Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer its True/ False questions 1. The general partners of a partnership pay self-employment tax on their share of net business income of the

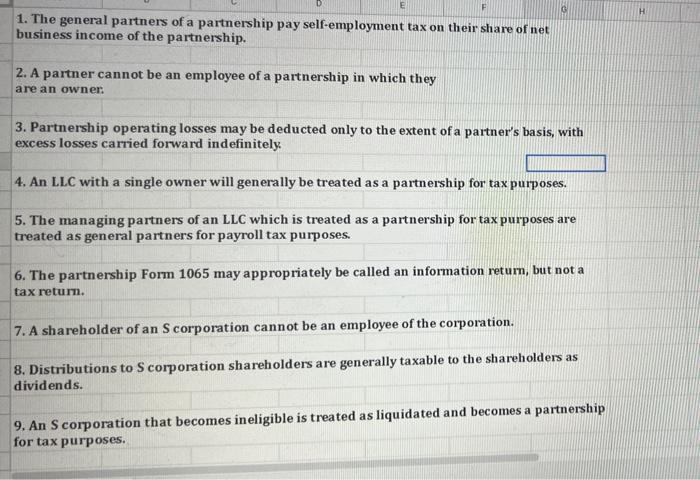

please answer its True/ False questions

1. The general partners of a partnership pay self-employment tax on their share of net business income of the partnership. 2. A partner cannot be an employee of a partnership in which they are an owner. 3. Partnership operating losses may be deducted only to the extent of a partner's basis, with excess losses carried forward indefinitely. 4. An LLC with a single owner will generally be treated as a partnership for tax purposes. 5. The managing partners of an LLC which is treated as a partnership for tax purposes are treated as general partners for payroll tax purposes. 6. The partnership Form 1065 may appropriately be called an information return, but not a tax return. 7. A shareholder of an S corporation cannot be an employee of the corporation. 8. Distributions to S corporation shareholders are generally taxable to the shareholders as dividends. 9. An S corporation that becomes ineligible is treated as liquidated and becomes a partnership for tax purposes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started