Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in detial for question #5 if possible please include codification for references. Thanks very much Case analysis Philadelphia Management Systems, Inc. (hereinafter Philly)

Please answer in detial for question #5 if possible please include codification for references. Thanks very much

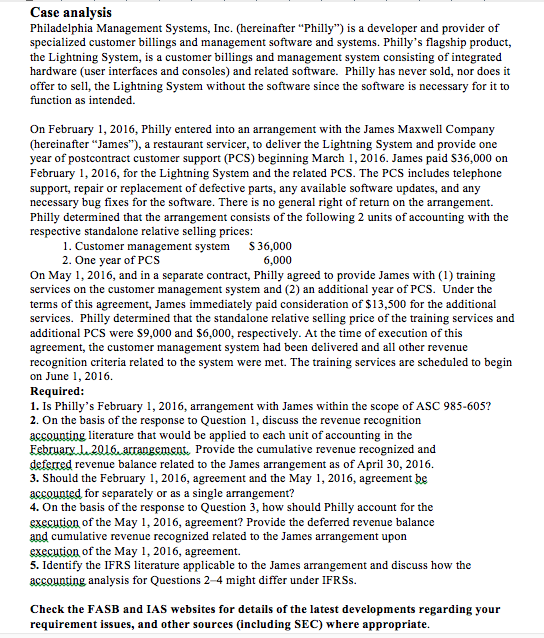

Case analysis Philadelphia Management Systems, Inc. (hereinafter "Philly") is a developer and provider of specialized customer billings and management software and systems. Philly's flagship product, the Lightning System, is a customer billings and management system consisting of integrated hardware (user interfaces and consoles) and related software. Philly has never sold, nor does it offer to sell, the Lightning System without the software since the software is necessary for it to function as intended. On February 1, 2016, Philly entered into an arrangement with the James Maxwell Company (hereinafter "James"), a restaurant servicer, to deliver the Lightning System and provide one year of postcontract customer support (PCS) beginning March 1, 2016. James paid $36,000 on February 1, 2016, for the Lightning System and the related PCS. The PCS includes telephone support, repair or replacement of defective parts, any available software updates, and any necessary bug fixes for the software. There is no general right of return on the arrangement. Philly determined that the arrangement consists of the following 2 units of accounting with the respective standalone relative selling prices: Customer management system $ 36,000 One year of PCS 6,000 On May 1, 2016, and in a separate contract, Philly agreed to provide James with training services on the customer management system and an additional year of PCS. Under the terms of this agreement, James immediately paid consideration of $13, 500 for the additional services. Philly determined that the standalone relative selling price of the training services and additional PCS were $9,000 and $6,000, respectively. At the time of execution of this agreement, the customer management system had been delivered and all other revenue recognition criteria related to the system were met. The training services are scheduled to begin on June 1, 2016. Is Philly's February 1, 2016, arrangement with James within the scope of ASC 985-605? On the basis of the response to Question 1, discuss the revenue recognition accounting literature that would be applied to each unit of accounting in the February 1, 2016, arrangement. Provide the cumulative revenue recognized and deferred revenue balance related to the James arrangement as of April 30, 2016. Should the February 1, 2016, agreement and the May 1, 2016, agreement be accounted for separately or as a single arrangement? On the basis of the response to Question 3, how should Philly account for the execution of the May 1, 2016, agreement? Provide the deferred revenue balance and cumulative revenue recognized related to the James arrangement upon execution of the May 1, 2016, agreement. Identify the IFRS literature applicable to the James arrangement and discuss how the accounting analysis for Questions 2-4 might differ under IFRSsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started