PLEASE ANSWER CORRECTLY ASAP!!!! THANK YOU!

PLEASE ANSWER CORRECTLY ASAP!!!! THANK YOU!

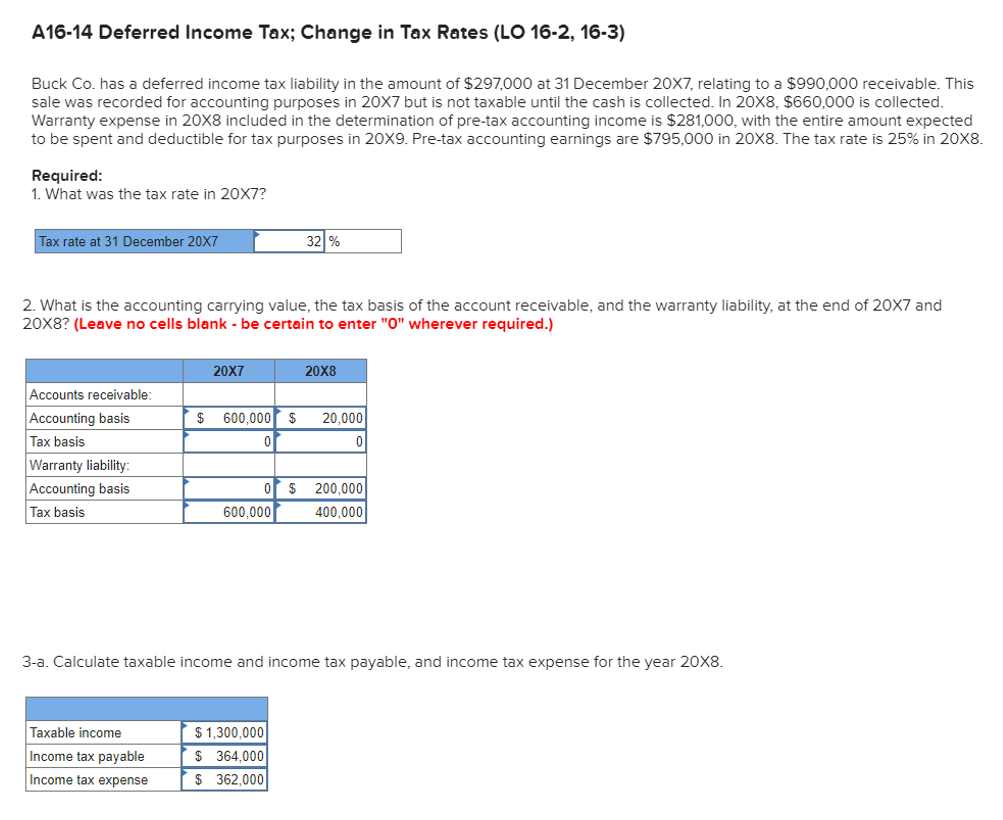

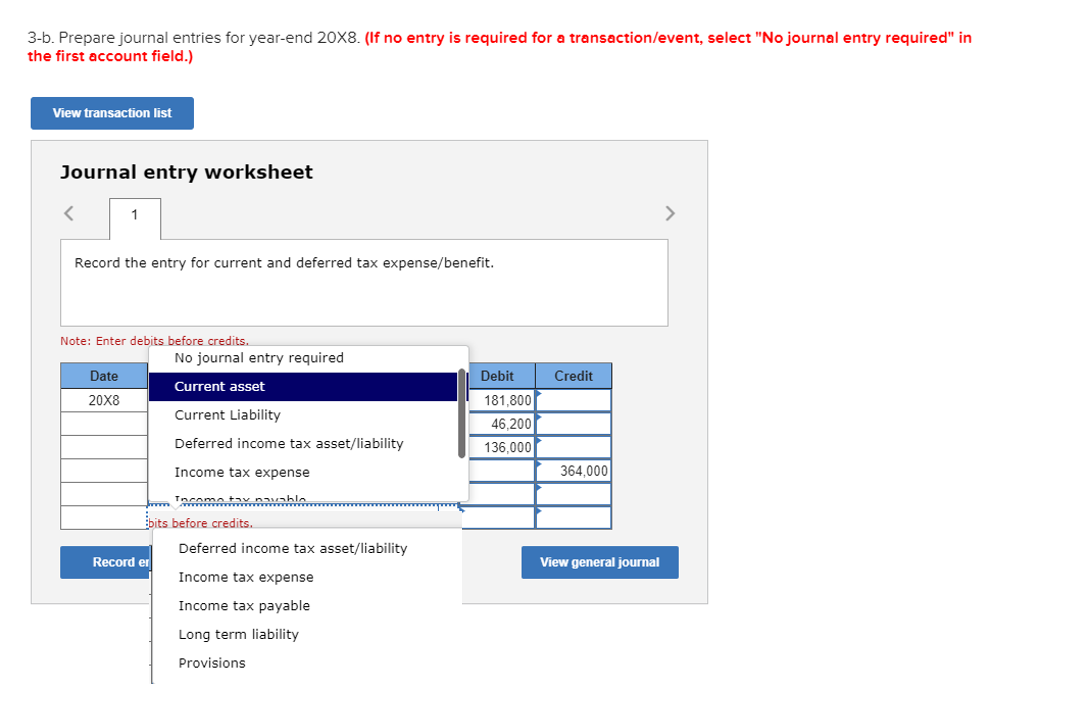

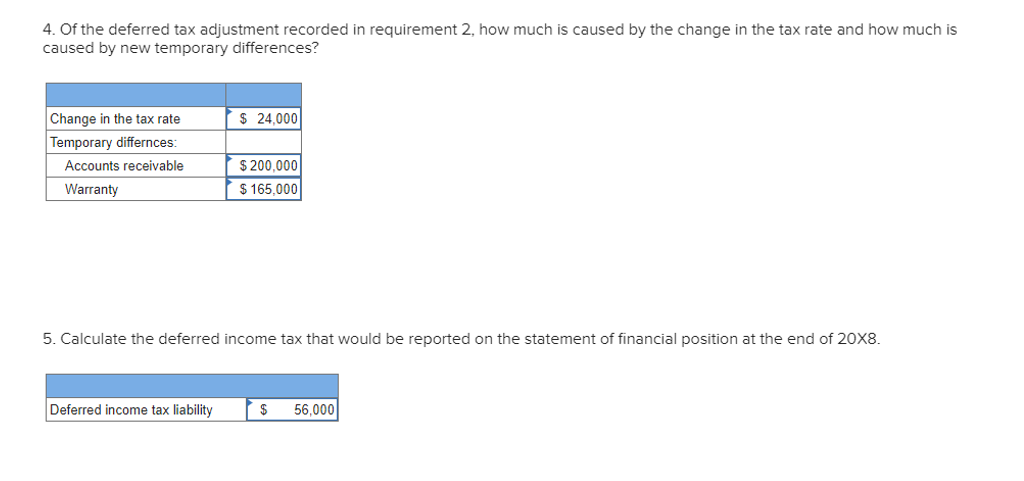

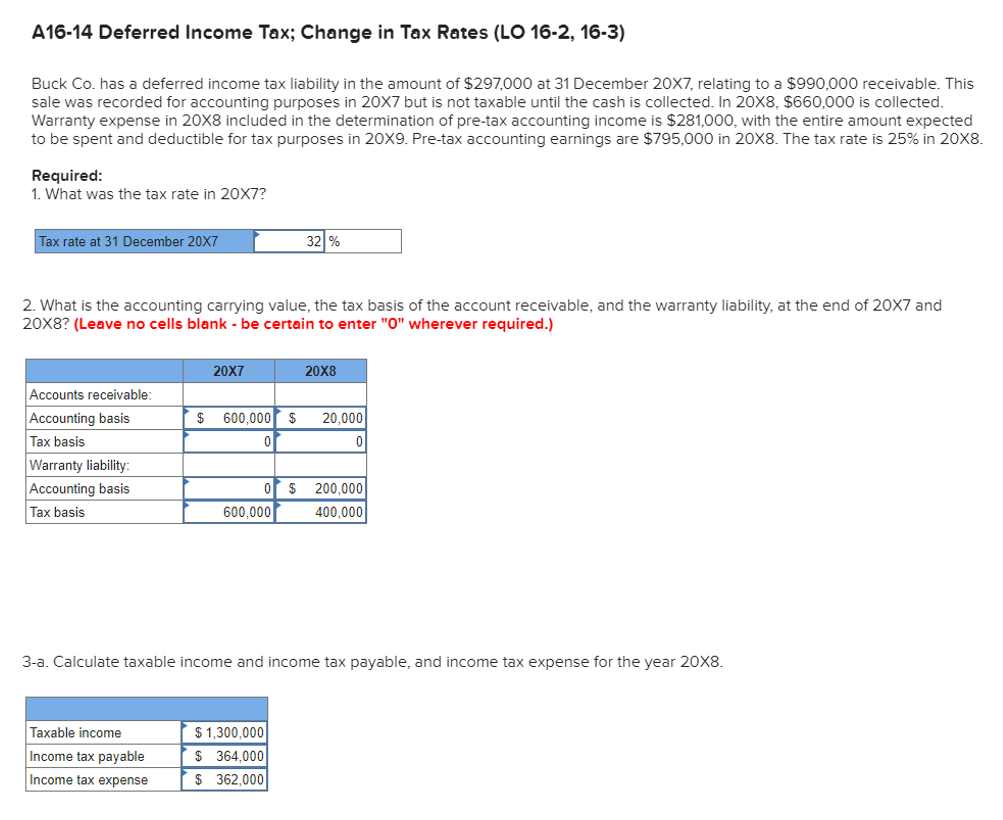

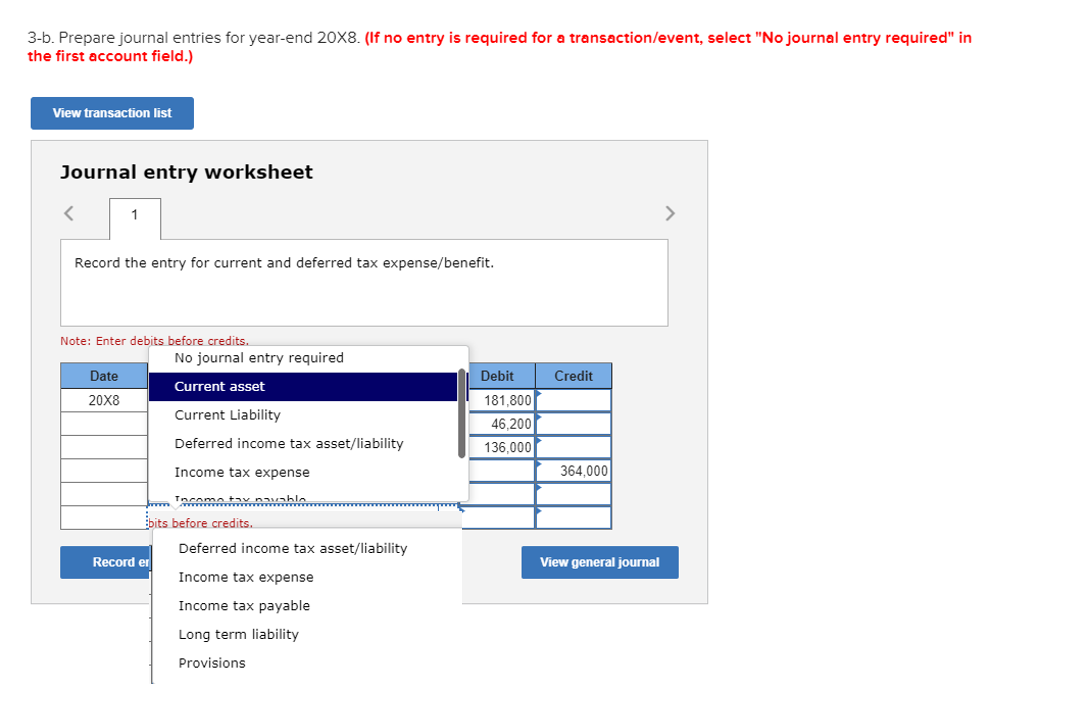

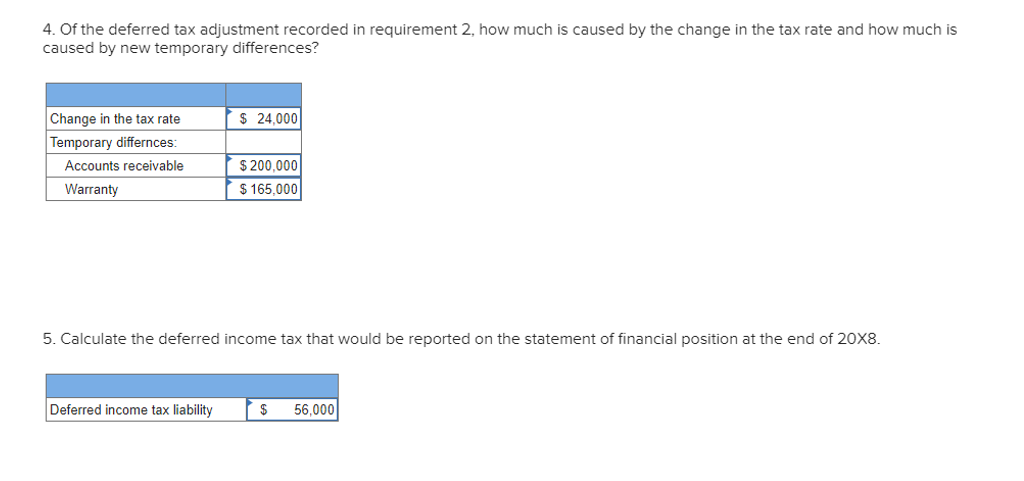

A16-14 Deferred Income Tax; Change in Tax Rates (LO 16-2, 16-3) Buck Co. has a deferred income tax liability in the amount of $297,000 at 31 December 207, relating to a $990,000 receivable. This sale was recorded for accounting purposes in 207 but is not taxable until the cash is collected. In 208,$660,000 is collected. Warranty expense in 208 included in the determination of pre-tax accounting income is $281,000, with the entire amount expected to be spent and deductible for tax purposes in 209. Pre-tax accounting earnings are $795,000 in 208. The tax rate is 25% in 208 Required: 1. What was the tax rate in 207 ? 2. What is the accounting carrying value, the tax basis of the account receivable, and the warranty liability, at the end of 207 and 20X8? (Leave no cells blank - be certain to enter "0" wherever required.) 3-a. Calculate taxable income and income tax payable, and income tax expense for the year 208. 3-b. Prepare journal entries for year-end 208. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for current and deferred tax expense/benefit. Note: Enter debits before credits. 4. Of the deferred tax adjustment recorded in requirement 2 , how much is caused by the change in the tax rate and how much is caused by new temporary differences? 5. Calculate the deferred income tax that would be reported on the statement of financial position at the end of 208. A16-14 Deferred Income Tax; Change in Tax Rates (LO 16-2, 16-3) Buck Co. has a deferred income tax liability in the amount of $297,000 at 31 December 207, relating to a $990,000 receivable. This sale was recorded for accounting purposes in 207 but is not taxable until the cash is collected. In 208,$660,000 is collected. Warranty expense in 208 included in the determination of pre-tax accounting income is $281,000, with the entire amount expected to be spent and deductible for tax purposes in 209. Pre-tax accounting earnings are $795,000 in 208. The tax rate is 25% in 208 Required: 1. What was the tax rate in 207 ? 2. What is the accounting carrying value, the tax basis of the account receivable, and the warranty liability, at the end of 207 and 20X8? (Leave no cells blank - be certain to enter "0" wherever required.) 3-a. Calculate taxable income and income tax payable, and income tax expense for the year 208. 3-b. Prepare journal entries for year-end 208. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for current and deferred tax expense/benefit. Note: Enter debits before credits. 4. Of the deferred tax adjustment recorded in requirement 2 , how much is caused by the change in the tax rate and how much is caused by new temporary differences? 5. Calculate the deferred income tax that would be reported on the statement of financial position at the end of 208

PLEASE ANSWER CORRECTLY ASAP!!!! THANK YOU!

PLEASE ANSWER CORRECTLY ASAP!!!! THANK YOU!