Please answer in the below format.

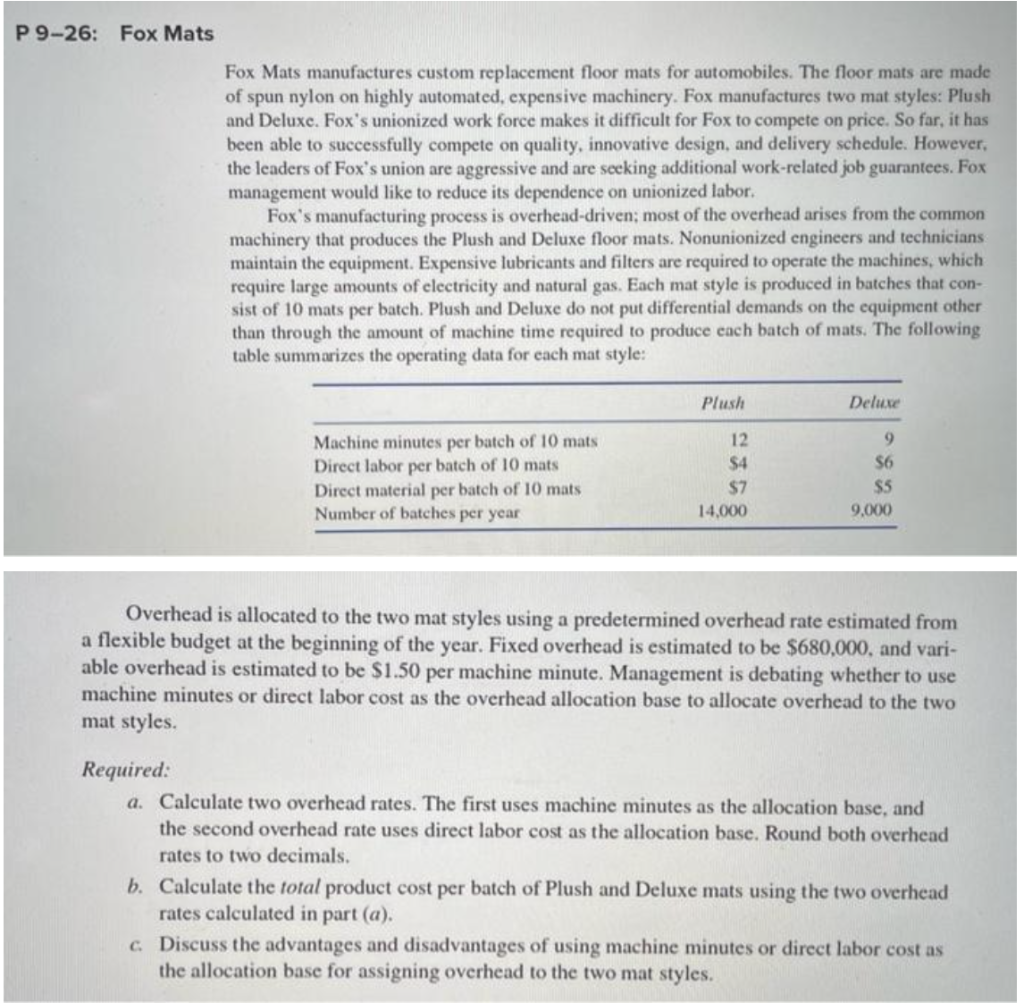

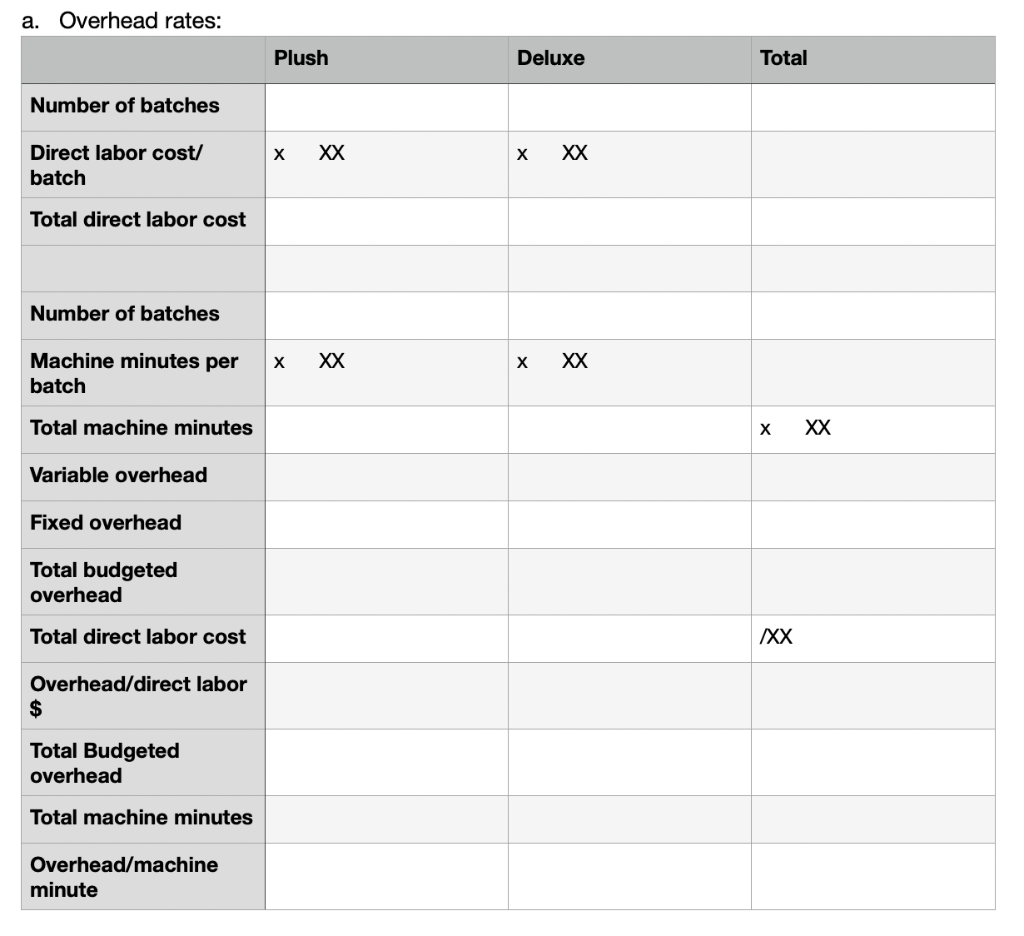

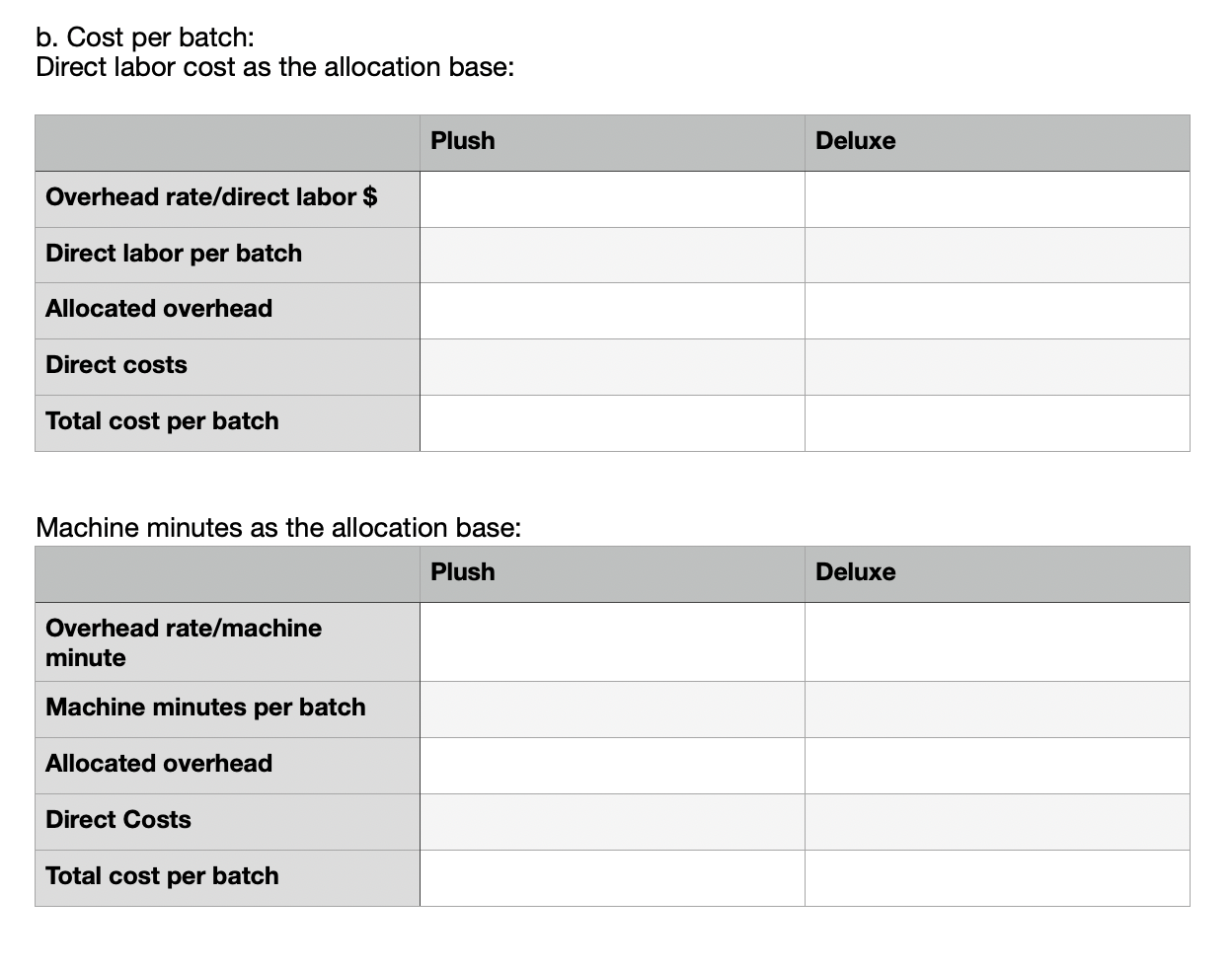

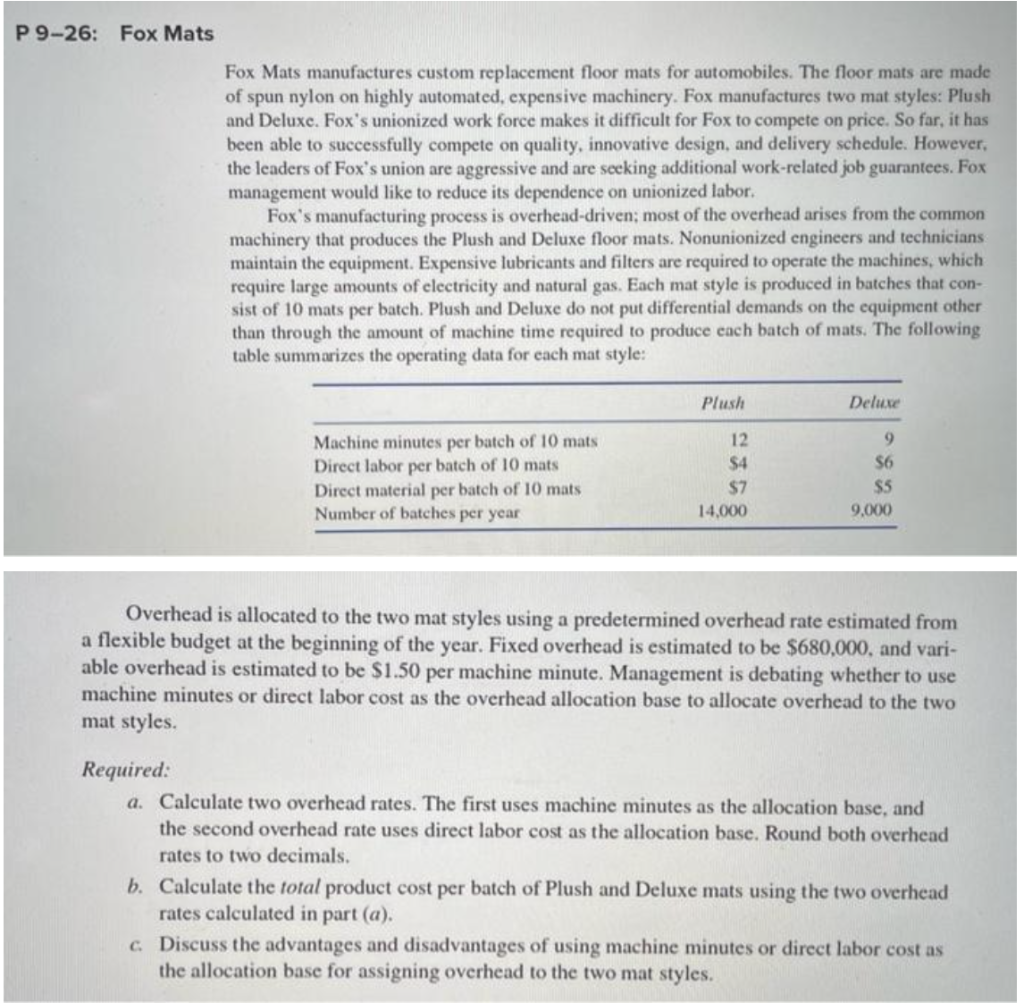

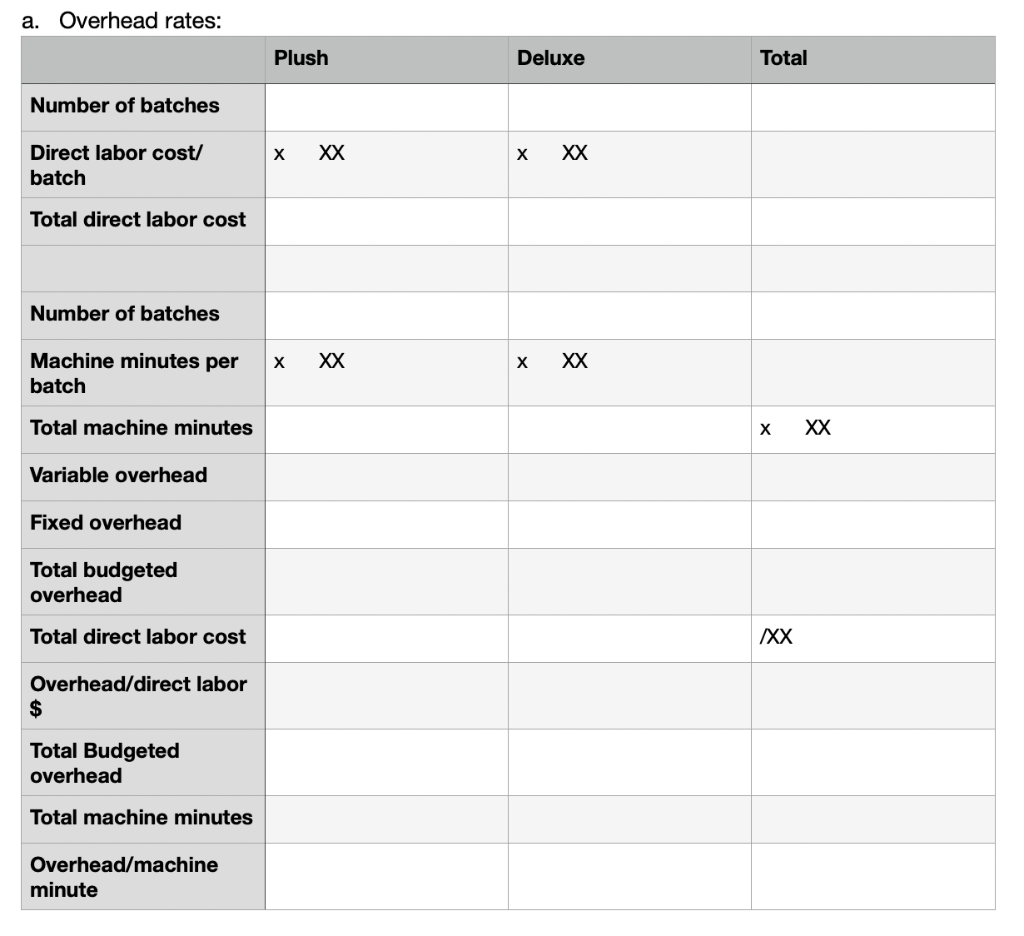

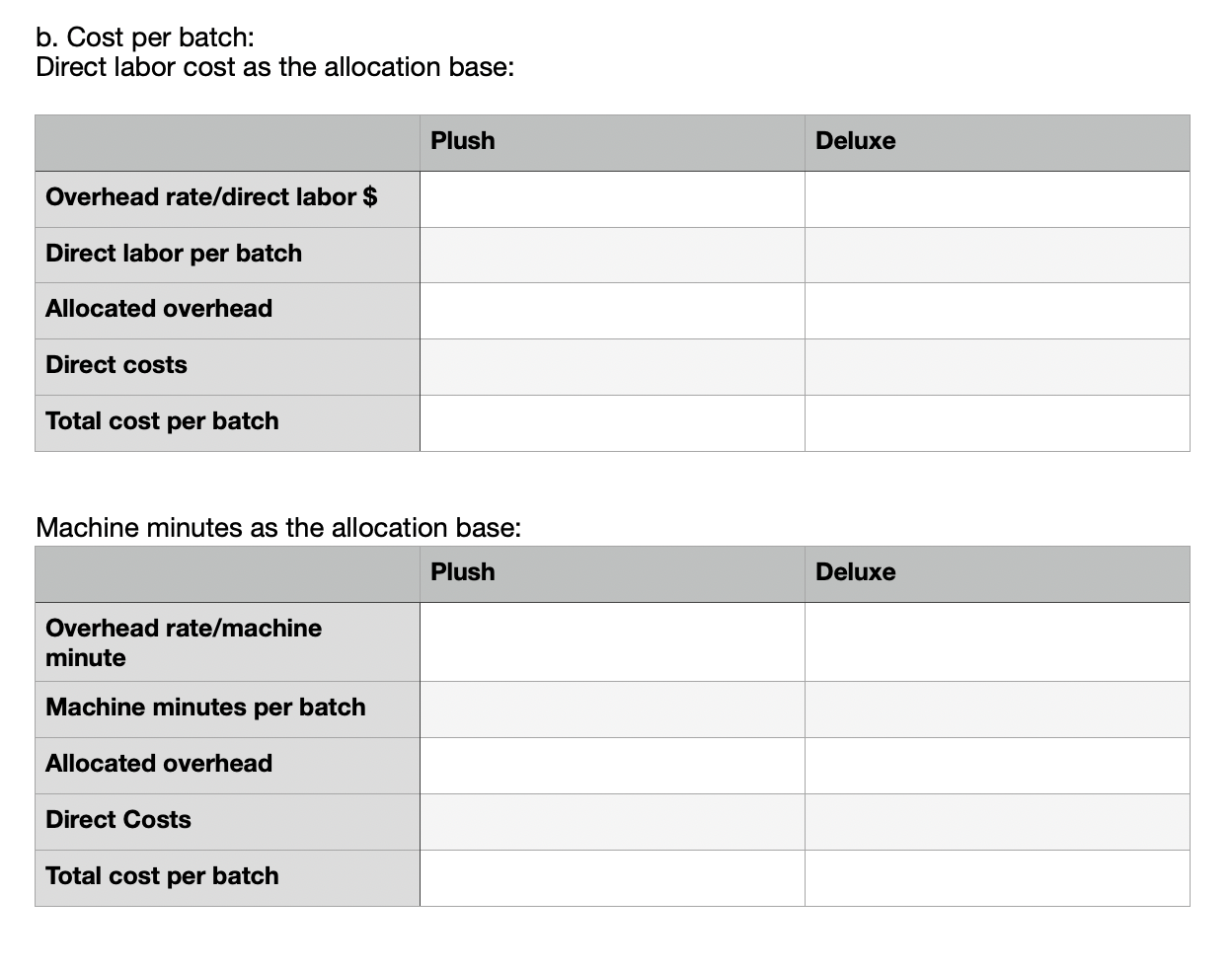

P 9-26: Fox Mats Fox Mats manufactures custom replacement floor mats for automobiles. The floor mats are made of spun nylon on highly automated, expensive machinery. Fox manufactures two mat styles: Plush and Deluxe. Fox's unionized work force makes it difficult for Fox to compete on price. So far, it has been able to successfully compete on quality, innovative design, and delivery schedule. However, the leaders of Fox's union are aggressive and are seeking additional work-related job guarantees. Fox management would like to reduce its dependence on unionized labor. Fox's manufacturing process is overhead-driven; most of the overhead arises from the common machinery that produces the Plush and Deluxe floor mats. Nonunionized engineers and technicians maintain the equipment. Expensive lubricants and filters are required to operate the machines, which require large amounts of electricity and natural gas. Each mat style is produced in batches that consist of 10 mats per batch. Plush and Deluxe do not put differential demands on the equipment other than through the amount of machine time required to produce each batch of mats. The following table summarizes the operating data for each mat style: Overhead is allocated to the two mat styles using a predetermined overhead rate estimated from a flexible budget at the beginning of the year. Fixed overhead is estimated to be $680,000, and variable overhead is estimated to be $1.50 per machine minute. Management is debating whether to use machine minutes or direct labor cost as the overhead allocation base to allocate overhead to the two mat styles. Required: a. Calculate two overhead rates. The first uses machine minutes as the allocation base, and the second overhead rate uses direct labor cost as the allocation base. Round both overhead rates to two decimals. b. Calculate the total product cost per batch of Plush and Deluxe mats using the two overhead rates calculated in part (a). c. Discuss the advantages and disadvantages of using machine minutes or direct labor cost as the allocation base for assigning overhead to the two mat styles. i b. Cost per batch: Direct labor cost as the allocation base: Machine minutes as the allocation base: P 9-26: Fox Mats Fox Mats manufactures custom replacement floor mats for automobiles. The floor mats are made of spun nylon on highly automated, expensive machinery. Fox manufactures two mat styles: Plush and Deluxe. Fox's unionized work force makes it difficult for Fox to compete on price. So far, it has been able to successfully compete on quality, innovative design, and delivery schedule. However, the leaders of Fox's union are aggressive and are seeking additional work-related job guarantees. Fox management would like to reduce its dependence on unionized labor. Fox's manufacturing process is overhead-driven; most of the overhead arises from the common machinery that produces the Plush and Deluxe floor mats. Nonunionized engineers and technicians maintain the equipment. Expensive lubricants and filters are required to operate the machines, which require large amounts of electricity and natural gas. Each mat style is produced in batches that consist of 10 mats per batch. Plush and Deluxe do not put differential demands on the equipment other than through the amount of machine time required to produce each batch of mats. The following table summarizes the operating data for each mat style: Overhead is allocated to the two mat styles using a predetermined overhead rate estimated from a flexible budget at the beginning of the year. Fixed overhead is estimated to be $680,000, and variable overhead is estimated to be $1.50 per machine minute. Management is debating whether to use machine minutes or direct labor cost as the overhead allocation base to allocate overhead to the two mat styles. Required: a. Calculate two overhead rates. The first uses machine minutes as the allocation base, and the second overhead rate uses direct labor cost as the allocation base. Round both overhead rates to two decimals. b. Calculate the total product cost per batch of Plush and Deluxe mats using the two overhead rates calculated in part (a). c. Discuss the advantages and disadvantages of using machine minutes or direct labor cost as the allocation base for assigning overhead to the two mat styles. i b. Cost per batch: Direct labor cost as the allocation base: Machine minutes as the allocation base