Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer it carefully not just explanation of how to do it , thankyou Banana plc is examining the possibility of replacing an existing machine

Please answer it carefully not just explanation of how to do it thankyou

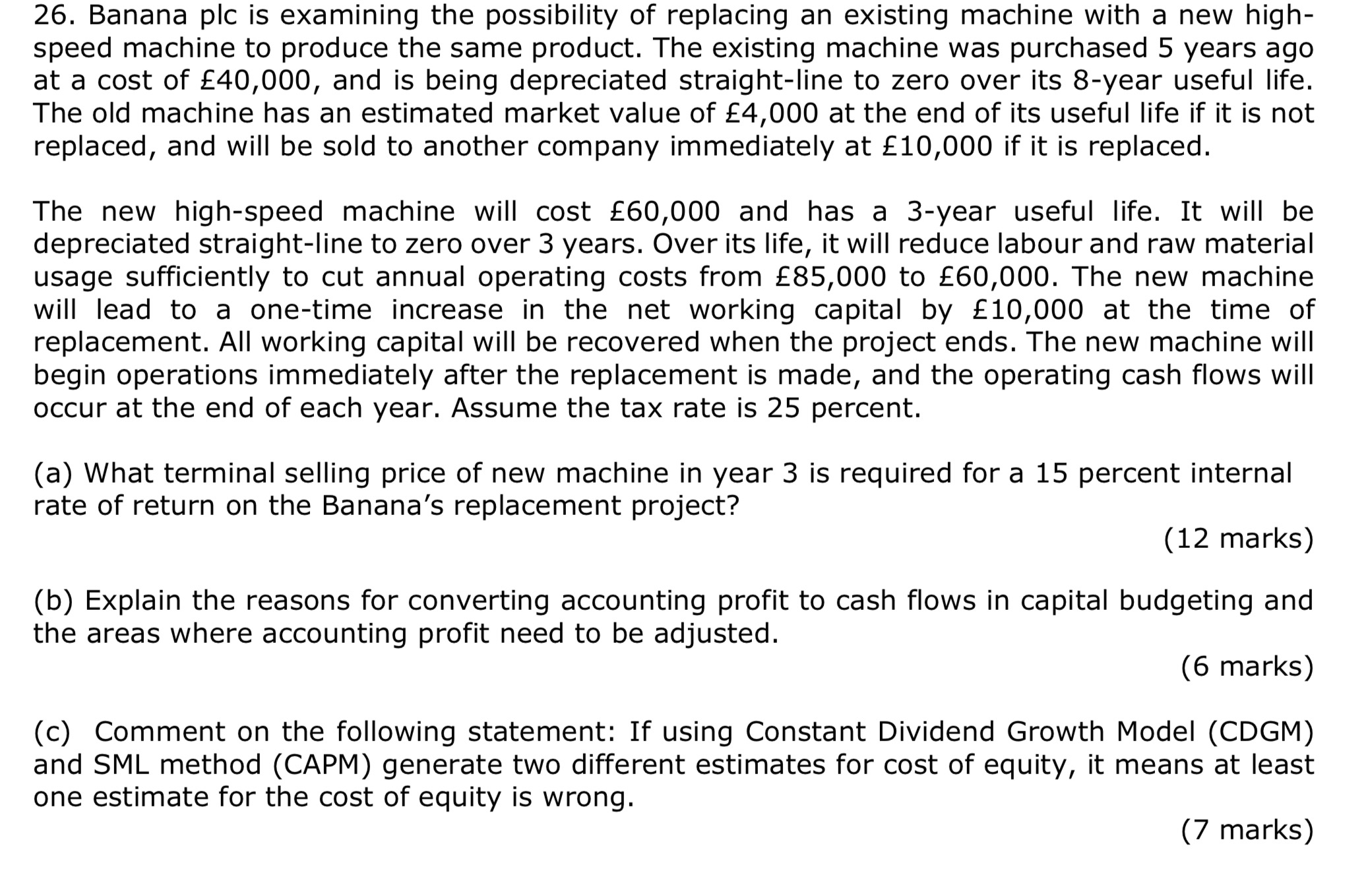

Banana plc is examining the possibility of replacing an existing machine with a new high

speed machine to produce the same product. The existing machine was purchased years ago

at a cost of and is being depreciated straightline to zero over its year useful life.

The old machine has an estimated market value of at the end of its useful life if it is not

replaced, and will be sold to another company immediately at if it is replaced.

The new highspeed machine will cost and has a year useful life. It will be

depreciated straightline to zero over years. Over its life, it will reduce labour and raw material

usage sufficiently to cut annual operating costs from to The new machine

will lead to a onetime increase in the net working capital by at the time of

replacement. All working capital will be recovered when the project ends. The new machine will

begin operations immediately after the replacement is made, and the operating cash flows will

occur at the end of each year. Assume the tax rate is percent.

a What terminal selling price of new machine in year is required for a percent internal

rate of return on the Banana's replacement project?

marks

b Explain the reasons for converting accounting profit to cash flows in capital budgeting and

the areas where accounting profit need to be adjusted.

marks

c Comment on the following statement: If using Constant Dividend Growth Model CDGM

and SML method CAPM generate two different estimates for cost of equity, it means at least

one estimate for the cost of equity is wrong.

marksBanana plc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started