Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER IN DETAIL STEP BY STEP HOW TO DO. PLEASE BE EXTREMELY DETAILED AND HOW TO DO IN EXCEL AND THE FORMULAS. QUESTIONS 1,

PLEASE ANSWER IN DETAIL STEP BY STEP HOW TO DO. PLEASE BE EXTREMELY DETAILED AND HOW TO DO IN EXCEL AND THE FORMULAS. QUESTIONS 1, 3, and 4

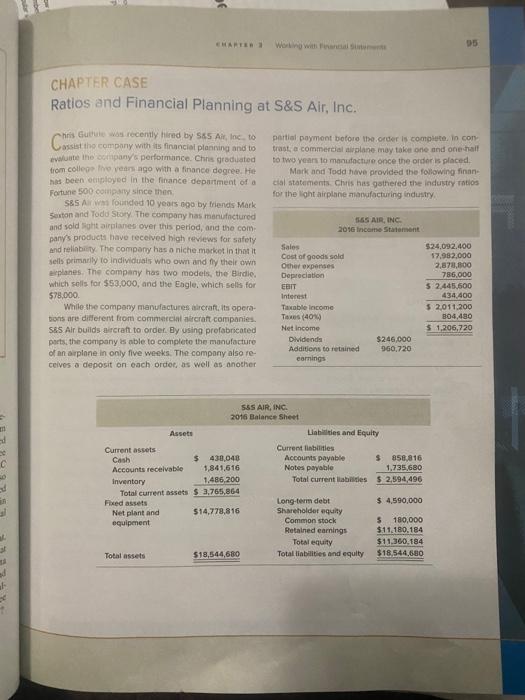

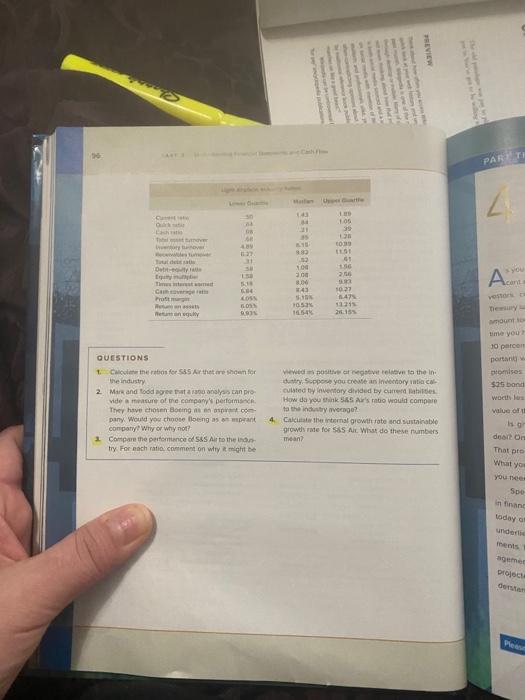

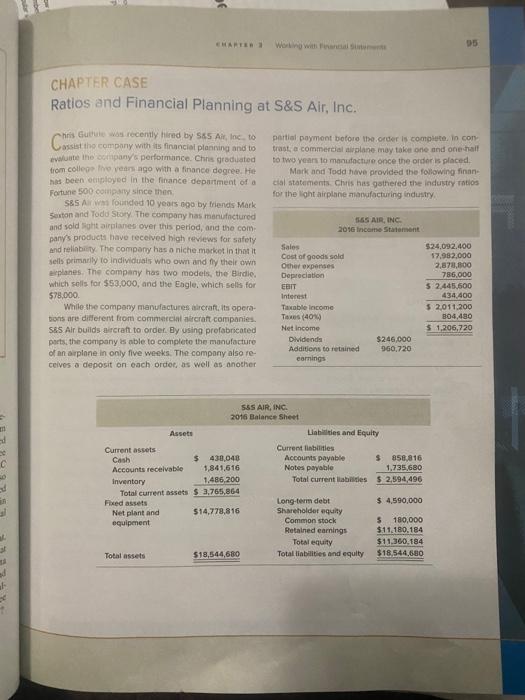

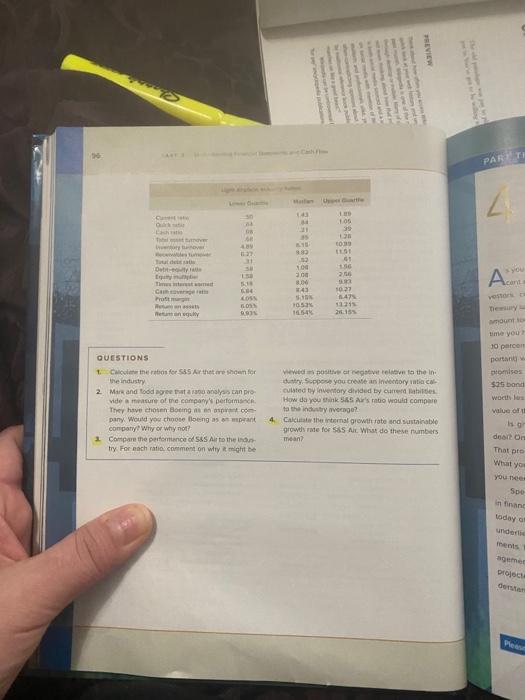

CHARTER CHAPTER CASE Ratios and Financial Planning at S&S Air, Inc. partial payment before the order is complete in con trast a commercial plane may take one and one hall to two years to manufacture once the order is placed Mark and Todd have provided the following finan al statements. Chris hes gathered the industry tatlos for the light airplane manufacturing Industry 365 AIR, INC 2016 Income Statement by Corset the company with its financiat planning and to te the company's performance. Chris graduated from college the years ago with a finance degree. He has been oployed in the finance department of a Fortune 500 company since then S&S As founded 10 years ago by friends Mark Sexton and Todo Story. The company has manufactured and sold sght airplanes over this period, and the com pany's products have received high reviews for safety and reliability. The company has o niche market in that it Sells primarily to individuals who own and fly their own airplanes. The company has two models, the Birdie. which solls for 553,000, and the Engle, which sells for 578,000 While the company manufactures inicraft, its opera- tions are different from commercial aircraft companies. SRS Air builds aircraft to order. By using profabricated parts, the company is able to complete the manufacture of an airplane in only five weeks. The company also re- ceives a deposit on each ordot, as well as another Sales Cost of goods sold Other expenses Depreciation EDIT Interest Taxable income Tues40% Net Income Dividends Additions to retained earnings $24.092.400 17,982,000 2,873,300 786,000 5 2.445,600 434.400 $ 2,011.200 B04.480 $ 1,206,720 $246,000 960.720 555 AIR, INC 2016 Balance Sheet Assets Liabilities and Equity Current assets Current libilities Cash 438,040 Accounts payable $ 856,816 Accounts receivable 1,841,616 Notes payable 1.735,680 Inventory 1.486,200 Total current liabides $2.594,496 Total current assets 3,765,864 Fixed assets Long-term debit $ 4,590,000 Net plant and 514,778.816 Shareholder equity equipment Common stock $ 180,000 Retained earnings $.11.180.184 Total equity $11.360.184 Total assets $18,544,680 Total liabilities and equity $18,544,680 PARTI 2 10 HOS 39 Dette 100 300 3.00 43 250 Aca Camer 4 C 50 102 11:47 11 2015 105 154 TE Menu time you 10 percen porn promises $25 bond QUESTIONS 1 Connebos for SS Ar there shown for the industry 2 Mars and food grans can pro vide a measure of me company's perform They have chosen Boeing som pany Would you choose long as prant company Why or why not? 1 Compare the performance of S&S Arto the indus try For each ratio comment on why it might be wewe positivt to the in uttry. Swopose you create an inventory Culated by hutory divided by carries How do you thinks Air's ratio would compare to the industry venge? 4. Calculate the internal growth rate and sustainable growth rate for $85 At Wisat do these numbers mean? watu value of doar on That pro- Whatyo Spe in and today underli mens mer Ontar CHARTER CHAPTER CASE Ratios and Financial Planning at S&S Air, Inc. partial payment before the order is complete in con trast a commercial plane may take one and one hall to two years to manufacture once the order is placed Mark and Todd have provided the following finan al statements. Chris hes gathered the industry tatlos for the light airplane manufacturing Industry 365 AIR, INC 2016 Income Statement by Corset the company with its financiat planning and to te the company's performance. Chris graduated from college the years ago with a finance degree. He has been oployed in the finance department of a Fortune 500 company since then S&S As founded 10 years ago by friends Mark Sexton and Todo Story. The company has manufactured and sold sght airplanes over this period, and the com pany's products have received high reviews for safety and reliability. The company has o niche market in that it Sells primarily to individuals who own and fly their own airplanes. The company has two models, the Birdie. which solls for 553,000, and the Engle, which sells for 578,000 While the company manufactures inicraft, its opera- tions are different from commercial aircraft companies. SRS Air builds aircraft to order. By using profabricated parts, the company is able to complete the manufacture of an airplane in only five weeks. The company also re- ceives a deposit on each ordot, as well as another Sales Cost of goods sold Other expenses Depreciation EDIT Interest Taxable income Tues40% Net Income Dividends Additions to retained earnings $24.092.400 17,982,000 2,873,300 786,000 5 2.445,600 434.400 $ 2,011.200 B04.480 $ 1,206,720 $246,000 960.720 555 AIR, INC 2016 Balance Sheet Assets Liabilities and Equity Current assets Current libilities Cash 438,040 Accounts payable $ 856,816 Accounts receivable 1,841,616 Notes payable 1.735,680 Inventory 1.486,200 Total current liabides $2.594,496 Total current assets 3,765,864 Fixed assets Long-term debit $ 4,590,000 Net plant and 514,778.816 Shareholder equity equipment Common stock $ 180,000 Retained earnings $.11.180.184 Total equity $11.360.184 Total assets $18,544,680 Total liabilities and equity $18,544,680 PARTI 2 10 HOS 39 Dette 100 300 3.00 43 250 Aca Camer 4 C 50 102 11:47 11 2015 105 154 TE Menu time you 10 percen porn promises $25 bond QUESTIONS 1 Connebos for SS Ar there shown for the industry 2 Mars and food grans can pro vide a measure of me company's perform They have chosen Boeing som pany Would you choose long as prant company Why or why not? 1 Compare the performance of S&S Arto the indus try For each ratio comment on why it might be wewe positivt to the in uttry. Swopose you create an inventory Culated by hutory divided by carries How do you thinks Air's ratio would compare to the industry venge? 4. Calculate the internal growth rate and sustainable growth rate for $85 At Wisat do these numbers mean? watu value of doar on That pro- Whatyo Spe in and today underli mens mer Ontar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started