Please answer FULLY and CORRECTLY. If you do not want to do so PLEASE skip this post. If you choose to half do the work and it is incorrect I will defintly report your work. I do not have post to waste. Thank you

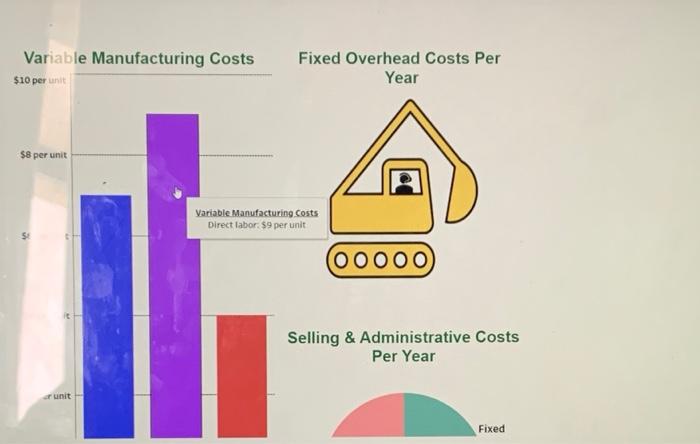

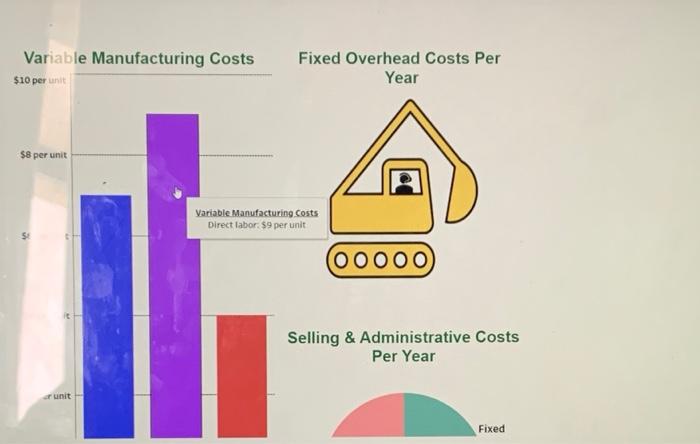

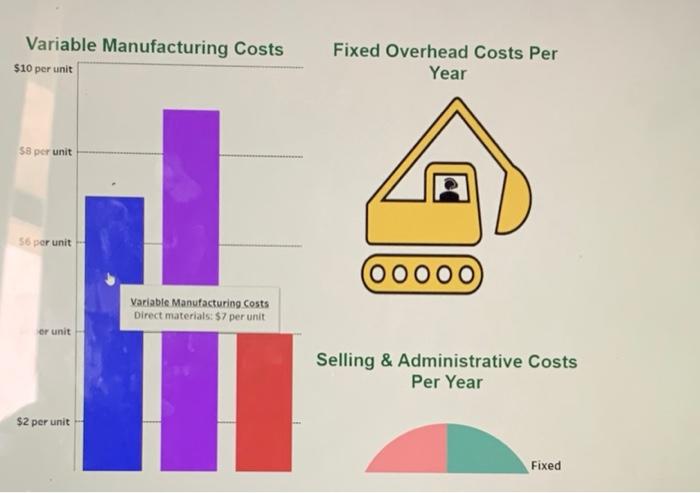

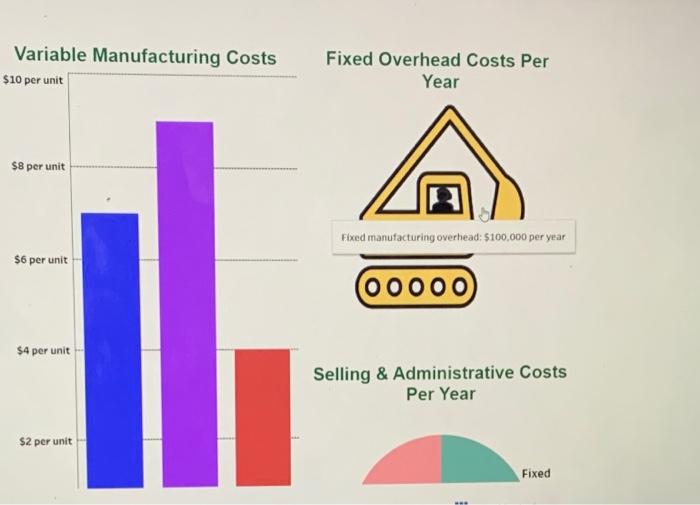

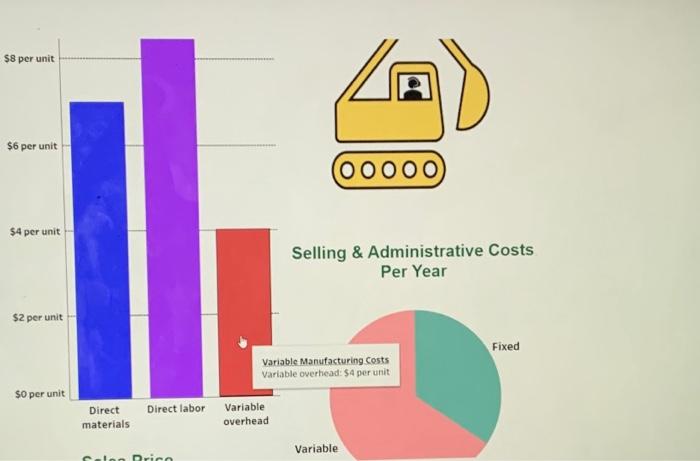

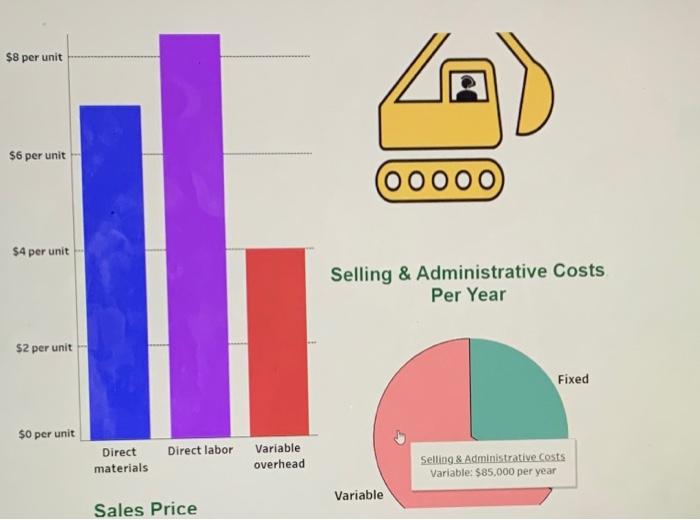

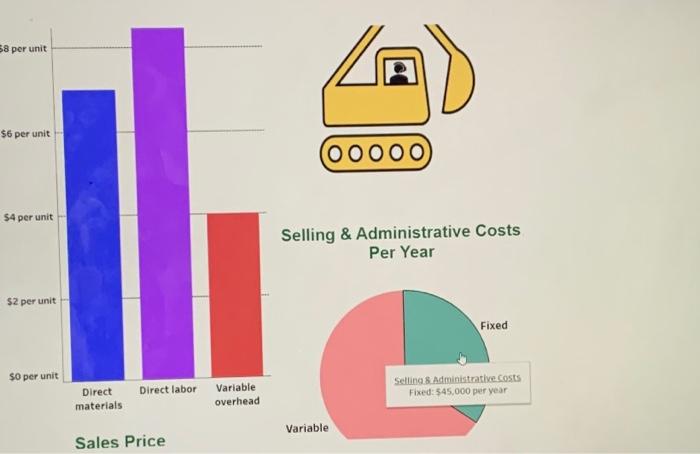

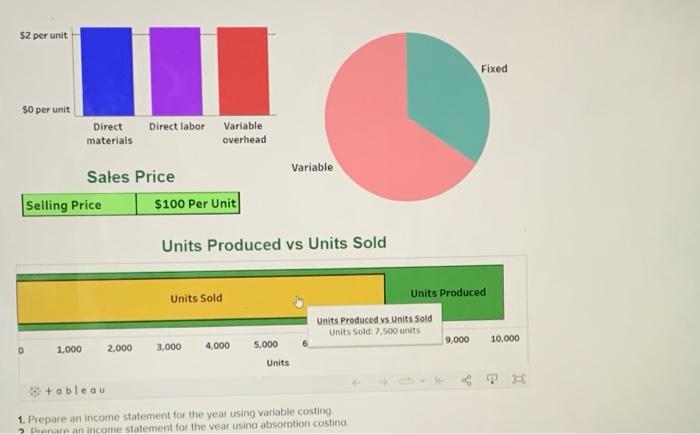

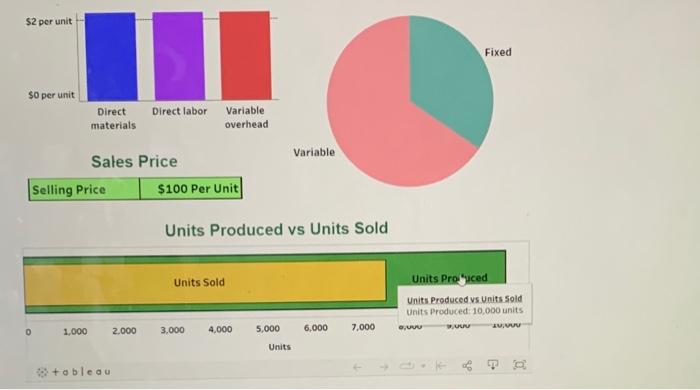

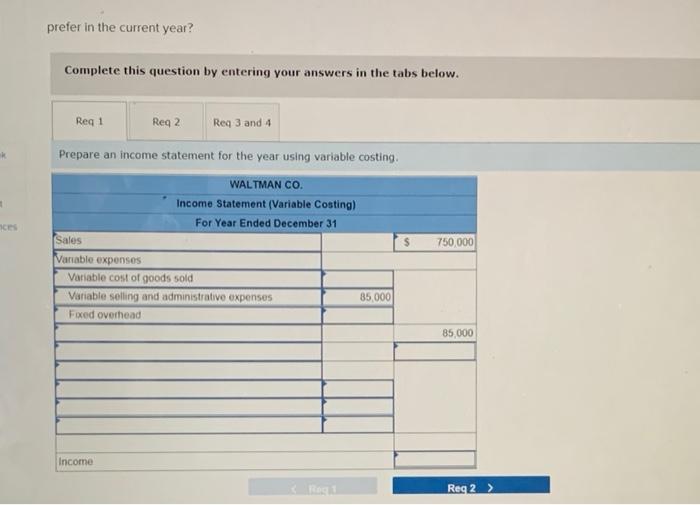

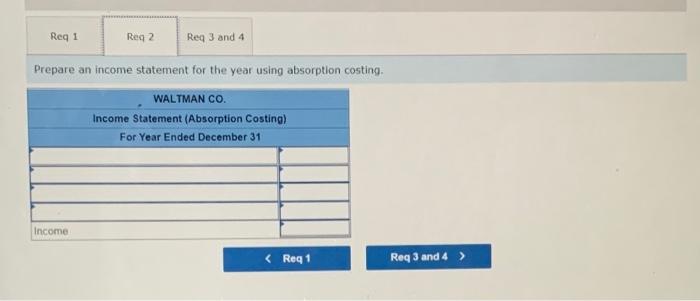

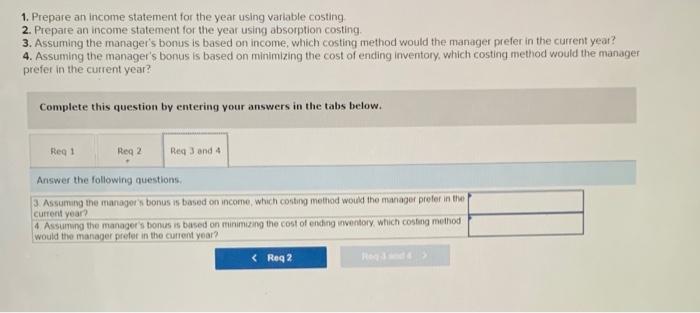

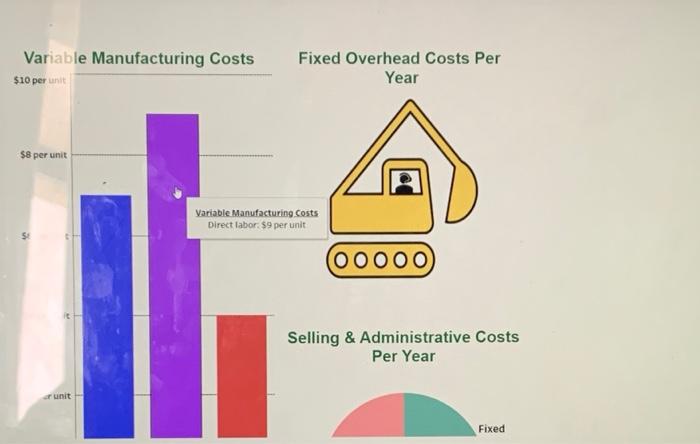

Variable Manufacturing Costs $10 per unit Fixed Overhead Costs Per Year $8 per unit Variable Manufacturing Costs Direct labor $9 per unit 00000 Selling & Administrative Costs Per Year er unit Fixed Variable Manufacturing Costs $10 per unit Fixed Overhead Costs Per Year 58 per unit 56 per unit 00000 Variable Manufacturing Costs Direct materials: 57 per unit or unit Selling & Administrative Costs Per Year $2 per unit Fixed Variable Manufacturing Costs $10 per unit Fixed Overhead Costs Per Year $8 per unit Fixed manufacturing overhead: $100.000 per year $6 per unit $4 per unit Selling & Administrative Costs Per Year $2 per unit Fixed $8 per unit $6 per unit 00000 $4 per unit Selling & Administrative Costs Per Year $2 per unit Fixed Variable Manufacturing Costs Variable overhead: $a per unit $0 per unit Direct labor Direct materials Variable overhead Variable $8 per unit $6 per unit 0000 $4 per unit Selling & Administrative Costs Per Year $2 per unit Fixed $0 per unit Direct labor Direct materials Variable overhead Selling & Administrative Costs Variable: $85,000 per year Variable Sales Price S8 per unit $6 per unit 00000 poo $4 per unit Selling & Administrative Costs Per Year $2 per unit Fixed so per unit Direct labor Direct materials Selling 8. Administrative costs Fixed: 545,000 per year Variable overhead Variable Sales Price $2 per unit Fixed SO per unit Direct Direct labor Variable materials overhead Variable Sales Price Selling Price $100 Per Unit Units Produced vs Units Sold Units Sold Units Produced 9,000 10,000 Units Produced vs Units Sold Units Sold: 7.500 units 1.000 2.000 3,000 4,000 5,000 Units $+ableau 1. Prepare an income statement for the year using variable costing ? Pense an income statement for the vear usina absorption costina $2 per unit Fixed $0 per unit Direct labor Direct materials Variable overhead Variable Sales Price Selling Price $100 Per Unit Units Produced vs Units Sold Units Sold Units Produced Units Produced vs Units Sold Units Produced: 10.000 units BUw 0 1.000 2.000 3,000 4.000 5.000 6.000 7.000 Units %+obleau prefer in the current year? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req 3 and 4 Prepare an income statement for the year using variable costing WALTMAN CO. Income Statement (Variable Costing) For Year Ended December 31 Sales 750,000 Variable expenses Variable cost of goods sold Variable selling and administrative expenses Fixed overhead 85.000 85 000 Income Reg 2 > Req 1 Reg 2 Req 3 and 4 Prepare an income statement for the year using absorption costing. WALTMAN CO. Income Statement (Absorption Costing) For Year Ended December 31 Income 1. Prepare an income statement for the year using variable costing 2. Prepare an income statement for the year using absorption costing. 3. Assuming the manager's bonus is based on income, which costing method would the manager prefer in the current year? 4. Assuming the manager's bonus is based on minimizing the cost of ending inventory, which costing method would the manager prefer in the current year? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 and 4 Answer the following questions 3. Assuming the manager's bonus is based on income, which costing method would the manager preferinte current year? 4 Assuming the manager's bonus is based on minimizing the cost of ending inventory which costing method would the manager prefer in the current year?