Please answer Correctly. People are wasting my time by giving wrong solutions. Only answer if 100% sure

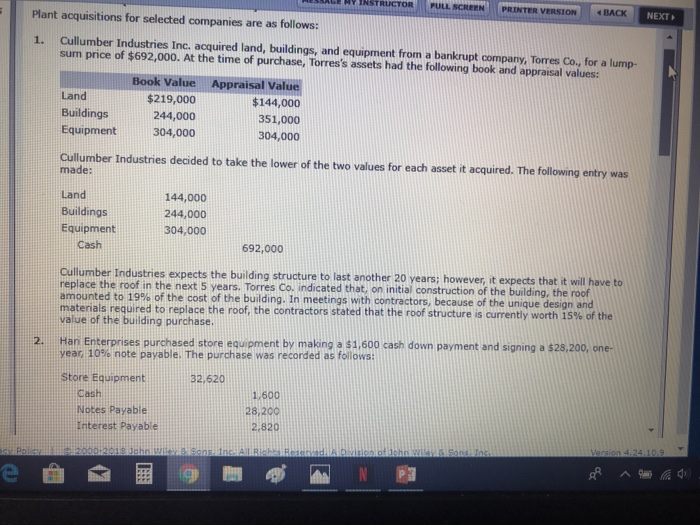

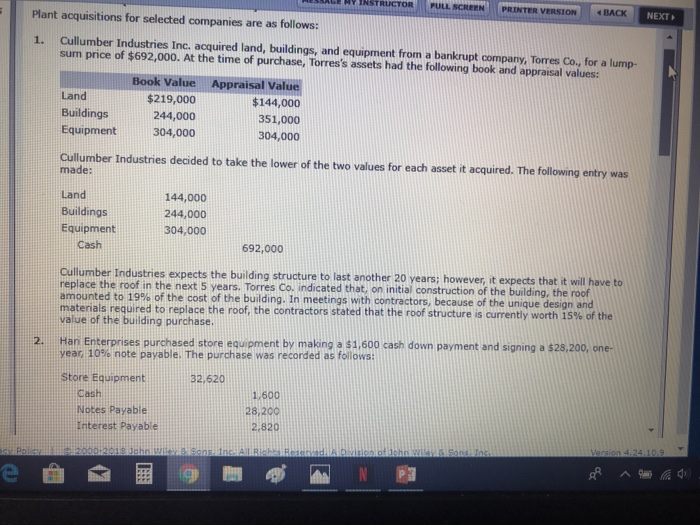

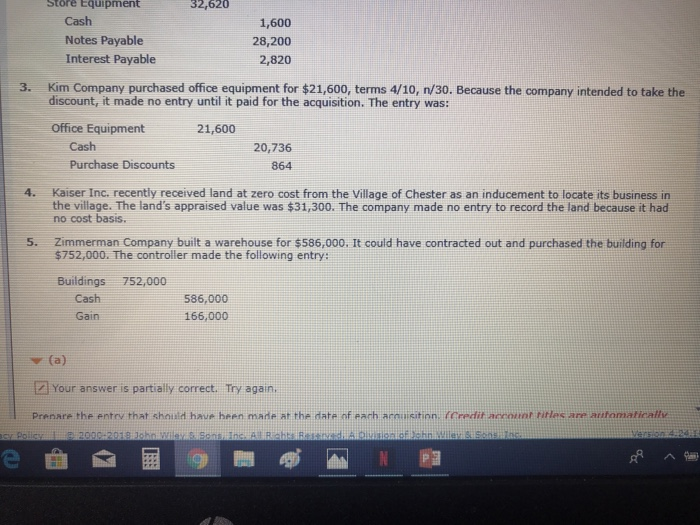

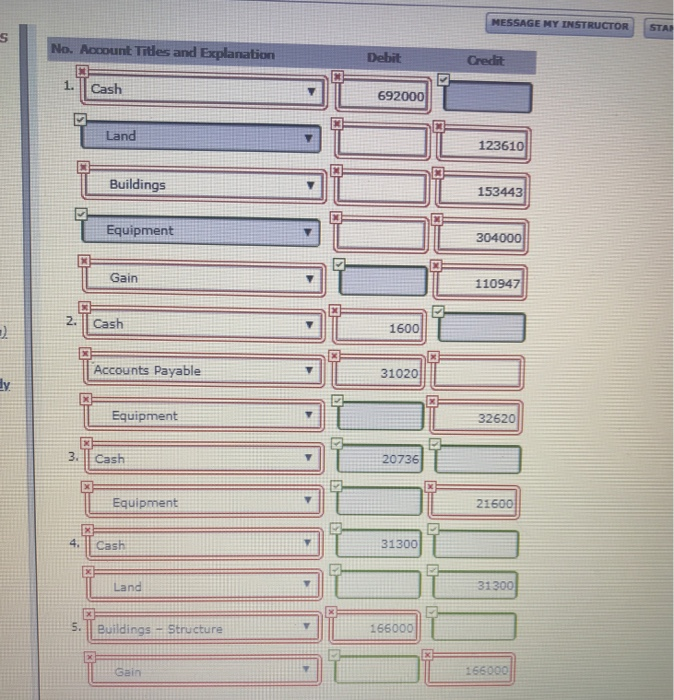

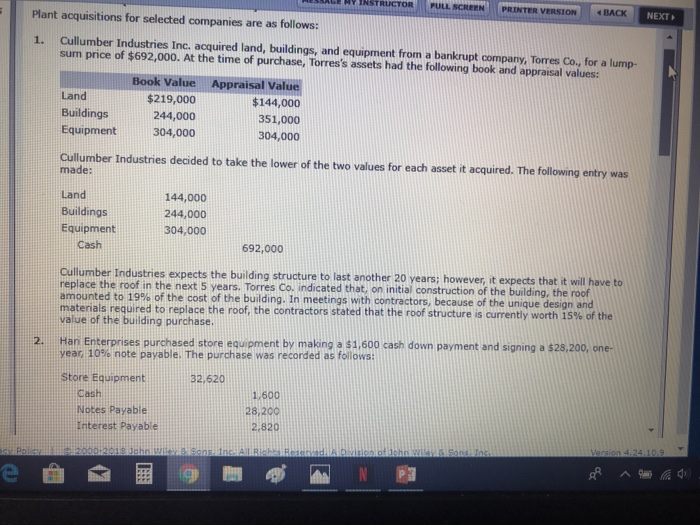

NSTRUCTOR | FULL SCREEN | | PRINTER VERSION | | E BACK NEXT Plant acquisitions for selected companies are as follows: 1. Cullumber Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump- sum price of $692,000. At the time of purchase, Torres's assets had the following book and appraisal values: Book Value $219,000 244,000 Appraisal Value $144,000 351,000 304,000 Land Buildings Equipment 304,000o Cullumber Industries decided to take the lower of the two values for each asset it acquired. The following entry was made: Land Buildings Equipment 144,000 244,000 304,000 Cash 692,000 Cullumber Industries expects the building structure to last another 20 years: however, it expects that it wil replace the roof in the next 5 years. Torres Co. indicate amounted to 19% of the cost ofthe building. In meetings with contractors because of the unique design and materials required to replace the roof, the contractors stated that the roof structure is currently worth 15% of the value of the building purchase d that, on initial construction of the building, the roof 2. Han Enterprises purchased store equipment by making a $1,600 cash down payment and signing a $28,200, one- year, 10% note payable. The purchase was recorded as follows: Store Equipment 32,620 Cash Notes Payable Interest Payable 1,500 28,200 2.820 Store Equipment 32,620 Cash Notes Payable Interest Payable 1,600 28,200 2,820 3. Kim Company purchased office equipment for $21,600, terms 4/10, n/30. Because the company intended to take the discount, it made no entry until it paid for the acquisition. The entry was: Office Equipment 21,600 Cash 20,736 864 4. Kaiser Inc. recently received land at zero cost from the Village of Chester as an inducement to locate its business in the village. The land's appraised value was $31,300. The company made no entry to record the land because it had no cost basis. Zimmerman Company built a warehouse for $586,000. It could have contracted out and purchased the building for $752,000. The controller made the following entry: 5. Buildings 752,000 Cash Gain 586,000 166,000 (a) Your answer is partially correct. Try again; Prenare the entrv that thould have heen made at the date of earh arauisition fCredit accouet ritles are antomatically MESSAGE MY INSTRUCTOR STA Account Tiles and Explanation Debit 1. Cash 692000 Land 123610 Buildings 153443 Equipment 304000 Gain 110947 2. I Cash 1600 Accounts Payable 31020 ly Equipment 32620 3. Cash 20736 Equipment 21600 4.Cash 31300 Land 31300 5. Buildings Structure 166000 Gain