Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer correctly and put in a table The above table contains the bilateral net positions (in million dollars) among three dealers for two types

please answer correctly and put in a table

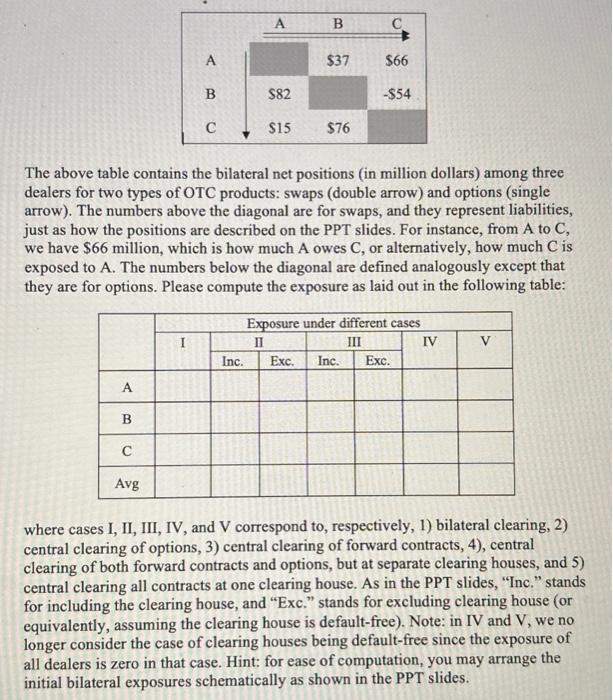

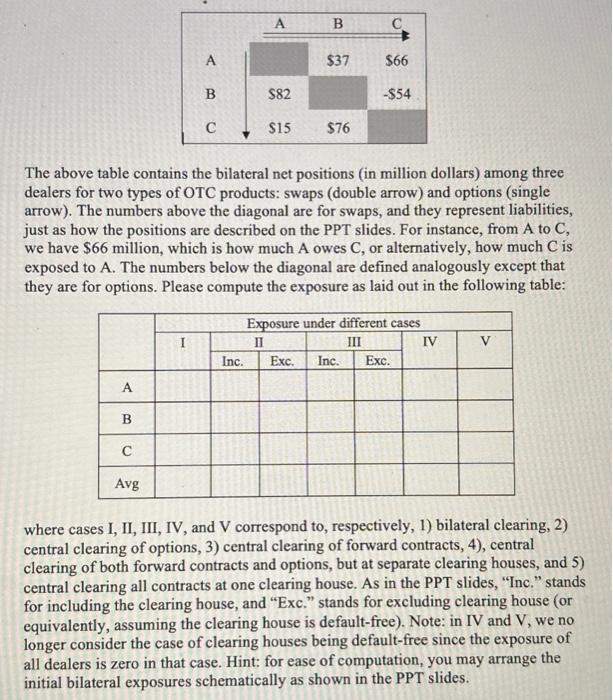

The above table contains the bilateral net positions (in million dollars) among three dealers for two types of OTC products: swaps (double arrow) and options (single arrow). The numbers above the diagonal are for swaps, and they represent liabilities, just as how the positions are described on the PPT slides. For instance, from A to C, we have $66 million, which is how much A owes C, or alternatively, how much C is exposed to A. The numbers below the diagonal are defined analogously except that they are for options. Please compute the exposure as laid out in the following table: where cases I, II, III, IV, and V correspond to, respectively, 1) bilateral clearing, 2) central clearing of options, 3) central clearing of forward contracts, 4), central clearing of both forward contracts and options, but at separate clearing houses, and 5) central clearing all contracts at one clearing house. As in the PPT slides, "Inc." stands for including the clearing house, and "Exc." stands for excluding clearing house (or equivalently, assuming the clearing house is default-free). Note: in IV and V, we no longer consider the case of clearing houses being default-free since the exposure of all dealers is zero in that case. Hint: for ease of computation, you may arrange the initial bilateral exposures schematically as shown in the PPT slides. The above table contains the bilateral net positions (in million dollars) among three dealers for two types of OTC products: swaps (double arrow) and options (single arrow). The numbers above the diagonal are for swaps, and they represent liabilities, just as how the positions are described on the PPT slides. For instance, from A to C, we have $66 million, which is how much A owes C, or alternatively, how much C is exposed to A. The numbers below the diagonal are defined analogously except that they are for options. Please compute the exposure as laid out in the following table: where cases I, II, III, IV, and V correspond to, respectively, 1) bilateral clearing, 2) central clearing of options, 3) central clearing of forward contracts, 4), central clearing of both forward contracts and options, but at separate clearing houses, and 5) central clearing all contracts at one clearing house. As in the PPT slides, "Inc." stands for including the clearing house, and "Exc." stands for excluding clearing house (or equivalently, assuming the clearing house is default-free). Note: in IV and V, we no longer consider the case of clearing houses being default-free since the exposure of all dealers is zero in that case. Hint: for ease of computation, you may arrange the initial bilateral exposures schematically as shown in the PPT slides

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started