please answer D, E and F

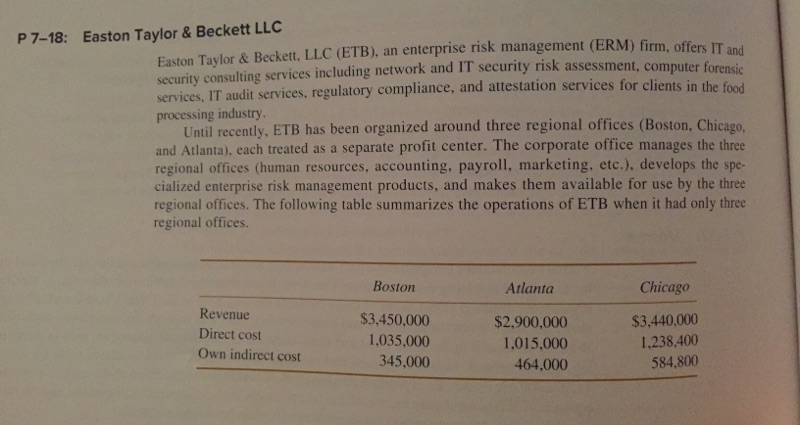

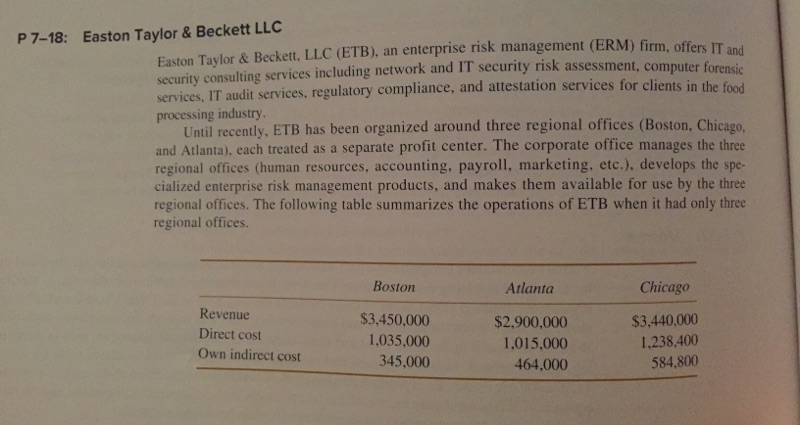

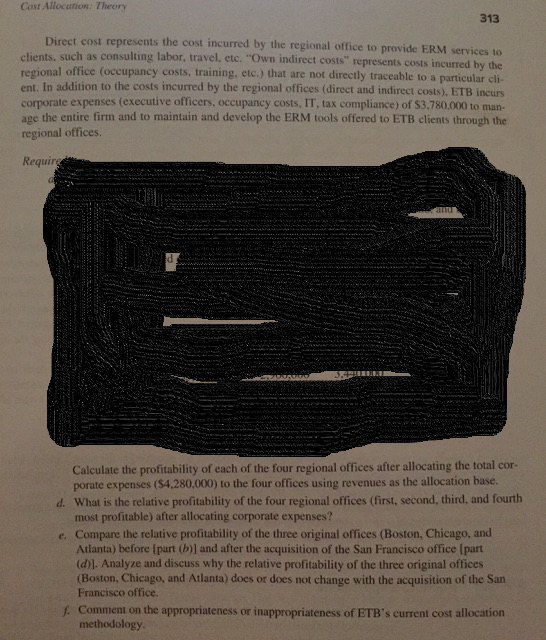

Easton Taylor & Beckett LLC Easton Taylor & Beckett, LLC (ETB), an enterprise risk management (ERM) firm, offer security consulting services including network and IT security risk assessment, co P7-18: mputer forensic IT audit services, regulatory compliance, and attestation services for clients in the food processing industry Until recently. ETB has been organized around three regional offices (Boston, Chicago and Atlanta), each treated as a separate profit center. The corporate office manages the three regional offices (human resources, accounting, payroll, marketing, etc.), develops the spe- cialized enterprise risk management products, and makes them available for use by the three regional offices. The following table summarizes the operations of ETB when it had only three regional offices. Boston S3,450,000 1,035,000 Chicago Atlanta $2,900,000 1.015,000 $3,440,000 1,238.400 Revenue Direct cost Own indirect cost 584,800 345,000 464,000 Cost Allocation: Theory 313 Direct cost represents the cost incurred by the regional office to clients, such as consulting labor, travel, etc. "Own indirect costs" regional office (occupancy costs, training, etc.) that are not directly traceable to a particular cli nt. In addition to the costs incurred by the regional offices (direct and indirect costs). ETB incurs corporate expenses (executive officers, occupancy costs, IT, tax compliance) of $3.780.000 to man age the entire firm and to maintain and develop the ERM tools offered to ETB clients through the regional offices. provide ERM services to represents costs incurred by the Requir Calculate the profitability of each of the four regional offices after allocating the total cor porate expenses (54,280.000) to the four offices using revenues as the allocation bas d. What is the relative profitability of the four regional offices (first, second, third, and fourth most profitable) after allocating corporate expenses? Compare the relative profitability of the three original offices (Boston, Chicago, and Atlanta) before [part (b)) and after the acquisition of the San Francisco office Ipart (d)l. Analyze and discuss why the relative profitability of the three original offices (Boston, Chicago, and Atlanta) does or does not change with the acquisition of the San Francisco offic Comment on the appropriateness or inappropriateness of ETB's current cost allocation methodology Easton Taylor & Beckett LLC Easton Taylor & Beckett, LLC (ETB), an enterprise risk management (ERM) firm, offer security consulting services including network and IT security risk assessment, co P7-18: mputer forensic IT audit services, regulatory compliance, and attestation services for clients in the food processing industry Until recently. ETB has been organized around three regional offices (Boston, Chicago and Atlanta), each treated as a separate profit center. The corporate office manages the three regional offices (human resources, accounting, payroll, marketing, etc.), develops the spe- cialized enterprise risk management products, and makes them available for use by the three regional offices. The following table summarizes the operations of ETB when it had only three regional offices. Boston S3,450,000 1,035,000 Chicago Atlanta $2,900,000 1.015,000 $3,440,000 1,238.400 Revenue Direct cost Own indirect cost 584,800 345,000 464,000 Cost Allocation: Theory 313 Direct cost represents the cost incurred by the regional office to clients, such as consulting labor, travel, etc. "Own indirect costs" regional office (occupancy costs, training, etc.) that are not directly traceable to a particular cli nt. In addition to the costs incurred by the regional offices (direct and indirect costs). ETB incurs corporate expenses (executive officers, occupancy costs, IT, tax compliance) of $3.780.000 to man age the entire firm and to maintain and develop the ERM tools offered to ETB clients through the regional offices. provide ERM services to represents costs incurred by the Requir Calculate the profitability of each of the four regional offices after allocating the total cor porate expenses (54,280.000) to the four offices using revenues as the allocation bas d. What is the relative profitability of the four regional offices (first, second, third, and fourth most profitable) after allocating corporate expenses? Compare the relative profitability of the three original offices (Boston, Chicago, and Atlanta) before [part (b)) and after the acquisition of the San Francisco office Ipart (d)l. Analyze and discuss why the relative profitability of the three original offices (Boston, Chicago, and Atlanta) does or does not change with the acquisition of the San Francisco offic Comment on the appropriateness or inappropriateness of ETB's current cost allocation methodology