Answered step by step

Verified Expert Solution

Question

1 Approved Answer

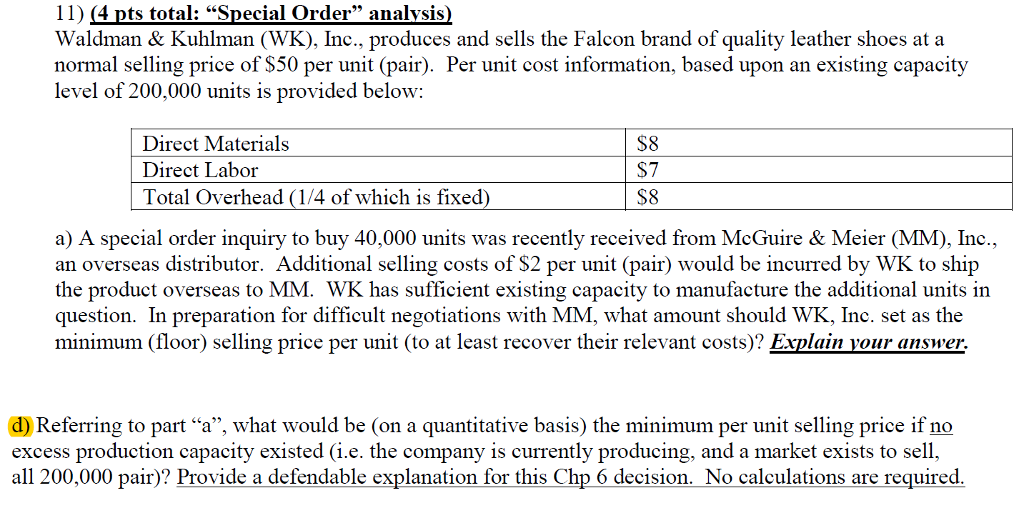

please answer ( D ) 11) (4 pts total: Special Order analvsis) Waldman& Kuhlman (WK), Inc., produces and sells the Falcon brand of quality leather

please answer ( D )

11) (4 pts total: "Special Order" analvsis) Waldman& Kuhlman (WK), Inc., produces and sells the Falcon brand of quality leather shoes at a normal selling price of S50 per unit (pair). Per unit cost information, based upon an existing capacity level of 200,000 units is provided below: Direct Materials Direct Labor S8 S7 S8 Total Overhead (1/4 of which is fixed) a) A special order inquiry to buy 40,000 units was recently received from McGuire & Meier (MM), Inc., an overseas distributor. Additional selling costs of S2 per unit (pair) would be incurred by WK to ship the product overseas to MM. WK has sufficient existing capacity to manufacture the additional units in question. In preparation for difficult negotiations with MM, what amount should WK, Inc. set as the minimum (floor) selling price per unit (to at least recover their relevant costs)? Explain your answer. Referring to part "a", what would be (on a quantitative basis) the minimum per unit selling price if no excess production capacity existed (i.e. the company is currently producing, and a market exists to sell, all 200,000 pair)? Provide a defendable explanation for this Chp 6 decision. No calculations are requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started