please answer fully. theres task 1, 1.1 and 2 tasks. thank you

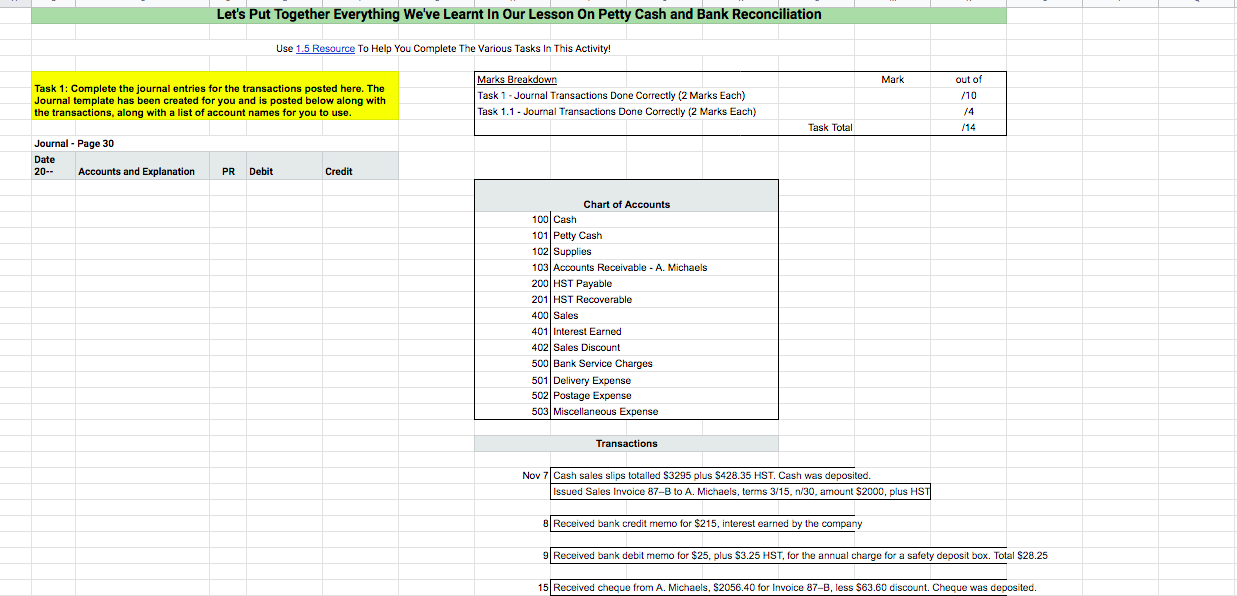

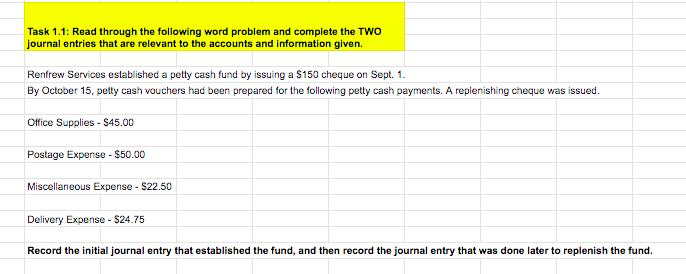

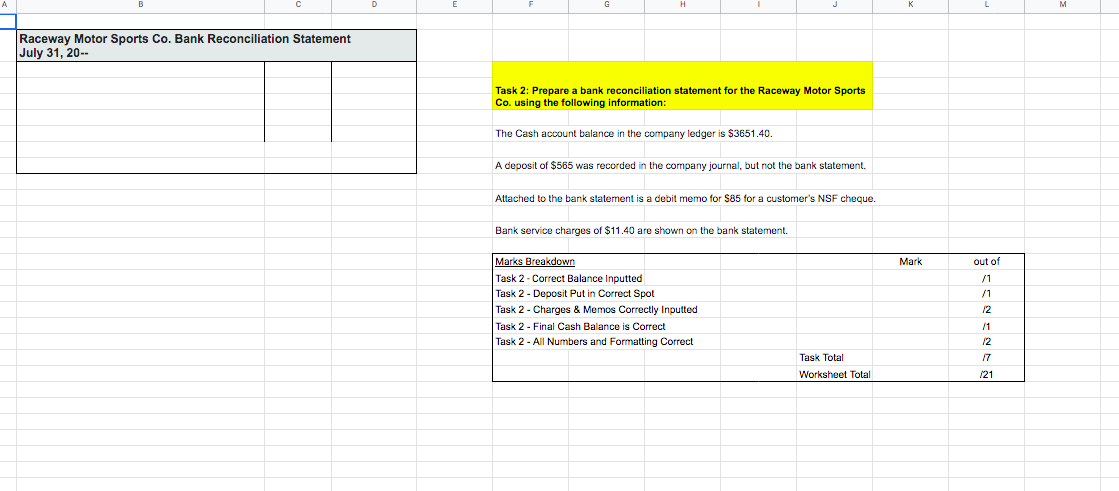

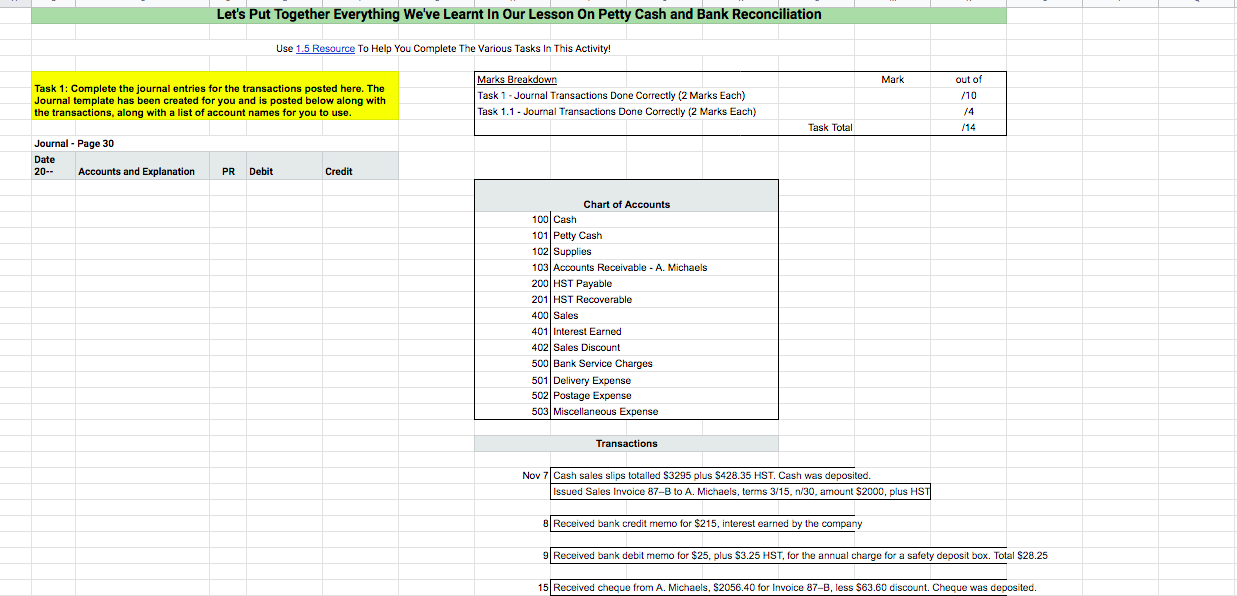

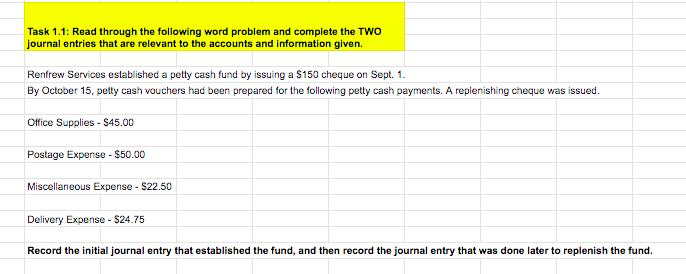

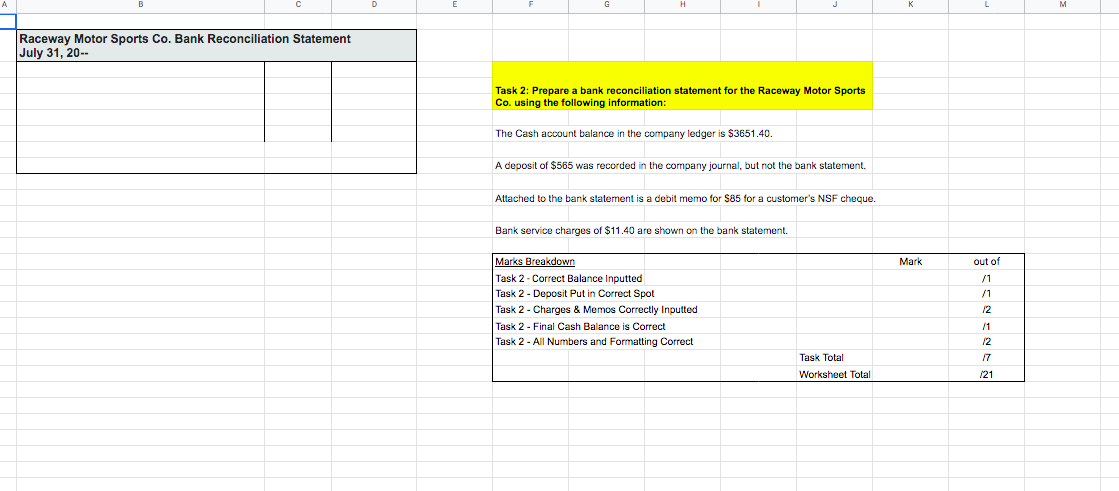

Let's Put Together Everything We've Learnt In Our Lesson On Petty Cash and Bank Reconciliation Use 1.5 Resource To Help You Complete The Various Tasks In This Activity! Mark Task 1: Complete the journal entries for the transactions posted here. The Journal template has been created for you and is posted below along with the transactions, along with a list of account names for you to use. Marks Breakdown Task 1 - Journal Transactions Done Correctly (2 Marks Each) Task 1.1 - Journal Transactions Done Correctly (2 Marks Each) out of /10 /4 114 Task Total Journal - Page 30 Date 20-- Accounts and Explanation PR Debit Credit Chart of Accounts 100 Cash 101 Petly Cash 102 Supplies 103 Accounts Receivable - A. Michaels 200 HST Payable 201 HST Recoverable . 400 Sales 401 Interest Earned a. 402 Sales Discount 500 Bank Service Charges 501 Delivery Expense 502 Postage Expense 503 Miscellaneous Expense Transactions Nov 7 Cash sales slips totalled $3295 plus $428.35 HST. Cash was deposited. Issued Sales Invoice 87-B to A. Michaels, terms 3/15, n/30, amount $2000, plus HST 8 Received bank credit memo for $215, interest earned by the company 9 Received bank debit memo for $25, plus $3.25 HST, for the annual charge for a safety deposit box. Total $28.25 15 Received cheque from A. Michaels, $2056.40 for Invoice 87-B, less $63.60 discount. Cheque was deposited. Task 1.1: Read through the following word problem and complete the TWO journal entries that are relevant to the accounts and information given. Renfrew Services established a petty cash fund by issuing a $150 cheque on Sept. 1. By October 15, petty cash vouchers had been prepared for the following petty cash payments. A replenishing cheque was issued. Office Supplies - $45.00 Postage Expense - $50.00 Miscellaneous Expense - $22.50 Delivery Expense - $24.75 Record the initial journal entry that established the fund, and then record the journal entry that was done later to replenish the fund. Raceway Motor Sports Co. Bank Reconciliation Statement July 31, 20- Task 2: Prepare a bank reconciliation statement for the Raceway Motor Sports Co. using the following information: The Cash account balance in the company ledger is $3651.40. A deposit of $565 was recorded in the company journal, but not the bank statement. Attached the bank statement is a debit memo for $85 for a customer's NSF cheque. Bank service charges of $11.40 are shown on the bank statement, Mark out of /1 /1 Marks Breakdown Task 2 - Correct Balance Inputted Task 2 - Deposit Put in Correct Spot Task 2 - Charges & Memos Correctly Inputted Task 2 - Final Cash Balance is correct Task 2 - All Numbers and Formatting Correct 12 11 12 17 Task Total Worksheet Total 121 Let's Put Together Everything We've Learnt In Our Lesson On Petty Cash and Bank Reconciliation Use 1.5 Resource To Help You Complete The Various Tasks In This Activity! Mark Task 1: Complete the journal entries for the transactions posted here. The Journal template has been created for you and is posted below along with the transactions, along with a list of account names for you to use. Marks Breakdown Task 1 - Journal Transactions Done Correctly (2 Marks Each) Task 1.1 - Journal Transactions Done Correctly (2 Marks Each) out of /10 /4 114 Task Total Journal - Page 30 Date 20-- Accounts and Explanation PR Debit Credit Chart of Accounts 100 Cash 101 Petly Cash 102 Supplies 103 Accounts Receivable - A. Michaels 200 HST Payable 201 HST Recoverable . 400 Sales 401 Interest Earned a. 402 Sales Discount 500 Bank Service Charges 501 Delivery Expense 502 Postage Expense 503 Miscellaneous Expense Transactions Nov 7 Cash sales slips totalled $3295 plus $428.35 HST. Cash was deposited. Issued Sales Invoice 87-B to A. Michaels, terms 3/15, n/30, amount $2000, plus HST 8 Received bank credit memo for $215, interest earned by the company 9 Received bank debit memo for $25, plus $3.25 HST, for the annual charge for a safety deposit box. Total $28.25 15 Received cheque from A. Michaels, $2056.40 for Invoice 87-B, less $63.60 discount. Cheque was deposited. Task 1.1: Read through the following word problem and complete the TWO journal entries that are relevant to the accounts and information given. Renfrew Services established a petty cash fund by issuing a $150 cheque on Sept. 1. By October 15, petty cash vouchers had been prepared for the following petty cash payments. A replenishing cheque was issued. Office Supplies - $45.00 Postage Expense - $50.00 Miscellaneous Expense - $22.50 Delivery Expense - $24.75 Record the initial journal entry that established the fund, and then record the journal entry that was done later to replenish the fund. Raceway Motor Sports Co. Bank Reconciliation Statement July 31, 20- Task 2: Prepare a bank reconciliation statement for the Raceway Motor Sports Co. using the following information: The Cash account balance in the company ledger is $3651.40. A deposit of $565 was recorded in the company journal, but not the bank statement. Attached the bank statement is a debit memo for $85 for a customer's NSF cheque. Bank service charges of $11.40 are shown on the bank statement, Mark out of /1 /1 Marks Breakdown Task 2 - Correct Balance Inputted Task 2 - Deposit Put in Correct Spot Task 2 - Charges & Memos Correctly Inputted Task 2 - Final Cash Balance is correct Task 2 - All Numbers and Formatting Correct 12 11 12 17 Task Total Worksheet Total 121