Please answer, I will thumbs you up!

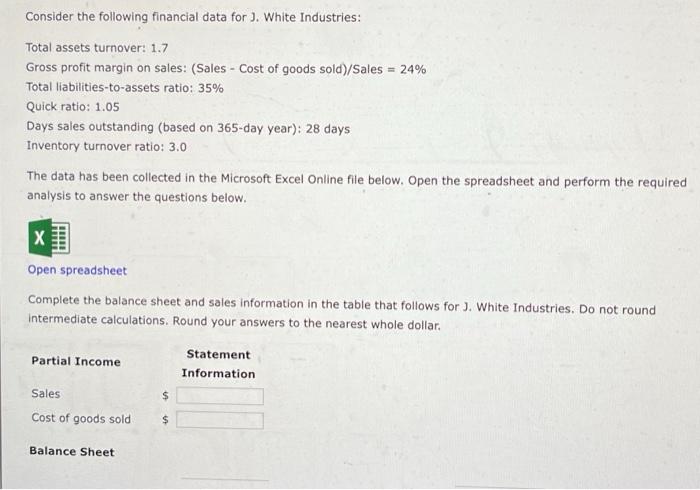

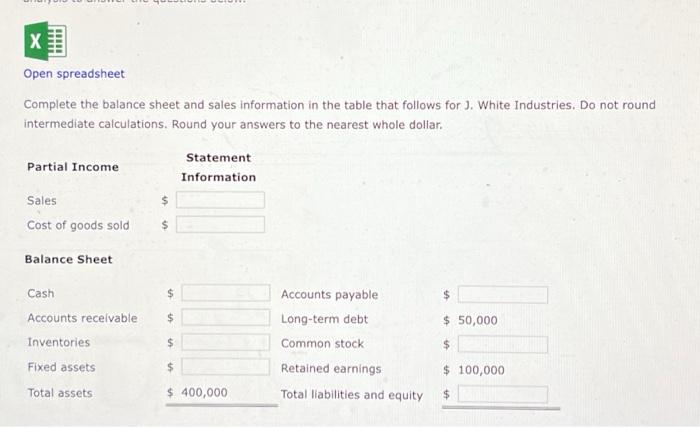

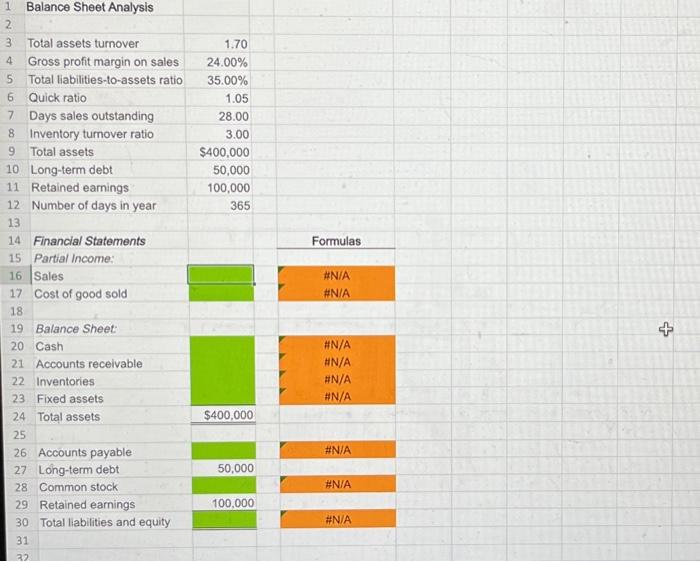

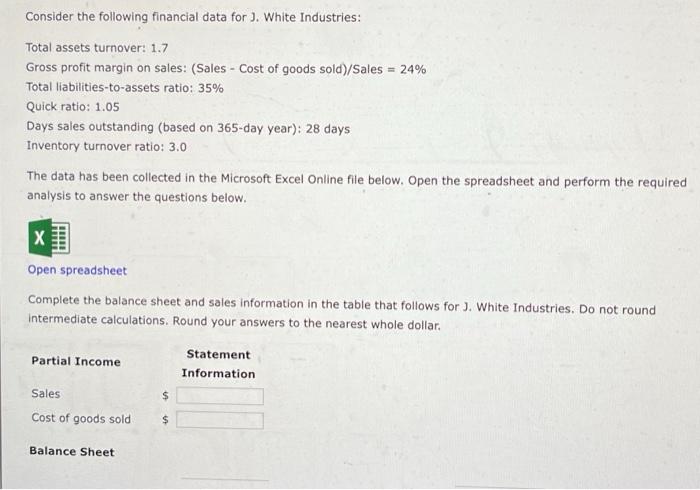

Consider the following financial data for J. White Industries: Total assets turnover: 1.7 Gross profit margin on sales: (Sales - Cost of goods sold) / Sales =24% Total liabilities-to-assets ratio: 35% Quick ratio: 1.05 Days sales outstanding (based on 365-day year): 28 days Inventory turnover ratio: 3.0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Complete the balance sheet and sales information in the table that follows for J. White Industries, Do not round intermediate calculations. Round your answers to the nearest whole dollar. Open spreadsheet Complete the balance sheet and sales information in the table that follows for J. White Industries, Do not round intermediate calculations. Round your answers to the nearest whole dollar. \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline 1 & Balance Sheet Analysis & & & & & & & \\ \hline 2 & (: & & & & & 2 & ? & \\ \hline 3 & Total assets turnover & 1.70 & = & & & & & \\ \hline 4 & Gross profit margin on sales & 24.00% & & & & & & \\ \hline 5 & Total liabilities-to-assets ratio & 35.00% & & & & & & \\ \hline 6 & Quick ratio & 1.05 & & & & & & \\ \hline 7 & Days sales outstanding & 28.00 & = & & & & & \\ \hline 8 & Inventory turnover ratio & 3.00 & & & & & 4 & \\ \hline 9 & Total assets & $400,000 & & & & & . 1= & \\ \hline 10 & Long-term debt & 50,000 & & & & & 11 & \\ \hline 11 & Retained earnings & 100,000 & & & & & & \\ \hline 12 & Number of days in year & 365 & & = & & IR & 3ian & \\ \hline 13 & & & x & & & & 4 & \\ \hline 14 & Financial Statements & y & Formulas & & & & H. & \\ \hline 15 & Partial Income: & & & & & & H & \\ \hline 16 & Sales & & #N/A & & 3 & 34 & 12 & \\ \hline 17 & Cost of good sold & & \#N/A & 4 & 11 & & & \\ \hline 18 & 3 & & & & = & 1 & & \\ \hline 19 & Balance Sheet: & & & 4 & & 57 & rit & \\ \hline 20 & Cash & & #N/A & & & & & \\ \hline 21 & Accounts receivable & & N/A & & 18 & & a & \\ \hline 22 & Inventories & & #N/A & & & 6 & & 3 \\ \hline 23 & Fixed assets & & #N/A & & 63 & & 81 & 2 \\ \hline 24 & Total assets & $400,000 & & & & Ansi & x2+3 & \\ \hline 25 & . & & & & & 428 & & rrict \\ \hline 26 & Accounts payable & & \#N/A & & & 57 & & \\ \hline 27 & Lohg-term debt & 50,000 & & & x= & & 18 & \\ \hline 28 & Common stock & & HN/A & 4 & x22 & & 30 & 1 \\ \hline 29 & Retained earnings & 100,000 & & x & & & 4 & \\ \hline 30 & Total liabilities and equity & & \#N/A & & & & 1 & \\ \hline 31 & & = & & & 1 & & & \\ \hline 3) & & & & & & & 1+ & \\ \hline \end{tabular}