Please answer in memo format with rules and regulations in correct format too

Please answer in memo format with rules and regulations in correct format too

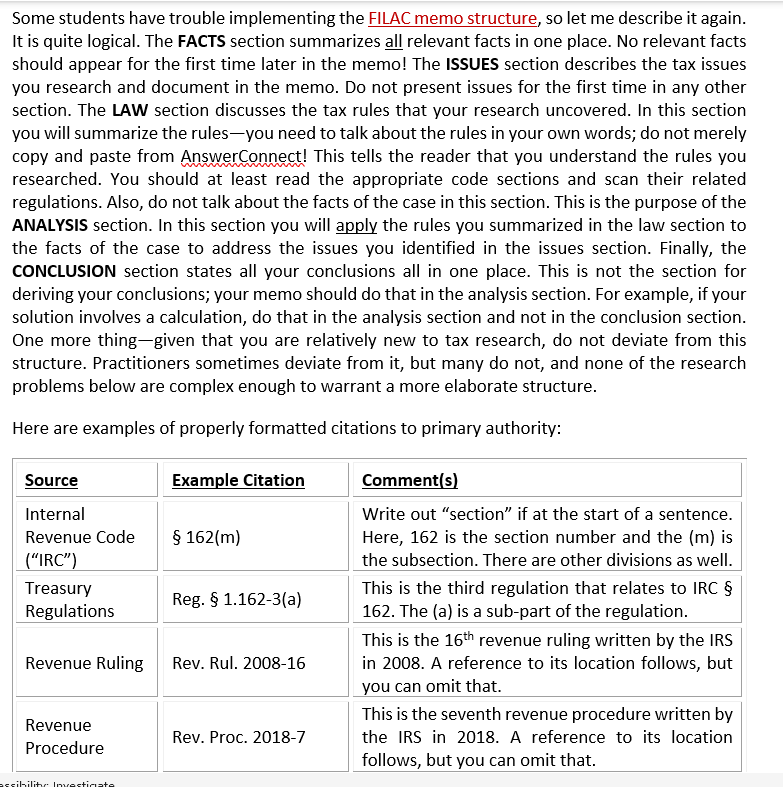

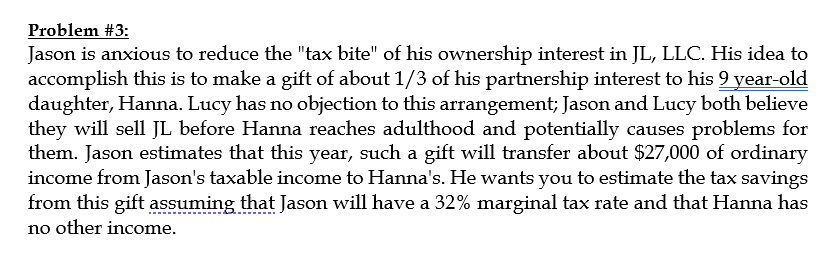

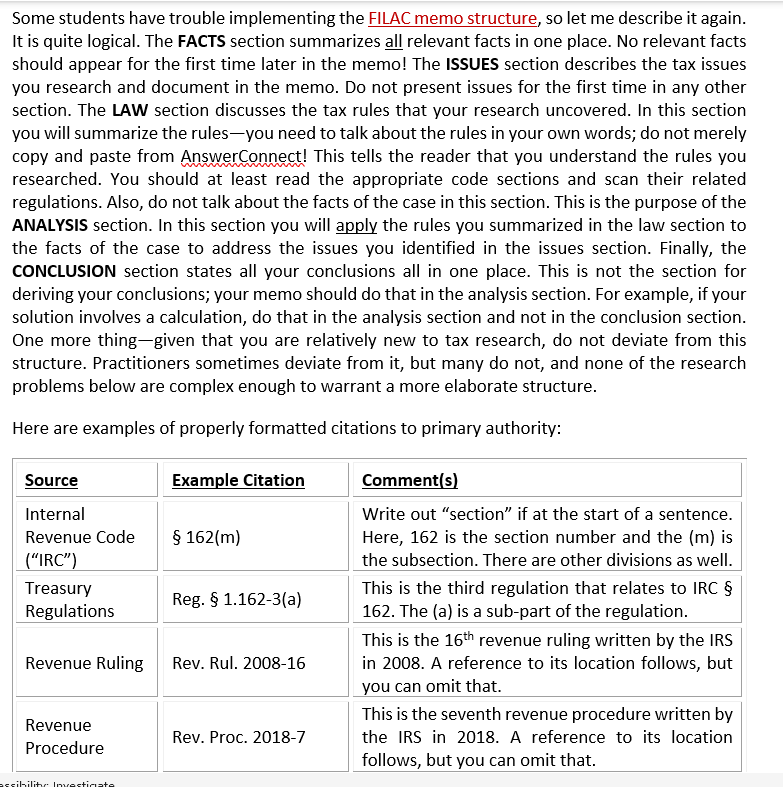

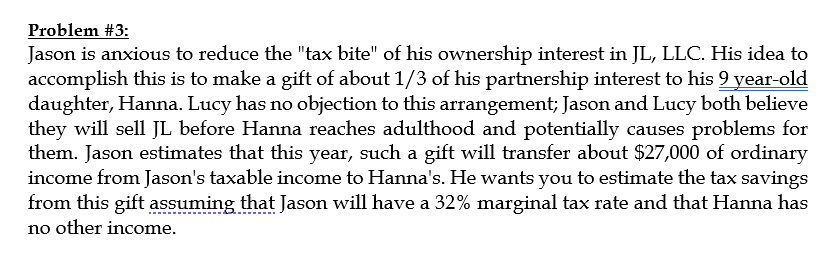

Some students have trouble implementing the FILAC memo structure, so let me describe it again. It is quite logical. The FACTS section summarizes all relevant facts in one place. No relevant facts should appear for the first time later in the memo! The ISSUES section describes the tax issues you research and document in the memo. Do not present issues for the first time in any other section. The LAW section discusses the tax rules that your research uncovered. In this section you will summarize the rules-you need to talk about the rules in your own words; do not merely copy and paste from Answerconnect! This tells the reader that you understand the rules you researched. You should at least read the appropriate code sections and scan their related regulations. Also, do not talk about the facts of the case in this section. This is the purpose of the ANALYSIS section. In this section you will apply the rules you summarized in the law section to the facts of the case to address the issues you identified in the issues section. Finally, the CONCLUSION section states all your conclusions all in one place. This is not the section for deriving your conclusions; your memo should do that in the analysis section. For example, if your solution involves a calculation, do that in the analysis section and not in the conclusion section. One more thing-given that you are relatively new to tax research, do not deviate from this structure. Practitioners sometimes deviate from it, but many do not, and none of the research problems below are complex enough to warrant a more elaborate structure. Problem \#3: Jason is anxious to reduce the "tax bite" of his ownership interest in JL, LLC. His idea to accomplish this is to make a gift of about 1/3 of his partnership interest to his 9year-old daughter, Hanna. Lucy has no objection to this arrangement; Jason and Lucy both believe they will sell JL before Hanna reaches adulthood and potentially causes problems for them. Jason estimates that this year, such a gift will transfer about $27,000 of ordinary income from Jason's taxable income to Hanna's. He wants you to estimate the tax savings from this gift assuming that Jason will have a 32% marginal tax rate and that Hanna has no other income

Please answer in memo format with rules and regulations in correct format too

Please answer in memo format with rules and regulations in correct format too