Answered step by step

Verified Expert Solution

Question

1 Approved Answer

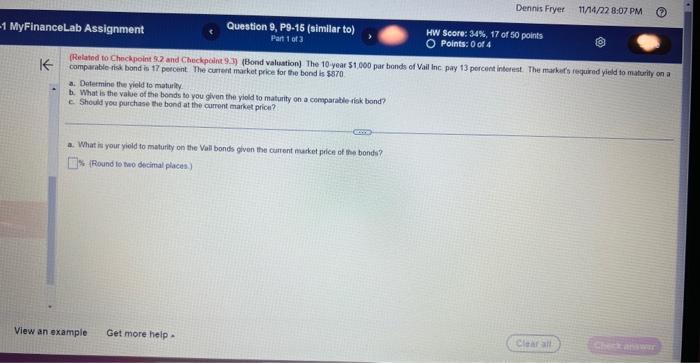

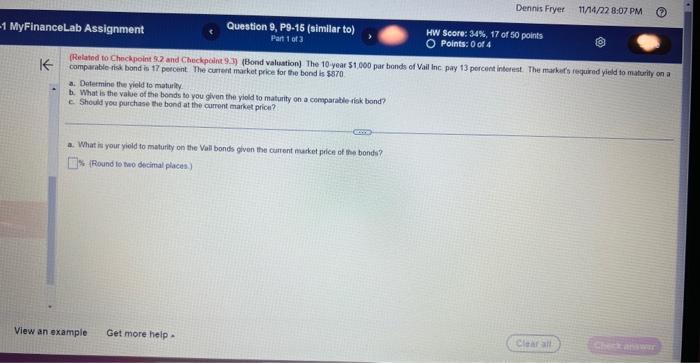

please answer for A, B, and C. Thank you! (Related to Checkpoint 9.2 and Checkpoint 93 ) (Bond valuation) The 10 year $1,600 par bonds

please answer for A, B, and C. Thank you!

(Related to Checkpoint 9.2 and Checkpoint 93 ) (Bond valuation) The 10 year $1,600 par bonds of Vail lnc pay 13 percent inter test. The markefs fequired yield to maturity on a comparable risk bond is 17 poccent. The current market price for the bend is $370 a. Datermine the yield to maturity. b. What is the value of the bonds to you given the yiold to maturity on a comparatle risk bond? c. Should you purchase the bond at the current market pricil? a. What is your yiold to maturity on the Vali bonds given the current murket pice of me bonds? (Found to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started