please answer in full

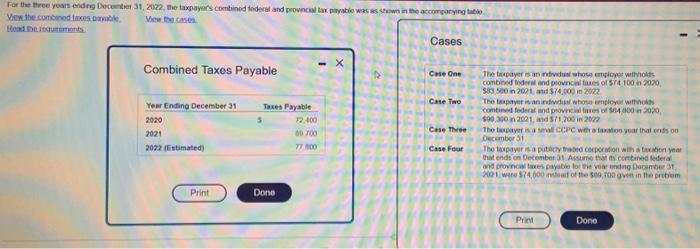

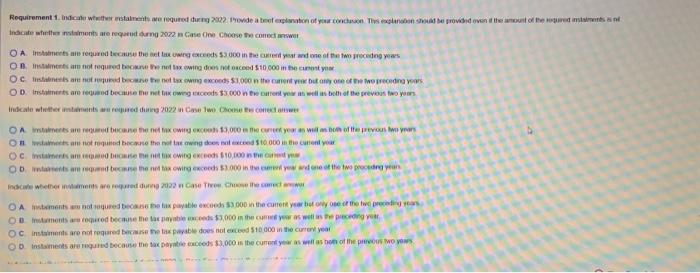

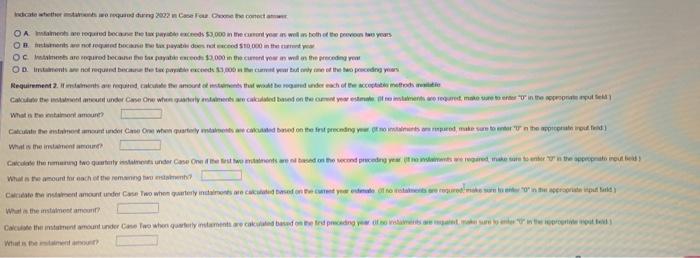

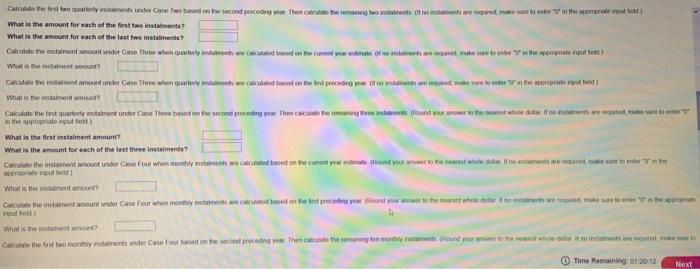

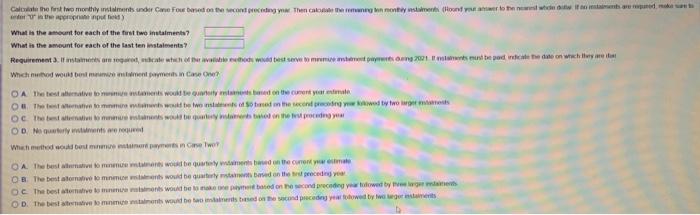

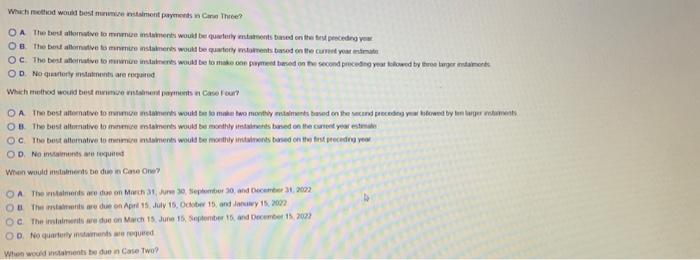

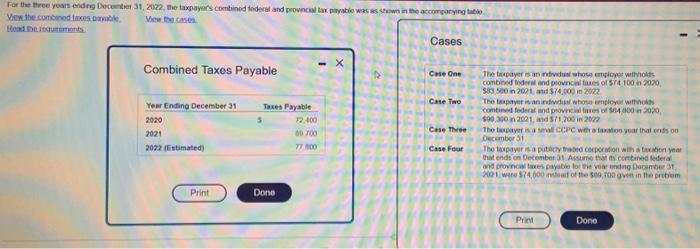

c. instainente are not requared beicarare the tax porable does not exceod 510000 in the currer year What is twe intariont amoune? What is the irviairnot arouing? What is the instameot arpour? Nhat is the rotainvid aryour? What is the amount for nach of the first two inatalments? What is the ansount for each of the last two indalments? What 15 the inshaliapt wrount? Whint in the imulrient ament? in the appopraile irput taid) What is the first instaiment amount? What is the a mocent for each of the last theee instalments? What is the entienteit anourt? incut lioid. What is tee materinit arrour? What is the ascount for each of the first foo instaimenits? What is the amount for each of the last ten isstaienente? When exitted nocid best mramie natanaif payments n care I twor D. No queater'y inshumento are coquired D. No inclawents are requeed When would msindrierts to dim in Case orve? D. fov quarteriy instamants are ragueced Whas woud onsharnents tw dae in Case Two? A. Ithe instalrunts are due en March t5, Junn 15 , Sopsomber is, and Docenber 15,2072 . D. The instalmevits ade due on Marci 31, date 30,5 epomber 30 , and Docember 31,2522 . When wend motaiments be doe in Cose Theo? B. The insinisents are due on March. 15 , Juen is, Seitember 15 and Decenber 15,2002 . C. The intiniments ave due on Apet 15, day 15 , October 15 , and dernary 15 , 20\%2. D. No guarterly ifstarnents are fogured When would instairents be die in Cavw Four? A. The instaments would be due on that tast day of each month, begroang in tamayy 2002 8. The instalments would be due on the 15 th day of each mond tegrumg in amany 208c c. The instalinents would be due of the last diy at each month, beginning in Afre zeop? D. The instainents would be dos cn that 150 dry d eachimsonts. begining in Aond 202 , Vex the sunconod taxes dumble. Vere frocasen. Peat fie iedurements: Cases Combined Taxes Payable sinsinn200L, and 374,600 in 2002 500.250n2col, and 571,200in2002 Case thoe Tho tewpayer is a senal ccepc wefr a fasation year that enss on December 31 Case Fear. The tavpayer s a putioy tiasid cerporation with a taxiben yeat that ende on Decenter ot Assime thar as contined feteral c. instainente are not requared beicarare the tax porable does not exceod 510000 in the currer year What is twe intariont amoune? What is the irviairnot arouing? What is the instameot arpour? Nhat is the rotainvid aryour? What is the amount for nach of the first two inatalments? What is the ansount for each of the last two indalments? What 15 the inshaliapt wrount? Whint in the imulrient ament? in the appopraile irput taid) What is the first instaiment amount? What is the a mocent for each of the last theee instalments? What is the entienteit anourt? incut lioid. What is tee materinit arrour? What is the ascount for each of the first foo instaimenits? What is the amount for each of the last ten isstaienente? When exitted nocid best mramie natanaif payments n care I twor D. No queater'y inshumento are coquired D. No inclawents are requeed When would msindrierts to dim in Case orve? D. fov quarteriy instamants are ragueced Whas woud onsharnents tw dae in Case Two? A. Ithe instalrunts are due en March t5, Junn 15 , Sopsomber is, and Docenber 15,2072 . D. The instalmevits ade due on Marci 31, date 30,5 epomber 30 , and Docember 31,2522 . When wend motaiments be doe in Cose Theo? B. The insinisents are due on March. 15 , Juen is, Seitember 15 and Decenber 15,2002 . C. The intiniments ave due on Apet 15, day 15 , October 15 , and dernary 15 , 20\%2. D. No guarterly ifstarnents are fogured When would instairents be die in Cavw Four? A. The instaments would be due on that tast day of each month, begroang in tamayy 2002 8. The instalments would be due on the 15 th day of each mond tegrumg in amany 208c c. The instalinents would be due of the last diy at each month, beginning in Afre zeop? D. The instainents would be dos cn that 150 dry d eachimsonts. begining in Aond 202 , Vex the sunconod taxes dumble. Vere frocasen. Peat fie iedurements: Cases Combined Taxes Payable sinsinn200L, and 374,600 in 2002 500.250n2col, and 571,200in2002 Case thoe Tho tewpayer is a senal ccepc wefr a fasation year that enss on December 31 Case Fear. The tavpayer s a putioy tiasid cerporation with a taxiben yeat that ende on Decenter ot Assime thar as contined feteral

please answer in full

please answer in full