PLEASE ANSWER EACH PART PLEASE! if not please do not answer so another expert can!

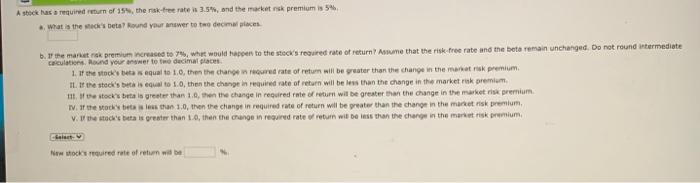

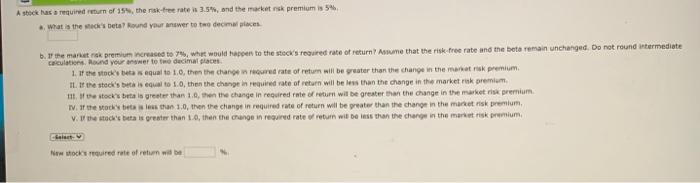

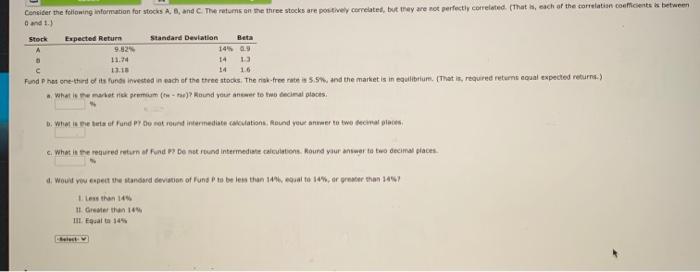

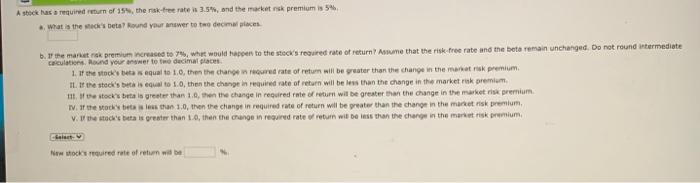

Astock has required return of the risk tree rate is 3.5%, and the market risk premium is 5% What is the neck beta? Round your answer to two decimales b. the mark premium was to 7%, what would happen to the stock's required rate of return Asume that the risk-free rate and the beta remain unchanged. Do not round Wermediate crculations. Round your answer to the decimalac 1. If the stocks beta equal to 10, then the change in ured rate of return will be greater than the change in the manner premium 11. If the stock's beta equal to 10, then the change in ured rate of return will be less than the change in the market rak premium, 111. fe stocks beta is greater than then the change in required rate ofretum will be greater than the change in the market is premium 1 at the stock less than 1.0, then the change in required me of return will be greater than the change in the mannerisk premium V. the stock as greater than 10, then the change in required rate return will be less than the change in the mantrisk premium New tired rate of return will be Calculate the required rate of setum for Mudd Enterprises assoming travestors expect a 3.6 rate of station in the future. The real risk free rate is 3.0, and the market rak premium is 5.09 Mudd has beta of 1.5 and its realed rate of return averaged 13.5% over the past years, Round your answer to the deam places Grade it Now Save & Continue Continue without Consider the following information for stocks A and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated (That sach of the correlation coefficient is between and 1.) Stock Expected Return Standard Deviation Beta 9.529 14% 0.9 11.14 14 c 13.10 14 16 Fund Phas one-third of its run invested in each of the three stocks. The nok free rates and the market is in equilibrium. That is required returns oual expected returns.) What is the market skremme)? Round your answer to two decimal places D. Whole lots of fund P7 Dorot round intermediate calculations, Round your answer to two decat place c. What is the roured return of Fund Pentround intermediate Round your answer to two decimal places 4. Would you eventu tandard deviation of Fund to be less than 1%, 10% or greater than 14 less than 145 1 Greater than 109 Best