Answered step by step

Verified Expert Solution

Question

1 Approved Answer

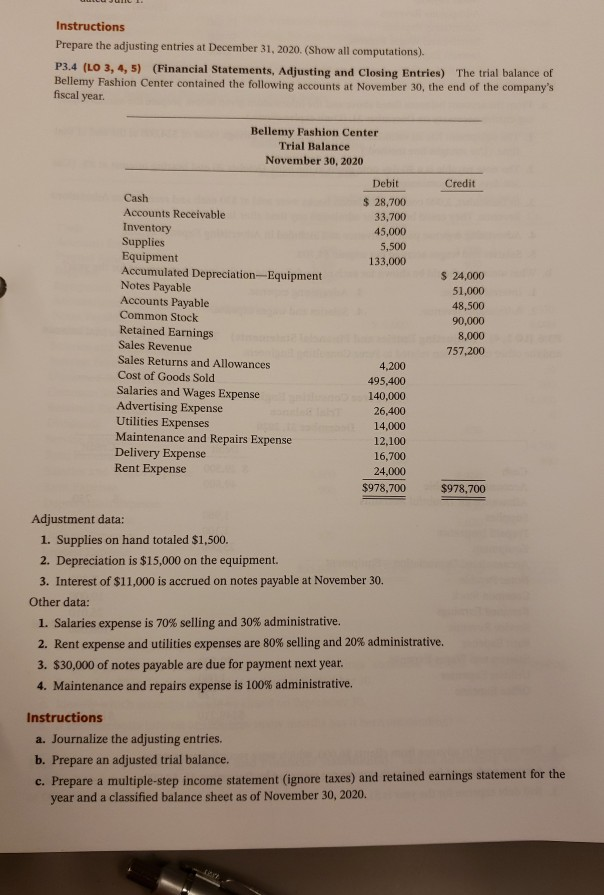

please answer instructions a,b,c,d Instructions Prepare the adjusting entries at December 31, 2020. (Show all computations). P3.4 (LO 3, 4, 5) (Financial Statements, Adjusting and

please answer instructions a,b,c,d

Instructions Prepare the adjusting entries at December 31, 2020. (Show all computations). P3.4 (LO 3, 4, 5) (Financial Statements, Adjusting and Closing Entries) The trial balance of Bellemy Fashion Center contained the following accounts at November 30, the end of the company's fiscal year. Bellemy Fashion Center Trial Balance November 30, 2020 Debit Credit Cash $ 28,700 33,700 Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Common Stock Retained Earnings Sales Revenue Sales Returns and Allowances 45,000 5,500 133,000 S 24,000 51,000 48,500 90,000 8,000 757,200 4,200 Cost of Goods Sold 495,400 Salaries and Wages Expense Advertising Expense Utilities Expenses 140,000 26,400 14,000 Maintenance and Repairs Expense Delivery Expense Rent Expense 12,100 16,700 24,000 $978,700 $978,700 Adjustment data: 1. Supplies on hand totaled $1,500. 2. Depreciation is $15,000 on the equipment. 3. Interest of $11,000 is accrued on notes payable at November 30. Other data: 1. Salaries expense is 70% selling and 30% administrative. 2. Rent expense and utilities expenses are 80% selling and 20% administrative. 3. $30,000 of notes payable are due for payment next year. 4. Maintenance and repairs expense is 100 % administrative. Instructions a. Journalize the adjusting entries. b. Prepare adjusted trial balance. an c. Prepare a multiple-step income statement (ignore taxes) and retained earnings statement for the year and a classified balance sheet as of November 30, 2020. unting Information System d. Journalize the closing entries. Prepare a post-closing trial balance. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started