Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer each question, don't leave any questions, thank you! 1. Consider a CAPM-style economy, in which investors form portfolios out of a set of

Please answer each question, don't leave any questions, thank you!

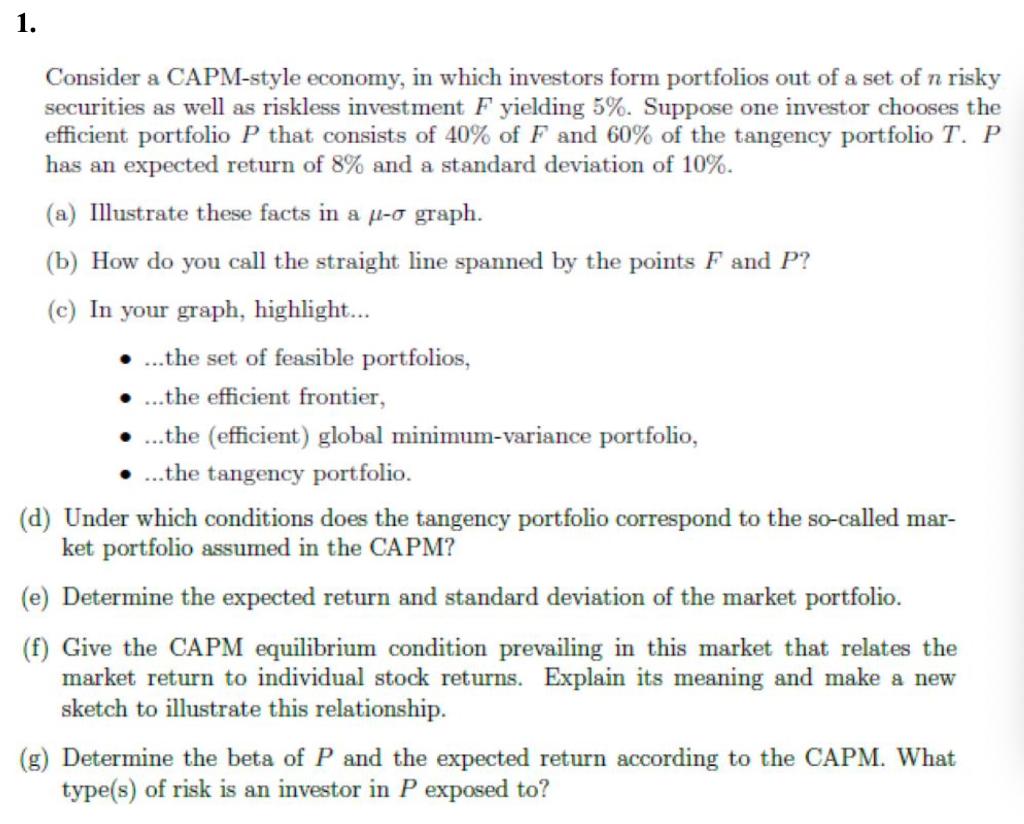

1. Consider a CAPM-style economy, in which investors form portfolios out of a set of n risky securities as well as riskless investment F yielding 5%. Suppose one investor chooses the efficient portfolio P that consists of 40% of F and 60% of the tangency portfolio T. P has an expected return of 8% and a standard deviation of 10%. (a) Illustrate these facts in a fo graph. (b) How do you call the straight line spanned by the points F and P? (c) In your graph, highlight... .... the set of feasible portfolios, ....the efficient frontier, ....the efficient) global minimum-variance portfolio, ...the tangency portfolio. () Under which conditions does the tangency portfolio correspond to the so-called mar- ket portfolio assumed in the CAPM? (e) Determine the expected return and standard deviation of the market portfolio. (f) Give the CAPM equilibrium condition prevailing in this market that relates the market return to individual stock returns. Explain its meaning and make a new sketch to illustrate this relationship. (g) Determine the beta of P and the expected return according to the CAPM. What type(s) of risk is an investor in P exposed to? 1. Consider a CAPM-style economy, in which investors form portfolios out of a set of n risky securities as well as riskless investment F yielding 5%. Suppose one investor chooses the efficient portfolio P that consists of 40% of F and 60% of the tangency portfolio T. P has an expected return of 8% and a standard deviation of 10%. (a) Illustrate these facts in a fo graph. (b) How do you call the straight line spanned by the points F and P? (c) In your graph, highlight... .... the set of feasible portfolios, ....the efficient frontier, ....the efficient) global minimum-variance portfolio, ...the tangency portfolio. () Under which conditions does the tangency portfolio correspond to the so-called mar- ket portfolio assumed in the CAPM? (e) Determine the expected return and standard deviation of the market portfolio. (f) Give the CAPM equilibrium condition prevailing in this market that relates the market return to individual stock returns. Explain its meaning and make a new sketch to illustrate this relationship. (g) Determine the beta of P and the expected return according to the CAPM. What type(s) of risk is an investor in P exposed toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started