Answered step by step

Verified Expert Solution

Question

1 Approved Answer

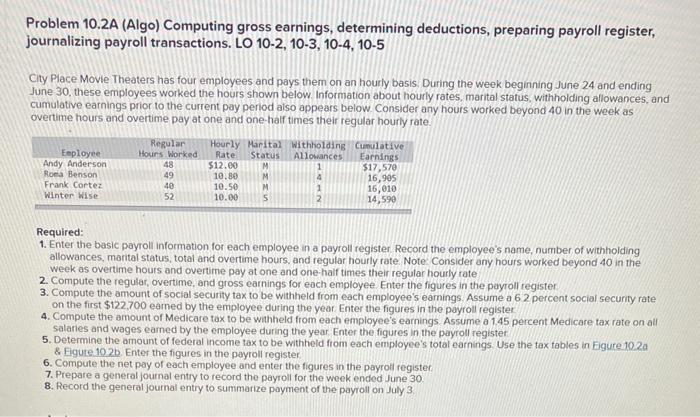

please answer everything Problem 10.2A (Algo) Computing gross earnings, determining deductions, preparing payroll register, fournalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5 City Place Movie

please answer everything

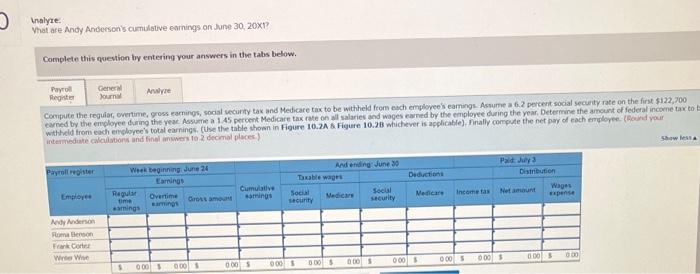

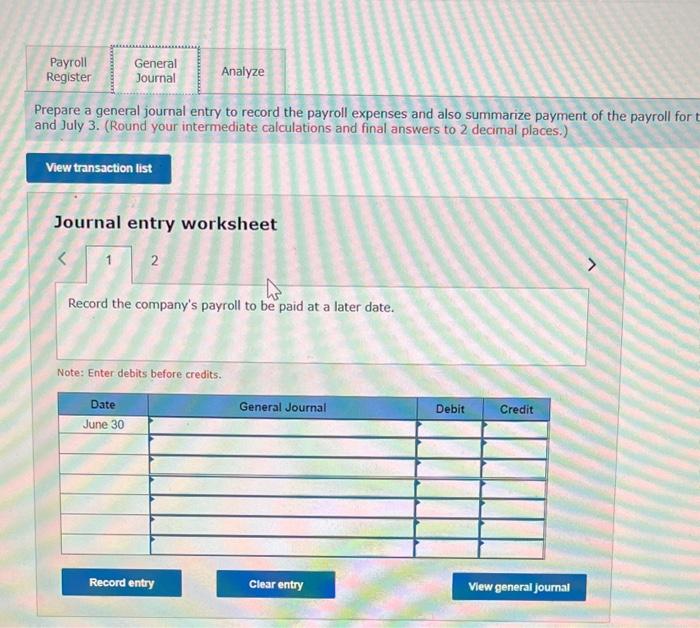

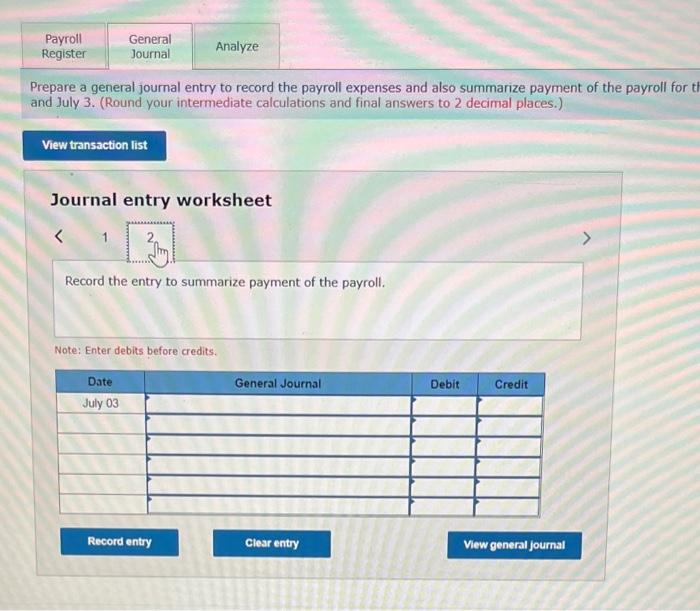

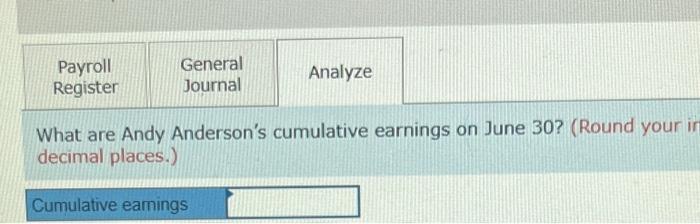

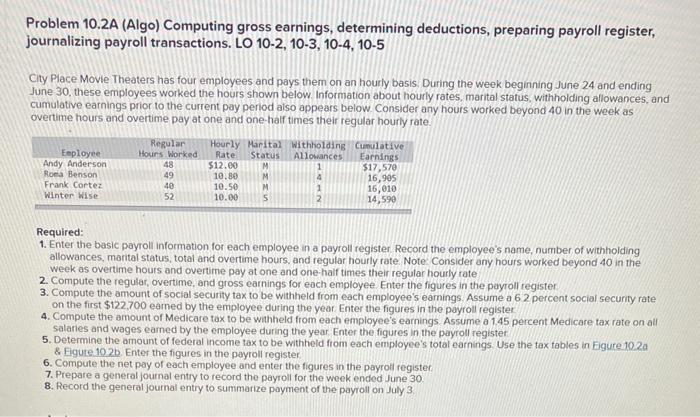

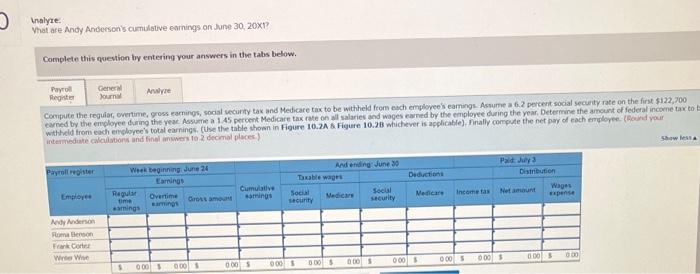

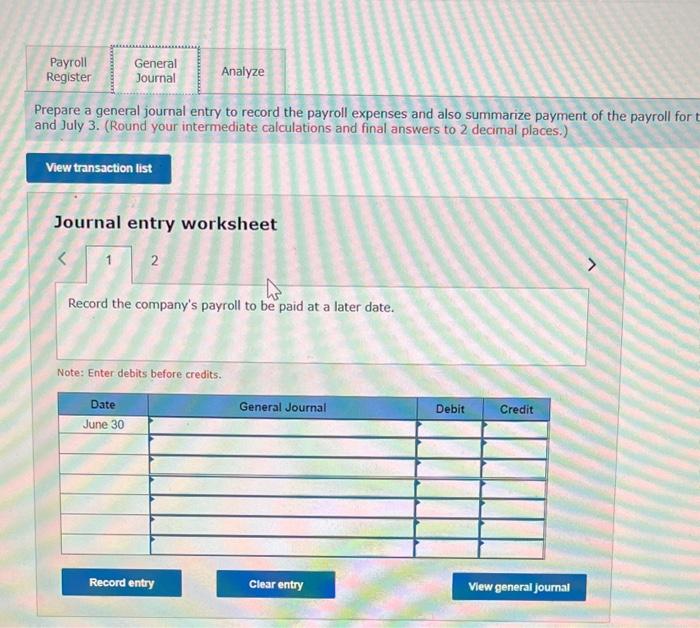

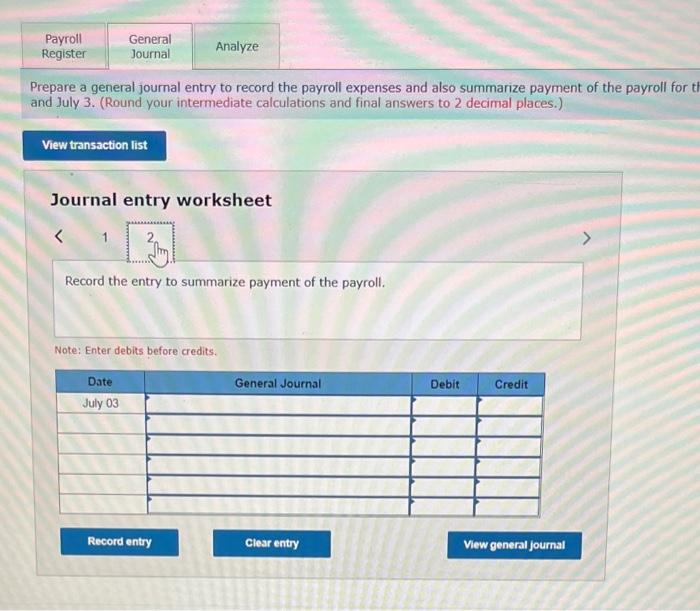

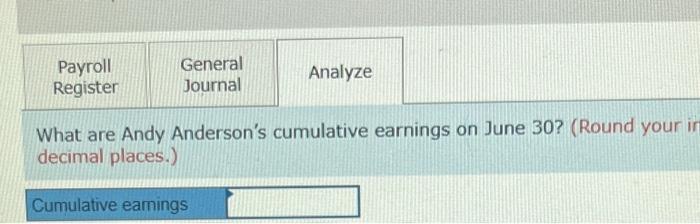

Problem 10.2A (Algo) Computing gross earnings, determining deductions, preparing payroll register, fournalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5 City Place Movie Theaters has four employees and pays them on an hourly basis. During the week beginining June 24 and ending June 30, these employees worked the hours shown below. Information about hourly rates, marital status, with holding allowances, and cumulative earnings prior to the current pay period also appears below. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif times their regular hourly rate. Required: 1. Enter the basic payroli information for each employee in a payroll register Record the employee's name, number of withholding allowances, marital status, total and overtime hours, and regular hourly rate. Note Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif times their regular hourly rate 2. Compute the regular, overtime, and gross earnings for each employee Enter the figures in the payroll register 3. Compute the amount of social security tax to be withheld from each employee's eamings. Assume a 62 percent social security rate on the first $122,700 earned by the employee during the year Enter the figures in the payroll register 4. Compute the amount of Medicare tax to be withheld from each employee's earnings. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register 5. Determine the amount of federal income tax to be withheld from each employee's total earnings. Use the tax tables in Eigure 10 2a \& Figure 1020 . Enter the figures in the payroll register. 6. Compute the net pay of each employee and enter the figures in the payroli register. 7. Prepare a general journal entry to record the payroll for the woek ended June 30 . 8. Record the general journal entry to summarize payment of the payroll on July 3 . tnalyre. Yhat are Andy Andecson's cumulstive earnings on June 30,201 ? Complete this quevion by entering your answers in the tabs below. Compute the reguiar, overtme, gross earnings, social wecurty tax and Medicare tax to be withheld frem esch emploree's eamings Assume a 6.2 percent social securty rate on the firs \$\$122,700 irtermediate colailators and finol minwers to 2 decomal places) Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for and July 3 . (Round your intermediate calculations and final answers to 2 decimal places.) Journal entry worksheet Record the company's payroll to be paid at a later date. Note: Enter debits before credits. Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for and July 3. (Round your intermediate calculations and final answers to 2 decimal places.) Journal entry worksheet Record the entry to summarize payment of the payroll. Note: Enter debits before credits. What are Andy Anderson's cumulative earnings on June 30 ? (Round your i decimal places.) Problem 10.2A (Algo) Computing gross earnings, determining deductions, preparing payroll register, fournalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5 City Place Movie Theaters has four employees and pays them on an hourly basis. During the week beginining June 24 and ending June 30, these employees worked the hours shown below. Information about hourly rates, marital status, with holding allowances, and cumulative earnings prior to the current pay period also appears below. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif times their regular hourly rate. Required: 1. Enter the basic payroli information for each employee in a payroll register Record the employee's name, number of withholding allowances, marital status, total and overtime hours, and regular hourly rate. Note Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif times their regular hourly rate 2. Compute the regular, overtime, and gross earnings for each employee Enter the figures in the payroll register 3. Compute the amount of social security tax to be withheld from each employee's eamings. Assume a 62 percent social security rate on the first $122,700 earned by the employee during the year Enter the figures in the payroll register 4. Compute the amount of Medicare tax to be withheld from each employee's earnings. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register 5. Determine the amount of federal income tax to be withheld from each employee's total earnings. Use the tax tables in Eigure 10 2a \& Figure 1020 . Enter the figures in the payroll register. 6. Compute the net pay of each employee and enter the figures in the payroli register. 7. Prepare a general journal entry to record the payroll for the woek ended June 30 . 8. Record the general journal entry to summarize payment of the payroll on July 3 . tnalyre. Yhat are Andy Andecson's cumulstive earnings on June 30,201 ? Complete this quevion by entering your answers in the tabs below. Compute the reguiar, overtme, gross earnings, social wecurty tax and Medicare tax to be withheld frem esch emploree's eamings Assume a 6.2 percent social securty rate on the firs \$\$122,700 irtermediate colailators and finol minwers to 2 decomal places) Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for and July 3 . (Round your intermediate calculations and final answers to 2 decimal places.) Journal entry worksheet Record the company's payroll to be paid at a later date. Note: Enter debits before credits. Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for and July 3. (Round your intermediate calculations and final answers to 2 decimal places.) Journal entry worksheet Record the entry to summarize payment of the payroll. Note: Enter debits before credits. What are Andy Anderson's cumulative earnings on June 30 ? (Round your i decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started