Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer following for rate thumbs up. The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to

please answer following

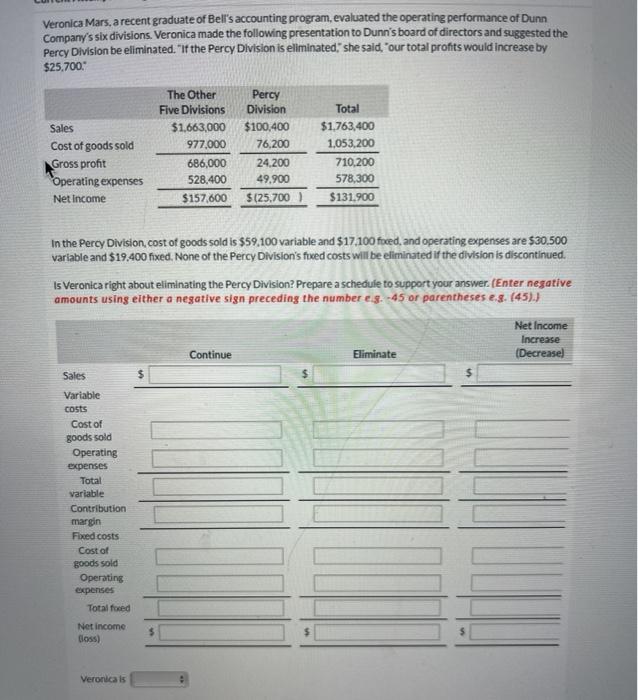

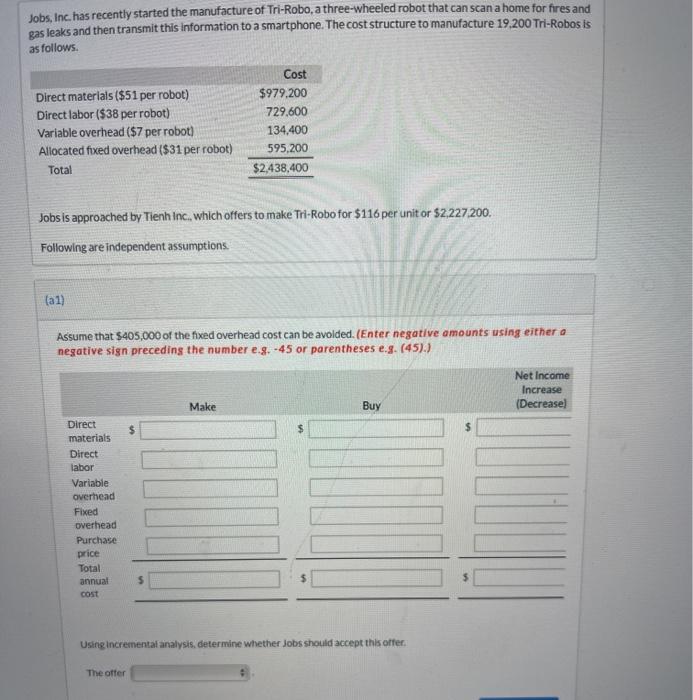

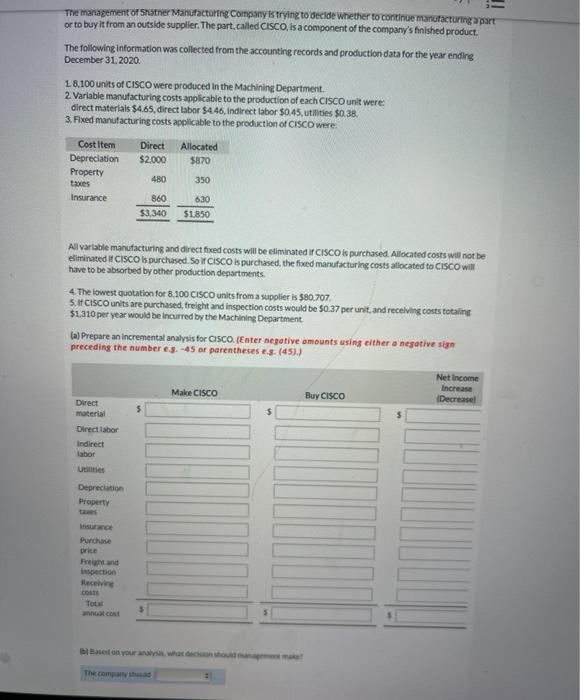

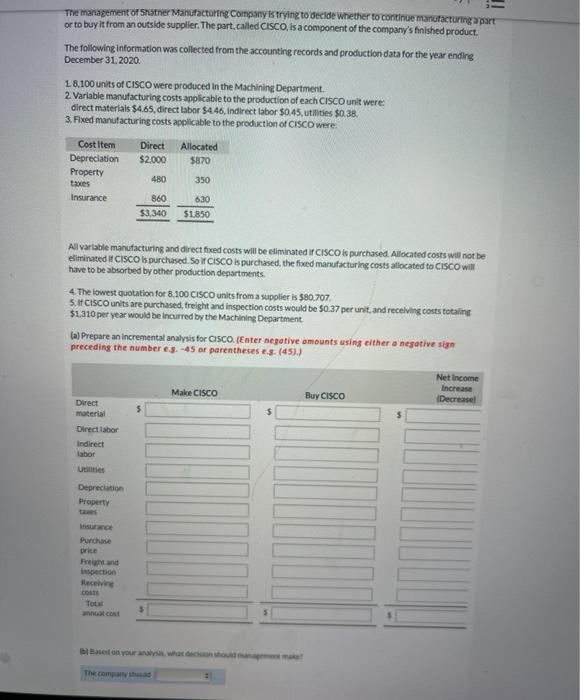

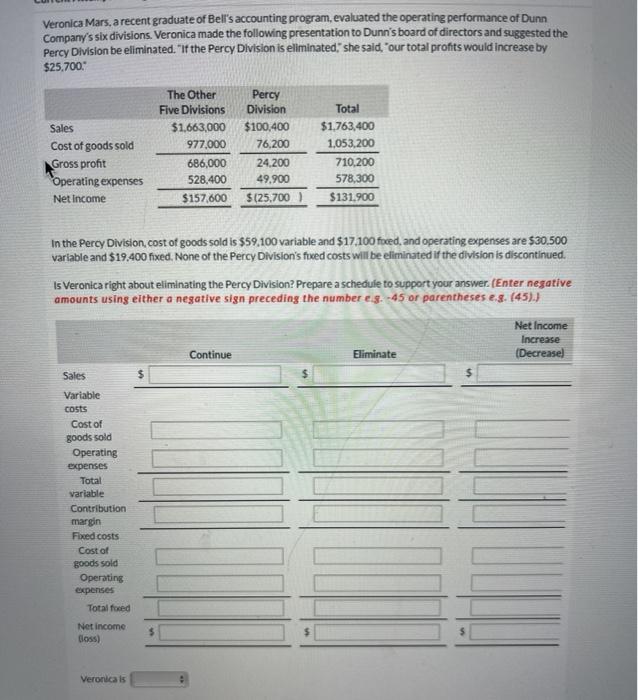

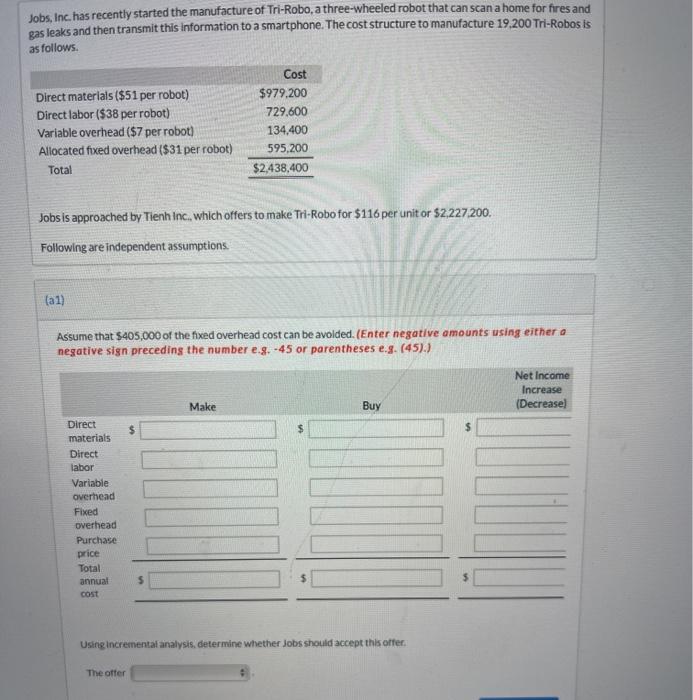

The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to buy it from an outside supplier. The part called CISCO, is a component of the company's finished product. The following information was collected from the accounting records and production data for the year ending December 31, 2020 1.8.100 units of CISCO were produced in the Machining Department. 2 Variable manufacturing costs applicable to the production of each CISCO unit were direct materials $4.65, direct labor $4.46, Indirect labor $0.45, utilities $0.38. 3. Fixed manufacturing costs applicable to the production of CISCO were: Cost Item Depreciation Property Direct $2.000 Allocated $870 480 350 Insurance 860 53.340 630 $1,850 All variable manufacturing and direct fixed costs will be eliminated in CISCO is purchased Allocated costs will not be eliminated CISCO is purchased. So I CISCO is purchased, the fed manufacturing costs allocated to CISCO will have to be absorbed by other production departments. 4 The lowest quotation for 8.100 CISCO units from a supplier is $80,707 5.14 CISCO units are purchased, freight and inspection costs would be $0.37 per unit and receiving costs totaling $1,310 per year would be incurred by the Machining Department la) Prepare an incremental analysis for Cisco (Enter negative amounts using either a negative sin preceding the number e.s. -45 or parentheses e.s. (45).) Make CISCO Net Income Increase Decrease) Buy CISCO 5 Direct material Direct labor Indirect Labor Utilities Depreciation Property Purchase price Freight and inspection Receiving Total The companhad Veronica Mars, a recent graduate of Bell's accounting program, evaluated the operating performance of Dunn Company's six divisions. Veronica made the following presentation to Dunn's board of directors and suggested the Percy Division be eliminated. "If the Percy Division is eliminated," she said, "our total profits would increase by $25.700,- Sales Cost of goods sold Gross profit Operating expenses Net Income The Other Five Divisions $1,663,000 977,000 686,000 528.400 $157,600 Percy Division $100,400 76,200 24,200 49.900 $125.700) Total $1,763,400 1,053,200 710.200 578,300 $131.900 In the Percy Division cost of goods sold is $59.100 variable and $17.100 foved, and operating expenses are $30.500 variable and $19.400 fixed. None of the Percy Division's fixed costs will be eliminated if the division is discontinued. Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your answer (Enter negative amounts using either a negative sign preceding the number 4.9. -45 or parentheses es. (45).) Net Income Increase (Decrease) Continue Eliminate Sales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Total fored Net income Boss) Veronicals Jobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 19.200 Tri-Robos is as follows Direct materials ($51 per robot) Direct labor ($38 per robot) Variable overhead ($7 per robot) Allocated fixed overhead ($31 per robot) Total Cost $979,200 729,600 134.400 595,200 $2,438,400 Jobs is approached by Tienh Inc, which offers to make Tri-Robo for $116 per unit or $2.227.200. Following are independent assumptions. (1) Assume that $405,000 of the fixed overhead cost can be avoided. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net Income Increase (Decrease) Make Buy $ Direct materials Direct labor Variable overhead Fixed overhead Purchase price Total annual cost Using incremental analysis, determine whether Jobs should accept this offer The offer for rate thumbs up.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started