Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer it carefully with proper explanition. The LP company has $ 1 0 million in assets, 8 0 % financed by debt and 2

Please answer it carefully with proper explanition.

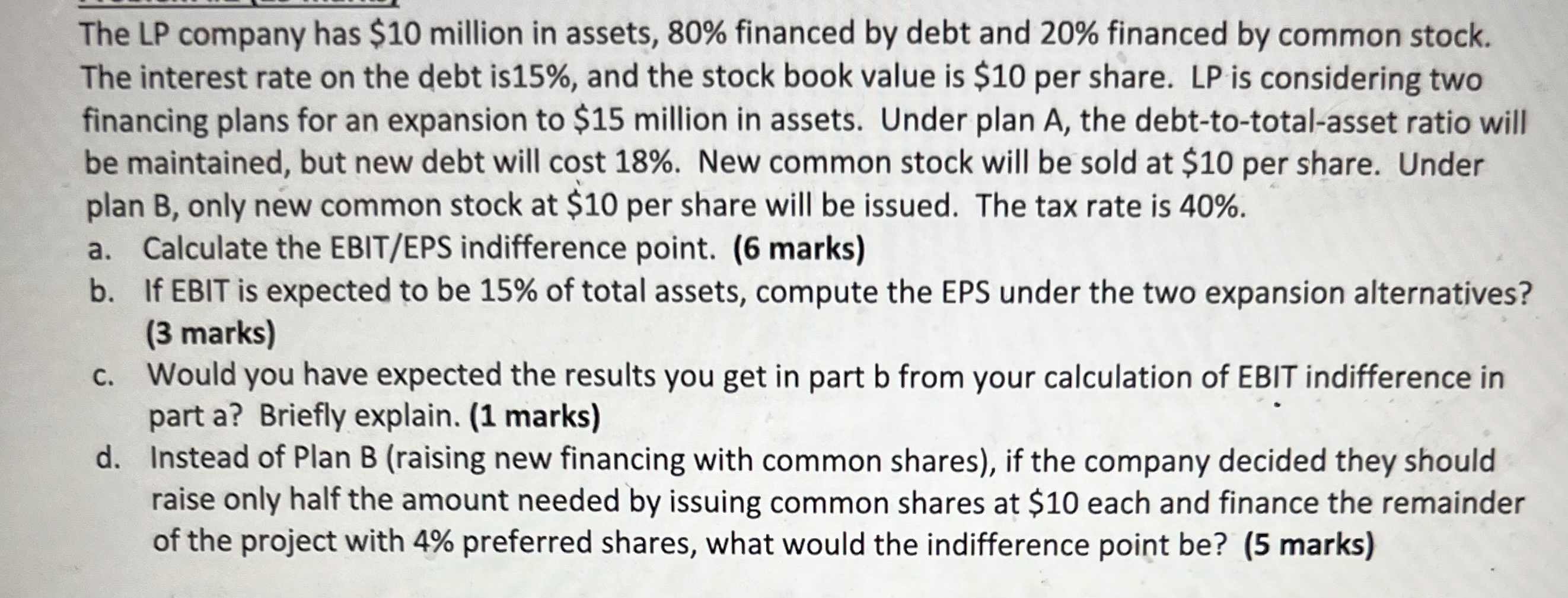

The LP company has $ million in assets, financed by debt and financed by common stock. The interest rate on the debt is and the stock book value is $ per share. LP is considering two financing plans for an expansion to $ million in assets. Under plan A the debttototalasset ratio will be maintained, but new debt will cost New common stock will be sold at $ per share. Under plan B only new common stock at $ per share will be issued. The tax rate is

a Calculate the EBITEPS indifference point.

b If EBIT is expected to be of total assets, compute the EPS under the two expansion alternatives?

c Would you have expected the results you get in part b from your calculation of EBIT indifference in part a Briefly explain.

d Instead of Plan B raising new financing with common shares if the company decided they should raise only half the amount needed by issuing common shares at $ each and finance the remainder of the project with preferred shares, what would the indifference point be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started