Please answer correctly EXCEPT A & C which I already have. I will thumbs up if the correct answers, other two answers on Chegg are incorrect please don't provide those answers.

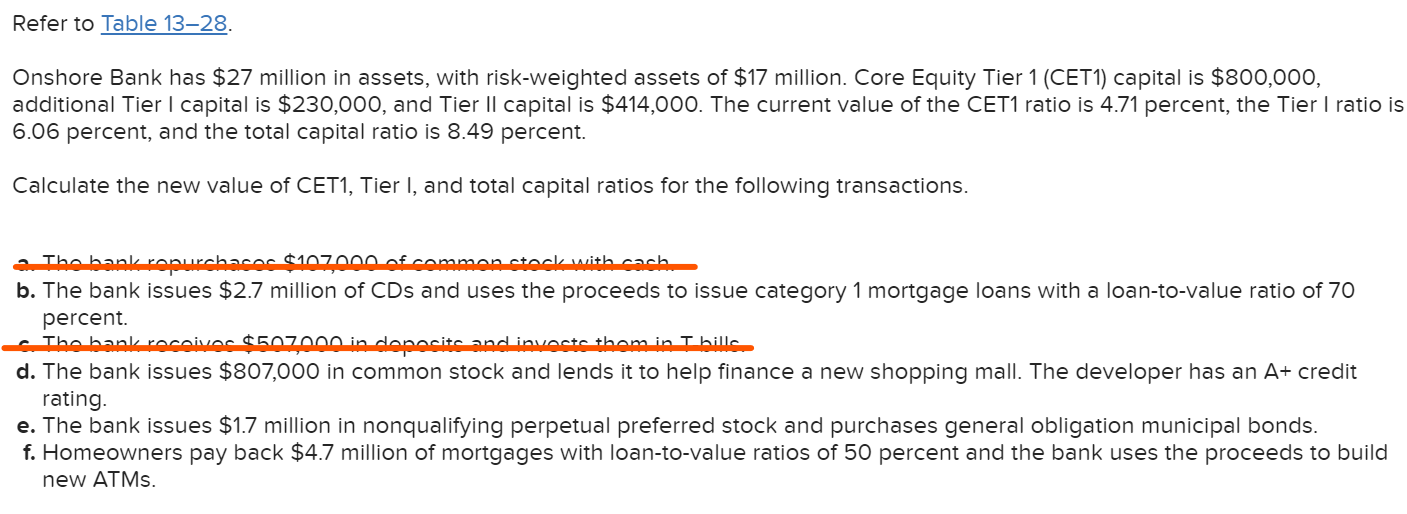

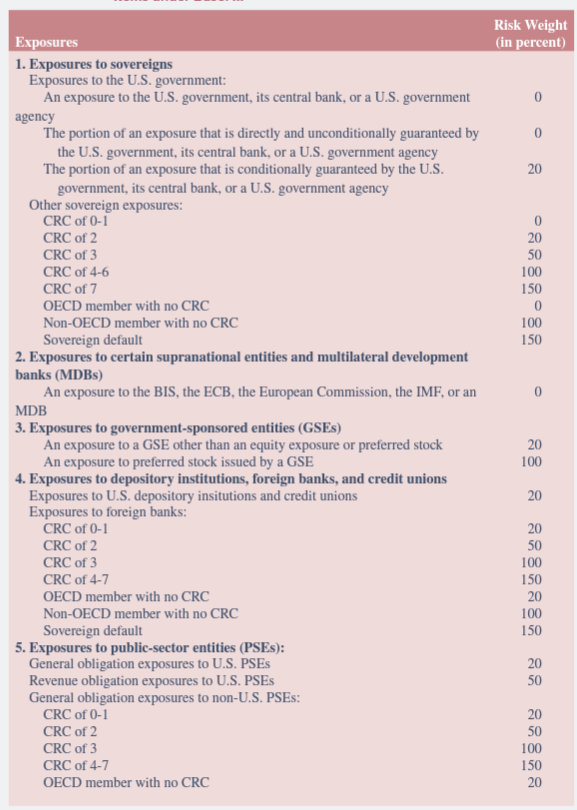

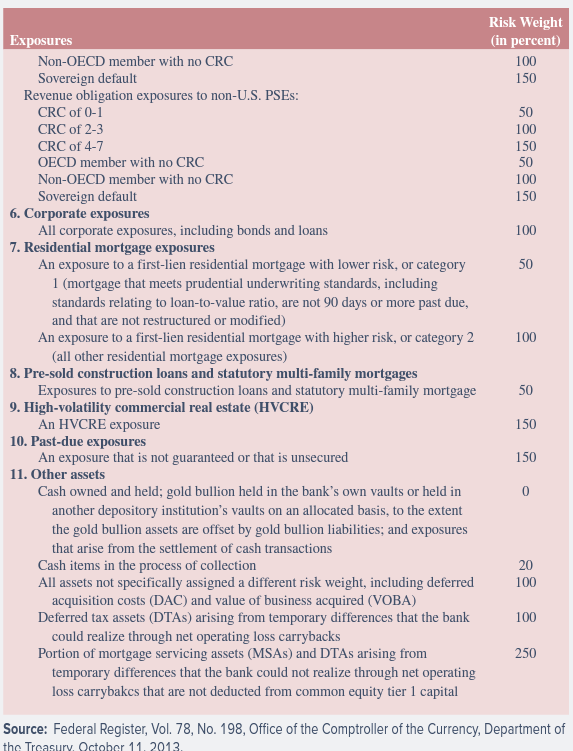

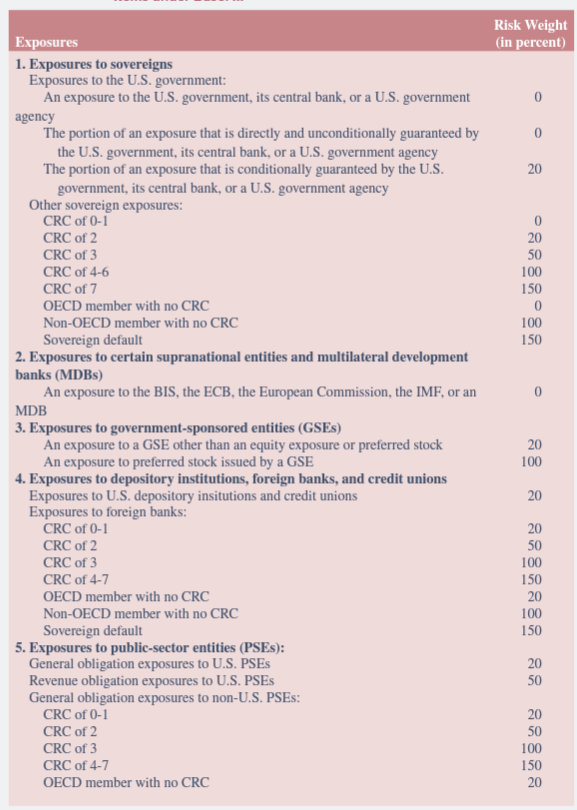

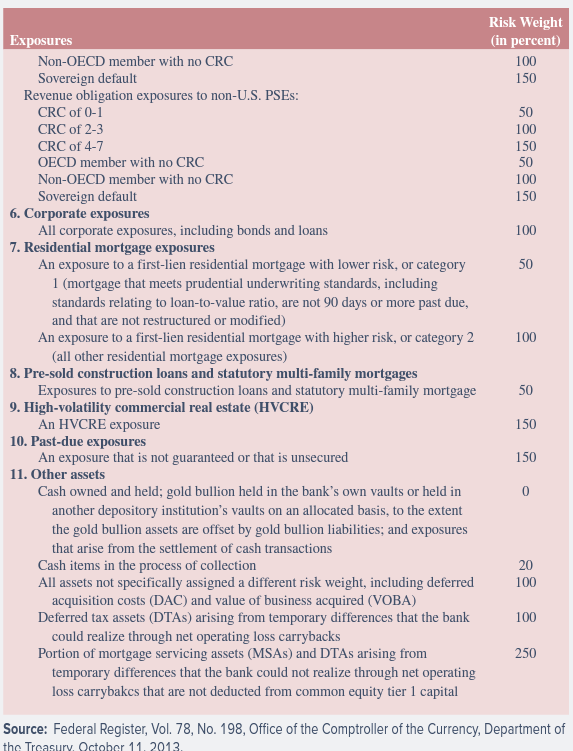

Onshore Bank has $27 million in assets, with risk-weighted assets of $17 million. Core Equity Tier 1 (CET1) capital is $800,000, additional Tier I capital is $230,000, and Tier II capital is $414,000. The current value of the CET1 ratio is 4.71 percent, the Tier I ratio is 6.06 percent, and the total capital ratio is 8.49 percent. Calculate the new value of CET1, Tier I, and total capital ratios for the following transactions. b. The bank issues $2.7 million of CD s and uses the proceeds to issue category 1 mortgage loans with a loan-to-value ratio of 70 percent. d. The bank issues $807,000 in common stock and lends it to help finance a new shopping mall. The developer has an A+ credit rating. e. The bank issues $1.7 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds. f. Homeowners pay back $4.7 million of mortgages with loan-to-value ratios of 50 percent and the bank uses the proceeds to build new ATMs. Risk Weight Exposures (in percent) 1. Exposures to sovereigns Exposures to the U.S. government: An exposure to the U.S. government, its central bank, or a U.S. government 0 agency The portion of an exposure that is directly and unconditionally guaranteed by 0 the U.S. government, its central bank, or a U.S. government agency The portion of an exposure that is conditionally guaranteed by the U.S. 20 government, its central bank, or a U.S. government agency Other sovereign exposures: CRC of 0-1 CRC of 2 CRC of 3 CRC of 46 CRC of 7 OECD member with no CRC Non-OECD member with no CRC Sovereign default 2. Exposures to certain supranational entities and multilateral development banks (MDBs) An exposure to the BIS, the ECB, the European Commission, the IMF, or an 0 MDB 3. Exposures to government-sponsored entities (GSEs) An exposure to a GSE other than an equity exposure or preferred stock An exposure to preferred stock issued by a GSE 4. Exposures to depository institutions, foreign banks, and credit unions Exposures to U.S. depository insitutions and credit unions Exposures to foreign banks: CRC of 0-1 CRC of 2 CRC of 3 CRC of 4-7 OECD member with no CRC Non-OECD member with no CRC Sovereign default 0 20 50 100 150 0 100 150 5. Exposures to public-sector entities (PSEs): General obligation exposures to U.S. PSEs Revenue obligation exposures to U.S. PSEs General obligation exposures to non-U.S. PSEs: CRC of 0-1 CRC of 2 CRC of 3 20 100 20 CRC of 4-7 20 50 100 150 20 100 150 OECD member with no CRC 20 50 20 50 100 150 20 Source: Federal Register, Vol. 78, No. 198, Office of the Comptroller of the Currency, Department of