PLEASE ANSWER FOR NUMBERS 21 - 23 PLEASE. SHOW ALL WORK NEEDED

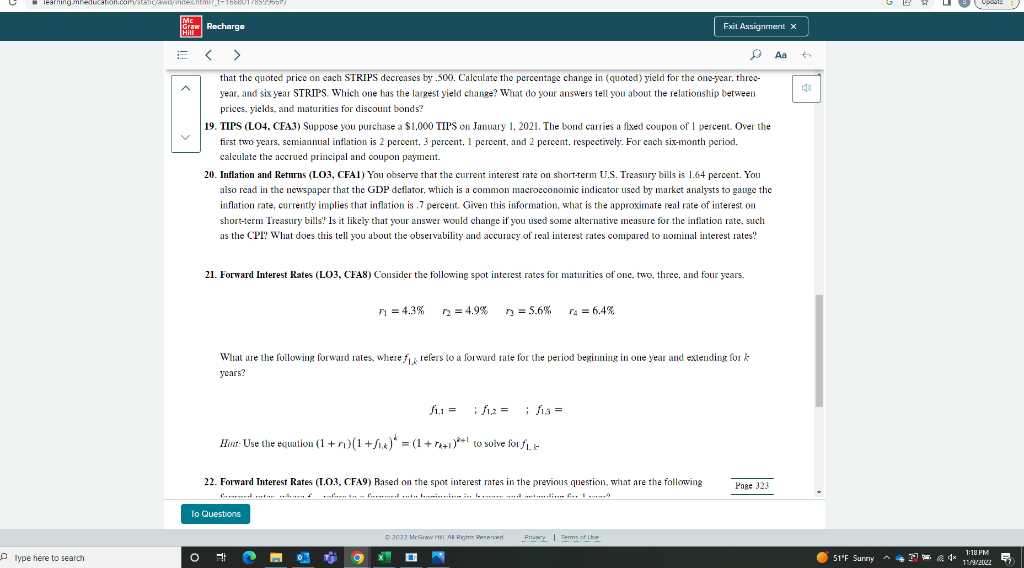

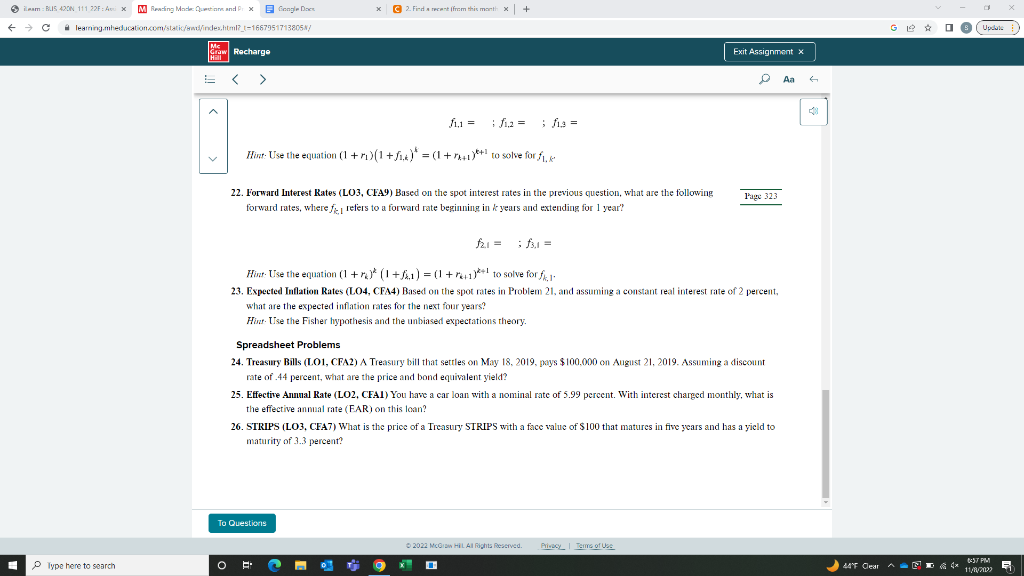

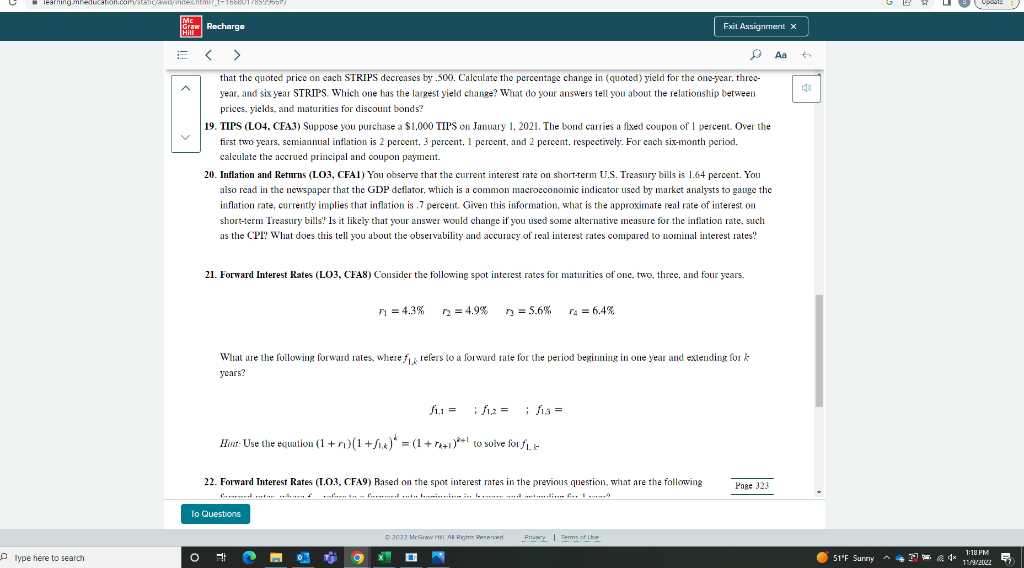

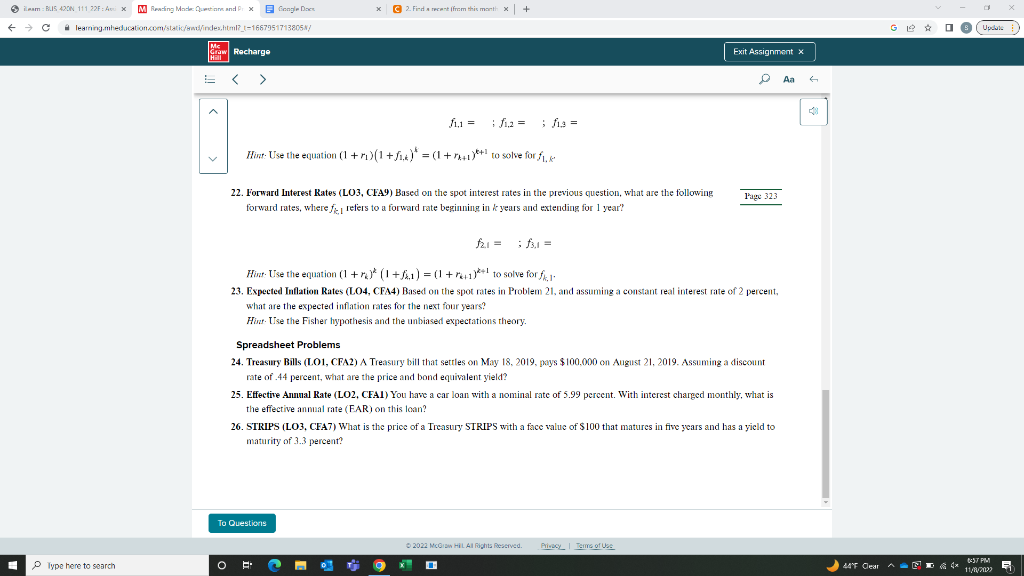

that the quoted price on each STRIPS decreases by .500. Calculate the percentage change in (quoted) yield for the one-year. threeyear. and six year STRIPS. Which one has the largest yield change? What do your answers tell you about the relationship berween prices, yields, and maturities for discount bonds? 19. TIPS (LO4, CFA3) Suppose you purchase a \$1,000 TIPS on January 1, 2021. The bond carries a fixed coupon of 1 percent. Over the first two years, semiannual inflation is 2 percent, 3 percent, 1 percent, and 2 percent, respectively. For each six-month period. calculate the accrued principal and coupon payment. 20. Inflation and Returns (LO3, CFA1) You observe that the current interest rate on short-term U.S. Treasury bills is 1.64 percent. You also read in the newspaper that the GDP deflator, which is a common macrocconomic indicator used by market analysts to gauge the inflation rate, currently implies that inflation is .7 percent. Given this information, what is the approximate real rate of interest on short-term Treasury bills? Is it likely that your answer would change if you used some alternative measure for the inflation rate, such as the CPI? What does this tell you about the observability and accuracy of real interest rates compared to nominal interest rates? 21. Forward Interest Rates (LO3, CFA8) Consider the following spot interest rates for maturities of one, two, three, and four years. r1=4.3%r2=4.9%r3=5.6%r4=6.4% What are the following forward rates, where f1,k refers to a forward rate for the period beginning in one year and extending for k years? f1,1=;f1,2=;f1,3= Hint: Use the equation (1+r1)(1+f1,k)k=(1+rk+1)k+1 to solve for f1,k f1,1=;f1,2=;f1,3= Hiart. Use the equation (1+r1)(1+f1,k)k=(1+rk+1)k+1 to solve for f1,k 22. Forward Lnterest Rates (LO3, CFA9) Based on the spot interest rates in the previous question, what are the following forward rates, where fk,1 refers to a forward rate beginning in k years and extending for 1 year? f2,1=;f3,1= Hint. Tse the equation (1+rk)k(1+fk,1)=(1+rk+1)k+1 to solve for fk,1. 23. Expected Inflation Rates (LO4, CFA4) Based on the spot rates in Problem 21, and assuming a constant real interest rate of 2 percent, what are the expected inflation rates for the next four years? Hist. The the Fisher hypothesis and the unbiased expectations theory. Spreadsheet Problems 24. Treasury Bills (LO1, CFA2) A Treasury bill that sertles on May 18, 2019, pays $100,000 on August 21, 2019. Assuming a discount rate of .44 percent, what are the price and bond equivalent yield? 25. Effective Annnal Rate (LO2, CFA1) You have a car loan with a nominal rate of 5.99 percent. With interest charged monthly, what is the effective annual rate (FAR) on this loan? 26. STRIPS (LO3, CFA7) What is the price of a Treasury STRIPS with a face value of $100 that matures in five years and has a yield to maturity of 3.3 percent? that the quoted price on each STRIPS decreases by .500. Calculate the percentage change in (quoted) yield for the one-year. threeyear. and six year STRIPS. Which one has the largest yield change? What do your answers tell you about the relationship berween prices, yields, and maturities for discount bonds? 19. TIPS (LO4, CFA3) Suppose you purchase a \$1,000 TIPS on January 1, 2021. The bond carries a fixed coupon of 1 percent. Over the first two years, semiannual inflation is 2 percent, 3 percent, 1 percent, and 2 percent, respectively. For each six-month period. calculate the accrued principal and coupon payment. 20. Inflation and Returns (LO3, CFA1) You observe that the current interest rate on short-term U.S. Treasury bills is 1.64 percent. You also read in the newspaper that the GDP deflator, which is a common macrocconomic indicator used by market analysts to gauge the inflation rate, currently implies that inflation is .7 percent. Given this information, what is the approximate real rate of interest on short-term Treasury bills? Is it likely that your answer would change if you used some alternative measure for the inflation rate, such as the CPI? What does this tell you about the observability and accuracy of real interest rates compared to nominal interest rates? 21. Forward Interest Rates (LO3, CFA8) Consider the following spot interest rates for maturities of one, two, three, and four years. r1=4.3%r2=4.9%r3=5.6%r4=6.4% What are the following forward rates, where f1,k refers to a forward rate for the period beginning in one year and extending for k years? f1,1=;f1,2=;f1,3= Hint: Use the equation (1+r1)(1+f1,k)k=(1+rk+1)k+1 to solve for f1,k f1,1=;f1,2=;f1,3= Hiart. Use the equation (1+r1)(1+f1,k)k=(1+rk+1)k+1 to solve for f1,k 22. Forward Lnterest Rates (LO3, CFA9) Based on the spot interest rates in the previous question, what are the following forward rates, where fk,1 refers to a forward rate beginning in k years and extending for 1 year? f2,1=;f3,1= Hint. Tse the equation (1+rk)k(1+fk,1)=(1+rk+1)k+1 to solve for fk,1. 23. Expected Inflation Rates (LO4, CFA4) Based on the spot rates in Problem 21, and assuming a constant real interest rate of 2 percent, what are the expected inflation rates for the next four years? Hist. The the Fisher hypothesis and the unbiased expectations theory. Spreadsheet Problems 24. Treasury Bills (LO1, CFA2) A Treasury bill that sertles on May 18, 2019, pays $100,000 on August 21, 2019. Assuming a discount rate of .44 percent, what are the price and bond equivalent yield? 25. Effective Annnal Rate (LO2, CFA1) You have a car loan with a nominal rate of 5.99 percent. With interest charged monthly, what is the effective annual rate (FAR) on this loan? 26. STRIPS (LO3, CFA7) What is the price of a Treasury STRIPS with a face value of $100 that matures in five years and has a yield to maturity of 3.3 percent