Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in detail. Thank you very much! 7. To try to penetrate the Central American market, a Canadian beverage company is considering building a

Please answer in detail. Thank you very much!

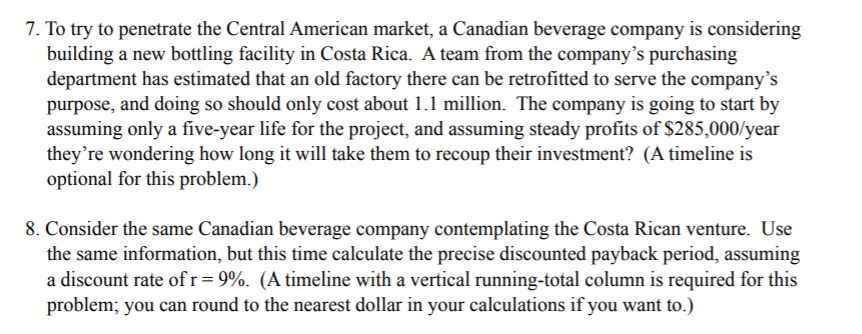

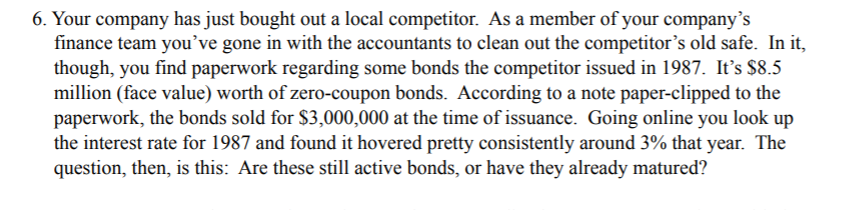

7. To try to penetrate the Central American market, a Canadian beverage company is considering building a new bottling facility in Costa Rica. A team from the company's purchasing department has estimated that an old factory there can be retrofitted to serve the company's purpose, and doing so should only cost about 1.1 million. The company is going to start by assuming only a five-year life for the project, and assuming steady profits of $285,000/year theyre wondering how long it will take them to recoup their investment? (A timeline is optional for this problem.) 8. Consider the same Canadian beverage company contemplating the Costa Rican venture. Use the same information, but this time calculate the precise discounted payback period, assuming a discount rate of r=9%. (A timeline with a vertical running-total column is required for this problem; you can round to the nearest dollar in your calculations if you want to.) = 6. Your company has just bought out a local competitor. As a member of your company's finance team you've gone in with the accountants to clean out the competitor's old safe. In it, though, you find paperwork regarding some bonds the competitor issued in 1987. It's $8.5 million (face value) worth of zero-coupon bonds. According to a note paper-clipped to the paperwork, the bonds sold for $3,000,000 at the time of issuance. Going online you look up the interest rate for 1987 and found it hovered pretty consistently around 3% that year. The question, then, is this: Are these still active bonds, or have they already matured? 7. To try to penetrate the Central American market, a Canadian beverage company is considering building a new bottling facility in Costa Rica. A team from the company's purchasing department has estimated that an old factory there can be retrofitted to serve the company's purpose, and doing so should only cost about 1.1 million. The company is going to start by assuming only a five-year life for the project, and assuming steady profits of $285,000/year theyre wondering how long it will take them to recoup their investment? (A timeline is optional for this problem.) 8. Consider the same Canadian beverage company contemplating the Costa Rican venture. Use the same information, but this time calculate the precise discounted payback period, assuming a discount rate of r=9%. (A timeline with a vertical running-total column is required for this problem; you can round to the nearest dollar in your calculations if you want to.) = 6. Your company has just bought out a local competitor. As a member of your company's finance team you've gone in with the accountants to clean out the competitor's old safe. In it, though, you find paperwork regarding some bonds the competitor issued in 1987. It's $8.5 million (face value) worth of zero-coupon bonds. According to a note paper-clipped to the paperwork, the bonds sold for $3,000,000 at the time of issuance. Going online you look up the interest rate for 1987 and found it hovered pretty consistently around 3% that year. The question, then, is this: Are these still active bonds, or have they already matured

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started