Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 4, 2020, the company secretary for Reggae Vibes Limited sent out notices to the shareholders of the company advising of the annual

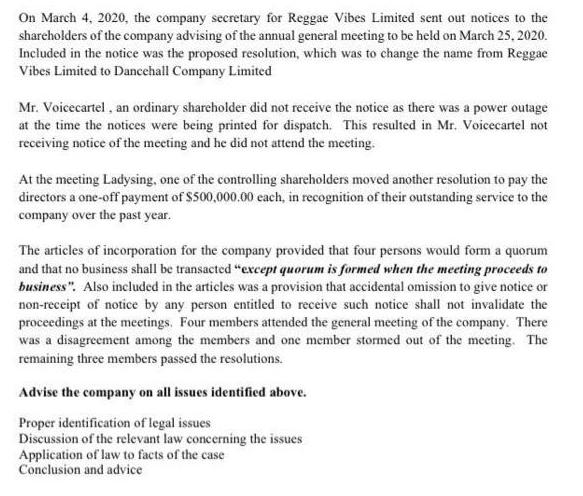

On March 4, 2020, the company secretary for Reggae Vibes Limited sent out notices to the shareholders of the company advising of the annual general meeting to be held on March 25, 2020. Included in the notice was the proposed resolution, which was to change the name from Reggae Vibes Limited to Dancehall Company Limited Mr. Voicecartel, an ordinary sharcholder did not receive the notice as there was a power outage at the time the notices were being printed for dispatch. This resulted in Mr. Voicecartel not receiving notice of the meeting and he did not attend the meeting. At the meeting Ladysing, one of the controlling shareholders moved another resolution to pay the directors a one-off payment of $500,000.00 each, in recognition of their outstanding service to the company over the past year. The articles of incorporation for the company provided that four persons would form a quorum and that no business shall be transacted "except quorum is formed when the meeting proceeds to business". Also included in the articles was a provision that accidental omission to give notice or non-receipt of notice by any person entitled to receive such notice shall not invalidate the proceedings at the meetings. Four members attended the general meeting of the company. There was a disagreement among the members and one member stormed out of the meeting. The remaining three members passed the resolutions. Advise the company on all issues identified above. Proper identification of legal issues Discussion of the relevant law concerning the issues Application of law to facts of the case Conclusion and advice

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The issues identified here are The need to change the name from Reggae Vibes LTD to Dancehall Compan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started