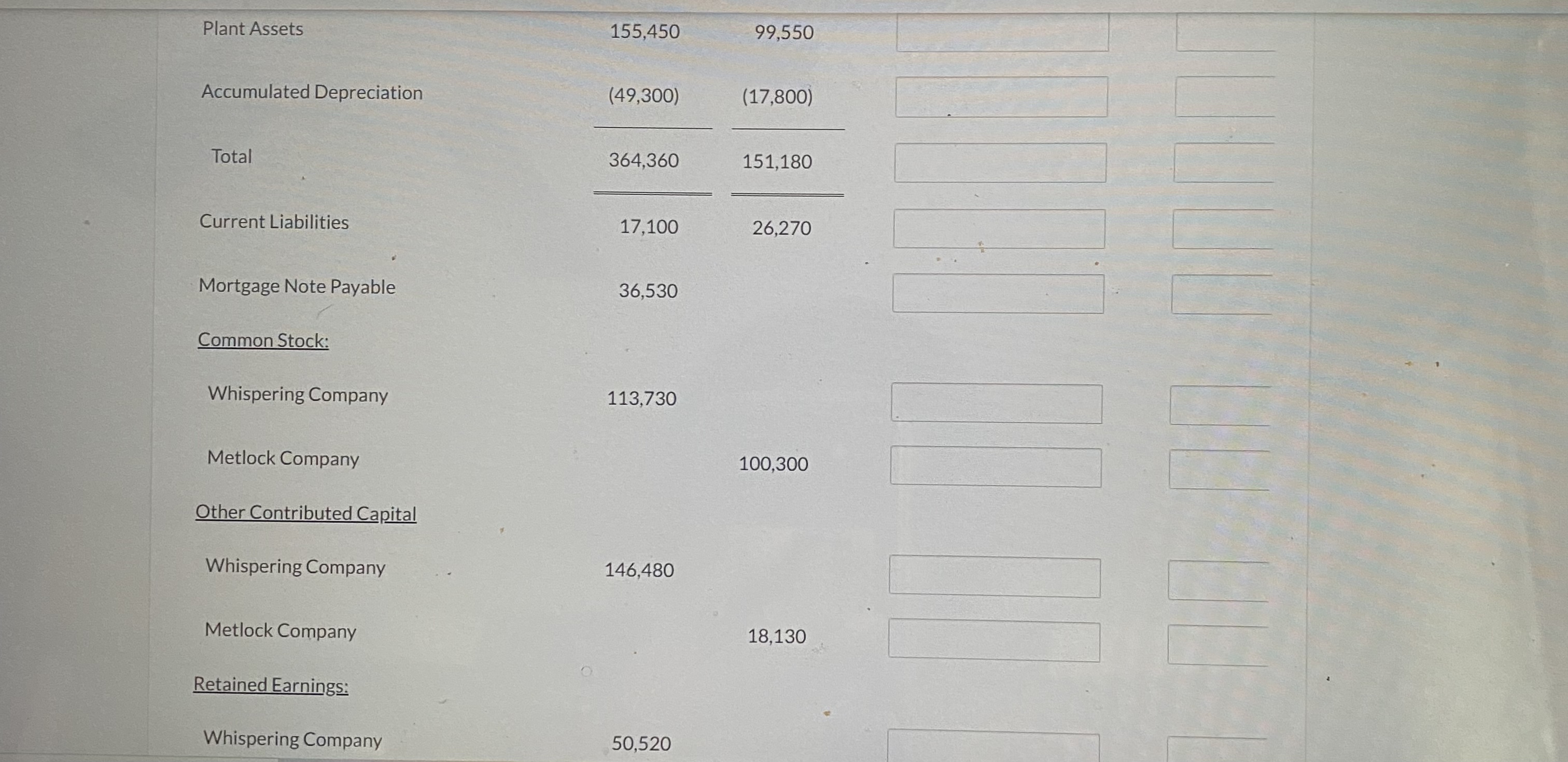

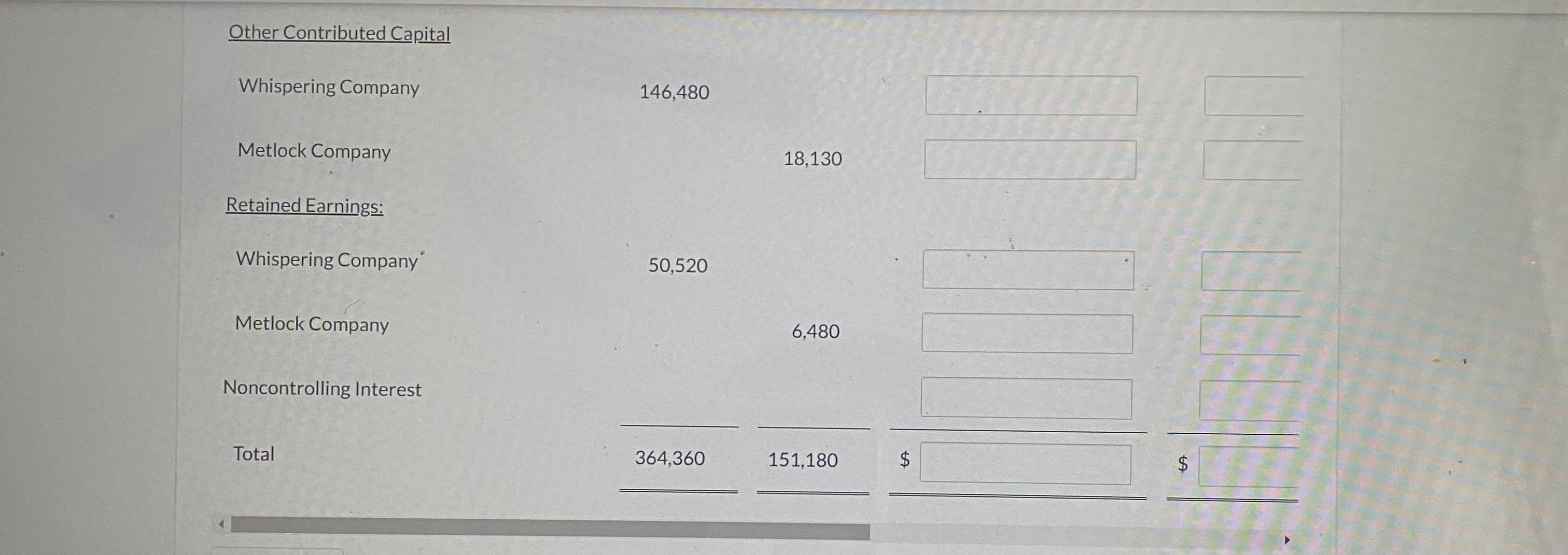

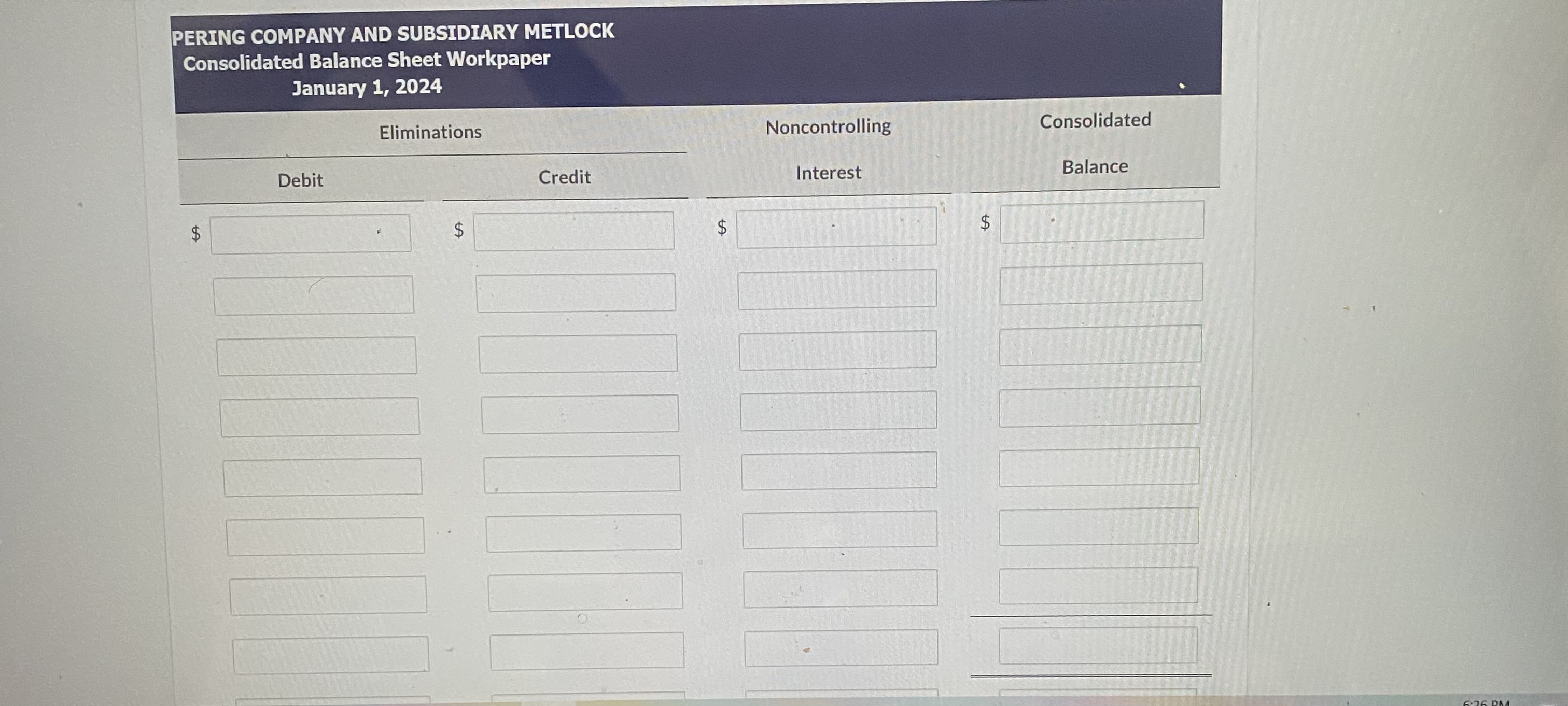

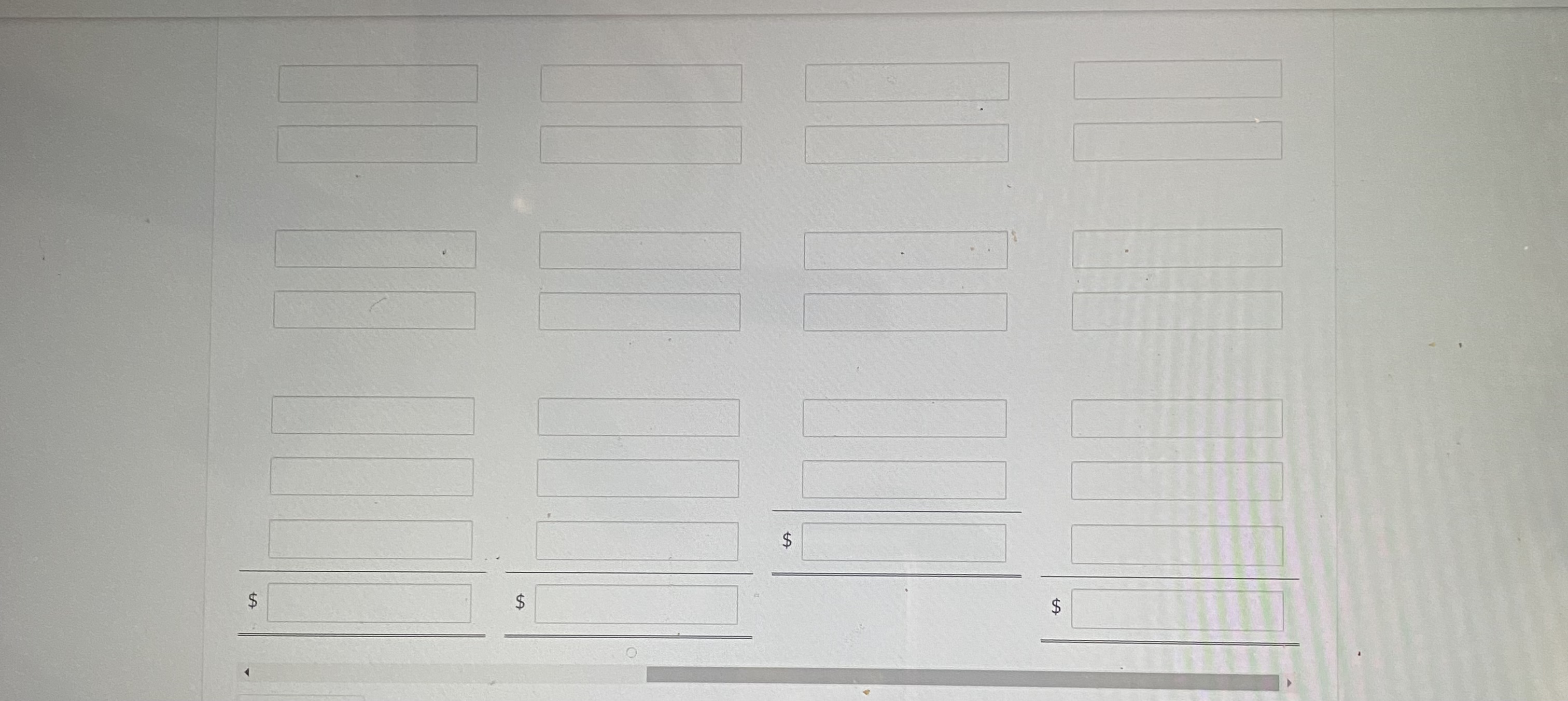

On January 1, 2024, Whispering Company purchased 8,024 shares of Metlock Company's common stock for $118,000. Immediately after the stock acquisition, the statements of financial position of Whispering and Metlock appeared as follows: Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired Prepare a schedule to compute the difference between book value of equity and the value implied by the purchase price. Any: difference between the book value of equity and the value implied by the purchase price relates to subsidiary plant assets. Prepare a consolidated balance sheet workpaper as of January 1, 2024. Plant Assets Accumulated Depreciation Total Current Liabilities Mortgage Note Payable Common Stock: Whispering Company Metlock Company Other Contributed Capital Whispering Company Metlock Company Retained Earnings: 155,45099,550 \( \frac{\frac{(49,300)}{364,360} \frac{(17,800)}{151,180}}{\hline \frac{26,270}{17,100}} \) 36,530 113,730 100,300 146,480 18,130 50,520 Other Contributed Capital Whispering Company Metlock Company Retained Earnings: Whispering Company Metlock Company Noncontrolling Interest Total 146,480 18,130 50,520 6,480 PERING COMPANY AND SUBSIDIARY METLOCK Consolidated Balance Sheet Workpaper January 1, 2024 Consolidated $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started