Answered step by step

Verified Expert Solution

Question

1 Approved Answer

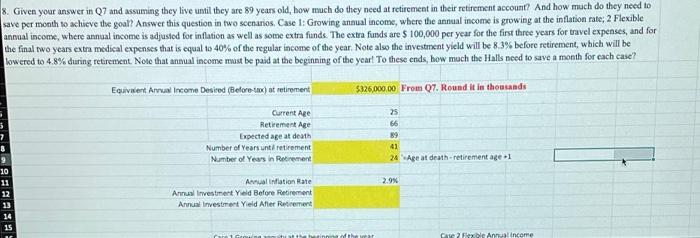

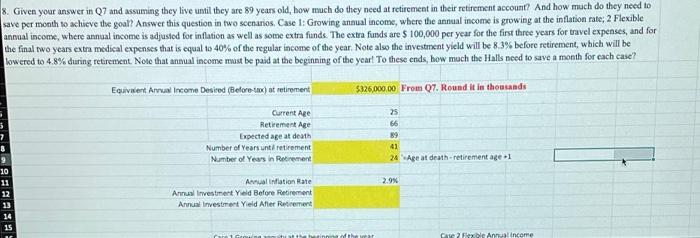

please answer how to get the annual investment yield before and after retirement and the show steps please. 8. Given your answer in Q7 and

please answer how to get the annual investment yield before and after retirement and the show steps please.

8. Given your answer in Q7 and assuming they live until they are 89 years old, how much do they need at retirement in their retirement account? And how much do they need to save per month to achieve the goal? Answer this question in two scenarios. Case 1: Growing annual income, where the annual income is growing at the inflation rate 2 Flexible annual income, where annual income is adjusted for inflation as well as some extra funds. The extra funds are $ 100,000 per year for the first three years for travel expenses, and for the final two years extra medical expenses that is equal to 40% of the regular income of the year. Note also the investment yield will be 8.3% before retirement, which will be lowered to 4.8% during retirement. Note that annual income must be paid at the beginning of the yearl To these ends, how much the Halls need to save a month for each case? Equivalent Annual Income Desired (Before-tr) at retirement $226,000.00 From Q7. Round it in thousands Current Are Retirement Age Expected age at death Number of Years untretirement Number of Years in Retirement 25 66 89 41 24 Age at death-retirement age 1 & 9 10 11 12 2.9% Annualnation Rate Anul Inwestment Yield Before Retirement Annual Investment Yield After Retement 13 Celle Annual income 8. Given your answer in Q7 and assuming they live until they are 89 years old, how much do they need at retirement in their retirement account? And how much do they need to save per month to achieve the goal? Answer this question in two scenarios. Case 1: Growing annual income, where the annual income is growing at the inflation rate 2 Flexible annual income, where annual income is adjusted for inflation as well as some extra funds. The extra funds are $ 100,000 per year for the first three years for travel expenses, and for the final two years extra medical expenses that is equal to 40% of the regular income of the year. Note also the investment yield will be 8.3% before retirement, which will be lowered to 4.8% during retirement. Note that annual income must be paid at the beginning of the yearl To these ends, how much the Halls need to save a month for each case? Equivalent Annual Income Desired (Before-tr) at retirement $226,000.00 From Q7. Round it in thousands Current Are Retirement Age Expected age at death Number of Years untretirement Number of Years in Retirement 25 66 89 41 24 Age at death-retirement age 1 & 9 10 11 12 2.9% Annualnation Rate Anul Inwestment Yield Before Retirement Annual Investment Yield After Retement 13 Celle Annual income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started