Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer fast 6. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate

please answer fast

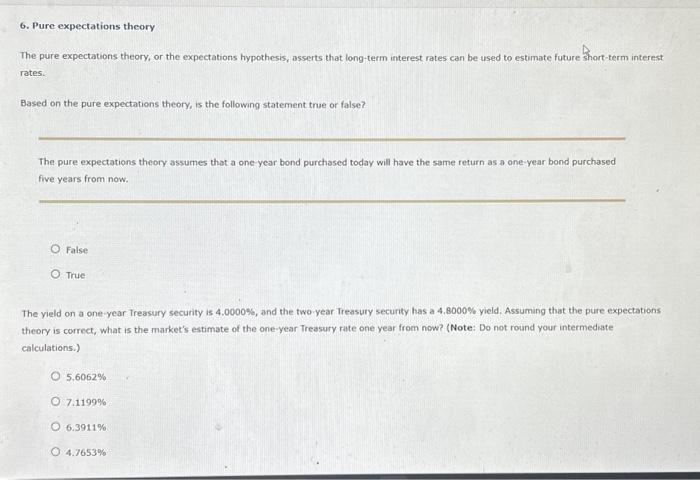

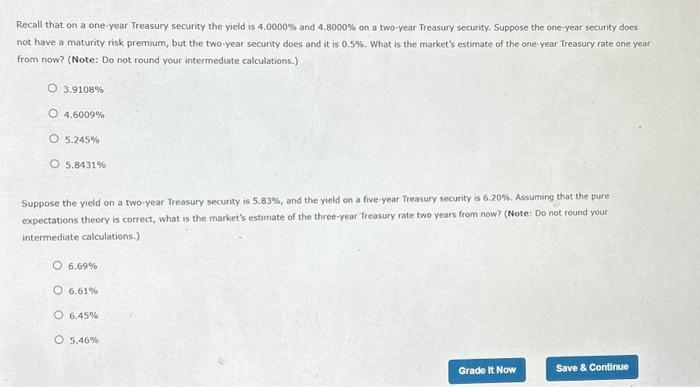

6. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True The yield on a one-year Treasury security is 4,0000\%s, and the two-year Treasury security has a 4,8000\% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 5.6062% 7.1199% 6.3911% 4.7653% Recall that on a one-year Treasury security the yield is 4.0000% and 4.8000% on a two-year Treasury security. Suppose the one-year security does. not have a maturity risk premim, but the two-year security does and it is 0,5%. What is the market's estimate of the one-year Treasury rate one yearfrom now? (Note: Do not round your intermediate calculations.) 3.9108% 4.6009% 5.245% 5.8431% Suppose the yield on a two-year Treasury secunty is 5.83\%, and the yield on a five-year Treasury security is 6.20%, Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year freasury rate two years from now? (Note: Do not round your intermediate calculations.) 6.69% 6.61% 6.45% 5.46%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started