Answered step by step

Verified Expert Solution

Question

1 Approved Answer

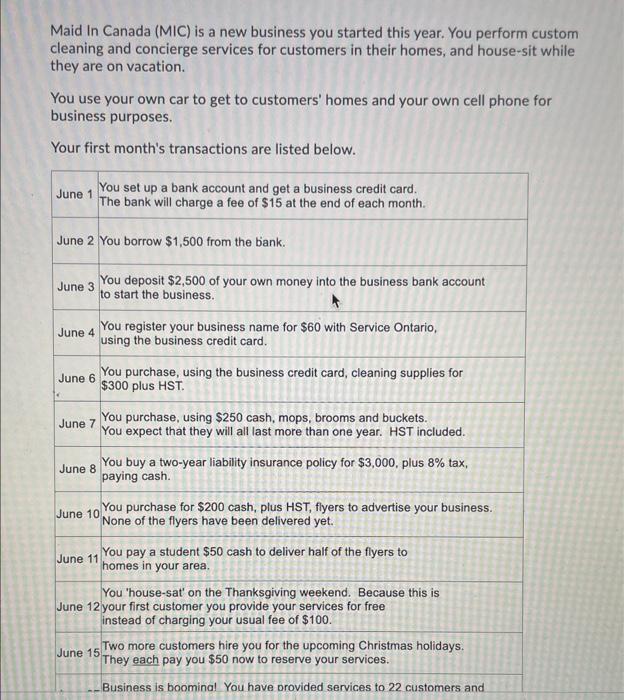

please answer! fill in the blank tom hile wuiro i 4 They each pay you $50 now to reserve your services. June 27 Business is

please answer! fill in the blank

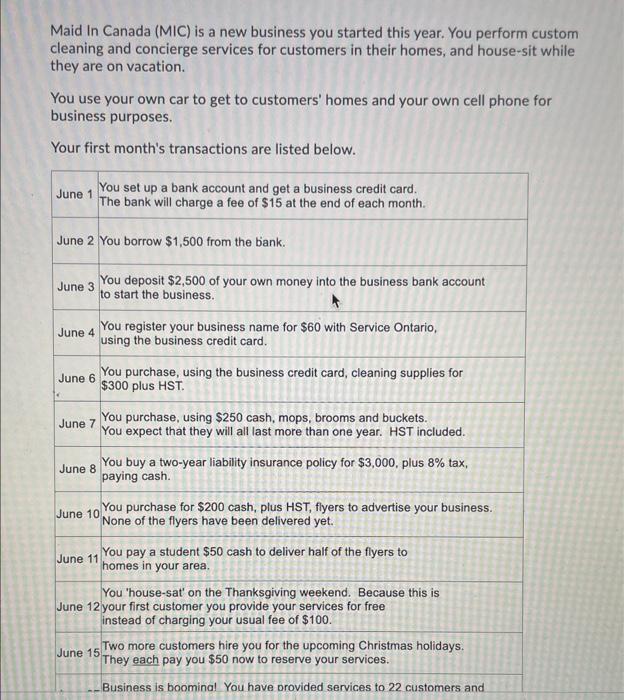

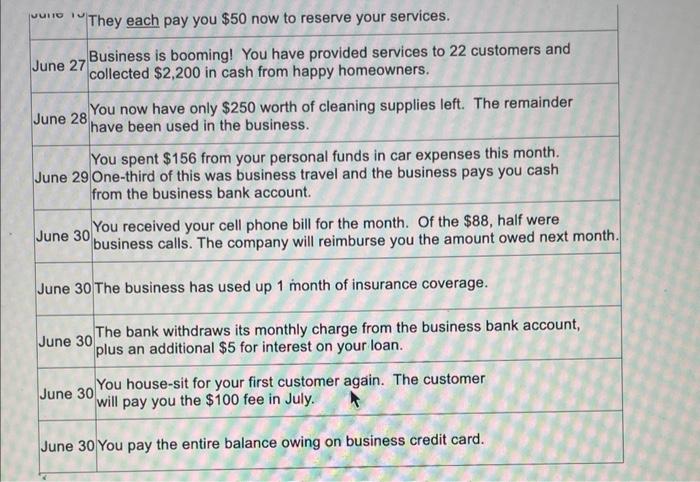

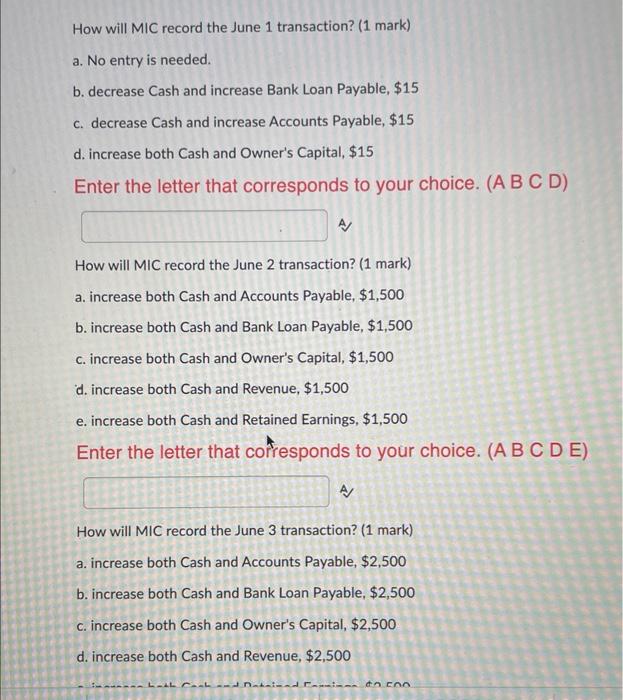

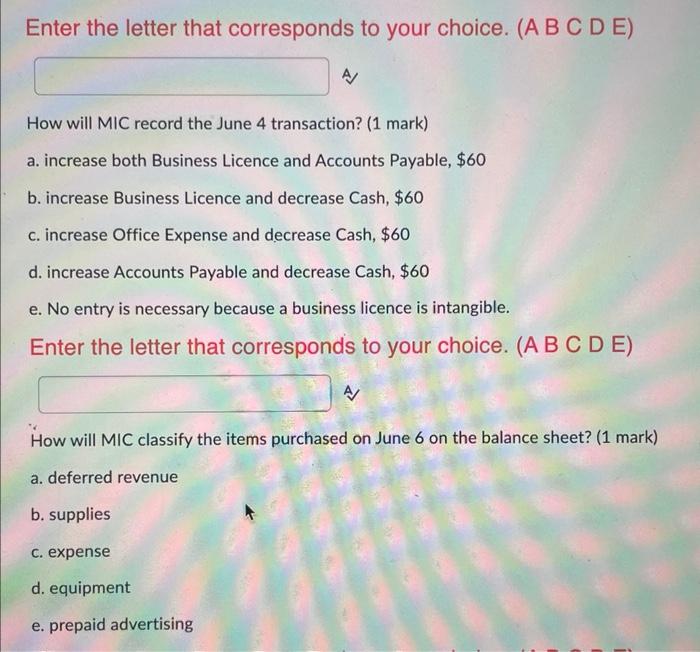

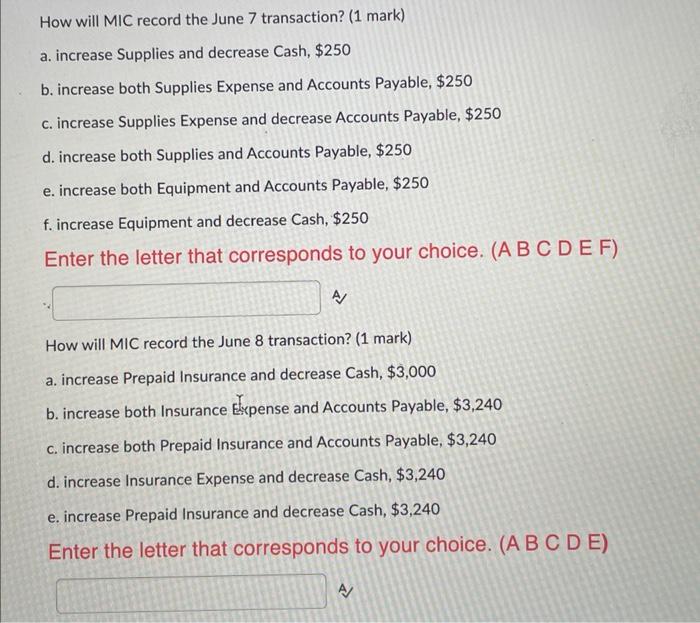

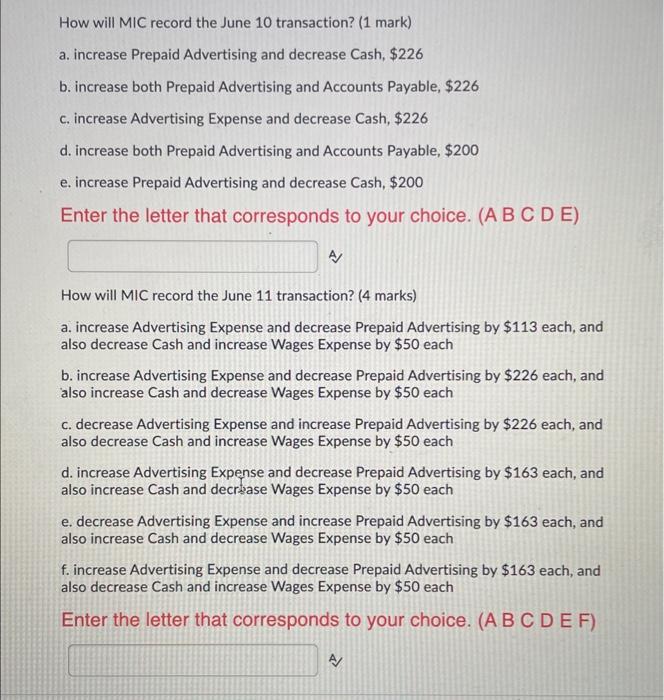

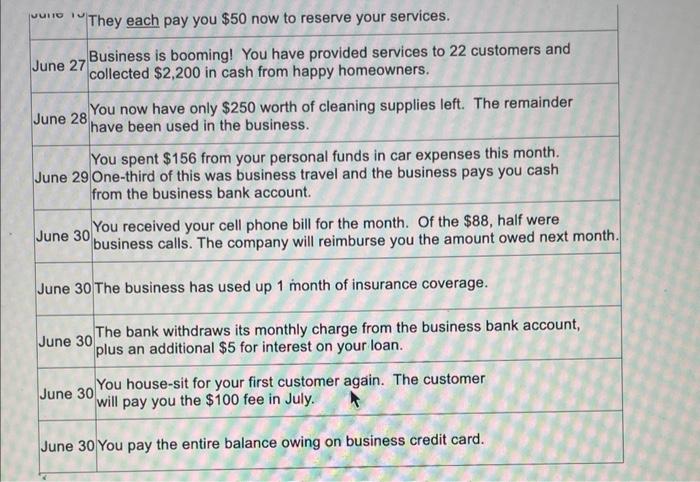

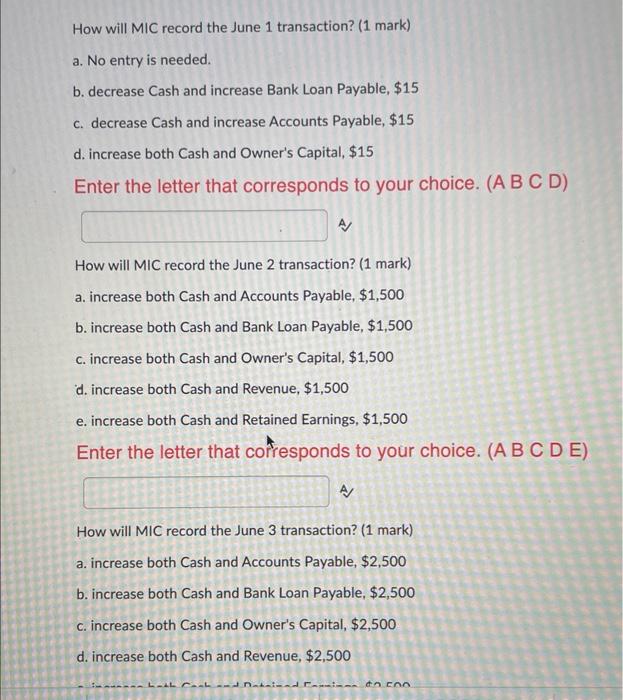

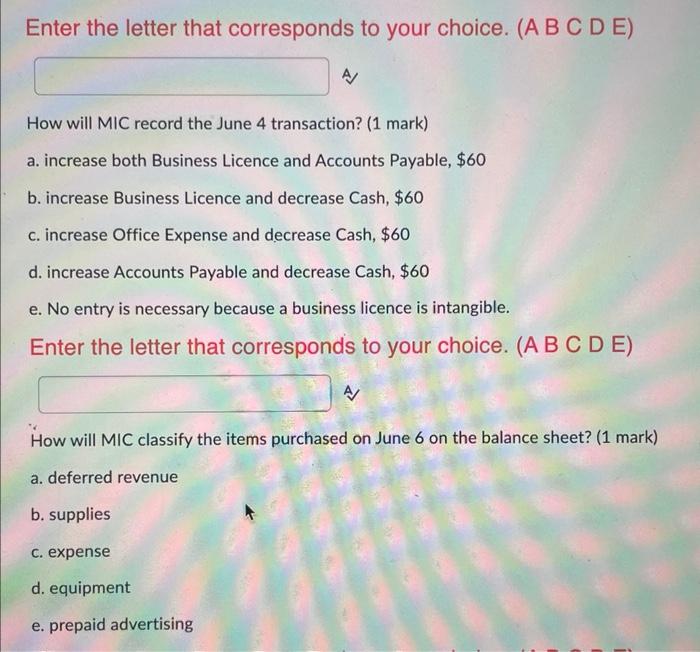

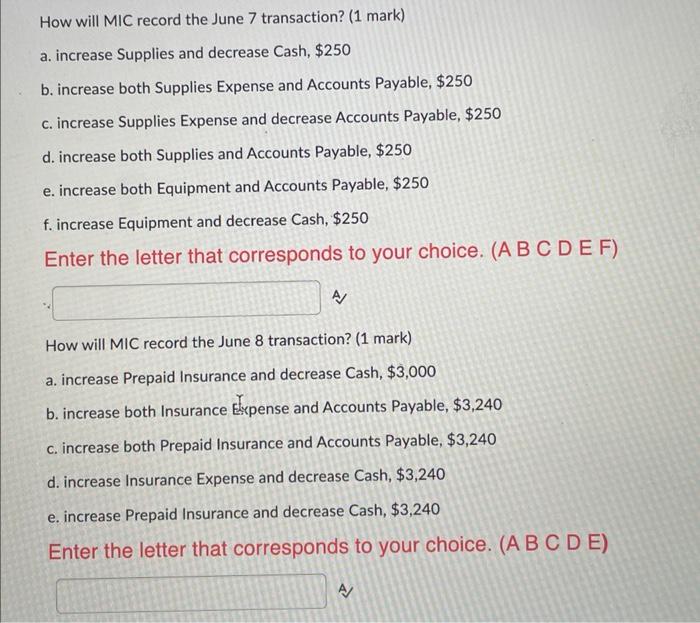

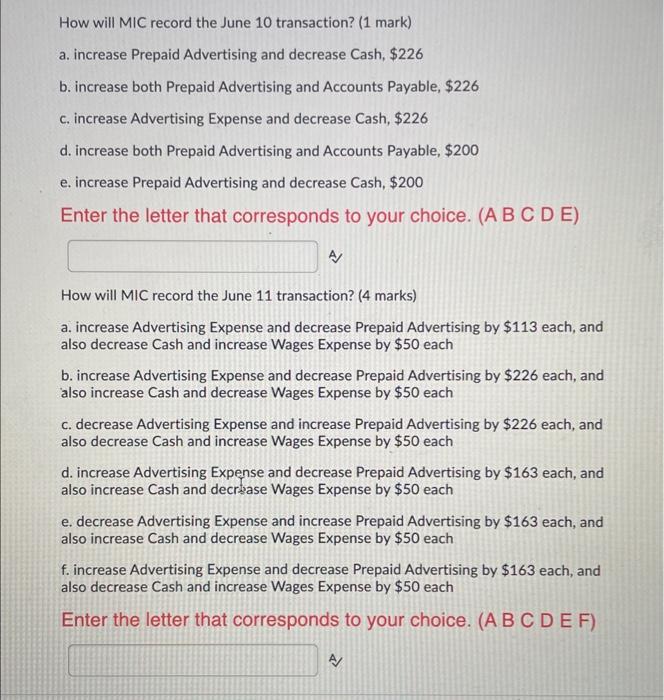

tom hile wuiro i 4 They each pay you $50 now to reserve your services. June 27 Business is booming! You have provided services to 22 customers and collected $2,200 in cash from happy homeowners. June 28 You now have only $250 worth of cleaning supplies left. The remainder have been used in the business. You spent $156 from your personal funds in car expenses this month. June 29 One-third of this was business travel and the business pays you cash from the business bank account. June 30 You received your cell phone bill for the month. Of the $88, haf business calls. The company will reimburse you the amount June 30 The business has used up 1 month of insurance coverage. June 30 The bank withdraws its monthly charge from the business bank account, plus an additional $5 for interest on your loan. June 30 You house-sit for your first customer again. The customer will pay you the $100 fee in July. June 30 You pay the entire balance owing on business credit card. How will MIC record the June 1 transaction? (1 mark) a. No entry is needed. b. decrease Cash and increase Bank Loan Payable, $15 c. decrease Cash and increase Accounts Payable, $15 d. increase both Cash and Owner's Capital, \$15 Enter the letter that corresponds to your choice. (A B C D) How will MIC record the June 2 transaction? (1 mark) a. increase both Cash and Accounts Payable, $1,500 b. increase both Cash and Bank Loan Payable, $1,500 c. increase both Cash and Owner's Capital, $1,500 d. increase both Cash and Revenue, $1,500 e. increase both Cash and Retained Earnings, \$1,500 Enter the letter that corresponds to your choice. (A B C D E) A How will MIC record the June 3 transaction? (1 mark) a. increase both Cash and Accounts Payable, $2,500 b. increase both Cash and Bank Loan Payable, $2,500 c. increase both Cash and Owner's Capital, $2,500 d. increase both Cash and Revenue, $2,500 Enter the letter that corresponds to your choice. (A B C D E) How will MIC record the June 4 transaction? (1 mark) a. increase both Business Licence and Accounts Payable, $60 b. increase Business Licence and decrease Cash, $60 c. increase Office Expense and decrease Cash, \$60 d. increase Accounts Payable and decrease Cash, \$60 e. No entry is necessary because a business licence is intangible. Enter the letter that corresponds to your choice. (A B C D E) A. How will MIC classify the items purchased on June 6 on the balance sheet? (1 mark) a. deferred revenue b. supplies c. expense d. equipment a. increase Supplies and decrease Cash, $250 b. increase both Supplies Expense and Accounts Payable, $250 c. increase Supplies Expense and decrease Accounts Payable, $250 d. increase both Supplies and Accounts Payable, $250 e. increase both Equipment and Accounts Payable, $250 f. increase Equipment and decrease Cash, $250 Enter the letter that corresponds to your choice. (A B C D E F) How will MIC record the June 8 transaction? (1 mark) a. increase Prepaid Insurance and decrease Cash, $3,000 b. increase both Insurance Expense and Accounts Payable, $3,240 c. increase both Prepaid Insurance and Accounts Payable, $3,240 d. increase Insurance Expense and decrease Cash, \$3,240 e. increase Prepaid Insurance and decrease Cash, $3,240 Enter the letter that corresponds to your choice. (A B C D E) A/ How will MIC record the June 10 transaction? (1 mark) a. increase Prepaid Advertising and decrease Cash, $226 b. increase both Prepaid Advertising and Accounts Payable, $226 c. increase Advertising Expense and decrease Cash, $226 d. increase both Prepaid Advertising and Accounts Payable, $200 e. increase Prepaid Advertising and decrease Cash, \$200 Enter the letter that corresponds to your choice. (A B C D E) A How will MIC record the June 11 transaction? (4 marks) a. increase Advertising Expense and decrease Prepaid Advertising by $113 each, and also decrease Cash and increase Wages Expense by $50 each b. increase Advertising Expense and decrease Prepaid Advertising by $226 each, and also increase Cash and decrease Wages Expense by $50 each c. decrease Advertising Expense and increase Prepaid Advertising by $226 each, and also decrease Cash and increase Wages Expense by $50 each d. increase Advertising Expense and decrease Prepaid Advertising by $163 each, and also increase Cash and decrsase Wages Expense by $50 each e. decrease Advertising Expense and increase Prepaid Advertising by $163 each, and also increase Cash and decrease Wages Expense by $50 each f. increase Advertising Expense and decrease Prepaid Advertising by $163 each, and also decrease Cash and increase Wages Expense by $50 each Enter the letter that corresponds to your choice. (A B C D E F) A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started