Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in full complete and detailed steps. Exercise 5.11. Consider a single-period economy with three states j,j=1,2,3 and three base assets, a zero-coupon bond

Please answer in full complete and detailed steps.

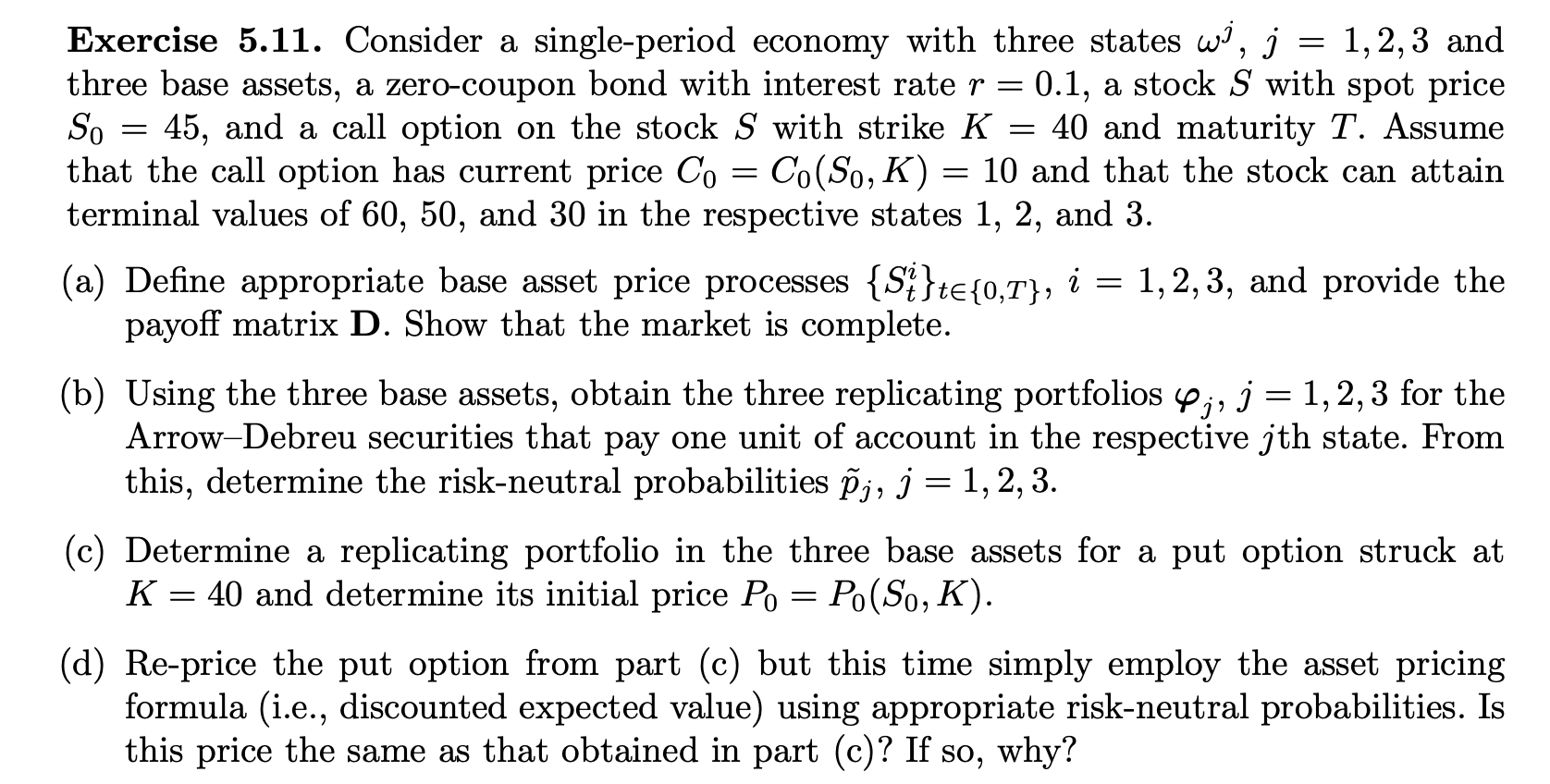

Exercise 5.11. Consider a single-period economy with three states j,j=1,2,3 and three base assets, a zero-coupon bond with interest rate r=0.1, a stock S with spot price S0=45, and a call option on the stock S with strike K=40 and maturity T. Assume that the call option has current price C0=C0(S0,K)=10 and that the stock can attain terminal values of 60,50 , and 30 in the respective states 1,2 , and 3 . (a) Define appropriate base asset price processes {Sti}t{0,T},i=1,2,3, and provide the payoff matrix D. Show that the market is complete. (b) Using the three base assets, obtain the three replicating portfolios j,j=1,2,3 for the Arrow-Debreu securities that pay one unit of account in the respective j th state. From this, determine the risk-neutral probabilities p~j,j=1,2,3. (c) Determine a replicating portfolio in the three base assets for a put option struck at K=40 and determine its initial price P0=P0(S0,K). (d) Re-price the put option from part (c) but this time simply employ the asset pricing formula (i.e., discounted expected value) using appropriate risk-neutral probabilities. Is this price the same as that obtained in part (c)? If so, whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started