Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer in American style. only part2 (16 marks) needed to be answer. Question 2 (21 marks) Part I (5 marks) Peter Company uses a

please answer in American style.

only part2 (16 marks) needed to be answer.

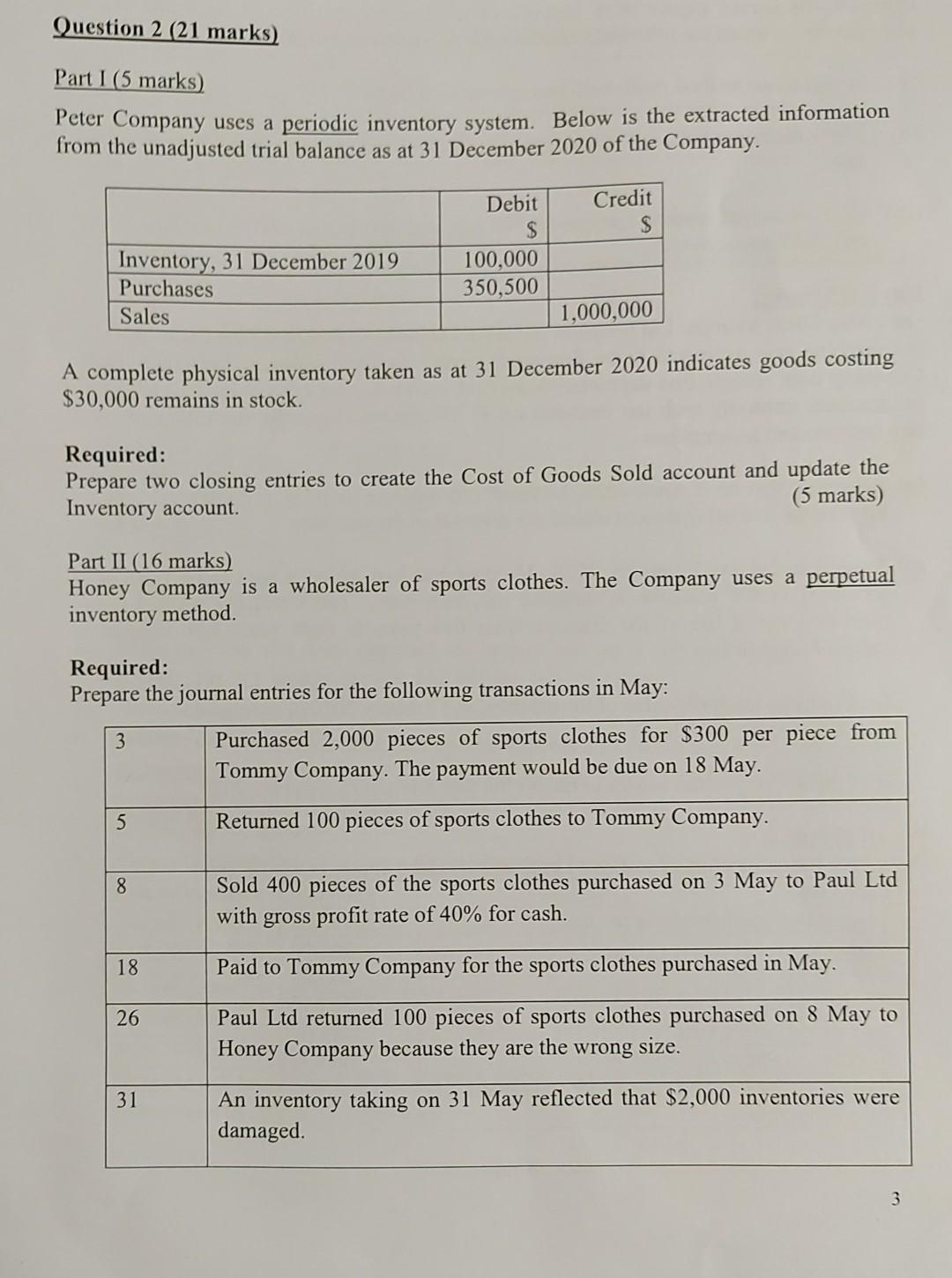

Question 2 (21 marks) Part I (5 marks) Peter Company uses a periodic inventory system. Below is the extracted information from the unadjusted trial balance as at 31 December 2020 of the Company. Credit $ Debit $ 100.000 350,500 Inventory, 31 December 2019 Purchases Sales 1,000,000 A complete physical inventory taken as at 31 December 2020 indicates goods costing $30,000 remains in stock. Required: Prepare two closing entries to create the Cost of Goods Sold account and update the Inventory account (5 marks) Part II (16 marks) Honey Company is a wholesaler of sports clothes. The Company uses a perpetual inventory method. Required: Prepare the journal entries for the following transactions in May: 3 Purchased 2,000 pieces of sports clothes for $300 per piece from Tommy Company. The payment would be due on 18 May. 5 Returned 100 pieces of sports clothes to Tommy Company. 8. Sold 400 pieces of the sports clothes purchased on 3 May to Paul Ltd with gross profit rate of 40% for cash. 18 Paid to Tommy Company for the sports clothes purchased in May. 26 Paul Ltd returned 100 pieces of sports clothes purchased on 8 May to Honey Company because they are the wrong size. 31 An inventory taking on 31 May reflected that $2,000 inventories were damaged 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started