Please answer Fast

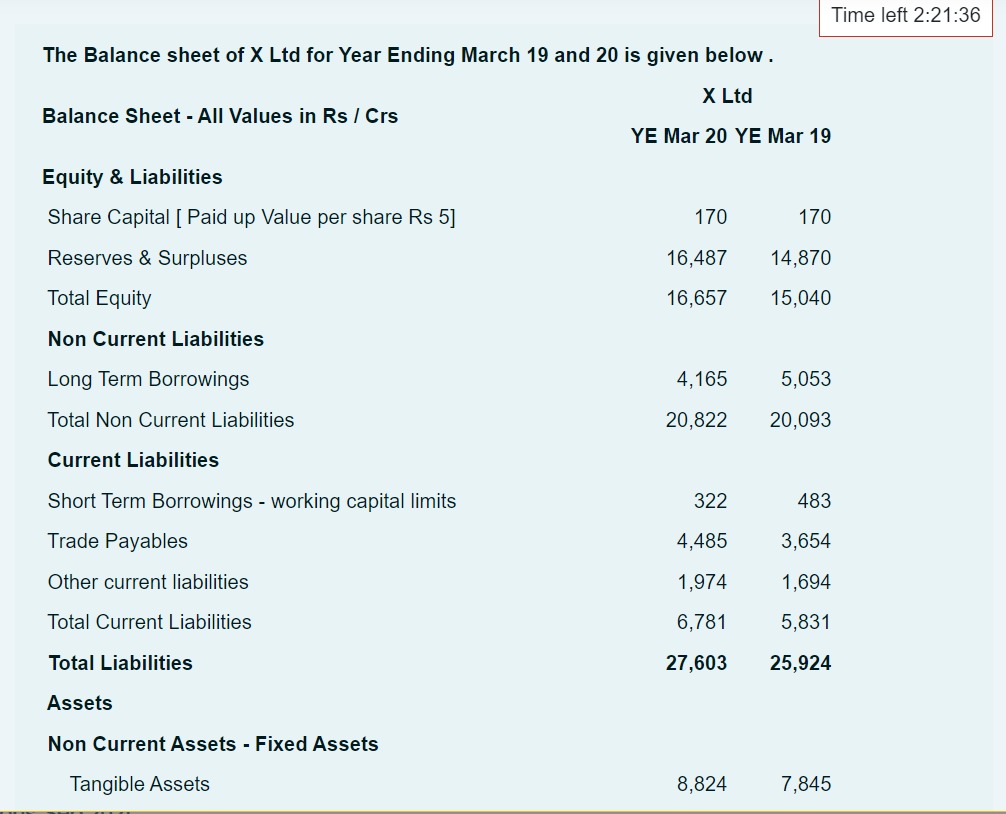

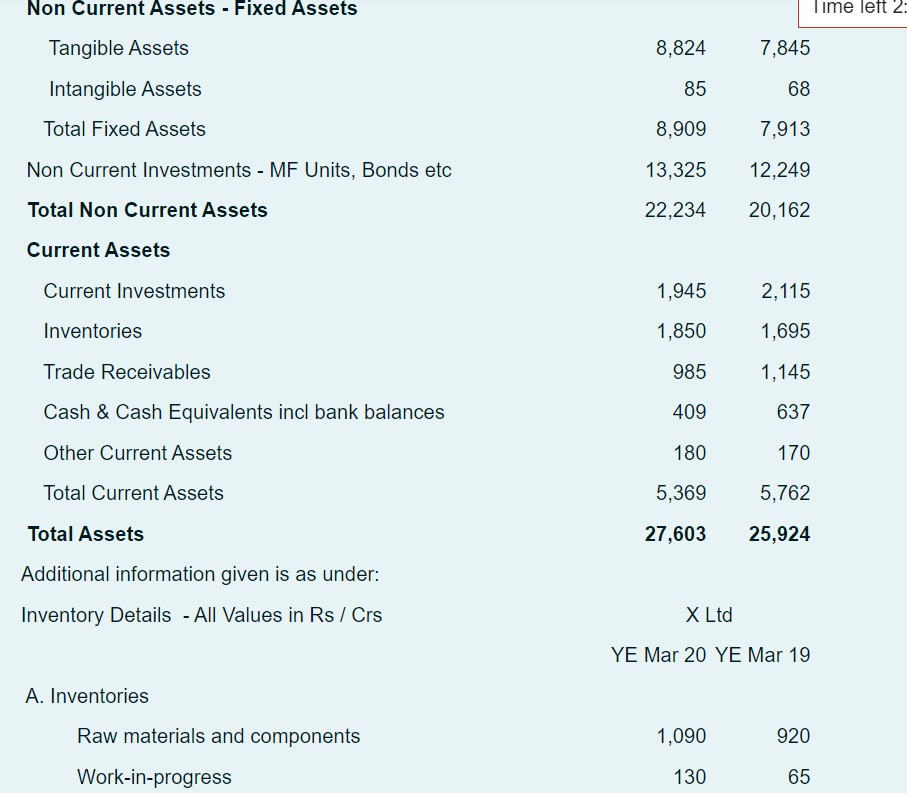

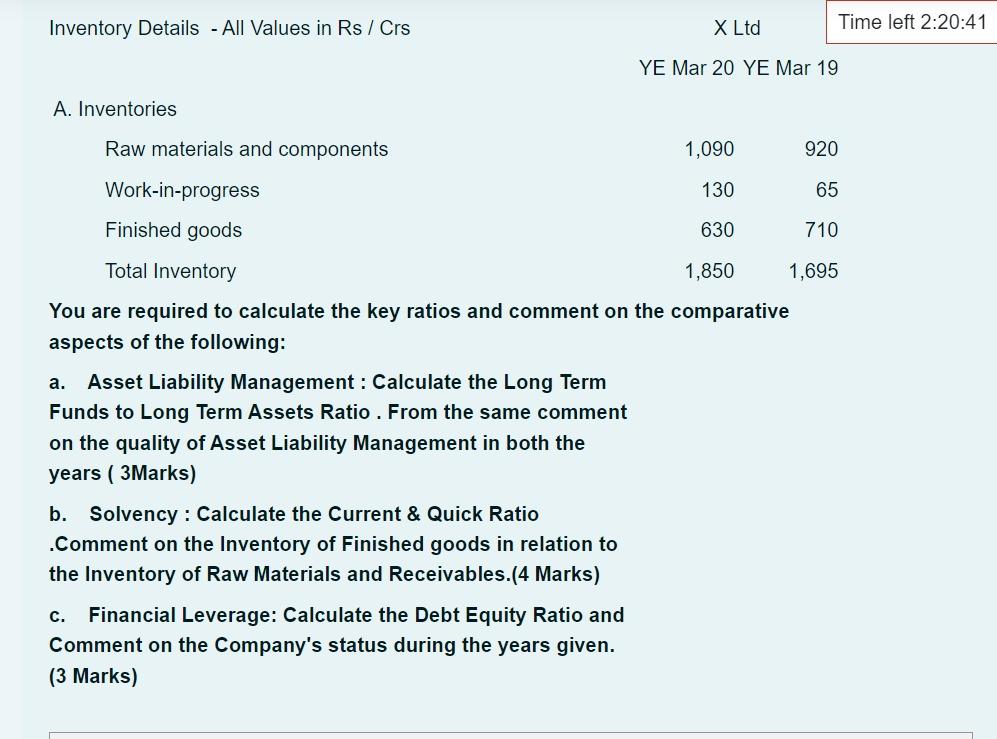

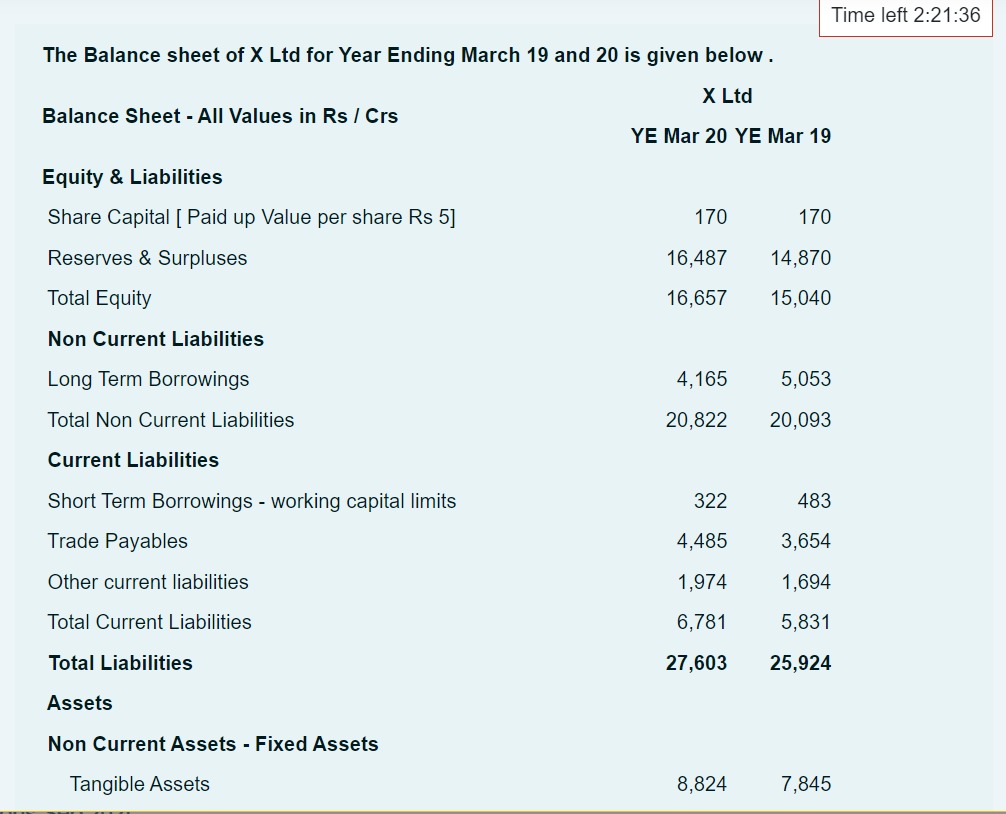

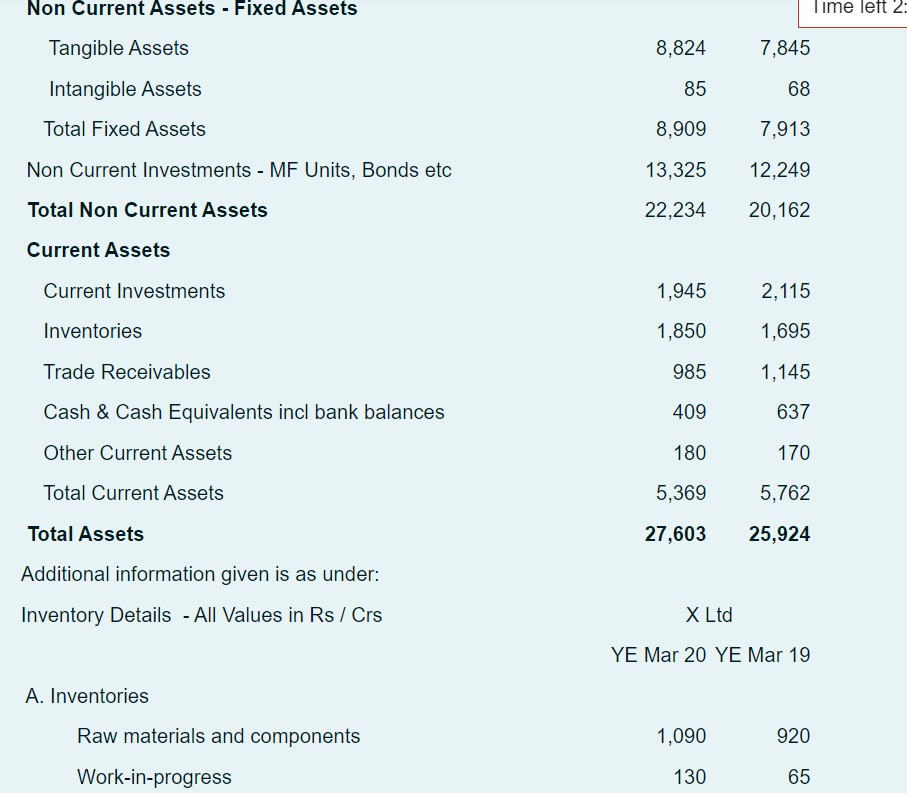

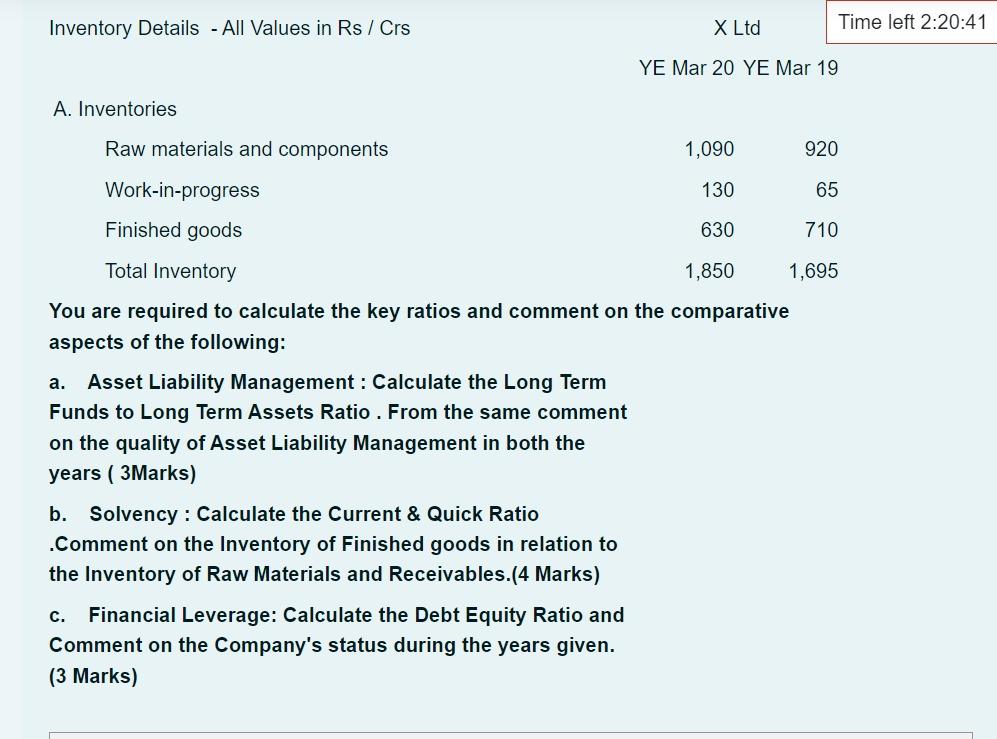

Time left 2:21:36 The Balance sheet of X Ltd for Year Ending March 19 and 20 is given below. X Ltd Balance Sheet - All Values in Rs / Crs YE Mar 20 YE Mar 19 Equity & Liabilities Share Capital (Paid up Value per share Rs 5] 170 170 Reserves & Surpluses 16,487 14,870 Total Equity 16,657 15,040 Non Current Liabilities Long Term Borrowings 4,165 5,053 Total Non Current Liabilities 20,822 20,093 Current Liabilities Short Term Borrowings - working capital limits 322 483 Trade Payables 4,485 3,654 Other current liabilities 1,974 1,694 Total Current Liabilities 6,781 5,831 Total Liabilities 27,603 25,924 Assets Non Current Assets - Fixed Assets Tangible Assets 8,824 7,845 Non Current Assets - Fixed Assets Time left 2: Tangible Assets 8,824 7,845 Intangible Assets 85 68 8,909 7,913 Total Fixed Assets Non Current Investments - MF Units, Bonds etc 13,325 12,249 Total Non Current Assets 22,234 20,162 Current Assets Current Investments 1,945 2,115 Inventories 1,850 1,695 Trade Receivables 985 1,145 409 637 Cash & Cash Equivalents incl bank balances Other Current Assets 180 170 Total Current Assets 5,369 5,762 Total Assets 27,603 25,924 Additional information given is as under: Inventory Details - All Values in Rs / Crs X Ltd YE Mar 20 YE Mar 19 A. Inventories Raw materials and components 1,090 920 Work-in-progress 130 65 Inventory Details - All Values in Rs / Crs X Ltd Time left 2:20:41 YE Mar 20 YE Mar 19 A. Inventories Raw materials and components 1,090 920 Work-in-progress 130 65 Finished goods 630 710 Total Inventory 1,850 1,695 You are required to calculate the key ratios and comment on the comparative aspects of the following: a. Asset Liability Management : Calculate the Long Term Funds to Long Term Assets Ratio . From the same comment on the quality of Asset Liability Management in both the years ( 3Marks) b. Solvency : Calculate the Current & Quick Ratio Comment on the Inventory of Finished goods in relation to the Inventory of Raw Materials and Receivables.(4 Marks) c. Financial Leverage: Calculate the Debt Equity Ratio and Comment on the Company's status during the years given