Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer for the all questions clearly part A and part B B. Mr. Saleh is an Omani and is the owner of Mandi Restaurant

please answer for the all questions clearly part A and part B

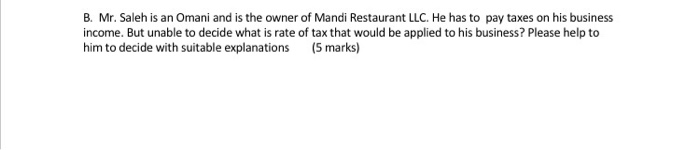

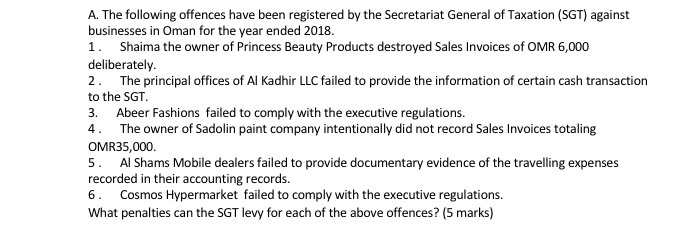

B. Mr. Saleh is an Omani and is the owner of Mandi Restaurant LLC. He has to pay taxes on his business income. But unable to decide what is rate of tax that would be applied to his business? Please help to him to decide with suitable explanations (5 marks) A. The following offences have been registered by the Secretariat General of Taxation (SGT) against businesses in Oman for the year ended 2018. 1. Shaima the owner of Princess Beauty Products destroyed Sales Invoices of OMR6,000 deliberately. 2. The principal offices of Al Kadhir LLC failed to provide the information of certain cash transaction to the SGT. 3. Abeer Fashions failed to comply with the executive regulations. 4. The owner of Sadolin paint company intentionally did not record Sales Invoices totaling OMR35,000 5. Al Shams Mobile dealers failed to provide documentary evidence of the travelling expenses recorded in their accounting records. Cosmos Hypermarket failed to comply with the executive regulations. What penalties can the SGT levy for each of the above offences? (5 marks) 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started