please answer it in detail and fast like this

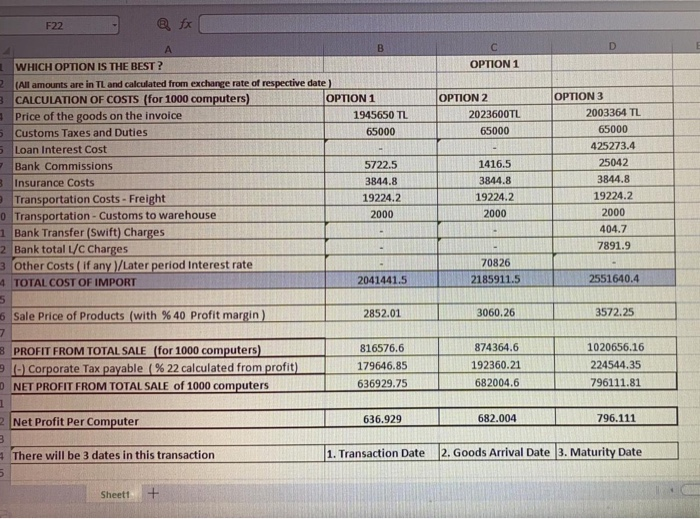

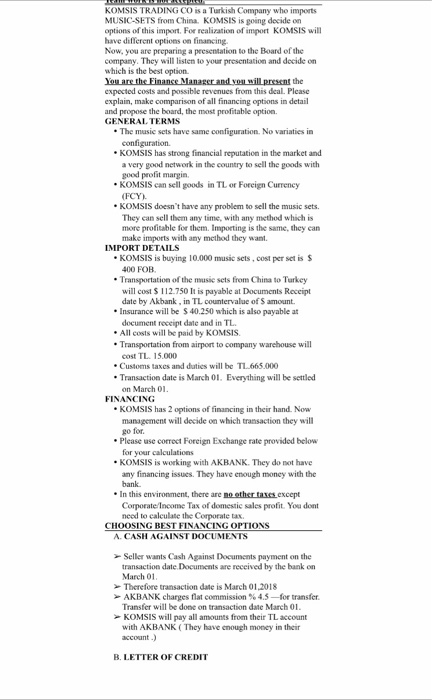

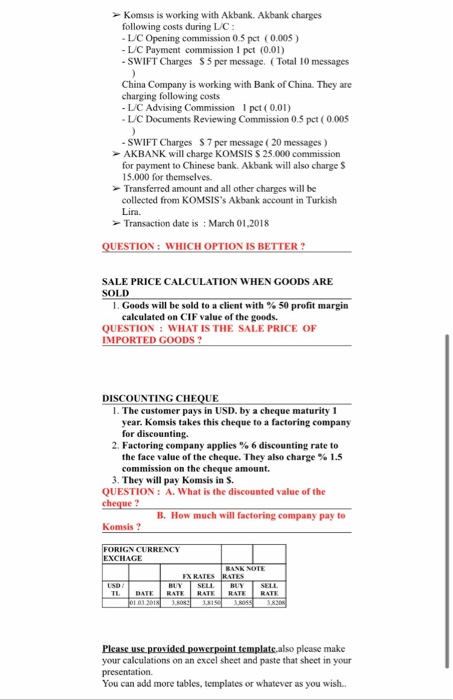

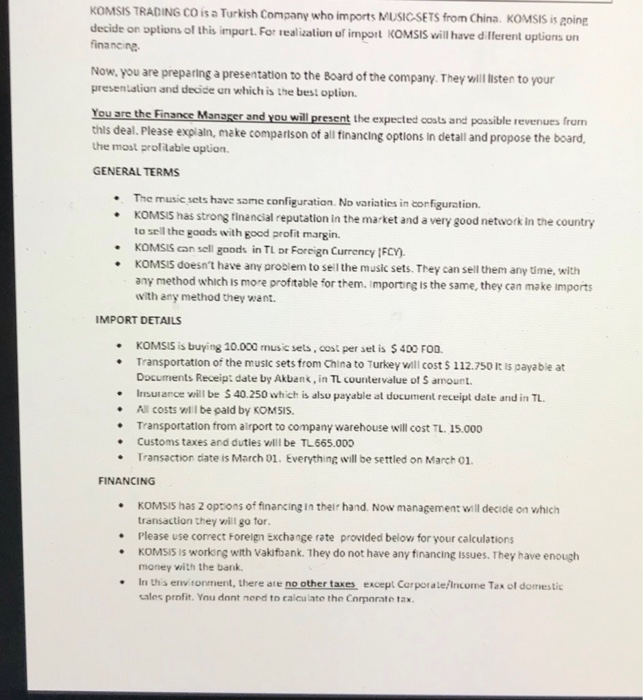

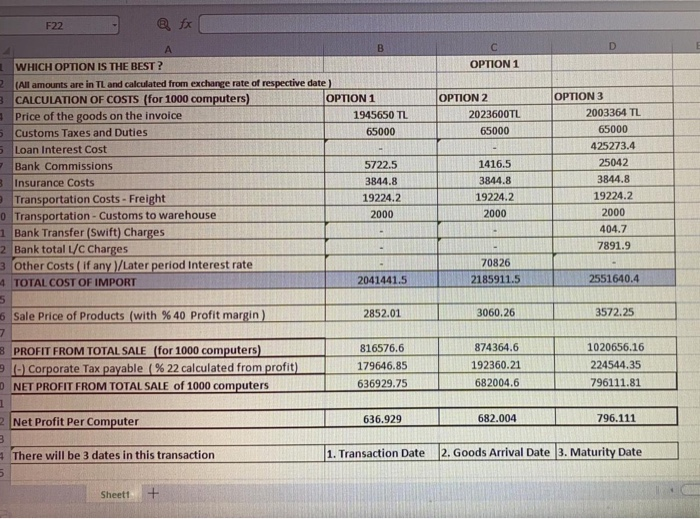

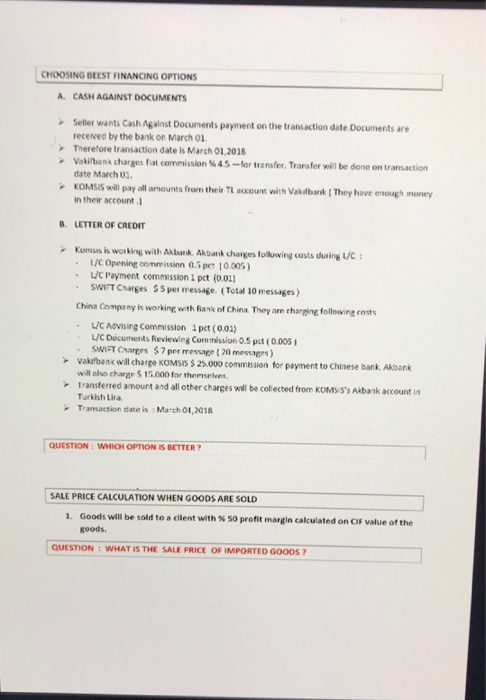

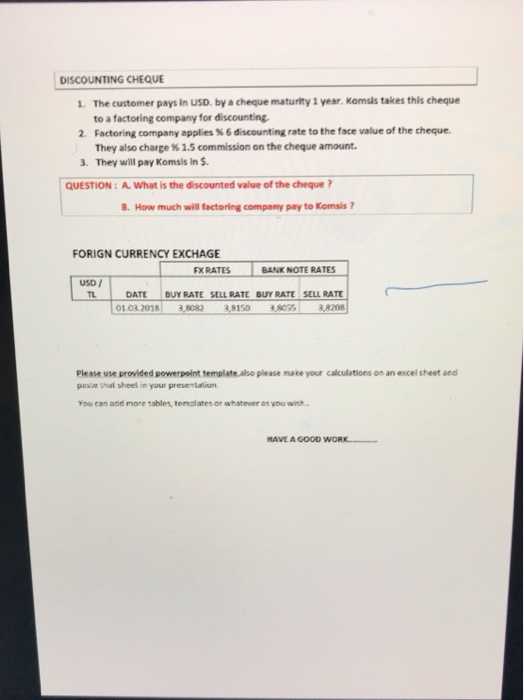

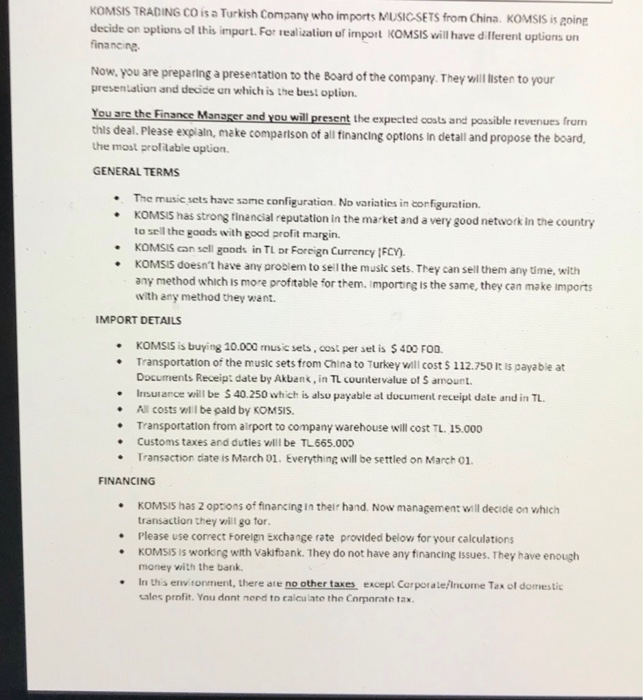

CHOOSING BEEST FINANCING OPTIONS A. CASH AGAINST DOCUMENTS Seller wants Cash Against Documents payment on the transaction date Documents are received by the bank on March 01 Therefore transaction date is March 01,2016 Vakilan charges at commission 45-ler transfer. Transfer will be done on transaction date March 01. KOMSIS will pay all amounts from the Taccount with Vadbank They have enough money in their account ! B. LETTER OF CREDIT Kom is working with Akbank Akbank charges following costs during UC : 1/C Opening commission 0.5 per 10.005) C Payment commission I pet (0.011 SWITCharges $5 per message. (Total 10 messages) China Company is working with Rank of China. They are charging following costs UC Advising Commission pc (0.01) UC Documents Reviewing Commission 0.5 put(0.005 SWIFT Changes $ 7 per message 20 meses) Vakufbank will change KOMSIS $25.000 commission for payment to Chinese bank. Akbank will also charge $15.000 for themselves Transferred amount and all other charges will be collected from KOMSS'S Akbank account in Turkish Lira. Transaction date is : March 01,2018 QUESTION WHICH OPTION IS BETTER? SALE PRICE CALCULATION WHEN GOODS ARE SOLD 1. Goods will be sold to a client with % 50 profit margin calculated on CIF value of the goods. QUESTION: WHAT IS THE SALE PRICE OF IMPORTED GOODS DISCOUNTING CHEQUE 1. The customer pays in USD. by a cheque maturity 1 year. Komsis takes this cheque to a factoring company for discounting 2. Factoring company applies 6 discounting rate to the face value of the cheque. They also charge % 1.5 commission on the cheque amount. 3. They will pay Komsis in 5. QUESTION: A. What is the discounted value of the cheque? B. How much will factoring company pay to komsis? FORIGN CURRENCY EXCHAGE FX RATES BANK NOTE RATES USD / TL DATE BUY RATE SELL RATE BUY RATE SELL RATE 01.03.2018 3,8082 3,8150 3.8055 3.8208 Please use provided powerpoint template.also please make your calculations on an excel sheet and paste that sheel in your presentation You can add more tables, temalates or whatever as you with HAVE A GOOD WORK.. KOMSIS TRADING CO is a Turkish Company who imports MUSIC SETS from China. KOMSIS is going decide on options of this import. For realization of import KOMSIS will have different uptions on financne Now, you are preparing a presentation to the Board of the company. They will listen to your presentation and decide on which is the best option. You are the Finance Manager and you will present the expected costs and possible revenues from this deal. Please explain, make comparison of all financing options in detail and propose the board, the most prolilable uption GENERAL TERMS The music sets have some configuration. No variaties in configuration. KOMSIS has strong financial reputation in the market and a very good network in the country to sell the goods with good profit margin. KOMSIS can sell goods in TL or Foreign Currency IFCY). KOMSIS doesn't have any problem to sell the music sets. They can sell them any time, with any method which is more profitable for them. Importing is the same, they can make imports with any method they want. IMPORT DETAILS KOMSIS is buying 10.000 music sets, cost per set is $ 400 FOD. Transportation of the music sets from China to Turkey will cost $ 112.750 it is payable at Documents Receipt date by Akbank, in TL countervalue of $ amount. Insurance will be $ 40.250 which is also payable al document receipt date and in TL. All costs will be paid by KOMIS. Transportation from alrport to company warehouse will cost TL. 15.000 Customs taxes and duties will be TL 665.000 Transaction date is March 01. Everything will be settled on March 01. FINANCING KOMSIS has 2 options of financing in their hand. Now management will decide on which transaction they will go for. Please use correct Foreign Exchange rate provided below for your calculations KOMSIS is working with Vakifoank. They do not have any financing issues. They have enough money with the bank. In this environment, there are no other taxes except Corporate/Income Tax of domestic sales profit. You dont need to calculate the Corporate tax. F22 @ fx | OPTION 1 OPTION 2 2023600TL 65000 WHICH OPTION IS THE BEST? (All amounts are in TL and calculated from exchange rate of respective date) CALCULATION OF COSTS (for 1000 computers) OPTION 1 Price of the goods on the invoice 1945650 TL Customs Taxes and Duties 65000 Loan Interest Cost Bank Commissions 5722.5 Insurance Costs 3844.8 Transportation Costs - Freight 19224.2 Transportation - Customs to warehouse 2000 Bank Transfer (Swift) Charges Bank total L/C Charges 3 Other Costs (if any)/Later period interest rate 4 TOTAL COST OF IMPORT 2041441.5 1416.5 3844.8 19224.2 2000 OPTION 3 2003364 TL 65000 425273.4 25042 3844.8 19224.2 2000 404.7 7891.9 70826 2185911.5 2551640.4 6 Sale Price of Products (with % 40 Profit margin). 2852.01 3060.26 3572.25 B PROFIT FROM TOTAL SALE (for 1000 computers) Corporate Tax payable (% 22 calculated from profit) NET PROFIT FROM TOTAL SALE of 1000 computers _ 816576.6 179646.85 636929.75 874364.6 192360.21 682004.6 1020656.16 224544.35 796111.81 2 Net Profit Per Computer 636.929 6 82.004 796.111 There will be 3 dates in this transaction 1. Transaction Date 2. Goods Arrival Date 3. Maturity Date Sheet + KOMSIS TRADING CO is a Turkish Company who imports MUSIC-SETS from China. KOMSIS is going decide on options of this import. For realization of import KOMSIS will have different options on financing. Now, you are preparing a presentation to the Board of the company. They will listen to your presentation and decide on which is the best option You are the Finance Manager and you will present the expected costs and possible revenues from this deal. Please explain, make comparison of all financing options in detail and propose the board, the most profitable option GENERAL TERMS The music sets have same configuration. No variaties in configuration KOMSIS has strong financial reputation in the market and a very good network in the country to sell the poods with goed profit margin KOMSIS can sell poods in TL or Foreign Currency (FCY KOMSIS doesn't have any problem to sell the music sets. They can sell them any time, with any method which is more profitable for them. Importing is the same, they can make imports with any method they want. IMPORT DETAILS KOMSIS is buying 10.000 music sets, cost per set is $ 400 FOR Transportation of the music sets from China to Turkey will cost $112.750 It is payable at Documents Receipt date by Akbank, in TL countervalue of S amount. Insurance will be $ 40.250 which is also payable at document receipt date and in TL All costs will be paid by KOMSIS Transportation from airport to company warehouse will cost TL 15.000 Customs taxes and duties will be T1.665.000 Transaction date is March 01. Everything will be settled on March 01. FINANCING KOMSIS has 2 options of financing in their hand. Now management will decide on which transaction they will go for Please use correct Foreign Exchange rate provided below for your calculations KOMSIS is working with AKBANK. They do not have any financing issues. They have enough money with the bank In this environment, there are no other tax except Corporate Income Tax of domestic sales profit. You dont need to calculate the Corporate tax CHOOSING BEST FINANCING OPTIONS A. CASH AGAINST DOCUMENTS Seller wants Cash Against Documents payment on the transaction date Documents are received by the bank on March 01 > Therefore transaction date is March 01.2018 > AKBANK charges flat commission % 4.5 for transfer Transfer will be done on transaction date March 01. > KOMSIS will pay all amounts from their TL account with AKBANK They have enough money in their account.) B. LETTER OF CREDIT Komsis is working with Akbank. Akbank charges following costs during LC: - LIC Opening commission 0.5 pct (0.005) - L/C Payment commission 1 pct (0.01) - SWIFT Charges S5 per message. (Total 10 messages China Company is working with Bank of China. They are charging following costs -LC Advising Commission I pct (0.01) - L/C Documents Reviewing Commission 0.5 pct (0.005 - SWIFT Charges S 7 per message ( 20 messages) > AKBANK will charge KOMSIS S 25.000 commission for payment to Chinese bank. Akbank will also charges 15.000 for themselves. Transferred amount and all other charges will be collected from KOMSIS's Akbank account in Turkish Lira Transaction date is : March 01,2018 QUESTION: WHICH OPTION IS BETTER? SALE PRICE CALCULATION WHEN GOODS ARE SOLD 1. Goods will be sold to a client with % 50 profit margin calculated on CIF value of the goods. QUESTION : WHAT IS THE SALE PRICE OF IMPORTED GOODS? DISCOUNTING CHEQUE 1. The customer pays in USD. by a cheque maturity 1 year. Komsis takes this cheque to a factoring company for discounting. 2. Factoring company applies % 6 discounting rate to the face value of the cheque. They also charge % 1.5 commission on the cheque amount. 3. They will pay Komsis in S. QUESTION: A. What is the discounted value of the cheque? B. How much will factoring company pay to Komsis? FORIGN CURRENCY EXCHAGE BANK MOTE FX RATES RATES 01.03.2018 RATE RATE 3.082 BISE ROS RATE 3.30 Please use provided powerpoint template.also please make your calculations on an excel sheet and paste that sheet in your presentation. You can add more tables, templates or whatever as you wish.. CHOOSING BEEST FINANCING OPTIONS A. CASH AGAINST DOCUMENTS Seller wants Cash Against Documents payment on the transaction date Documents are received by the bank on March 01 Therefore transaction date is March 01,2016 Vakilan charges at commission 45-ler transfer. Transfer will be done on transaction date March 01. KOMSIS will pay all amounts from the Taccount with Vadbank They have enough money in their account ! B. LETTER OF CREDIT Kom is working with Akbank Akbank charges following costs during UC : 1/C Opening commission 0.5 per 10.005) C Payment commission I pet (0.011 SWITCharges $5 per message. (Total 10 messages) China Company is working with Rank of China. They are charging following costs UC Advising Commission pc (0.01) UC Documents Reviewing Commission 0.5 put(0.005 SWIFT Changes $ 7 per message 20 meses) Vakufbank will change KOMSIS $25.000 commission for payment to Chinese bank. Akbank will also charge $15.000 for themselves Transferred amount and all other charges will be collected from KOMSS'S Akbank account in Turkish Lira. Transaction date is : March 01,2018 QUESTION WHICH OPTION IS BETTER? SALE PRICE CALCULATION WHEN GOODS ARE SOLD 1. Goods will be sold to a client with % 50 profit margin calculated on CIF value of the goods. QUESTION: WHAT IS THE SALE PRICE OF IMPORTED GOODS DISCOUNTING CHEQUE 1. The customer pays in USD. by a cheque maturity 1 year. Komsis takes this cheque to a factoring company for discounting 2. Factoring company applies 6 discounting rate to the face value of the cheque. They also charge % 1.5 commission on the cheque amount. 3. They will pay Komsis in 5. QUESTION: A. What is the discounted value of the cheque? B. How much will factoring company pay to komsis? FORIGN CURRENCY EXCHAGE FX RATES BANK NOTE RATES USD / TL DATE BUY RATE SELL RATE BUY RATE SELL RATE 01.03.2018 3,8082 3,8150 3.8055 3.8208 Please use provided powerpoint template.also please make your calculations on an excel sheet and paste that sheel in your presentation You can add more tables, temalates or whatever as you with HAVE A GOOD WORK.. KOMSIS TRADING CO is a Turkish Company who imports MUSIC SETS from China. KOMSIS is going decide on options of this import. For realization of import KOMSIS will have different uptions on financne Now, you are preparing a presentation to the Board of the company. They will listen to your presentation and decide on which is the best option. You are the Finance Manager and you will present the expected costs and possible revenues from this deal. Please explain, make comparison of all financing options in detail and propose the board, the most prolilable uption GENERAL TERMS The music sets have some configuration. No variaties in configuration. KOMSIS has strong financial reputation in the market and a very good network in the country to sell the goods with good profit margin. KOMSIS can sell goods in TL or Foreign Currency IFCY). KOMSIS doesn't have any problem to sell the music sets. They can sell them any time, with any method which is more profitable for them. Importing is the same, they can make imports with any method they want. IMPORT DETAILS KOMSIS is buying 10.000 music sets, cost per set is $ 400 FOD. Transportation of the music sets from China to Turkey will cost $ 112.750 it is payable at Documents Receipt date by Akbank, in TL countervalue of $ amount. Insurance will be $ 40.250 which is also payable al document receipt date and in TL. All costs will be paid by KOMIS. Transportation from alrport to company warehouse will cost TL. 15.000 Customs taxes and duties will be TL 665.000 Transaction date is March 01. Everything will be settled on March 01. FINANCING KOMSIS has 2 options of financing in their hand. Now management will decide on which transaction they will go for. Please use correct Foreign Exchange rate provided below for your calculations KOMSIS is working with Vakifoank. They do not have any financing issues. They have enough money with the bank. In this environment, there are no other taxes except Corporate/Income Tax of domestic sales profit. You dont need to calculate the Corporate tax. F22 @ fx | OPTION 1 OPTION 2 2023600TL 65000 WHICH OPTION IS THE BEST? (All amounts are in TL and calculated from exchange rate of respective date) CALCULATION OF COSTS (for 1000 computers) OPTION 1 Price of the goods on the invoice 1945650 TL Customs Taxes and Duties 65000 Loan Interest Cost Bank Commissions 5722.5 Insurance Costs 3844.8 Transportation Costs - Freight 19224.2 Transportation - Customs to warehouse 2000 Bank Transfer (Swift) Charges Bank total L/C Charges 3 Other Costs (if any)/Later period interest rate 4 TOTAL COST OF IMPORT 2041441.5 1416.5 3844.8 19224.2 2000 OPTION 3 2003364 TL 65000 425273.4 25042 3844.8 19224.2 2000 404.7 7891.9 70826 2185911.5 2551640.4 6 Sale Price of Products (with % 40 Profit margin). 2852.01 3060.26 3572.25 B PROFIT FROM TOTAL SALE (for 1000 computers) Corporate Tax payable (% 22 calculated from profit) NET PROFIT FROM TOTAL SALE of 1000 computers _ 816576.6 179646.85 636929.75 874364.6 192360.21 682004.6 1020656.16 224544.35 796111.81 2 Net Profit Per Computer 636.929 6 82.004 796.111 There will be 3 dates in this transaction 1. Transaction Date 2. Goods Arrival Date 3. Maturity Date Sheet + KOMSIS TRADING CO is a Turkish Company who imports MUSIC-SETS from China. KOMSIS is going decide on options of this import. For realization of import KOMSIS will have different options on financing. Now, you are preparing a presentation to the Board of the company. They will listen to your presentation and decide on which is the best option You are the Finance Manager and you will present the expected costs and possible revenues from this deal. Please explain, make comparison of all financing options in detail and propose the board, the most profitable option GENERAL TERMS The music sets have same configuration. No variaties in configuration KOMSIS has strong financial reputation in the market and a very good network in the country to sell the poods with goed profit margin KOMSIS can sell poods in TL or Foreign Currency (FCY KOMSIS doesn't have any problem to sell the music sets. They can sell them any time, with any method which is more profitable for them. Importing is the same, they can make imports with any method they want. IMPORT DETAILS KOMSIS is buying 10.000 music sets, cost per set is $ 400 FOR Transportation of the music sets from China to Turkey will cost $112.750 It is payable at Documents Receipt date by Akbank, in TL countervalue of S amount. Insurance will be $ 40.250 which is also payable at document receipt date and in TL All costs will be paid by KOMSIS Transportation from airport to company warehouse will cost TL 15.000 Customs taxes and duties will be T1.665.000 Transaction date is March 01. Everything will be settled on March 01. FINANCING KOMSIS has 2 options of financing in their hand. Now management will decide on which transaction they will go for Please use correct Foreign Exchange rate provided below for your calculations KOMSIS is working with AKBANK. They do not have any financing issues. They have enough money with the bank In this environment, there are no other tax except Corporate Income Tax of domestic sales profit. You dont need to calculate the Corporate tax CHOOSING BEST FINANCING OPTIONS A. CASH AGAINST DOCUMENTS Seller wants Cash Against Documents payment on the transaction date Documents are received by the bank on March 01 > Therefore transaction date is March 01.2018 > AKBANK charges flat commission % 4.5 for transfer Transfer will be done on transaction date March 01. > KOMSIS will pay all amounts from their TL account with AKBANK They have enough money in their account.) B. LETTER OF CREDIT Komsis is working with Akbank. Akbank charges following costs during LC: - LIC Opening commission 0.5 pct (0.005) - L/C Payment commission 1 pct (0.01) - SWIFT Charges S5 per message. (Total 10 messages China Company is working with Bank of China. They are charging following costs -LC Advising Commission I pct (0.01) - L/C Documents Reviewing Commission 0.5 pct (0.005 - SWIFT Charges S 7 per message ( 20 messages) > AKBANK will charge KOMSIS S 25.000 commission for payment to Chinese bank. Akbank will also charges 15.000 for themselves. Transferred amount and all other charges will be collected from KOMSIS's Akbank account in Turkish Lira Transaction date is : March 01,2018 QUESTION: WHICH OPTION IS BETTER? SALE PRICE CALCULATION WHEN GOODS ARE SOLD 1. Goods will be sold to a client with % 50 profit margin calculated on CIF value of the goods. QUESTION : WHAT IS THE SALE PRICE OF IMPORTED GOODS? DISCOUNTING CHEQUE 1. The customer pays in USD. by a cheque maturity 1 year. Komsis takes this cheque to a factoring company for discounting. 2. Factoring company applies % 6 discounting rate to the face value of the cheque. They also charge % 1.5 commission on the cheque amount. 3. They will pay Komsis in S. QUESTION: A. What is the discounted value of the cheque? B. How much will factoring company pay to Komsis? FORIGN CURRENCY EXCHAGE BANK MOTE FX RATES RATES 01.03.2018 RATE RATE 3.082 BISE ROS RATE 3.30 Please use provided powerpoint template.also please make your calculations on an excel sheet and paste that sheet in your presentation. You can add more tables, templates or whatever as you wish

please answer it in detail and fast like this

please answer it in detail and fast like this