Answered step by step

Verified Expert Solution

Question

1 Approved Answer

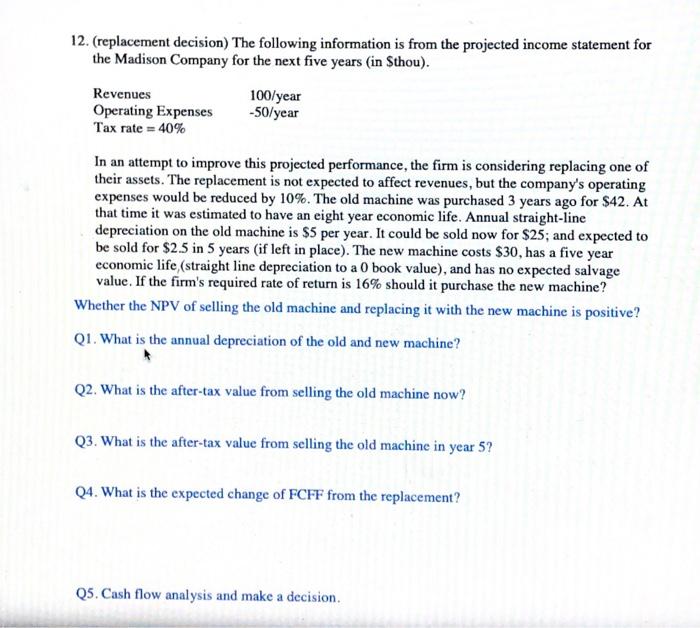

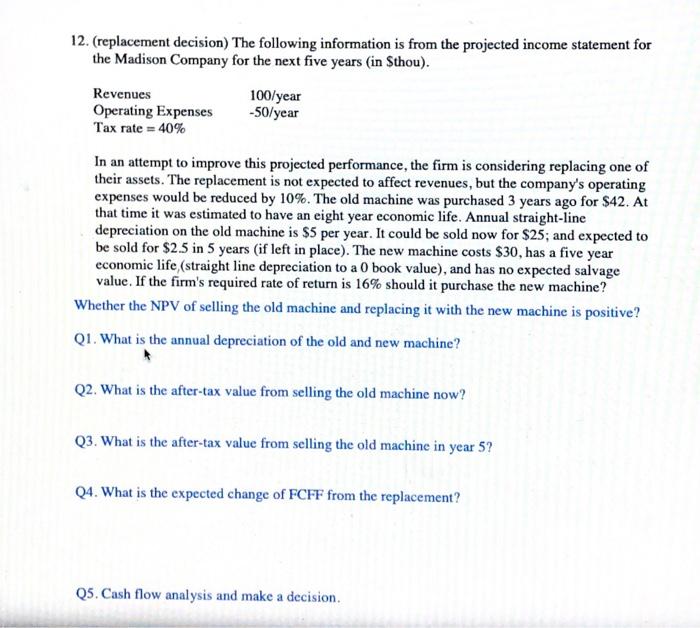

please answer it using finance calculate BA II Plus. 12. (replacement decision) The following information is from the projected income statement for the Madison Company

please answer it using finance calculate BA II Plus.

12. (replacement decision) The following information is from the projected income statement for the Madison Company for the next five years (in Sthou). Revenues 100/year -50/year Operating Expenses Tax rate = 40% In an attempt to improve this projected performance, the firm is considering replacing one of their assets. The replacement is not expected to affect revenues, but the company's operating expenses would be reduced by 10%. The old machine was purchased 3 years ago for $42. At that time it was estimated to have an eight year economic life. Annual straight-line depreciation on the old machine is $5 per year. It could be sold now for $25; and expected to be sold for $2.5 in 5 years (if left in place). The new machine costs $30, has a five year economic life, (straight line depreciation to a 0 book value), and has no expected salvage value. If the firm's required rate of return is 16% should it purchase the new machine? Whether the NPV of selling the old machine and replacing it with the new machine is positive? Q1. What is the annual depreciation of the old and new machine? Q2. What is the after-tax value from selling the old machine now? Q3. What is the after-tax value from selling the old machine in year 5? Q4. What is the expected change of FCFF from the replacement? Q5. Cash flow analysis and make a decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started