Answered step by step

Verified Expert Solution

Question

1 Approved Answer

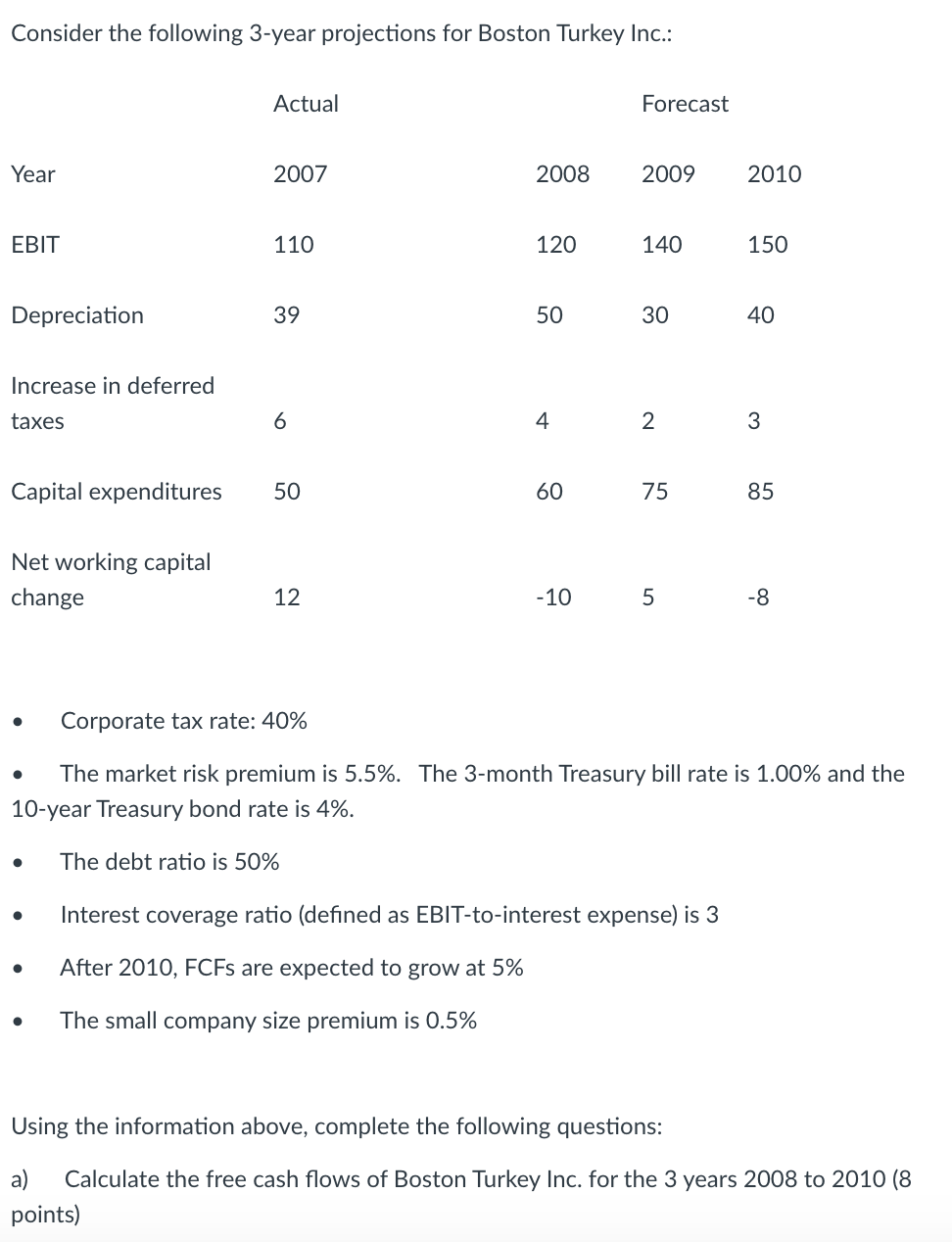

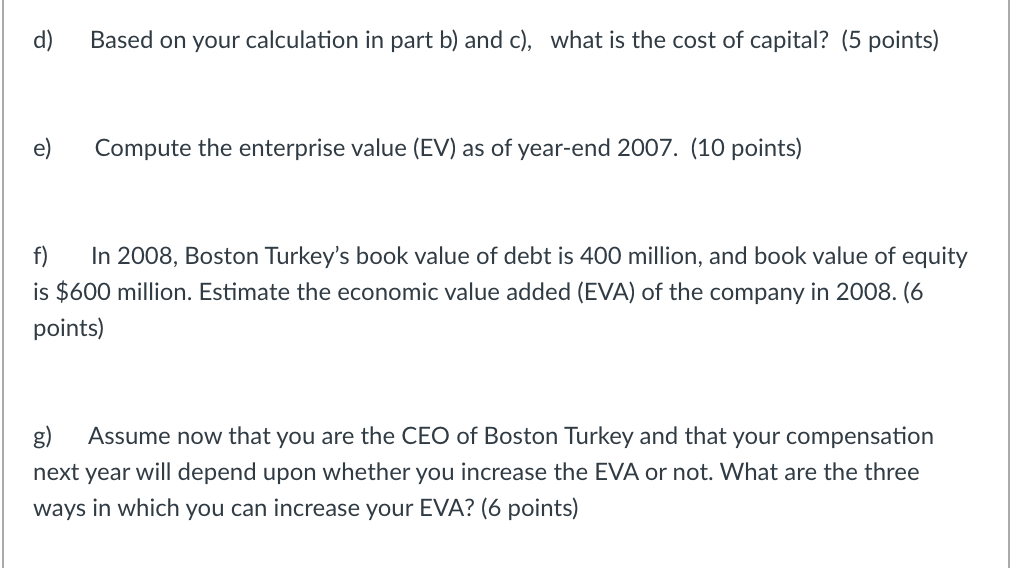

******PLEASE ANSWER D-G Consider the following 3-year projections for Boston Turkey Inc.: Actual Forecast Year 2007 2008 2009 2010 EBIT 110 120 140 150 Depreciation

******PLEASE ANSWER D-G

Consider the following 3-year projections for Boston Turkey Inc.: Actual Forecast Year 2007 2008 2009 2010 EBIT 110 120 140 150 Depreciation 39 50 30 40 Increase in deferred taxes 6 4. 2 3 Capital expenditures 50 60 75 85 Net working capital change 12 -10 5 -8 . Corporate tax rate: 40% . The market risk premium is 5.5%. The 3-month Treasury bill rate is 1.00% and the 10-year Treasury bond rate is 4%. The debt ratio is 50% . Interest coverage ratio (defined as EBIT-to-interest expense) is 3 After 2010, FCFs are expected to grow at 5% . The small company size premium is 0.5% Using the information above, complete the following questions: a) Calculate the free cash flows of Boston Turkey Inc. for the 3 years 2008 to 2010 (8 points) d) Based on your calculation in part b) and c), what is the cost of capital? (5 points) Compute the enterprise value (EV) as of year-end 2007. (10 points) In 2008, Boston Turkey's book value of debt is 400 million, and book value of equity is $600 million. Estimate the economic value added (EVA) of the company in 2008. (6 points) Assume now that you are the CEO of Boston Turkey and that your compensation next year will depend upon whether you increase the EVA or not. What are the three ways in which you can increase your EVA? (6 points) Consider the following 3-year projections for Boston Turkey Inc.: Actual Forecast Year 2007 2008 2009 2010 EBIT 110 120 140 150 Depreciation 39 50 30 40 Increase in deferred taxes 6 4. 2 3 Capital expenditures 50 60 75 85 Net working capital change 12 -10 5 -8 . Corporate tax rate: 40% . The market risk premium is 5.5%. The 3-month Treasury bill rate is 1.00% and the 10-year Treasury bond rate is 4%. The debt ratio is 50% . Interest coverage ratio (defined as EBIT-to-interest expense) is 3 After 2010, FCFs are expected to grow at 5% . The small company size premium is 0.5% Using the information above, complete the following questions: a) Calculate the free cash flows of Boston Turkey Inc. for the 3 years 2008 to 2010 (8 points) d) Based on your calculation in part b) and c), what is the cost of capital? (5 points) Compute the enterprise value (EV) as of year-end 2007. (10 points) In 2008, Boston Turkey's book value of debt is 400 million, and book value of equity is $600 million. Estimate the economic value added (EVA) of the company in 2008. (6 points) Assume now that you are the CEO of Boston Turkey and that your compensation next year will depend upon whether you increase the EVA or not. What are the three ways in which you can increase your EVA? (6 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started