please answer correctly. Thanks in advance!

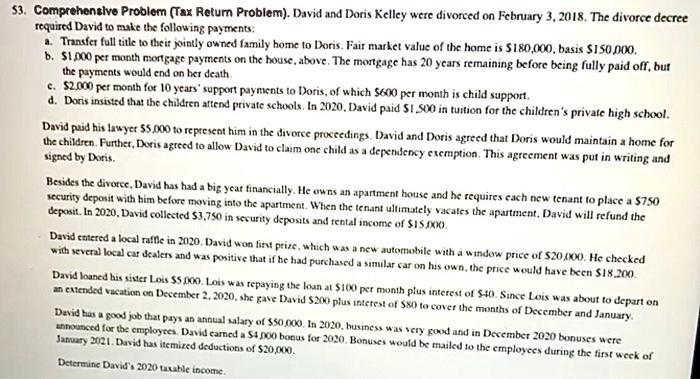

53. Comprehensive Problem (Tax Return Problem). David and Doris Kelley were divorced on February 3, 2018. The divorce decree required David to make the following payments: a. Transfer full title to their pointly owned family home to Doris. Fair market value of the home is $180,000, basis $150.000. 6. S1.000 per month mortgage payments on the house, above. The mortgage has 20 years remaining before being fully paid off, but the payments would end on her death c. $2.000 per month for 10 years' support payments to Doris, of which 5600 per month is child support. d. Doris insisted that the children attend private schools. In 2020, David paid Si soo in tuition for the children's private high school. David paid his lawyer S5.000 to represent him in the divorce proceedings. David and Doris agreed that Doris would maintain a home for the children. Further, Doris agreed to allow David to claim one child as a dependency exemption. This agreement was put in writing and signed by Doris. Besides the divorce, David has had a big year financially. He owns an apartment house and he requires cach new tenant to place a $750 security deposit with him before moving into the apartment. When the tenant ultimately vacates the apartment, David will refund the deposit. In 2020, David collected $3,750 in security deposits and rental income of $15.000 David entered a local raffle in 2020. David won first prize, which was a new automobile with a window price of $20,000. He checked with several local car dealers and was positive that if he had purchased a similar car on his own, the price would have been $18.200 David loaned his sister Lois S5.000. Lots was tepaying the loan at $100 per month plus interest of 540 Since Lois was about to depart on an extended vacation on December 2, 2020, she gave David S200 plus interest of S80 to cover the months of December and January Devid has a good job that pays an annual salary of $50,000. In 2020, husiness was very good and in December 2020 bonuses were unnounced for the employees. David cared a S4DOO bonus for 2020. Bonuses would be mailed to the employees during the first week of January 2021. David has itemized deductions of $20,000 Determine David 2020 taxable income