Answered step by step

Verified Expert Solution

Question

1 Approved Answer

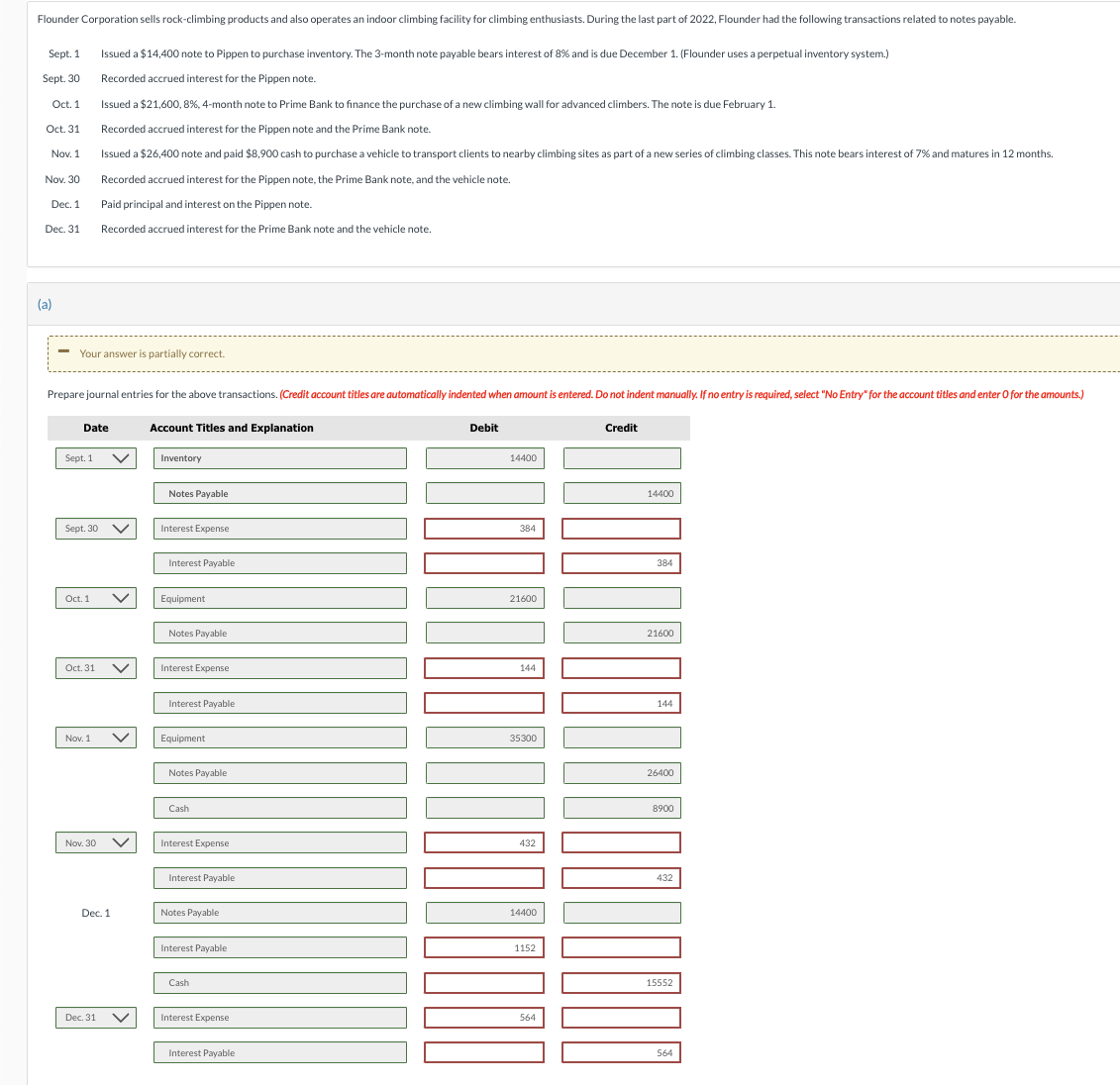

Please Answer Correctly! Thanks :) Sept. 1 Issued a $14,400 note to Pippen to purchase inventory. The 3-month note payable bears interest of 8% and

Please Answer Correctly! Thanks :)

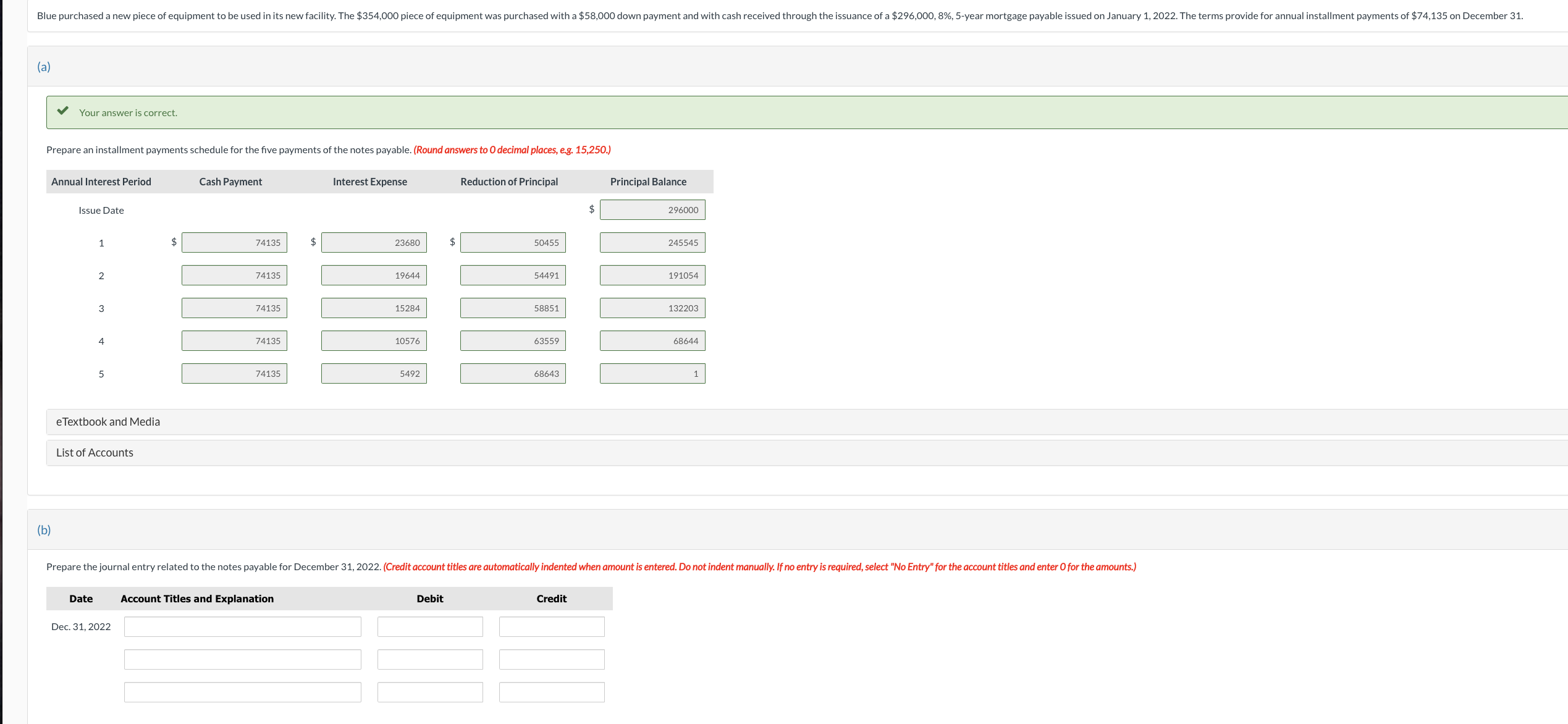

Sept. 1 Issued a $14,400 note to Pippen to purchase inventory. The 3-month note payable bears interest of 8% and is due December 1 . (Flounder uses a perpetual inventory system.) Sept 30 Recorded accrued interest for the Pippen note. Oct. 1 Issued a $21,600,8%,4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Oct. 31 Recorded accrued interest for the Pippen note and the Prime Bank note. Nov. 30 Recorded accrued interest for the Pippen note, the Prime Bank note, and the vehicle note. Dec. 1 Paid principal and interest on the Pippen note. Dec. 31 Recorded accrued interest for the Prime Bank note and the vehicle note. indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) Your answer is correct. Prepare an installment payments schedule for the five payments of the notes payable. (Round answers to 0 decimal places, e.g. 15,250.) eTextbook and Media List of Accounts (b) Date Account Titles and Explanation Dec. 31, 2022 Debit Credit

Sept. 1 Issued a $14,400 note to Pippen to purchase inventory. The 3-month note payable bears interest of 8% and is due December 1 . (Flounder uses a perpetual inventory system.) Sept 30 Recorded accrued interest for the Pippen note. Oct. 1 Issued a $21,600,8%,4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Oct. 31 Recorded accrued interest for the Pippen note and the Prime Bank note. Nov. 30 Recorded accrued interest for the Pippen note, the Prime Bank note, and the vehicle note. Dec. 1 Paid principal and interest on the Pippen note. Dec. 31 Recorded accrued interest for the Prime Bank note and the vehicle note. indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) Your answer is correct. Prepare an installment payments schedule for the five payments of the notes payable. (Round answers to 0 decimal places, e.g. 15,250.) eTextbook and Media List of Accounts (b) Date Account Titles and Explanation Dec. 31, 2022 Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started