Answered step by step

Verified Expert Solution

Question

1 Approved Answer

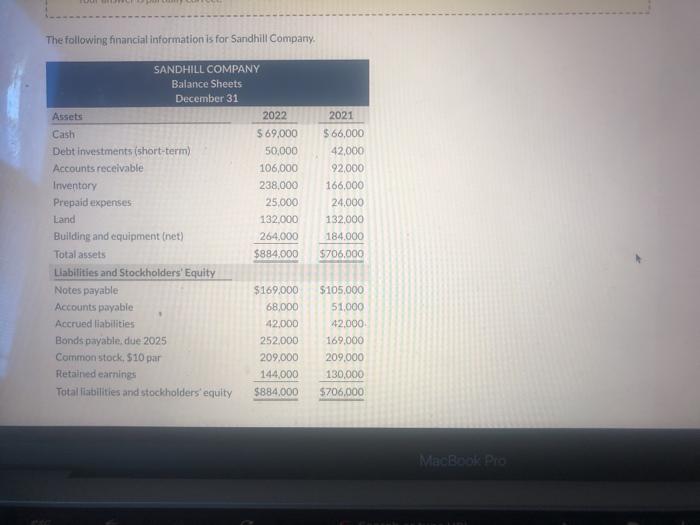

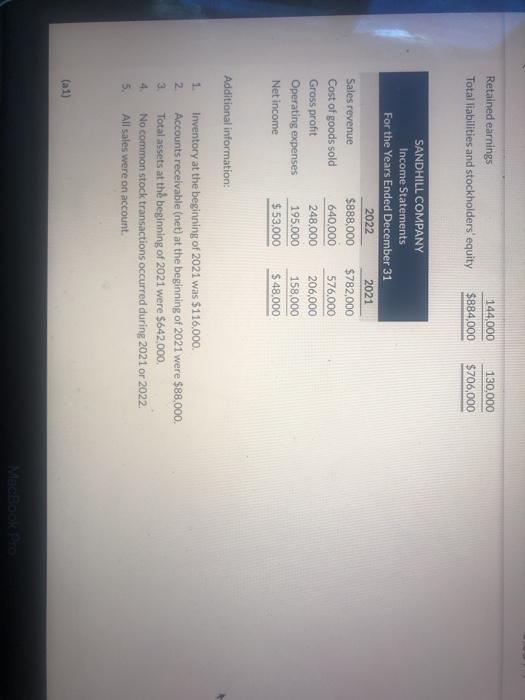

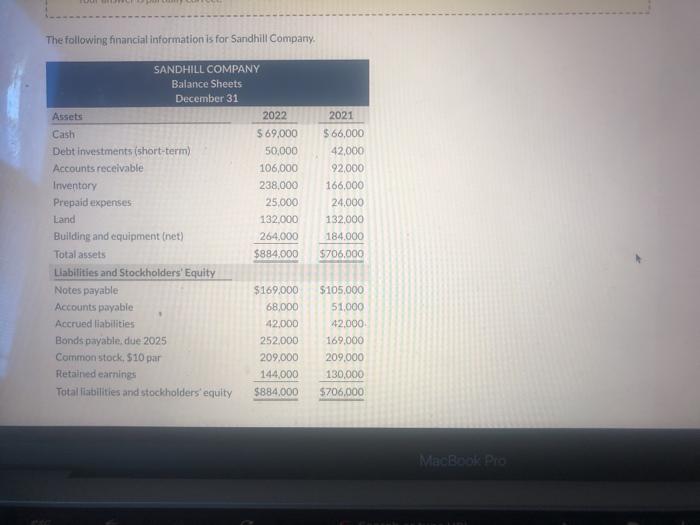

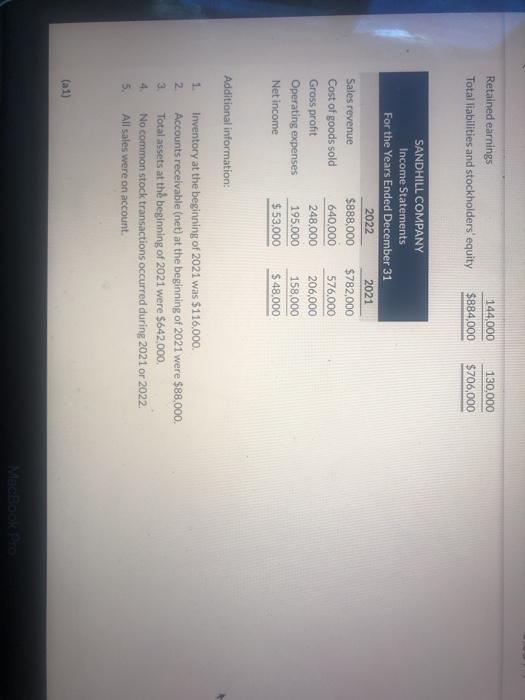

please answer for the red boxes, thank u The following financial information is for Sandhill Company 2021 SANDHILL COMPANY Balance Sheets December 31 Assets 2022

please answer for the red boxes, thank u

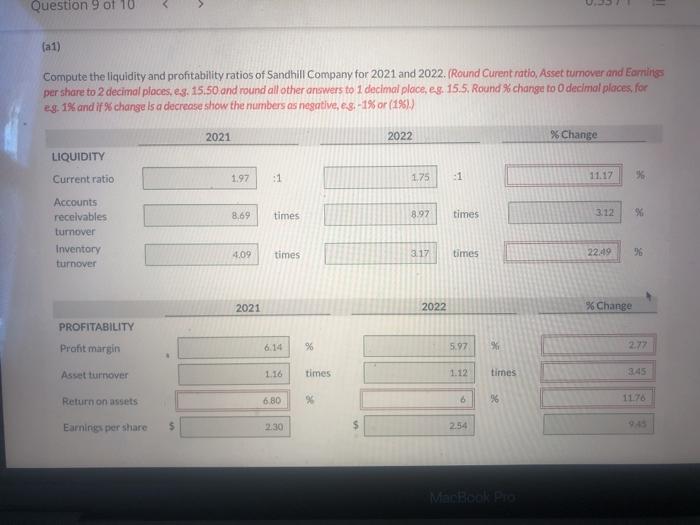

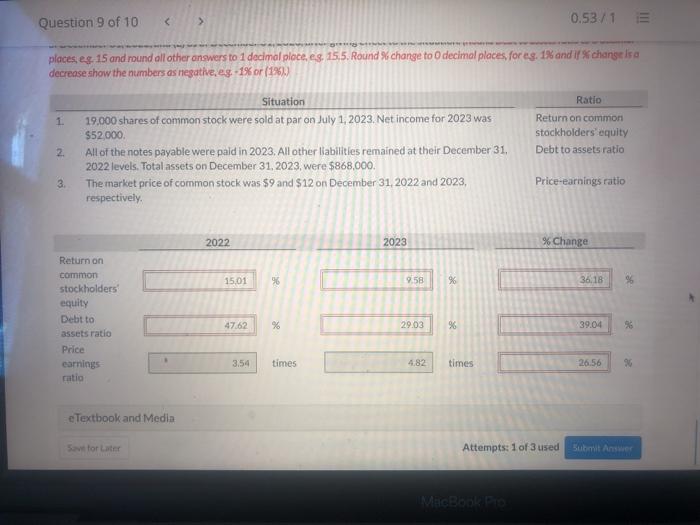

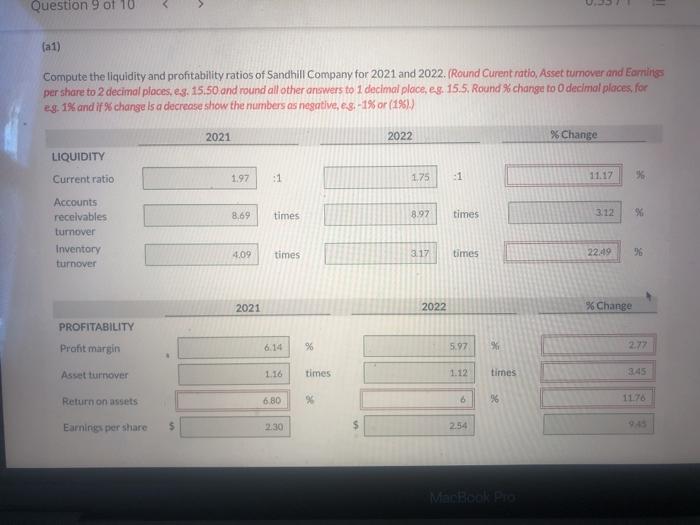

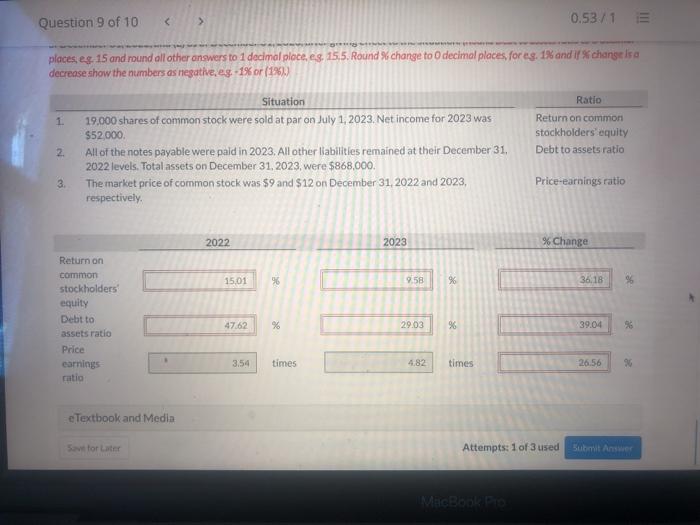

The following financial information is for Sandhill Company 2021 SANDHILL COMPANY Balance Sheets December 31 Assets 2022 Cash $ 69,000 Debt investments (short-term) 50,000 Accounts receivable 106,000 Inventory 238.000 Prepaid expenses 25,000 Land 132,000 Building and equipment (net) 264.000 Total assets $884.000 Liabilities and Stockholders' Equity Notes payable $169,000 Accounts payable 68,000 Accrued liabilities 42.000 Bonds payable, due 2025 252.000 Common stock, $10 par 209.000 Retained earnings 144,000 Total liabilities and stockholders equity $884.000 $ 66,000 42,000 92,000 166,000 24,000 132.000 184.000 5706,000 $105,000 51.000 42.000 169.000 209,000 130,000 $706.000 MacBook Pro Retained earnings Total liabilities and stockholders' equity 144,000 $884,000 130,000 $706,000 SANDHILL COMPANY Income Statements For the Years Ended December 31 2022 2021 Sales revenue $888.000 $782,000 Cost of goods sold 640,000 576,000 Gross profit 248.000 206,000 Operating expenses 195.000 158,000 Net income $ 53,000 $ 48,000 Additional information: 2 3 Inventory at the beginning of 2021 was $116,000 Accounts receivable (net) at the beginning of 2021 were $88,000 Total assets at the beginning of 2021 were $642.000 No common stock transactions occurred during 2021 or 2022. All sales were on account 5. (21) MECEDOS Question 9 of 10 (a1) Compute the liquidity and profitability ratios of Sandhill Company for 2021 and 2022. (Round Curent ratio, Asset tumover and Earnings per share to 2 decimal places, eg. 15.50 and round all other answers to 1 decimal place, eg. 15.5. Round % change to O decimal places for g. 1% and if % change is a decrease show the numbers as negative, e.g: -1% or (191) 2021 2022 % Change LIQUIDITY Current ratio 1.97 175 :1 11.17 % 8.69 times 8.92 times 3.12 % Accounts receivables turnover Inventory turnover 4.09 times 3.1 times 22.49 136 2021 2022 % Change PROFITABILITY Profit margin 6.14 % 5.97 2.77 Asset turnover 116 times 1.12 times Return on assets 6.80 % %6 1178 Earnings per share $ 2.30 $ 254 MacBook Pro Question 9 of 10 0.53/13 G places, eg. 15 and round all other answers to 1 decimal ploce, eg. 15,5. Round % change to decimal places, for ag. 1% and if % changes decrease show the numbers as negative, eg 1% or (190) 1. Situation 19.000 shares of common stock were sold at par on July 1, 2023, Net income for 2023 was $52.000. All of the notes payable were paid in 2023. All other liabilities remained at their December 31. 2022 levels. Total assets on December 31, 2023, were $868,000 The market price of common stock was $9 and $12 on December 31, 2022 and 2023, respectively. Ratio Return on common stockholders equity Debt to assets ratio 2. 3. Price-earnings ratio 2022 2023 % Change 15.01 98 9.58 % 36.18 Return on common stockholders equity Debt to assets ratio Price earnings ratio 47.62 29.03 %6 39.04 3.54 times 4.82 times 26.56 96 e Textbook and Media Savn for Later Attempts: 1 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started