Answered step by step

Verified Expert Solution

Question

1 Approved Answer

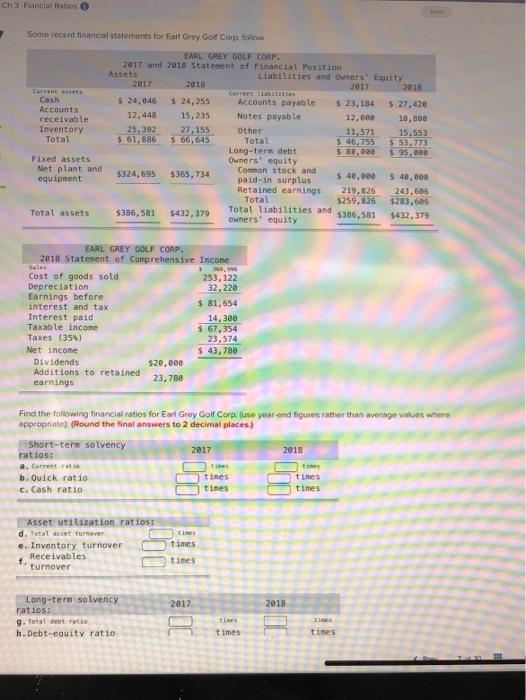

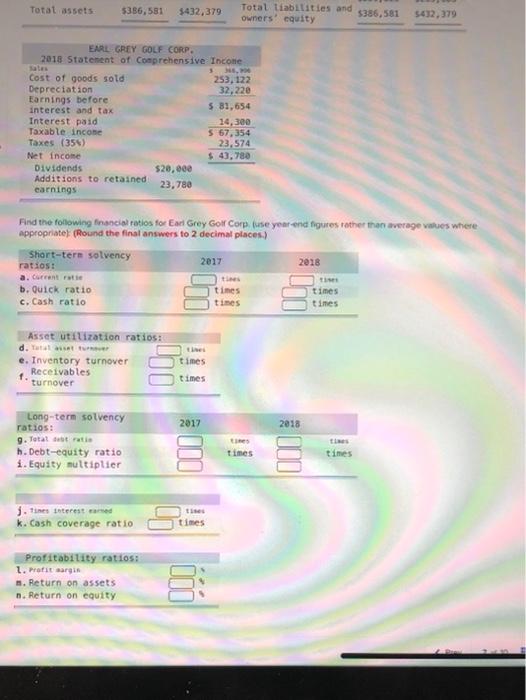

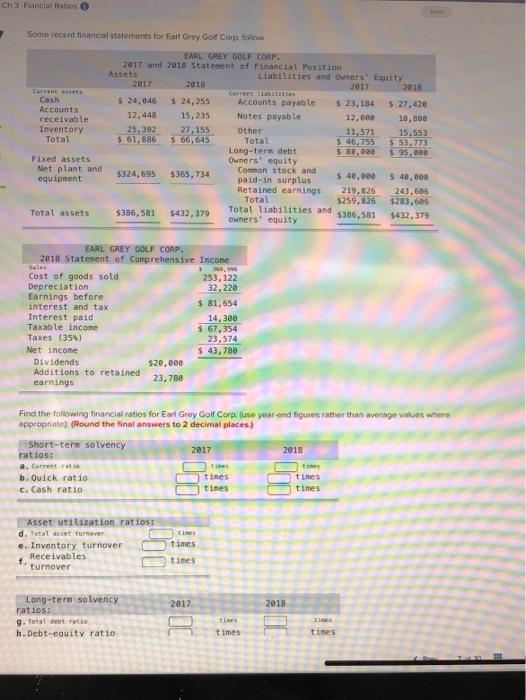

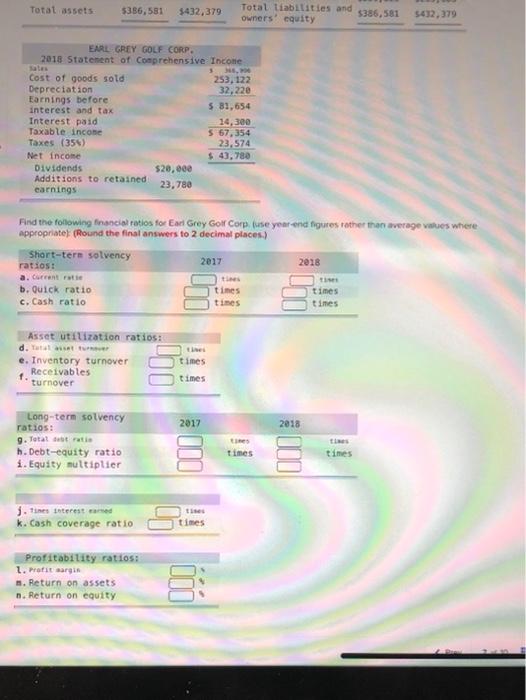

please answer full question Ch Finncial Ratios Some recent financial statements for Earl Grey Go Corp. follow EARL GREY GOLF CORP. 2017 and 2010 Statenent

please answer full question

Ch Finncial Ratios Some recent financial statements for Earl Grey Go Corp. follow EARL GREY GOLF CORP. 2017 and 2010 Statenent of Financial Position Assets Liabilities and Owners' Equity 2017 2010 2017 2018 Current Certi Cath $ 24,046 $ 24,255 Accounts payable $ 23, 184 $ 27, 420 Accounts 12,448 15,235 Notes payable 12.000 receivable 10,800 Inventory 25,392 27, 155 Other 11,571 15,553 Total $ 61,886 5 66,645 Totat 5:46.755 $ 53,723 Long-term debt 5 80.000 $ 95.000 Fixed assets Owners' equity Net plant and $324,695 $365, 734 Conmon stock and 540,000 540,000 equipment paid-in surplus Retained earnings 219,826 243,66 Total $259,826 $283,505 Total assets 5386,581 Total liabilities and $432,379 5386,581 $432.379 Owners' equity EARL GREY GOLF CORP. 2018 Statenent of Comprehensive Incone Sales $0.99 Cost of goods sold 253,122 Depreciation 32,220 Earnings before interest and tax $ 81,654 Interest paid 14,300 Taxable income $.67.354 Taxes (355) 23,574 Net Income 5.43,780 Dividends $20,000 Additions to retained earnings 23,789 Find the following tinancial ratios for Earl Grey Golf Corp. (use year-end figures rather than average values where appropriate (Round the final answers to 2 decimal places) Short-term solvency 2017 2018 rat 105 a. Current rate b. Quick ratio times times c. Cash ratio tines times Asset utilization ratios: d. Total asset turnover e. Inventory turnover Receivables f. turnover LE times times 2012 2018 Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio ties times times Total assets 5386,581 $432,379 Total liabilities and 5386,581 owners' equity 5432,379 EARL GREY GOLF CORP. 2018 Statement of Comprehensive Income 3, Cost of goods sold 253, 122 Depreciation 32,220 Earnings before interest and tax 581,654 Interest paid 14,300 Taxable income 5 67,354 Taxes (356) 23,574 Net income $ 43,780 Dividends $20,000 Additions to retained 23,780 earnings Find the following financial ratios for Earl Grey Golf Comp. (use year-end figures rather than average values where appropriate (Round the final answers to 2 decimal places.) Short-term solvency 2017 ratios: 2018 a. Current rate b. Quick ratio c. Cash ratio times times ties times times Asset utilization ratios: d. Ytt e. Inventory turnover f Receivables turnover times times 2017 2018 Long-term solvency ratios: 9. Total tratie h. Debt-equity ratio 1. Equity multiplier bil times 001 times 1. Tines Interest earned K. cash coverage ratio ti times Profitability ratios: 1. Profitsargin m. Return on assets n. Return on equity 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started