Please answer correctly

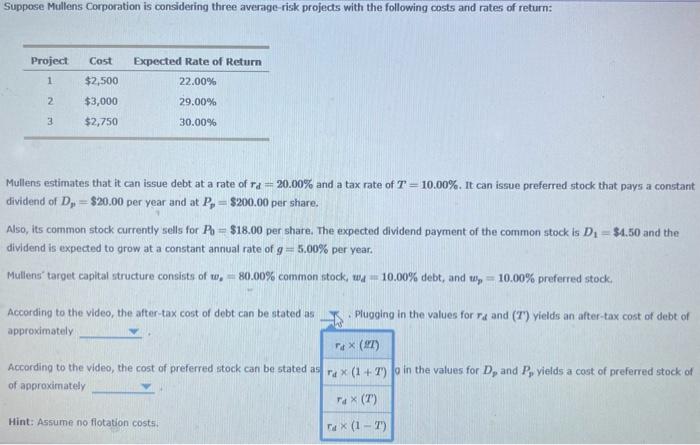

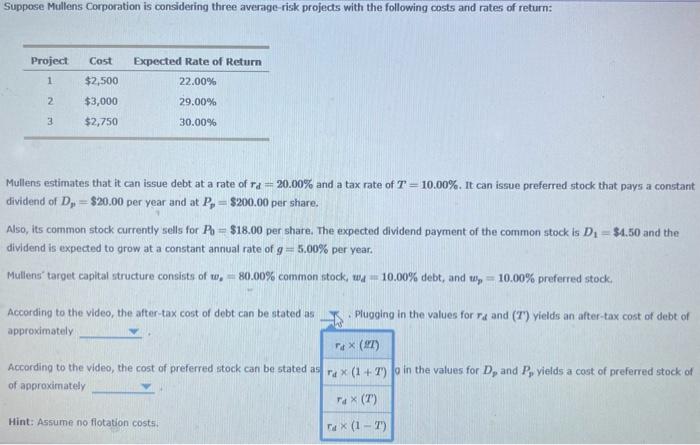

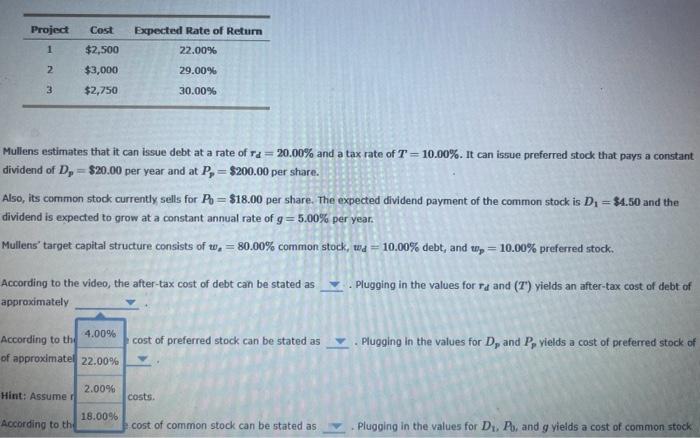

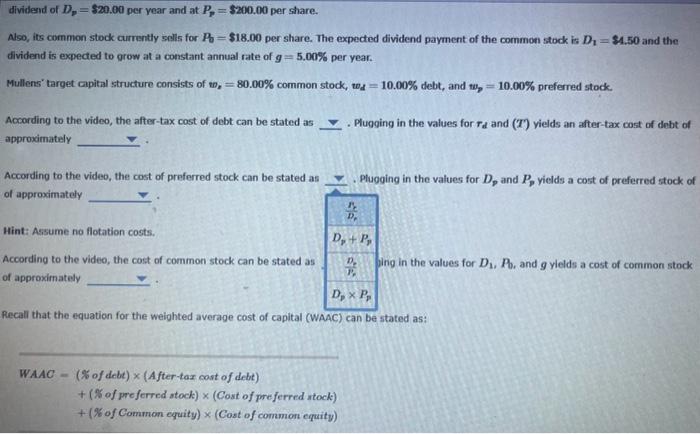

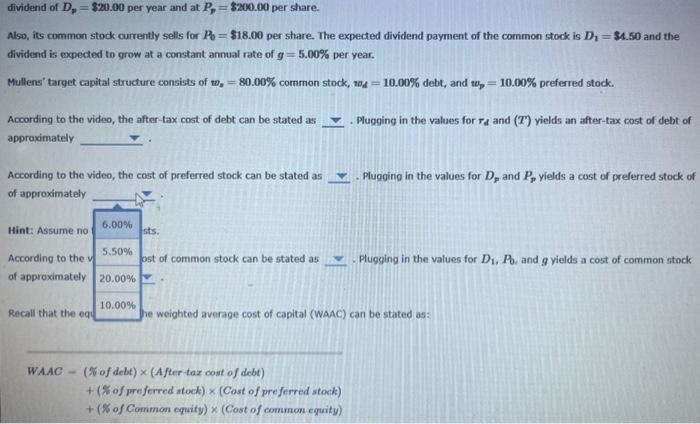

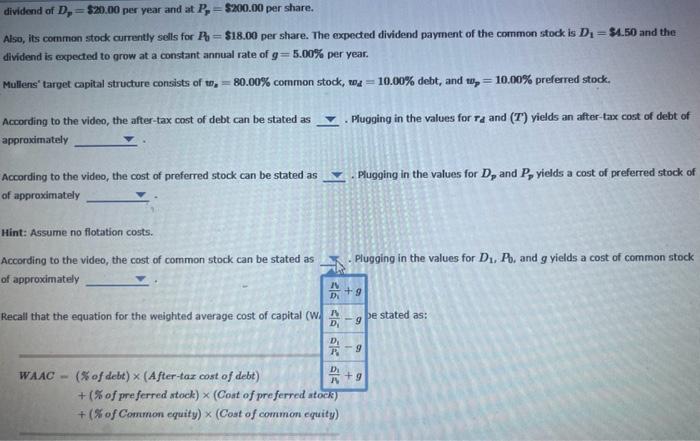

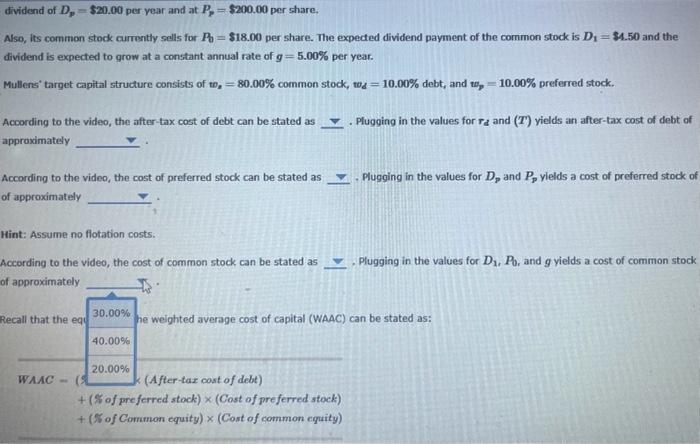

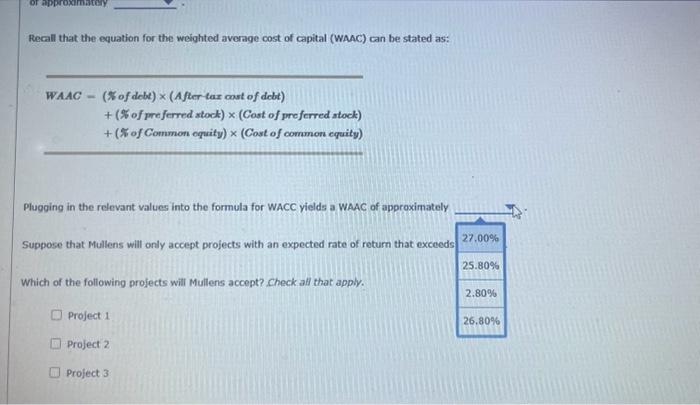

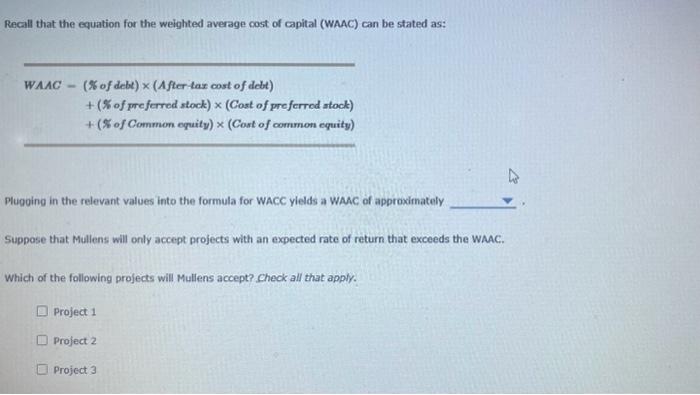

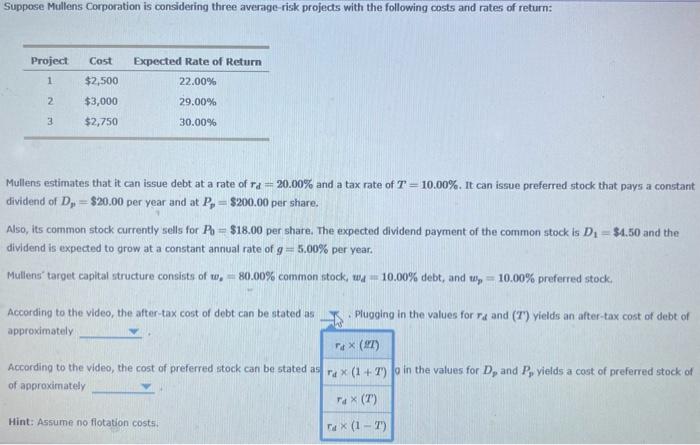

Mullens estimates that it can issue debt at a rate of rd=20.00% and a tax rate of T=10.00%. It can issue preferred stock that pays a constant dividend of Dp=$20.00 per year and at Pp=$200.00 per share. Also, its common stock currently sells for P0=$18.00 per share. The expected dividend payment of the common stock is D1=$4.50 and the dividend is expected to grow at a constant annual rate of g=5.00% per year. Mullens' target capital structure consists of wc=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Pluging in the values for rd and (T) yields an after-tax cost of debt of approximately rd(q) According to the video, the cost of preferred stock can be stated as rd(1+T)0 in the values for Dp and Pp yields a cost of preferred stock of of approximately rd(T) Hint: Assume no flotation costs. rd(1T) Mullens estimates that it can issue debt at a rate of rd=20.00% and a tax rate of T=10.00%. It can issue preferred stock that pays a constant dividend of Dp=$20.00 per year and at Pp=$200.00 per share. Also, its cormmon stock currently sells for P0=$18.00 per share. The expected dividend payment of the common stock is D1=$4.50 and the dividend is expected to grow at a constant annual rate of g=5.00% per year. Mullens' target capital structure consists of w=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for rd and (T) yields an after-tax cost of debt of approximately Plugging in the values for Dp and Pp vields a cost of preferred stock of cost of common stock can be stated as Plugging in the values for D2,P0, and g yields a cost of common stock dividend of Dp=$20.00 per year and at Pp=$200.00 per share. Aso, its common stock currently selis for P0=$18.00 per share. The expected dividend payment of the common stock is D2=$1.50 and the dividend is expected to orow at a constant annual rate of g=5.00% per year. Mullens' target capital structure consists of wz=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Pluging in the values for rd and (T) vields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for Dp and Pp yields a cost of preferred stock of of approximately Hint: Assume no flotation costs. Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC=(% of debt )(Aftertax cast of debt) +( \%of preferred stack) (Cost of preferred stock) +(% of Common equity )( Cost of common equity ) dividend of Dp=$20.00 per year and at Pp=$200.00 per stare. Also, its common stock currently sells for P6=$18.00 per stare. The expected dividend payment of the common stock is D1=$1.50 and the dividend is expected to grow at a constant annual rate of g=5.00% per year. Mullens' target capital structure consists of wg=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Pluging in the values for rd and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Pluging in the values for Dp and Pp yields a cost of preferred stock of of approximately \begin{tabular}{l|l|l} Hint: Assume no & 6.00% & sts. \\ \hline According to the v & 5.50% & \\ \hline & ost of common stock can be stated as \end{tabular} Plugging in the values for D1,P0, and g vields a cost of common stock of approximately 20.00% 10.00% Recall that the equ he weighted average cost of capital (WAAC) can be stated as: WA.AC-(%ofdebt)(Aftertaxcontofdebt)+(%ofpreferredstock)(Costofpreferredstock)+(%ofCommonequity)(Costofcommonequity) dividend of Dp=$20.00 per year and at Pp=$200.00 per share. Also, its common stodk currently sells for P0=$18.00 per share. The expected dividend payment of the common stock is D1=$4.50 and the dividend is expected to orow at a constant annual rate of g=5.00% per year. Mullens' tarpet capital structure consists of ws=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for Td and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for Dp and Pp yields a cost of preferred stock of of approximately Hint: Assume no flotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D1,P0, and g yields a cost of common stock of approximately WAAC=(% of debt )( After-tax cost of debt )ND1+g + (\% of preferred stock )( (Cost of preferred stock) +( Si of Conmon equity )( Cost of common equity ) dividend of Dp=$20.00 per vear and at Pp=$200.00 per share. Also, its common stock currently sells for Pb=$18.00 per share. The expected dividend payment of the common stock is D1=$4.50 and the dividend is expected to grow at a constant annual rate of g=5.00% per year. Mullens' target capital structure consists of w2=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as . Plugging in the values for rd and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as . Plugging in the values for Dp and Pp ylelds a cost of preferred stock of of approximately Hint: Assume no flotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D1,P0, and g yields a cost of common stock of approximately Recall that the equ \begin{tabular}{|c|} 30.00% \\ 40.00% \end{tabular} \mid he weighted average cost of capital (WAAC) can be stated as: + (\% of preferred stack) (Cost of preferred stock) +(5 of Common equity) (Cont of common equity) Recall that the equation for the woighted average cost of capital (WAAC) can be stated as: WAAC=((ofdebt)(Aftertarcostofdebt)+(%ofpreferredstock)(Costofpreferredatock)+((%fCommonequity)(Costofcommonequity) Plugging in the relevant values into the formula for WACC vields a WAAC of approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3 Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC(%ofdebt)((Atertaxcostofdebt)+(%ofpreforredstock)(Costofpreferrodstock)+((ofCommonequity)(Contofcommonequity) Plugoing in the relevant values into the formula for WACC yields a WMAC of approdimately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3