Answered step by step

Verified Expert Solution

Question

1 Approved Answer

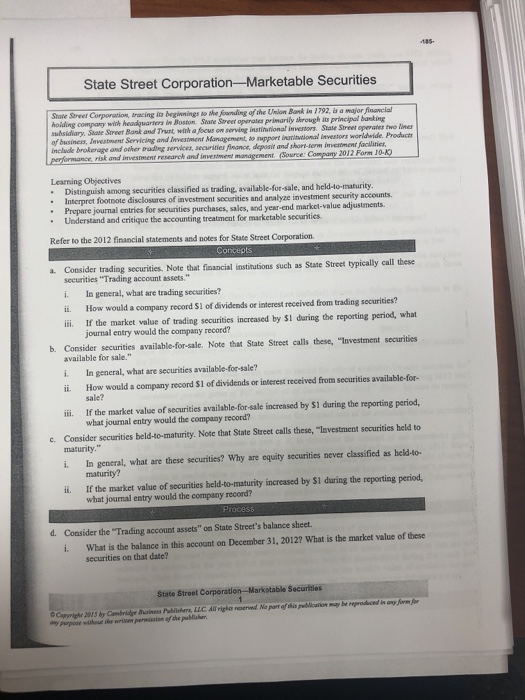

Please answer H. iii State Street Corporation-Marketable Securities Stane Street Corporation tracing its beginnings to the founding of the Union Bank in 1792, is a

Please answer H. iii

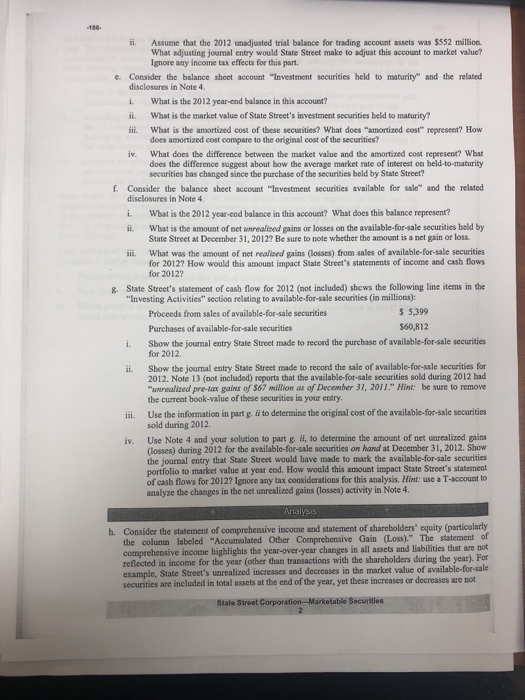

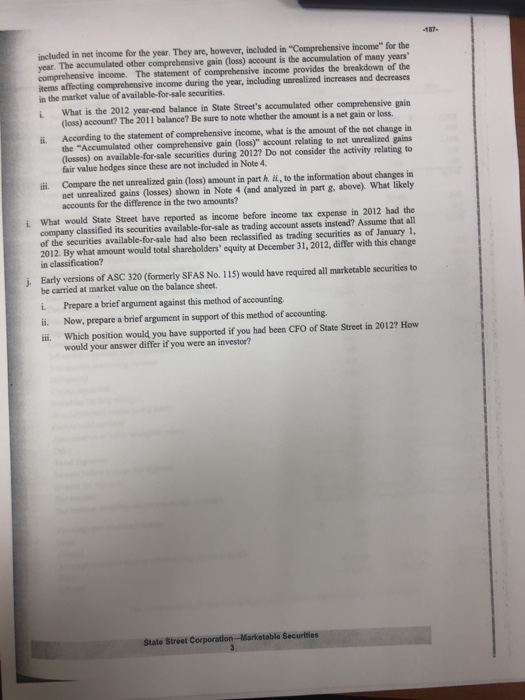

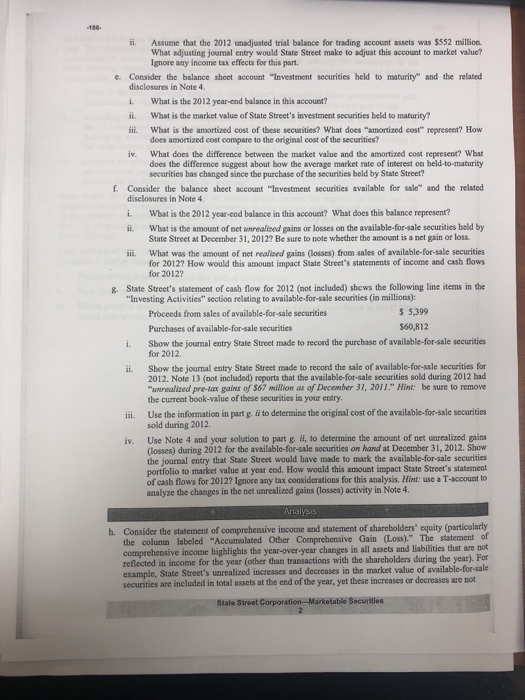

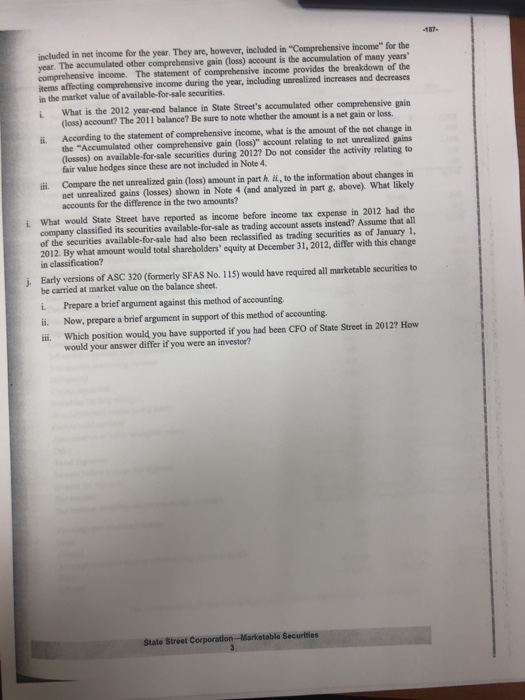

State Street Corporation-Marketable Securities Stane Street Corporation tracing its beginnings to the founding of the Union Bank in 1792, is a major financial subsidiary, Siate Street Bank and Trunt with a foeus on company with headquarters in Boston State Street operates primarily shrough its principal baking serving instinational invetors. Stale Streer operates two line inrintional investore worldride. Productr of business, Investmenr Servicing and Investment Management, to support includle brokerage and other gradng services, securities finance, deposit and short-term invermment, facilitier risk and invesmment research and invertment management Source: Company 2012 Form 10- Leaning Objoctives . Distinguish amon securities classified as trading, available-for-sale, and held-to-maturity. Prepare journal entries for securities purchases, sales, and year end market-value adjustments. of investment securities and analyze investment security accounts. Understand and critique the accounting treatment for marketabie securities Refer to the 2012 financial statements and notes for State Street Corporation. a. Consider trading securities. Note that financial institutions such as securities "Trading account assets." i. In general, what are trading securities? How would a company record S1 of dividends or interest received from trading securities? If the market value of trading securities increased by SI during the reporting period, what journal entry would the company record? b. Consider securities available-for-sale. Note that State Street calls these, "Investment securities available for sale. i. In general, what are securities available-for-sale? ii. How would a company record $1 of dividends or interest received from securities available-for- sale? ili. If the market value of securities available-for-sale increased by $1 during the reporting period, what journal entry would the company record? c. Consider securities beld-to-maturity. Note that State Street calls these, "Iavestment securities held to maturity i. In general, what are these securities? Why are equity securities never classified as held-4o- maturity? ii. If the market value of securities beld-to-maturity increased by $I during the reporting period, what jounal entry would the company record? d. Consider the "Trading account assets" on State Street's balance sheet What is the balance in this account on December 31, 2012? What is the market value of these securities on that date? i. State Street Corperation- Marotable Securitles Copyright 2015 hy Cantrite Buines, Publishers, All rigla reserved Na any purpose without the wrie permission efske pabisher refdiapeblatos bereprodal a aykmjr State Street Corporation-Marketable Securities Stane Street Corporation tracing its beginnings to the founding of the Union Bank in 1792, is a major financial subsidiary, Siate Street Bank and Trunt with a foeus on company with headquarters in Boston State Street operates primarily shrough its principal baking serving instinational invetors. Stale Streer operates two line inrintional investore worldride. Productr of business, Investmenr Servicing and Investment Management, to support includle brokerage and other gradng services, securities finance, deposit and short-term invermment, facilitier risk and invesmment research and invertment management Source: Company 2012 Form 10- Leaning Objoctives . Distinguish amon securities classified as trading, available-for-sale, and held-to-maturity. Prepare journal entries for securities purchases, sales, and year end market-value adjustments. of investment securities and analyze investment security accounts. Understand and critique the accounting treatment for marketabie securities Refer to the 2012 financial statements and notes for State Street Corporation. a. Consider trading securities. Note that financial institutions such as securities "Trading account assets." i. In general, what are trading securities? How would a company record S1 of dividends or interest received from trading securities? If the market value of trading securities increased by SI during the reporting period, what journal entry would the company record? b. Consider securities available-for-sale. Note that State Street calls these, "Investment securities available for sale. i. In general, what are securities available-for-sale? ii. How would a company record $1 of dividends or interest received from securities available-for- sale? ili. If the market value of securities available-for-sale increased by $1 during the reporting period, what journal entry would the company record? c. Consider securities beld-to-maturity. Note that State Street calls these, "Iavestment securities held to maturity i. In general, what are these securities? Why are equity securities never classified as held-4o- maturity? ii. If the market value of securities beld-to-maturity increased by $I during the reporting period, what jounal entry would the company record? d. Consider the "Trading account assets" on State Street's balance sheet What is the balance in this account on December 31, 2012? What is the market value of these securities on that date? i. State Street Corperation- Marotable Securitles Copyright 2015 hy Cantrite Buines, Publishers, All rigla reserved Na any purpose without the wrie permission efske pabisher refdiapeblatos bereprodal a aykmjr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started